How to Empower the Accounts Department of Your Startup with Automated Accounting

Still using paper or Excel or Tally for your business’s accounting tasks? There’s a better way.

Maybe a manual accounting system worked fine for your small business when you were just starting out. You sold your service or product, sent invoices from online invoicing templates, and recorded payments in a spreadsheet or perhaps an offline accounting solution like Tally.

Maybe a manual accounting system worked fine for your small business when you were just starting out. You sold your service or product, sent invoices from online invoicing templates, and recorded payments in a spreadsheet or perhaps an offline accounting solution like Tally.

But you have grown. And Spiderman’s uncle once said- With great growth, comes more complex accounting chores, like tax filing and automatic invoice preparation — maybe reporting. Okay, maybe we are paraphrasing, but even if you’re doing some of your work in Excel, you don’t have one central location for all your customer and vendor, sales and expense information. Locating a critical detail quickly is nearly impossible.

And that’s the first benefit of using cloud-based accounting software: All of your financial data is in one place. As you create records and transactions, they’re filed neatly in the appropriate areas. Everything is centralized and in its place.

But that’s not all, there are other ways IT startups and small business can benefit from accounting solution. To tell us more about that, we chatted with the accounting team of MSG91, India’s leading cloud-communication startup uses a cloud-based accounting software for their accounting.

Savings on all fronts

This is perhaps the most compelling reason to jump on board with cloud accounting software. “As a small business, you can begin your accounting with some manual processes. But as your needs grow, you should be leveraging on automation features such as APIs integration to build more automation and billing efficiencies.” Manish, an accountant from MSG91 team said. With automated processes, one is sure to save time and financial resources as the growing accounting needs will be taken care of without having to hire more people.

Improved accuracy:

While spreadsheets can be useful for a small business or a startup in their initial days of accounting, they inevitably become cumbersome. They can even be harmful by the time you’re managing financial data as your list of customers grows.

Thanks to cloud accounting tools and their automation features, you’re not constantly re-entering data you’ve already typed in, because of which the incidence of errors goes down to a significant rate. Deepak, another long-serving accountant from MSG91 said that the manual way of accounting slowed their team down and put them at risk of making big, expensive mistakes because of it being operated without any backup system.

Increased Transparency:

At any stage of a business, having complete transparency and control of the finances is crucial. This is especially true for IT startups and their business owners who know how a lack of financial transparency can impact consumer’s interest. The team at Giddh knows that using technology is the key to making small business finance more transparent.

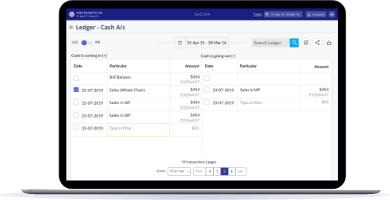

Accountants can truly benefit from a feature like real-time ledger sharing, using which they could email the ledger of their clients to them on their email for effective collaboration. They can also generate a “magic link” which stays valid for only 24 hours so that the business owners are completely in control.

Other than effective collaboration, sharing ledgers also introduces transparency between clients and accountants. “When the accounting team and the clients are on the same page, there is no space left for any discrepancies of any kind,” the accounting head of MSG91 said with a smile on his face.

Conclusion

The above is just a summary of why a startup should move their accounting system online. The folks over at MSG91 came to the conclusion that there are lots of other benefits to be had with moving to the cloud after their pain points started disappearing.

To witness the magic of cloud accounting yourself, book a demo today!