Own a Small Business? Here are 5 ways Online Accounting Software can benefit you

Write the success story of your business with the help of cloud accounting.

Pyaare Mohan, owner of a small and growing business, started his business two years back and has so far performed well. However, for accounting, he maintains an Excel spreadsheet in which he records transactions like amount to be recovered from customers, the amount due to suppliers, etc.

He now wants to expand his business and avail credit from the bank, but to his horror, the bank has refused his request since his expenses weren’t recorded properly and no accounting records are available with him.

To make things worse, he is penalised by the Tax department for not being tax compliant due to the lack of a proper accounting system.

Although this is a hypothetical situation, there are actually several small and medium business entrepreneurs who often neglect their overall accounting, which has a direct adverse effect on their businesses.

Every small business owner wants to save money and they want to maximize their profits too, and this is where online accounting software will help you out and meet your needs as well. Accounting software vendors have mostly moved their products to the cloud and they are now offering online subscriptions for a reasonable rate. Their features include expense tracking, invoicing, and simple analysis reports as well. Small businesses need to jump on the accounting software bandwagon because it provides you features and tools that meet all your accounting needs, and you will save money by not hiring an external professional to analyze your finances.

Fortunately, with the recent development in cloud computing, there are several online accounting solutions that have been introduced that make accounting safe, manageable and inexpensive for small business owners.

Here we have 5 benefits of online accounting for businesses of all sizes-

Access — Anywhere & Anytime

Online accounting gives you the flexibility to access your data whenever you want and wherever you are. You can be confident that you will have an up-to-date picture of how your business is doing with real time updates.

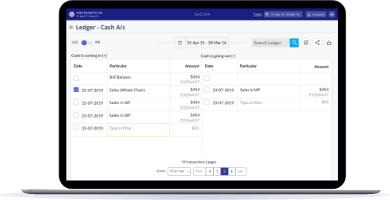

With cloud, your entire accounting data will be accessible via browser and an internet connection which frees you from being tied to a PC or an office. So even when you are in a different city and want to create an invoice or share a ledger, you can just open your browser and in a few clicks, have an access to your accounting solution.

Today there are several online accounting softwares that provide small business owners cloud based accounting solution so that they can be on top of their accounting even when they are on the move.

Today there are several online accounting softwares that provide small business owners cloud based accounting solution so that they can be on top of their accounting even when they are on the move.

2. Cost Effective

For a small sized business, being cost effective is the biggest priority. When budgets are tight, business owners end up making the mistake of cutting expenses on an accounting solution.

Well, not anymore! By adapting to the online accounting the upfront business costs can be drastically reduced. You would no longer need to worry about expensive version upgrades, maintenance costs and server failures if you bring your finances to an online accounting solution.

If you’re an Indian startup, Giddh will offer you FREE SUBSCRIPTION to its entire online accounting platform for one whole year.

If you’re an Indian startup, Giddh will offer you FREE SUBSCRIPTION to its entire online accounting platform for one whole year.

3. Expense Recording

Keeping track of both direct and indirect expenses can be exceptionally hard. Owners of small business make things complicated for themselves by not recording their expenses properly. And as the financial year ends, the clutter of mismanaged expenses frustrate them as they are unable to trace their financial footprint.

If you are one of those business owners and are stocking all your receipts and bills in a file, it will get more confusing as your business grows. Even if you are manually entering these expenses in your Excel spreadsheet one after other, you will always be at the danger of adding one extra comma or one less zero, leading to errors in your account books.

Your expenses and day-to-day accounting activities should be on one place- the cloud, helping you stay on top of your business. If you make the transition to cloud based accounting you would also not need to worry about losing your financial data if your computer ever crashes.

A small business accounting software is necessary no matter what kind of business you’re running. It can be a retail business or a one-man consultancy, whether the transactions are entered electronically or personally, online accounting software will force you to maintain financial data and stay up to date with it too. Once you’re forced to stay up to date with your financial data then you will notice an added benefit of finding the financial pulse of your business. This means that you will be able to spot any gaps or credit problems easily.

4. Easy and Direct Tax Compliance

The Indian tax system can be complex, and thus it can be a challenge to the business owners to stay compliant on time, every time. According to the World Bank Survey, 2016 – Indians on average spend 241 hours per year on tax preparation and filing.

Not to mention, with the introduction of GST, the entire tax landscape changed and there were many small Indian business owners who fell behind filing their GST returns and thus had to suffer penalties from the government.

To help these business owners stay tax compliant, several GSPs(GST Suvidha Provider) were formed that accumulated the filing data from business owners and then helped them be GST compliant.

Online accounting software is perfect if you find that the bookkeeping process is tedious, it will help you create essential financial reports without any frustration. Cloud business software will help you streamline your software so that the accounting process will benefit your company in many ways.

Another reason GST accounting software will benefit your company is that it will be easy to file GST tax returns. You can use GST-enabled accounting software to keep track of the invoices while allowing you to pull essential financial documents within a short period.

To make things easier for small business owners online accounting softwares such as Giddh, is one step ahead and offers them the option of direct GST filing, using which they can avoid the hassle of taking assistance of GSPs and can file their GST returns on their own. To read more on direct GST filing, you can click here.

5. Collaboration and Analysis Made Easy

Aside from requiring greater visibility into business financials and operational data, a small business owner should also know more about what’s actually driving business growth. There are several key financial reports such as- trial balance, profit & loss statements and balance sheet that the business owner require on a timely basis for analysis of their business.

Online accounting solutions offer business owners these reports with the option of sharing. So with a couple of clicks the reports can be easily shared and the business owner, their accountant, and even member of their sales team can have a firm grip on the ins and outs of their business. No more carrying data on flash drives or depending on an accountant.

For further analysis, these business owners can make use of a dashboard which presents key details such as their monthly and yearly net worth, expenses, revenues and easily compare them to the financial data of previous years or months. They can also see the money that they owe and the money which is owed to them as payable and receivables.

For further analysis, these business owners can make use of a dashboard which presents key details such as their monthly and yearly net worth, expenses, revenues and easily compare them to the financial data of previous years or months. They can also see the money that they owe and the money which is owed to them as payable and receivables.

But all this information would fail to serve a business owner if it’s not easy to analyse or comprehend. And thus, cloud accounting solutions like Giddh, offer dashboard which provides the financial insight in easy to understand graphical charts and graphs. You can also read more on Giddh dashboard here.

In Closing

In the end, the process of transitioning to cloud-based accounting software is a big step in itself, but it’s one that will save you a lot of money and time. This transition is vital if the bookkeeping process stresses you out and you don’t look forward to paperwork, then you’ll have to get a small business accounting software as soon as possible.

From shopping to banking, today almost everything is managed online. If you are the owner of small business and want to grow and don’t want to suffer losses like Pyaare Mohan, it’s high time you bring your accounting to the cloud and simplify your business. Want to witness the magic of cloud accounting? Click here.