Error-Free GST Reporting for Your Business

GST Filling & Accounting Software

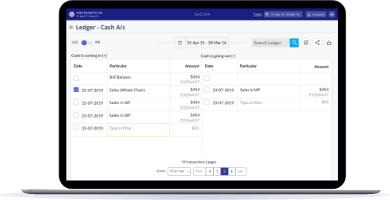

Seamless Integration with Accounting Systems

Advantages of filing GSTR with us

Direct Filing

We prepare your GST return file automatically and do the heavy lifting for you. Now file your Goods and Services Tax (GST) directly on portal.

100% Accurate

Get 10/10 on accuracy by identifying errors right before submitting your GST return online with the help of our straightforward error sheet.

Timely Notifications

Frustrated with last-minute tax return stress? With Giddh GST accounting, you will never miss another deadline or suffer the penalty.

Highly Collaborative

Be on the same page with your team. With our role based model, you can grant your CA the access to view the relevant GST tax return data.

Secure & Reliable

With 2-factor authentication, industry leading security and OTP verification, your GST return filing process is secure from the beginning till the end.

Best in Class Support

Stuck somewhere? Count on our friendly and knowledgable support team for your accounting & GST filing queries.

GST Return Collaborators

Automated GST Calculations and Submissions

Understanding GST

The full form of GST is Goods and Services tax. It’s a value-added tax that is levied on many goods and services that are sold for domestic consumption. The GST is paid by the customers and it’s simultaneously remitted to the government by the business that is selling the services and goods. This means that the money is generated by the consumers

Read More...

Indian GST Software for business owners

Presently, many businesses (small, medium, and large scale) are under constant pressure to be the first. And this can only happen when you start focussing on your growth strategy instead of wasting time manually managing accounts and taxes. GST accounting software is suggested because it can calculate your accounts, file GST returns online, help with

Read More...

Benefits of using GST software:

When using a GST online software, it will help business owners be aware of the tax rate that they need to pay, to whom, and the exact dates. GST software will also help you leverage significant advantages like accuracy, speed, cost-saving techniques, as well as providing up-to-date information.

Read More...

FAQs

As per the GST rules, a business having a turnover of Rs 40 lakhs ( Rs 10 lakhs for businesses in hill states and North East states) has to register as a taxable entity, known as GST registration process. It can be completed online on the official GST website within 6 working days. Here’s the step-by-step process for GST registration:

- Log in to the GST portal (https://www.gst.gov.in/) or visit a facilitation center and submit your PAN, email id, and mobile number in Part A of Form GST REG–01

- The PAN is verified on the portal, while the email id and mobile number are verified through an OTP.

- Once verified, you’ll receive an application reference number on your registered mobile number and email id.

- You can file and submit Part- B of Form GST REG-01 with the required documents and the application reference number.

- In case any additional information is required, GST REG-03 will be issued.

- You’ll need to respond to GST REG-04 within 7 days from the date of receipt of GST REG-03.

- Once you’ve provided all details from Form 01-04, the registration certificate will be issued in Form GST REG –06.

- If you’ve multiple businesses, then you’ll need to file separate GSTs for your separate businesses.

- Form GST REG-05 is used to reject the applications which don’t meet the criteria.

- If you deduct TDS and collect TCS, then you can submit Form GST REG – 07 at the time of registration.

GST Returns filing is the registration of GST Returns document, which contains all details concerning GST invoices, payments, and receipts during a specific period. The details that need to be filed in the GST Returns document are:

- Total sales Total purchases

- Output GST (paid by customers)

- Input Tax Credit (ITC paid by businesses)

There are several benefits to using the Giddh software for GST Returns Filing:

- Prepare your GST return file automatically on the portal

- 100% accurate filing with zero chances of errors

- Notifications of deadlines so that you don’t miss any deadline

- Collaborate with your team and allow access of GST data to your CA

- Secure and reliable with 2-factor authentication and OTP verification

- Complete support for all GST-related issues