5 Financial Mistakes to Avoid for Smarter Business Growth

A large number of things need to be taken care of in the business, especially when the business is in its growth stage, and things are shifting shape drastically. Also, a good amount of things have been modified in the accounting arena this year. Hence, the chances that you might accidentally commit a mistake have also increased.

In this blog, we’ll explore the five most common accounting errors business owners often overlook — and how best accounting practices (and tools like Giddh) can help you avoid them.

What Are Financial Mistakes in Business?

Financial mistakes refer to missteps in budgeting, cash flow tracking, expense categorization, or accounting processes that negatively impact your company’s financial health.

According to industry research, nearly 60% of SMBs in India face issues due to either poor record-keeping or incorrect financial planning. These errors, if not addressed early, can snowball into tax issues, poor business decisions, or even regulatory fines.

If you’ve ever asked:

-

What are the common mistakes in accounting?

-

What should I avoid in managing business finances?

This guide is for you.

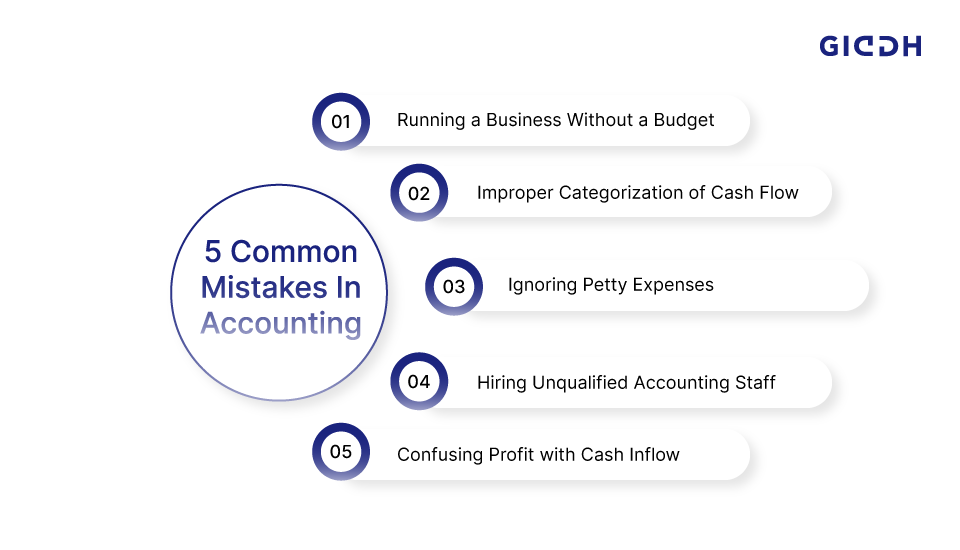

5 Areas Where You Might Accidentally Commit a Financial Mistake This Year

- Running a Business Without a Budget

Can you think of walking on a jammed-with-vehicles road with a blindfold on your eyes? Running a business without planning about the budget means walking the same way as above and running a great business, but blindly. You should therefore be paying attention to your financial plans this year.

- Improper Categorization of Cash Flow

Every business has a certain amount of cash coming in and going out. But the problem starts arising when you have no idea of how much exactly is coming in and how much is going out. And the root of this problem is your inability to categorize money in a proper manner, which should necessarily be paid a heed.

- Ignoring Petty Expenses

When it comes to managing the trade, every little thing matters. And the most common mistake people commit is treating the petty expenses casually, which takes shape of something bigger and affects things in the long run.

- Hiring Unqualified Accounting Staff

Another noticeable area that needs immediate attention is the person you are hiring to handle your accounts. Ask yourself some basic questions like, is the person qualified enough to handle something as big as accounts? Does he/she have the eye of a seer that will help you avoid future losses and manage present gains? If the answer is no, then well, it’s time to hire a better person.

- Confusing Profit with Cash Inflow

Problems start arising in the business when the accountants start confusing normal profits with huge cash inflows and forget where exactly these cash inflows were meant to be utilized. A proper distinguishing line therefore needs to be maintained before the confusion between normal profits and huge cash inflows starts surfacing.

Try to pay heed to these petty but important areas and you’ll never again have to face problem due to these little mistakes.

Best Accounting Practices in India (2025 Guide)

To avoid these errors and thrive in the evolving business environment, follow these accounting practices in India:

-

Automate where possible: Use cloud-based accounting software with GST and real-time reporting.

-

Separate business and personal expenses: Maintain clean ledgers for tax filing and compliance.

-

Schedule regular audits: Internal or external audits help catch inconsistencies early.

-

Stay updated on regulations: Keep pace with Indian tax laws, TDS, and e-invoicing norms.

-

Track every transaction: Even petty expenses should be logged to avoid leakages.

💡 Pro Tip: The best accounting practices combine automation with smart oversight. That’s where online accounting tools like Giddh can help.

How Giddh Accounting Helps You Avoid Costly Mistakes

Giddh is one of the best accounting software in India designed to reduce manual errors and enhance financial accuracy. Here’s how it helps avoid common financial mistakes:

✅ Automated Categorization – Reduce the risk of mislabeling income/expenses

✅ Real-Time Dashboards – Instantly visualize profit vs cash flow

✅ Multi-user Access with Permissions – Prevent unauthorized data changes

✅ GST & Compliance Ready – Stay aligned with Indian regulations

✅ Petty Cash Management – Log and track every rupee

Whether you're a growing startup or a mid-sized business, Giddh helps you implement error-free, compliant accounting workflows.

Final Checklist: Top 5 Financial Mistakes to Avoid in 2025

❌ Mistake | ✅ What to Do Instead |

|---|---|

Skipping budget planning | Set monthly and quarterly budgets |

Ignoring petty expenses | Log every transaction, no matter how small |

Hiring underqualified staff | Choose certified accountants or trusted platforms |

Misunderstanding cash vs profit | Use dashboards to track both |

Poor categorization | Automate with tools like Giddh |

In The End:

Accounting isn’t just a back-office task — it’s the foundation of sound business decision-making. Yet, financial mistakes, especially the common errors in accounting discussed above, are still prevalent among growing businesses in India. Whether it's poor budgeting, misclassified expenses, or confusing profit with cash flow, these issues can be avoided with the right knowledge and tools.

That’s where Giddh accounting software becomes your competitive advantage. It automates the tedious, eliminates manual mistakes, and ensures you're always compliant — from petty cash to profit analysis.

👉 Ready to reduce risk and improve accuracy?

Start using Giddh and avoid the most common accounting errors before they happen.

Frequently Asked Questions

Q: What are the common mistakes in accounting?

A: Misreporting income, incorrect categorization, missing expenses, and poor reconciliations.

Q: What are the best accounting practices for businesses in India?

A: Automation, separation of accounts, GST compliance, regular audits, and using tools like Giddh.

Q: How does Giddh help reduce financial mistakes?

A: Giddh automates key processes, offers real-time dashboards, and simplifies GST, helping prevent human errors.