Top 5 Accounting Software for Startups in India: Day-One Setup

Did you know that over 60% of Indian startups fail within the first few years due to poor financial management? A crucial reason for this failure is the neglect of proper accounting systems from day one. With so much at stake, it’s clear that accounting software is not just a luxury—it's a necessity for any startup looking to scale efficiently and stay compliant.

Accounting software plays a pivotal role in automating time-consuming tasks such as invoicing, expense tracking, and tax filing, allowing startup founders to focus on growing their business rather than wrestling with manual accounting. So, which is the best accounting software for your startup in India? Let’s explore how you can choose the best tool for your needs and set it up right from the start.

Why Day-One Accounting Software is Crucial for Startups in India

Setting up a proper accounting system from day one isn’t just about avoiding chaos later. It’s about ensuring that your startup is always in control of its financial health, even during the most turbulent early stages. Here are a few reasons why this step is so crucial for Indian startups:

-

Compliance and Taxation: One of the biggest challenges startups face is staying compliant with Indian tax laws, especially GST. Indian regulations are constantly changing, and failing to adapt can lead to penalties. Accounting software can help you automatically generate GST e-invoices and reports, ensuring that you never miss out on important deadlines.

-

Cost of Manual Processes: Manual accounting often leads to errors, misplaced data, and even fraud. Without automated checks and balances, your financial operations can quickly get out of hand. Startups often miss opportunities simply because they cannot accurately track their cash flow.

-

Lack of Transparency: Without accounting software, founders often struggle to get a clear picture of their financial health. Disorganized records can lead to poor decision-making and missed opportunities.

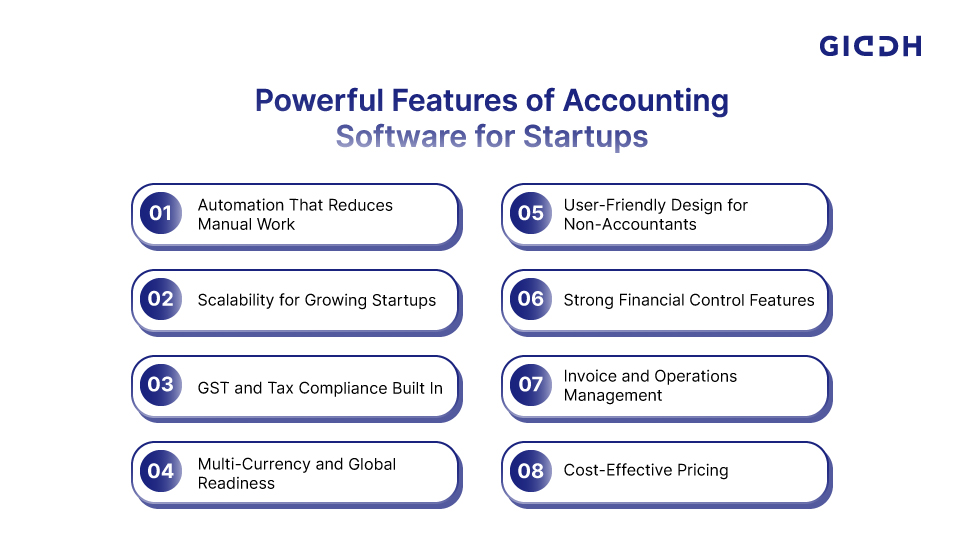

Key Features to Look for in Accounting Software for Startups

Choosing accounting software is an early decision that impacts compliance, reporting, and scalability. The right tool should simplify daily finance work while supporting long-term growth. Here are the non-negotiable features startups in India should evaluate before deciding.

Automation That Reduces Manual Work

Automation is the foundation of efficient accounting.

-

Automate invoicing and recurring bills.

-

Expense tracking with real-time updates.

-

Auto-generated financial and tax reports.

-

Reminders for GST filing and compliance deadlines.

This reduces errors, saves time, and keeps records consistent.

Scalability for Growing Startups

Your accounting software should not slow you down as you scale.

-

Support for increasing transaction volumes.

-

Ability to manage multiple business entities.

-

Option to handle over 100 companies if required.

-

Smooth transition from solo founder to finance team.

Scalability ensures you don’t need to switch systems every year.

GST and Tax Compliance Built In

For Indian startups, compliance is critical.

-

GST-compliant invoicing.

-

Accurate CGST, SGST, and IGST calculations.

-

GST-ready reports for filing and audits.

This places the software among the best accounting software in India for GST.

Multi-Currency and Global Readiness

If you work with international clients or vendors, this matters.

-

Multi-currency support with automatic conversions.

-

Clear tracking of foreign income and expenses.

Essential for startups planning cross-border operations.

User-Friendly Design for Non-Accountants

Founders shouldn’t need accounting knowledge to use the software.

-

Clean dashboards with clear financial summaries.

-

Simple navigation for invoices, expenses, and reports.

-

Minimal learning curve for teams.

Ease of use directly impacts adoption and accuracy.

Strong Financial Control Features

Good accounting software goes beyond basic entries.

-

Unlimited user access with role-based permissions.

-

Bank reconciliation to match transactions accurately.

-

Asset management to track business assets.

-

Inventory management for product-based startups.

These features bring structure without adding complexity.

Invoice and Operations Management

Operational efficiency matters from day one.

-

Centralized invoice management.

-

Support for barcode-based inventory tracking.

-

Faster billing, tracking, and reconciliation.

Useful for startups dealing with physical goods or high invoice volumes.

Cost-Effective Pricing

Affordability matters in the early stage.

-

Subscription-based pricing.

-

No high upfront costs.

-

Flexible plans that scale with usage.

This makes the software suitable for startups searching for free best accounting software options or affordable paid plans.

Top 5 Accounting Software Solutions for Startups in India

The Indian market is flooded with accounting software options. But how do you know which one is the best fit for your startup? Let’s break down some of the most popular tools for startups in India:

Giddh

Why choose Giddh?

It is a cloud-based accounting software with GST-compliant features, making it perfect for Indian startups. Giddh offers real-time data syncing, easy-to-understand dashboards, and automated reporting. Whether you’re managing invoicing, expenses, or taxes, Giddh simplifies these tasks.

Key Features That Matter Early On

-

GST-ready invoicing with auto tax calculations.

-

Real-time ledger updates and cash flow visibility.

-

Simple expense tracking with bill attachments.

-

Role-based access for founders, teams, and accountants.

-

Fully cloud-based with secure backups.

These features position Giddh among the best accounting software in India for GST and a strong option when founders ask which is the best accounting software for early-stage startups.

Best Practices for Using Giddh

-

Keep your chart of accounts simple in the early months.

-

Record transactions regularly to avoid reconciliation issues.

-

Enable GST settings from day one.

-

Review cash flow and receivables monthly.

TallyPrime

A household name in India, TallyPrime offers robust accounting features, including inventory management, tax computation, and financial reporting. It’s ideal for businesses that are scaling quickly.

Pros: In-depth financial features, tax compliance.

Pros: In-depth financial features, tax compliance.

Cons: The interface may seem a bit dated for some users.

Zoho Books

Zoho Books is a popular choice among Indian startups, offering seamless integration with other Zoho products. Its user-friendly interface and automatic GST calculations make it ideal for startups.

Pros: Integration with Zoho apps, ease of use.

Cons: Limited features in the free plan.

QuickBooks India

QuickBooks India offers an easy-to-use accounting software solution focused on simplifying invoicing, tax filings, and expense tracking. It’s suitable for small and medium-sized businesses.

Pros: Powerful invoicing, tax filing, and cloud-based.

Cons: Some users find it too expensive for what it offers.

ProfitBooks

ProfitBooks is designed for small businesses and startups. It provides basic accounting tools, including invoicing, expense tracking, and GST compliance, making it a good option for new entrepreneurs.

Pros: Simple to use, affordable pricing.

Cons: Limited customization options.

Step-by-Step Guide: Getting Started with Accounting Software

Setting up your accounting software correctly from day one is essential for smooth financial operations. Here’s a step-by-step guide to ensure a smooth setup:

-

Choose the Right Software: Refer to the previous section to identify the software that fits your needs.

-

Create Your Company Profile: Input essential details like your business name, GSTIN (if applicable), and other relevant data.

-

Link Your Bank Accounts: Connect your business bank accounts to track transactions automatically.

-

Set Up Categories for Expenses and Revenue: Customize categories that fit your business, making it easier to track financial data.

-

Create and Issue Your First Invoice: Start by issuing a simple invoice to a client. Use templates for consistency.

-

Set Reminders for Tax Filing: Ensure your software sends reminders to stay on top of deadlines.

By following these steps, you can avoid common mistakes and ensure the accounting system is well set up.

Common Mistakes to Avoid When Setting Up Accounting Software

Avoid These Pitfalls for a Smooth Financial Setup

Even with the best accounting software, mistakes can happen. Here are some common errors to avoid:

-

Choosing Software That Doesn’t Integrate: Make sure your accounting tool integrates with other systems, such as CRMs or payment gateways.

-

Ignoring GST Settings: Don’t forget to configure your GST settings to avoid compliance issues later.

-

Lack of Data Backup: Always back up your data to avoid losing critical financial information.

-

Not Training Your Team: Your team must be familiar with how to use the software. Provide training if necessary.

Why Automating Your Financials Now Pays Off in the Long Run

The benefits of automating your accounting tasks extend far beyond day one:

-

Better Financial Visibility: With automated tools, you gain a clearer understanding of your financial health at any given time.

-

Time Savings: Automation frees up valuable time, allowing you to focus on business growth rather than on manual tasks.

-

Scalability: As your business grows, automated tools can handle more complex financial transactions, saving you from a chaotic transition to more advanced systems.

Conclusion

Accounting software is not just a luxury for startups in India; it’s an essential tool for ensuring financial transparency, compliance, and scalability. Setting up the right accounting system from day one will save you time, reduce errors, and help you scale your business without getting bogged down by financial issues.

With so many options available, choosing the best accounting software for your startup can be overwhelming, but with tools like Giddh, TallyPrime, Zoho Books, and QuickBooks India, you can be assured of seamless financial management.

Ready to streamline your finances and scale your startup? Start with the best accounting software today!

FAQ

1. Which accounting software is best for GST compliance in India?

Answer: Giddh, TallyPrime, and Zoho Books are among the top accounting software solutions that ensure GST compliance, making them ideal choices for Indian startups.

2. What is the most affordable accounting software for startups in India?

Answer: ProfitBooks and Giddh offer cost-effective pricing plans suitable for small businesses and startups, making them popular choices among new entrepreneurs.

3. How do I choose the right accounting software for my startup?

Answer: Consider factors like ease of use, GST compliance, automation features, and scalability when choosing accounting software for your startup.