GST for Retailers: Key Accounting Changes You Need to Know

As a retailer, staying compliant with the Goods and Services Tax (GST) is crucial for your business’s success. GST for retailers brings a major shift in how you manage your accounts, requiring significant adjustments to your accounting practices.

With GST, retailers must navigate a range of changes from categorizing goods under different GST slabs (0%, 5%, 12%, 18%, and 28%) to reconfiguring their GST accounting systems to track tax components like CGST, SGST, and IGST.

This transition can be overwhelming, especially for retail businesses relying on traditional ledger-based methods. However, the right tools can simplify the process. In this blog, we’ll explore the essential accounting changes you need to make to get your retail business GST ready.

Why Does GST Matter for Retailers?

GST for retail business has a significant impact on how retailers conduct their operations, especially when compared to other industries. Unlike some sectors, retail businesses face unique challenges due to the volume and variety of transactions, the complexity of managing inventory, and the need to comply with different tax rates.

Here’s why GST accounting is crucial for retailers:

- Impact on Inter-State vs Intra-State Sales

One of the most complex aspects of GST for retailers is the distinction between inter-state and intra-state sales. The GST system taxes these differently:

-

Inter-State Sales (Sales between different states): These are subject to Integrated GST (IGST), a tax that applies when goods are sold across state borders. Retailers need to account for IGST separately in their GST accounting systems to ensure proper compliance.

- Intra-State Sales (Sales within the same state): These are taxed under Central GST (CGST) and State GST (SGST), meaning the tax is split between the central government and the state government. Keeping track of CGST and SGST separately is necessary to avoid errors in tax filing.

-

Managing Multiple Tax Rates

Retail businesses often deal with a wide range of products, each falling under different GST slabs. Unlike other industries that may only deal with a few categories, retailers must ensure that every product is classified under the correct GST rate—whether it’s 0%, 5%, 12%, 18%, or 28%. This adds a layer of complexity to GST for retail business operations, as it requires meticulous tracking and record-keeping.

- Increased Compliance Requirements

With the introduction of GST, retailers now need to file multiple returns, track both direct and indirect taxes, and maintain records for each transaction. This makes GST accounting even more important, as accurate and timely reporting is essential for avoiding penalties and ensuring the smooth operation of the business.

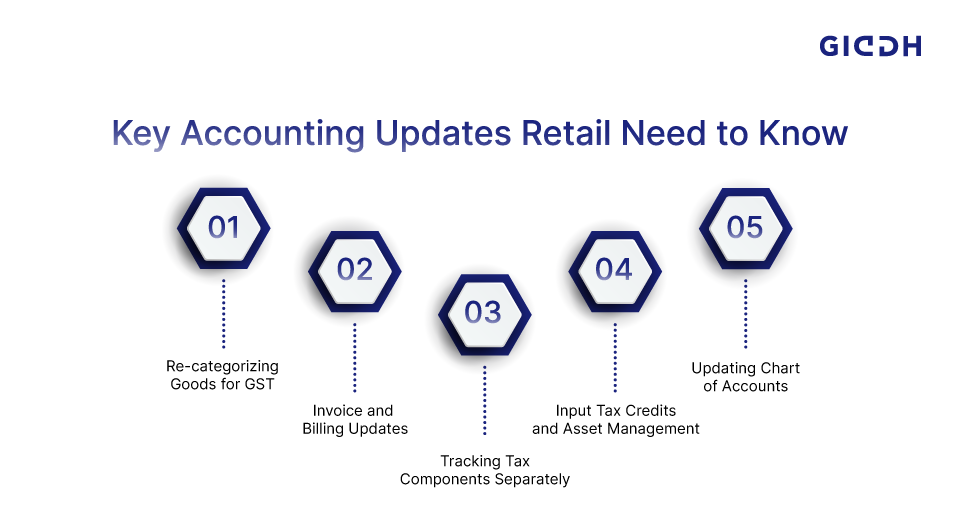

What Are the Key Accounting Changes Retailers Must Know for GST Compliance?

As retailers transition to GST, several accounting changes must be made to ensure compliance. These changes go beyond simple tax calculations and require significant updates to the way goods are categorized, invoices are issued, and tax components are tracked.

Here’s a breakdown of the essential accounting updates retailers need to implement:

1. Re-categorizing Goods for GST

Under the GST accounting system, retailers need to classify their goods into the appropriate GST tax slabs, which are:

- 0% GST: For essential goods like fresh food.

- 5% GST: For goods like spices and tea.

- 12% GST: For items like consumer electronics.

- 18% GST: For products like beauty items and home goods.

- 28% GST: For luxury goods like high-end vehicles and tobacco.

Accurately categorizing inventory under these five GST rates is essential for maintaining compliance and ensuring proper GST returns filing. Retailers must review their inventory, update classifications, and ensure the correct rate is applied to each product.

2. Invoice and Billing Updates

To comply with GST, the invoice and billing process needs to be updated. Certain mandatory fields must be included on GST-compliant invoices:

- GSTIN (GST Identification Number): This unique number must be included for each sale.

- Place of Consumption: Indicating the location where the goods are consumed or sold.

- HSN Codes: Harmonized System of Nomenclature (HSN) codes must be used for product classification.

In addition, inter-state sales will require IGST (Integrated GST) while intra-state sales will require CGST (Central GST) and SGST (State GST). It’s crucial for retailers to adjust their invoicing systems to differentiate between these two types of transactions and maintain accurate records.

3. Tracking Tax Components Separately

Retailers must track the different tax components separately in their GST accounting system:

- CGST (Central Goods and Services Tax): Collected by the central government.

- SGST (State Goods and Services Tax): Collected by the state government.

- IGST (Integrated Goods and Services Tax): Collected for inter-state transactions.

Separating these components in the chart of accounts is critical for accurate GST returns filing. Failure to do so can lead to confusion during audits, incorrect tax calculations, and potential penalties.

4. Input Tax Credits and Asset Management

One of the significant changes under GST is how refundable taxes are handled. Previously, refundable taxes were considered part of the cost of goods sold. Under the new system:

- Refundable taxes should now be treated as assets rather than expenses.

- Retailers must make adjustments in their inventory valuation and expense recording to ensure that tax credits are properly tracked.

This adjustment helps ensure that input tax credits are properly accounted for, making the tax filing process smoother and ensuring that no tax benefits are overlooked.

5. Updating Chart of Accounts

Retailers will need to make updates to their chart of accounts to reflect the changes brought about by GST:

-

Retire obsolete tax accounts: Remove old tax categories that are no longer relevant under the GST framework.

-

Set up new accounts: Establish accounts based on the type of business, the rules for credit availment, and the location of sales and purchases. This will help keep track of GST liabilities and ensure that GST returns filing is accurate.

Having a well-organized chart of accounts is essential for maintaining clarity and consistency in financial reporting under GST.

How to Transition from Offline to Online Accounting for GST Compliance?

Switching from traditional ledger books to online accounting can be challenging, but it offers significant benefits for GST accounting. Here’s how:

Challenges of Moving from Ledger Books to Digital Accounting

- Manual Errors: Recording transactions manually increases the risk of errors, affecting GST for retailers and tax calculations.

- Delayed Updates: Offline systems don’t provide real-time updates, leading to outdated records and potential mistakes in GST returns filing.

- Time-Consuming: Managing GST returns manually is tedious, especially with the need to track tax components separately for interstate and intrastate sales.

Advantages of Using Software Like Giddh

- Automated GST Calculations: Giddh automates tax calculations, ensuring accurate GST accounting and compliance.

- Real-Time Tracking: Track transactions instantly and stay updated without manual intervention.

- Simplified Reporting: Giddh generates automated reports, making GST returns filing quick and accurate.

With Giddh, GST returns are automatically calculated and filed, reducing errors and ensuring compliance, while making the entire process efficient and hassle-free.

How Can Giddh Help Retailers Stay GST‑Compliant and Organized?

When switching to GST, managing day‑to‑day finance becomes more complex, but using Giddh can make GST accounting painless and ensure your retail business stays compliant. Here’s how:

- Real-time tracking & automated GST returns filing

Giddh tracks all your sales and purchases automatically, breaking down tax components (CGST / SGST / IGST) in real-time. It simplifies gst returns filing by generating ready‑to‑file returns like GSTR‑1, GSTR‑3B, etc., directly from the platform.

- Automated re‑categorization of products and invoices

Inventory and product data are managed within Giddh. Once you classify items under the correct GST slabs, Giddh uses that info to auto‑generate compliant invoices reducing manual mistakes.

- Smart reporting for accounting changes and input tax credits

Giddh provides detailed reports, sales registers, purchase logs, inventory reports, and GST reports, giving you visibility into input tax credits and helping you reorganize your chart of accounts.

- Cloud-based, always accessible & secure bookkeeping

Because Giddh is cloud‑based, you and your team can access accounting data from anywhere (desktop or mobile), ensuring real-time updates. Secure login, data backups, and user‑role control add protection essential when handling tax and financial data under GST.

Conclusion

In conclusion, GST for retailers requires several key accounting changes, including re-categorizing goods, updating invoices, tracking tax components separately, and adjusting the chart of accounts. These steps are crucial for maintaining compliance and maximizing tax benefits.

Transitioning to digital accounting is not just a necessity but a smart move for improving efficiency, accuracy, and ease of GST returns filing. Manual bookkeeping can no longer keep pace with the complexities of GST, which is why adopting an automated accounting solution like Giddh can streamline your processes and ensure you're always GST-ready.

By choosing the right tools, you can simplify your GST accounting, stay compliant, and effortlessly manage your tax returns, allowing you to focus on growing your retail business.

Switch to Giddh and make GST accounting effortless for your retail business.