Grow Revenue Fast with a Snowball Income Approach

Revenue generation in a business does not only depend on the ability of a business to create and market its products; it also depends on some indispensable internal factors which cannot be overlooked. A major chunk of these internal factors comprises of the accounting activities carried out within the business. If not taken seriously, forget revenue generation, management of basic transactions would be impossible without applying proper accounting practices.

Let’s break down how accounting plays a pivotal role in accelerating revenue through a snowball financial method approach.

What Is the Snowball Effect in Finance?

The snowball effect in finance refers to how small gains can compound over time into substantial financial outcomes—just like a snowball rolling downhill. Applied to business, this means that small, consistent improvements in financial operations, such as reducing waste or improving cash flow visibility, can lead to exponential income growth.

This is where accounting becomes the foundation for enabling and accelerating this snowball system.

Key Accounting Practices That Drive Snowball Income

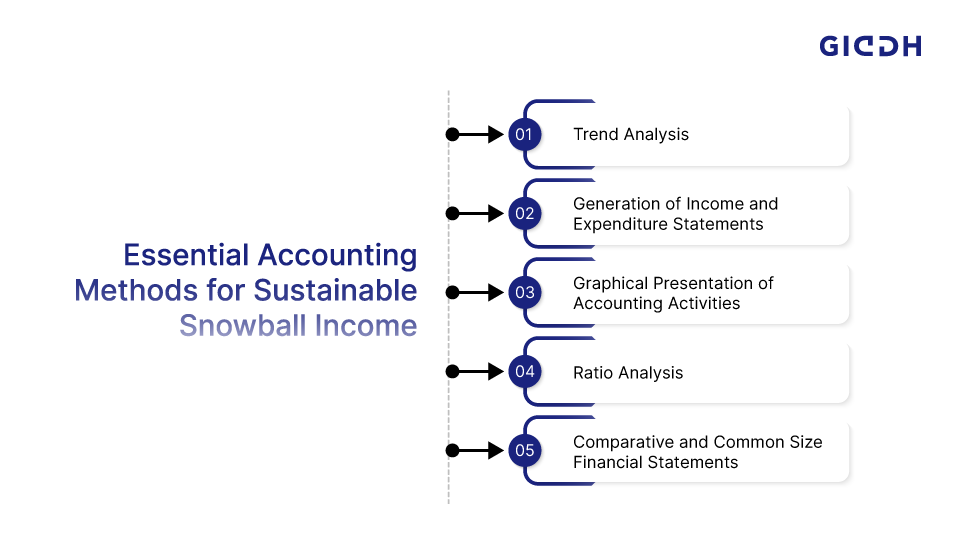

a. Trend Analysis

In order to observe the changes in the business; trend analysis can largely help a business. It takes into account a base year and compares it with the current year to analyze the actual current changes that have taken place in general.

b. Generation of Income and Expenditure Statements

A proper income and expenditure statement helps the business ascertain the total income and expenditure done during a period of time. This analysis helps in making necessary changes in the general income and expenditure and results in controlling unneeded expenditure, if any.

c. Graphical Presentation of Accounting Activities

With a proper graphical presentation of monthly/ yearly accounting activities, the business can easily comprehend the due modifications that can be done for further improvement. This gives a business concern a good chance to consider where exactly it has made accounting mistakes in the past and how these mistakes can be avoided in present and future as well.

d. Ratio Analysis

With the presence of a large number of accounting ratios like turnover ratios, profitability ratios and liquidity ratios a business can very simply make much needed alterations in the transactions that are taking place. For example, with debtors and creditors turnover ratio, the total number of debtors and creditors can be controlled accordingly.

e. Comparative and Common Size Financial Statements

The best part of putting accounting software into practice is that a large number of accounting statements can be analyzed including comparative and common size statements, balance sheet, profit and loss statement, trading account statement, et al. This analysis helps in comparison of present performance with past performance and lets the business improve and advance further in its operations.

Taking into account the above points, it can be directly said that accounting not only controls the business transactions but it also helps in overcoming mistakes, thereby assisting in profit generation.

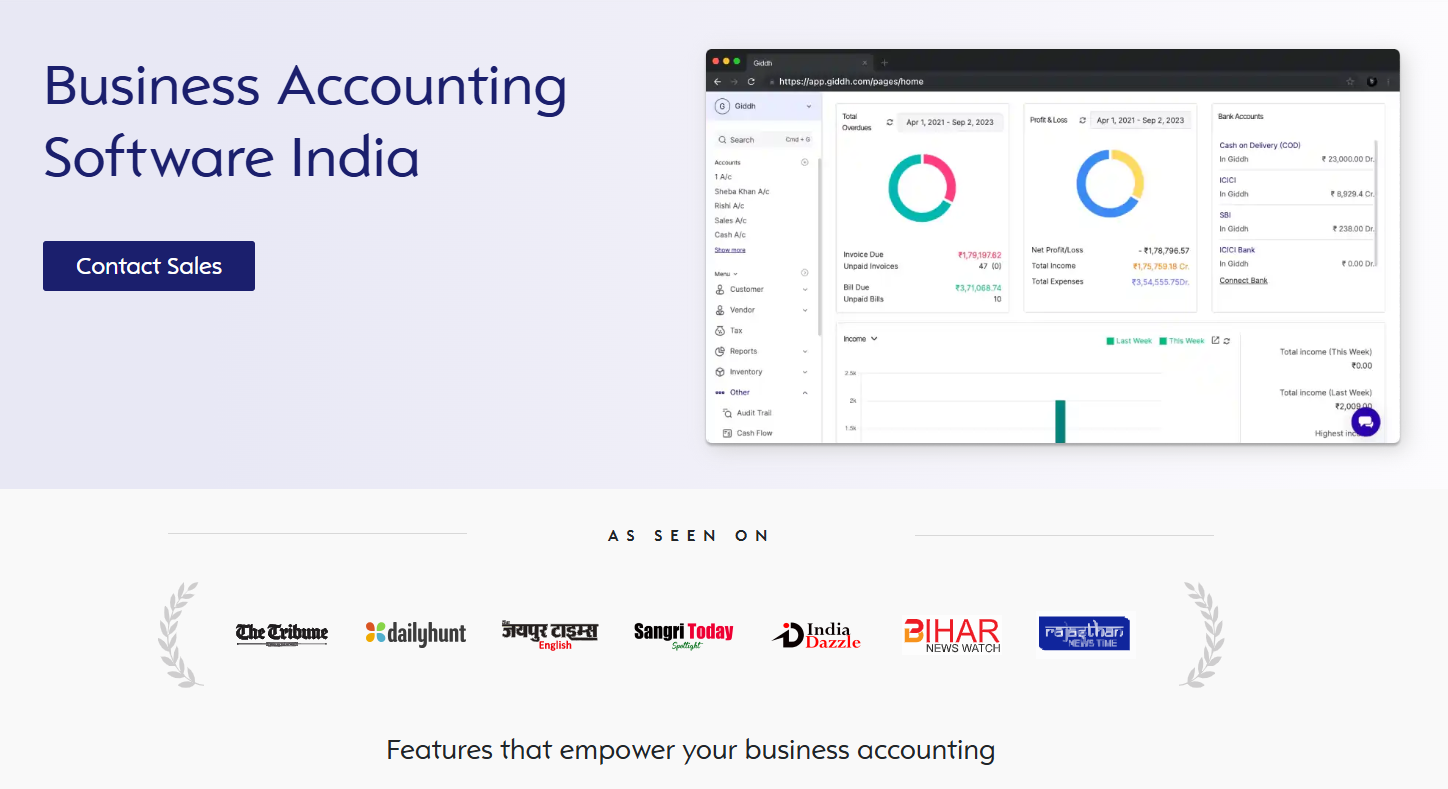

Giddh Accounting: A Smart Platform for Snowballing Your Income

To implement the snowball system meaningfully, you need the right tools.

Giddh Accounting is modern cloud-based accounting software that helps businesses simplify financial management and gain powerful insights. With features like:

-

Real-time ledger and balance sheets

-

Auto-generated ratio analysis

-

Multi-user collaboration

-

Graphical dashboards

-

Cash flow forecasting

...Giddh empowers you to build a strong financial core—fueling consistent, compounding revenue growth.

Giddh’s intuitive dashboards make snowball financial tracking effortless, whether you’re monitoring daily cash inflows or planning long-term investment returns.

✅ If you want to see the snowball effect in your business finances, automation and analytics through tools like Giddh are essential.

Why Small Financial Wins Matter in Business

Understanding the snowball system meaning in business context helps decision-makers shift from reactive to proactive financial management. Every time you automate a report, optimize an expense, or reduce your receivables cycle, you’re laying another layer on the snowball that eventually drives exponential business growth.

Final Thoughts:

Accounting is no longer a back-office function—it’s a strategic revenue multiplier. With tools like trend analysis, ratio tracking, and platforms like Giddh, your business can not only manage finances but also achieve compounding income gains over time.

When applied correctly, the snowball financial method becomes more than just a theory—it becomes your operating model.

FAQs

Q: What is the snowball effect in finance?

A: It’s the principle of compounding small gains into large financial outcomes over time, often used in debt repayment and revenue strategies.

Q: How can accounting help create snowball income?

A: By optimizing cash flow, tracking trends, and reducing unnecessary costs, accounting sets the foundation for sustained and compounding revenue growth.

Q: What accounting tools support the finance snowball method?

A: Platforms like Giddh help with real-time tracking, automation, and data visualization that fuel consistent financial improvements.