How to Simplify Your Financial Reporting and Analysis with Automated Tools

If you’re still managing your financial reports manually, you’re likely wasting valuable time and risking costly errors. Over 60% of businesses report significant inefficiencies in manual accounting processes.

These inefficiencies aren’t only time-consuming but also can lead to mistakes, missed deadlines, and poor decision-making. But there’s a better way. Automated financial reporting and analysis tools, such as Giddh, are transforming the way businesses manage their finances.

By automating tedious tasks such as data entry and report generation, these tools help improve accuracy, save time, and provide real-time insights that are crucial for business success.

In this post, we’ll explore why financial reporting automation is no longer optional, but essential, for modern financial management.

The Challenges of Financial Reporting and Analysis

Managing financial reports is a daunting task for many businesses, particularly for accountants and business owners who often juggle multiple responsibilities. With increasing regulatory requirements, a growing number of transactions, and a constant need for accuracy, manual financial reporting can quickly become overwhelming.

Common issues include:

-

Human error: Manual entry mistakes can result in inaccurate reports, which can have significant financial implications.

-

Time-consuming processes: Manually compiling, reconciling, and generating reports is often a slow and labor-intensive process.

-

Inability to provide real-time insights: With outdated methods, decision-makers must wait for reports to be finalized before taking action, resulting in missed opportunities or delays.

This is where automated financial reporting and analysis tools come in. They can significantly reduce errors, streamline workflows, and provide real-time insights that drive more intelligent business decisions.

Top Automated Financial Reporting Tools for Businesses

Several business finance tools in the market help automate their financial reporting processes. Let’s look at a few options:

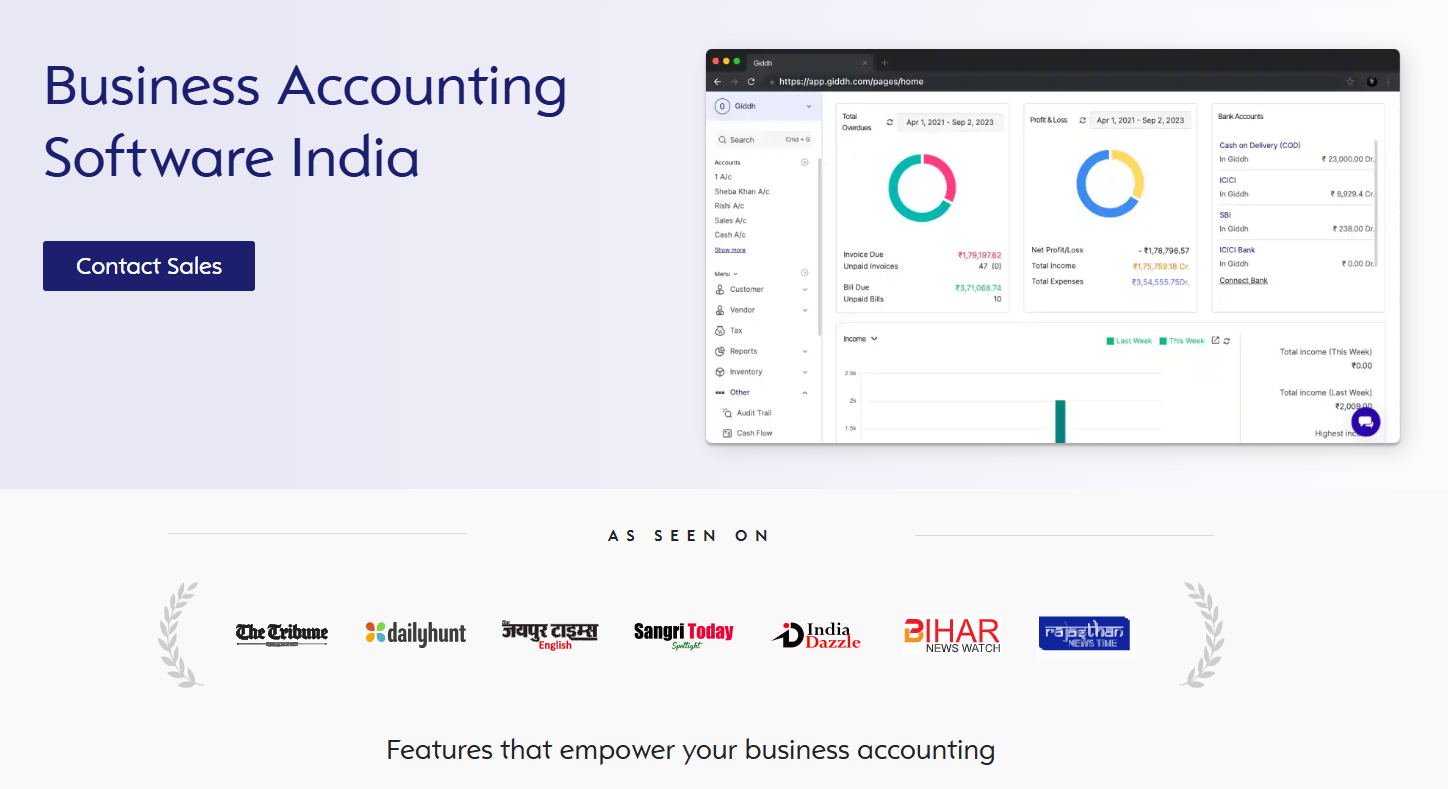

1. Giddh: Best Automated Tools For Financial Reporting And Analysis

Giddh is a financial management software designed specifically for Indian businesses. It simplifies financial reporting and analysis, as well as tax compliance, providing real-time insights into financial health while ensuring compliance with local regulations, such as GST and VAT.

With its automated features, Giddh helps businesses streamline their accounting processes, reducing manual errors and saving valuable time.

Features

-

Unlimited User Access: Allow unlimited users with customizable roles and permissions for collaborative financial management.

-

Simplified Ledger-Based Accounting: Manage finances effortlessly with one-step ledger entries, reducing errors and saving time.

-

Automatic Currency Conversion: Seamlessly handle international transactions with real-time, automatic currency conversion .

-

Manage Over 100 Companies: Easily manage finances for over 100 companies from a single platform, perfect for multi-entity businesses.

-

Built-In White Label Option: Rebrand the platform with your logo and colors for a tailored client experience.

-

Open & Public API Access: Integrate with other systems and automate tasks through Giddh’s open API.

-

One-Click Financial Reports Generation: Generate accurate financial reports with a single click, saving time and effort.

-

Real-Time Financial Analysis: Get up-to-the-minute financial insights to make informed decisions quickly.

-

Multi-Company and Multi-Branch Management: Simplify management and reporting across multiple companies and branches.

-

GST and VAT Compliance: Stay compliant with Indian tax regulations by automatically calculating and reporting GST and VAT.

-

Customizable Reporting: Tailor financial reports and dashboards to fit your specific business needs and preferences.

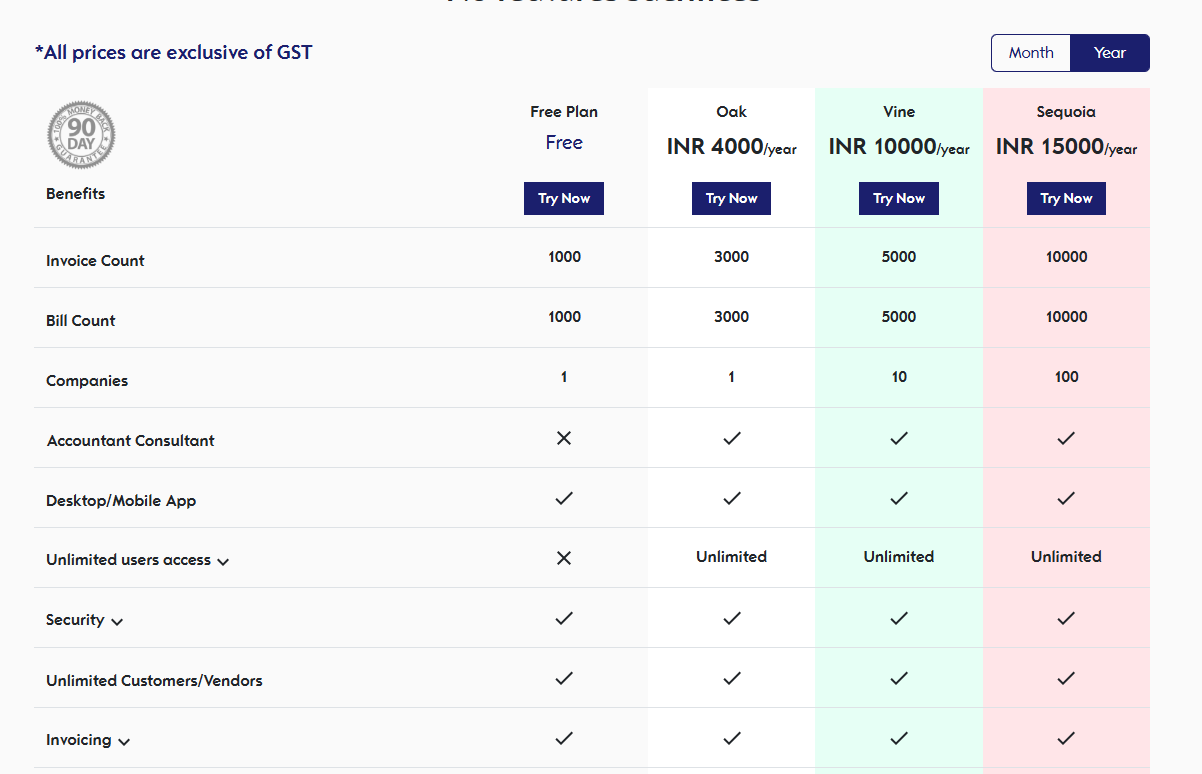

Pricing

- Free Plan: Includes basic features for small businesses with up to 3 companies.

- Premium Plan: ₹1,200 per month for full access to advanced features like real-time analysis, multi-company management, and tax compliance.

Pros

- [GST Compliance(https://giddh.com/blog/gst-compliance-guide-for-indian-businesses)]

- Ease of Use.

- Real-Time Updates

- Scalability

- Unlimited user access

Cons

- Limited Features in Free Plan

- No Payroll Integration

2. QuickBooks

QuickBooks is one of the most popular accounting solutions for small and medium-sized businesses. Known for its ease of use, QuickBooks offers robust features for financial reporting, invoicing, payroll, and tax management. Accountants and business owners widely use it for its intuitive interface and integration capabilities.

Pricing

- Simple Start: $25 per month

- Essentials: $50 per month

- Plus: $80 per month

- Advanced: $180 per month

Pros

- Ease of Use

- Integration

- Comprehensive Features

Cons

- Pricing

- Limited Customization

- Learning Curve

3. Xero

Xero is cloud-based accounting software tool designed for small to medium-sized businesses. It offers a comprehensive range of accounting features, including financial reporting and analysis. Known for its ease of use and real-time collaboration features, Xero is a popular choice for business owners and accountants alike.

Pricing

- Early: $12 per month (up to 20 invoices and quotes)

- Growing: $34 per month (unlimited invoices, bills, and bank transactions)

- Established: $65 per month (additional features like project tracking and multi-currency support)

Pros

- Real-Time Collaboration

- User-Friendly

- Multi-Currency Support

Cons

- Pricing for Small Businesses

- Limited Mobile Functionality

4. Wave

Wave is a free accounting software that offers invoicing, accounting, and receipt scanning features. It's ideal for small businesses and freelancers seeking a user-friendly, budget-friendly solution. Wave's simple interface makes it easy for users with limited accounting knowledge to handle their financial tasks.

Pricing

- Free Plan: $0 (includes basic accounting, invoicing, and receipt scanning)

- Payroll: Starts at $20 per month

- Payments: Transaction fees apply (2.9% + 30¢ for credit cards, 1% for bank payments)

Pros

- Core Features

- Ease of Use.

- Flexible Payment Processing

Cons

- Limited Features

- Limited Customer Support

5. Zoho Books

Zoho Books is part of the Zoho suite of business tools, offering comprehensive accounting features that include tax management, invoicing, financial reporting, and analysis. Zoho Books is particularly suitable for small to medium-sized businesses and offers seamless integration with other Zoho products.

Pricing

- Basic: ₹1,000 per month (basic features, single user)

- Standard: ₹2,500 per month (includes multiple users, advanced features)

- Professional: ₹4,500 per month (includes project tracking and advanced analytics)

Pros

- Affordable

- Automation

- Integration with Zoho Suite

Cons

- Limited Reporting Features

- Learning Curve

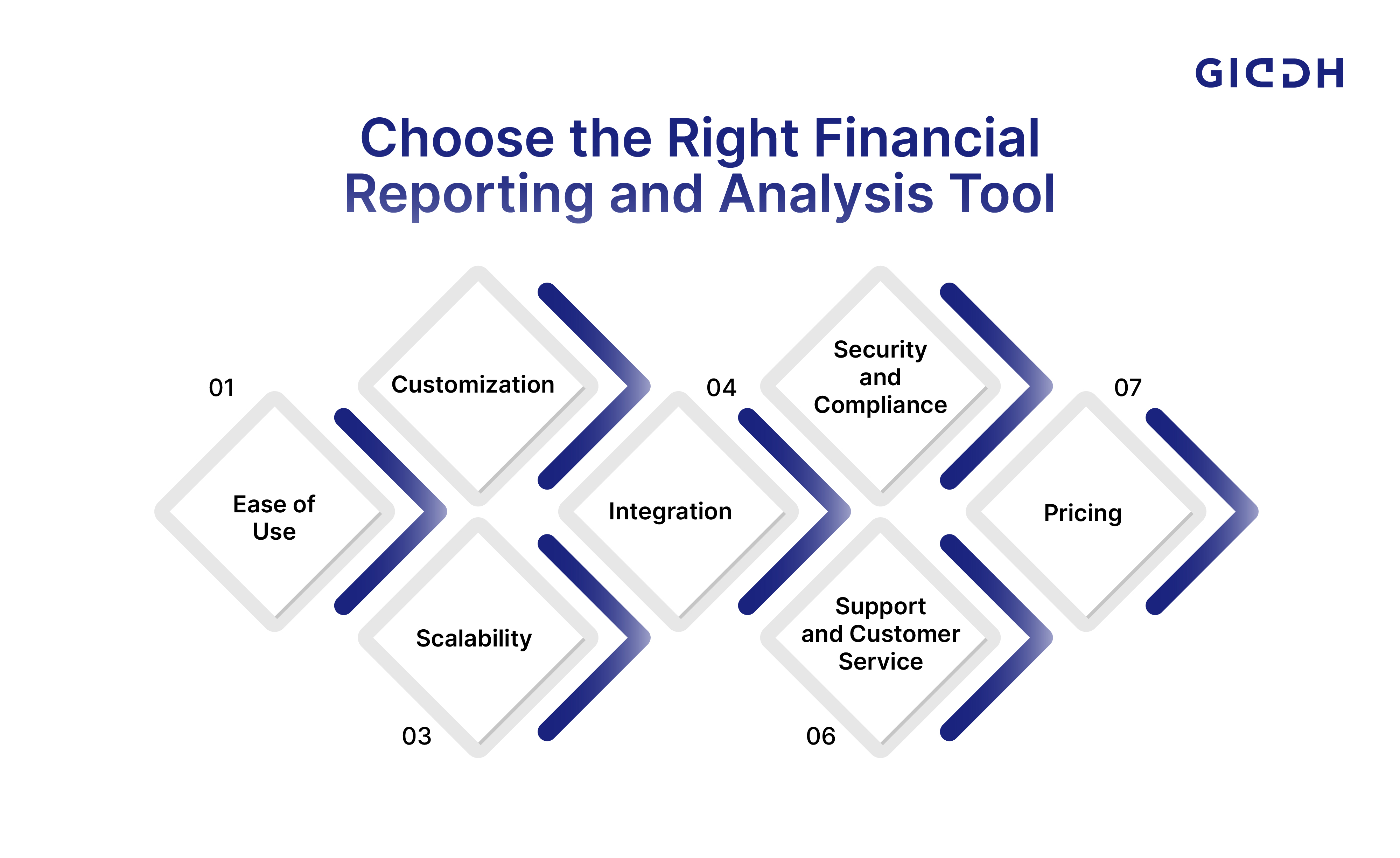

How to Choose the Right Financial Reporting Tool for Your Business

When selecting an automated financial reporting tool, it's crucial to choose one that aligns with your business's unique needs, both now and as it grows. Below are key factors to consider when evaluating financial reporting tools:

1. Ease of Use

The right tool should be intuitive and easy to navigate, especially for users who may not have extensive accounting knowledge. A complex system can lead to confusion, delays, and mistakes. Here’s why ease of use matters:

- Simple, intuitive interface

- Quick onboarding and minimal training

- Easy navigation for all skill levels

- Accessible support resources

2. Customization

Every business has unique accounting needs, so customization is a must. A one-size-fits-all solution may not provide the necessary flexibility to handle specific reporting requirements. Here’s how customization can benefit your business:

- Tailored reports to meet business needs.

- Personalized dashboards for real-time data.

- Adjustable categories and filters.

- Flexible user permissions.

3. Scalability

As your business grows, so will the complexity of your financial data. A tool that works well today might not be sufficient to handle a larger volume of transactions or the addition of multiple departments or locations in the future. Here’s why scalability is essential:

- Supports growth in transaction volume.

- Multi-company and multi-branch management.

- Scales with business expansion.

- Cloud-based for flexibility.

4. Integration

An automated financial analysis and reporting tool should seamlessly integrate with your existing systems. It ensures that data flows smoothly between platforms, reducing the need for manual data entry and the risk of errors. Here’s how to assess the integration capabilities:

- Syncs with accounting and ERP systems.

- Integrates with payment processors and bank accounts.

- Compatible with third-party apps (e.g., CRM, payroll).

- API access for custom integrations.

5. Security and Compliance

Ensuring the security of your financial data is paramount, especially when handling sensitive information such as tax data, payment details, and confidential business information. Here’s why security matters:

- Data encryption and secure storage.

- Automatic backups and recovery options.

- User access control features.

- Compliant with tax regulations (e.g., GST, VAT).

6. Support and Customer Service

The reliability of customer support can make or break your experience with an automated financial reporting and analysis tool. Problems may arise, and having a support team ready to assist you is essential. Here's what to consider:

- 24/7 customer support availability

- Multiple support channels (chat, email, phone)

- Online knowledge base and training materials

- Community forums for peer assistance

7. Pricing

While pricing shouldn’t be the sole deciding factor, it’s essential to ensure that the tool offers value for the price. Consider the following when assessing pricing:

- Transparent, upfront pricing

- Free trials or demo versions

- Long-term value for your business

- Flexible pricing tiers based on features

Wrapping It Up:

Automating your financial reporting and analysis is no longer optional; it’s essential for businesses seeking to enhance accuracy, save time, and gain real-time insights that inform better decisions.

Look for a solution that is easy to use, offers customization, and can scale as your business grows. By considering all these factors, you can ensure that the tool you choose aligns with your business needs both now and in the future.

With tools like Giddh, companies can generate reports quickly, reduce errors, ensure compliance, and scale effortlessly.

Ready to simplify your financial reporting? Start using Giddh’s automated tools today for better accuracy and efficiency.

FAQs

1: How does financial automation software improve accuracy and efficiency?

Financial automation software reduces manual data entry, minimizing the risk of human error. It also speeds up report generation by pulling real-time data from multiple sources. This ensures accurate, up-to-date financial reports and streamlines workflows, allowing your team to focus more on strategy and less on repetitive tasks.

2: Can automated financial analysis tools be customized to suit business needs?

Yes, most automated financial analysis tools are highly customizable. With tools like Giddh, businesses can customize report formats, key performance indicators (KPIs), and data visualizations to meet their specific needs.

3: What are the benefits of automated financial reporting for businesses in 2025?

In 2025, businesses benefit from faster reporting cycles, improved compliance with tax and regulatory changes, and better forecasting through real-time insights. Automated financial reporting also enhances decision-making, helps maintain data consistency, and allows small teams to handle large volumes of financial data efficiently.

4: How can automated financial analysis save time and reduce errors?

Automated financial analysis tools instantly process large datasets, eliminating the need for time-consuming calculations and manual cross-checking. These tools flag inconsistencies, reduce duplicate entries, and generate accurate financial summaries—freeing up your finance team to focus on high-value tasks.