Best accounting practices for Small and Medium Enterprises SMEs

Financial stability is a cornerstone of business growth and success. Whether it's meeting payment deadlines, managing cash flow, tracking invoicing, or overseeing the debt collection process, effective financial management is a key driver of business success. While the specifics of financial management can vary depending on your business type, size, and needs, the overarching goal remains the same.

Whether you’re handling everything in-house or using a digital tool, understanding the best accounting practices for SMEs is crucial for maintaining healthy cash flow, ensuring compliance, and preparing for long-term success.

In this article, we'll explore essential accounting practices that every SME should adopt and discuss how modern tools, such as Giddh, can simplify the process.

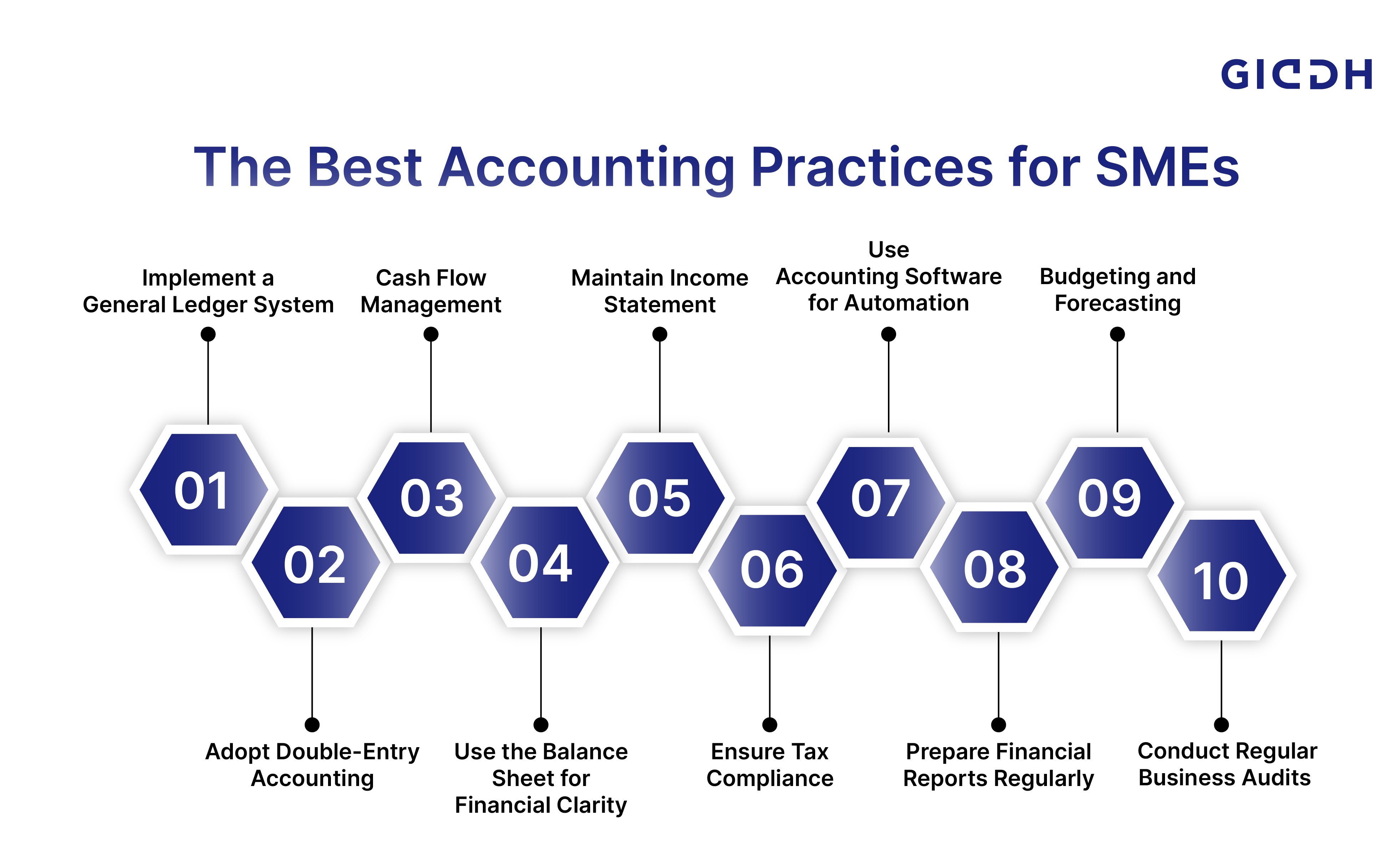

What Are The Best Accounting Practices for SMEs

Regardless of your business size, certain fundamental accounting principles apply universally. These principles, commonly referred to as Generally Accepted Accounting Principles (GAAP), guide how businesses of all sizes, including startups and SMEs, handle their financial transactions.

Understanding and implementing these accounting practices is crucial for long-term success. Below are some of the best accounting practices that SMEs should follow to optimize their financial management:

1. Implement a General Ledger System

A general ledger is a comprehensive record of all financial transactions made by the business. It serves as the foundation for all accounting processes and is critical for tracking assets, liabilities, income, and expenses. Whether using paper-based systems or accounting software, keeping an organized ledger is essential for accurate accounting and audits.

-

Track all transactions: Record every financial transaction in the ledger to maintain transparency.

-

Consistency: Keep regular updates to the general ledger to ensure it reflects your business’s current financial position.

2. Adopt Double-Entry Accounting

Double-entry accounting is a key principle for ensuring financial accuracy. In this method, every transaction is recorded twice: once as a debit and once as a credit. This approach helps maintain balance and accuracy in your financial records, reducing the risk of errors and ensuring that your financial statements are correct.

-

Record both sides of transactions: For every debit, there should be a corresponding credit.

-

Balance your books: The equation of assets = liabilities + equity should always hold.

3. Track Money Flow with Cash Flow Management

Efficient cash flow management is critical for SMEs. Cash either flows into the business (as revenue) or out (as expenses). Keeping a close eye on how money moves in and out of your business allows you to avoid liquidity issues, ensure you can cover operational expenses, and make timely investments.

-

Monitor incoming revenue: Ensure that all sales and income are tracked.

-

Control expenses: Regularly review outgoing payments to manage overhead costs effectively.

4. Use the Balance Sheet for Financial Clarity

The balance sheet is a vital document for assessing the financial health of your business. It lists your company’s assets, liabilities, and equity, giving you a clear view of its economic position at any given moment. Regularly reviewing your balance sheet enables you to track your company’s growth and identify areas that require improvement.

-

Assets: Track both current (cash, receivables) and fixed assets (property, equipment).

-

Liabilities: Record short-term and long-term debts to assess your financial obligations.

-

Equity: Understand the owner's share of the business.

5. Maintain Income Statement

The income statement, also known as a profit and loss (P&L) statement, shows how much money your business made and spent during a specific period. This document helps you measure profitability and is essential for making informed financial decisions.

-

Track revenue and expenses: Ensure that all income sources and expenses are accurately categorized.

-

Profit calculation: Subtract total expenses from total revenue to find your net profit or loss.

6. Ensure Tax Compliance

Staying compliant with tax regulations is crucial for avoiding penalties and ensuring efficient business operations. SME owners must maintain up-to-date records, including tax documents and financial transactions, to ensure timely and accurate tax filings.

-

Accurate record-keeping: Keep detailed records of income, expenses, and deductions.

-

Understand tax deadlines: Set reminders for tax filing dates to avoid missing important deadlines.

7. Use Accounting Software for Automation

Automating your accounting processes can save time, reduce errors, and improve overall efficiency. Accounting software like Giddh simplifies many accounting tasks, including invoicing, inventory management, and financial reporting. The software can automatically track transactions, generate reports, and integrate with other business systems.

-

Streamline financial tasks: Automab te recurring tasks such as invoicing and reporting.

-

Integrate systems: Ensure your accounting system integrates seamlessly with your sales and inventory systems to facilitate a smooth data flow.

8. Prepare Financial Reports Regularly

Regular financial reporting helps you monitor the health of your business and make data-driven decisions. These reports, including the balance sheet, income statement, and cash flow statement, provide insights into the financial status of the business.

-

Monthly or quarterly reports: Regular reports help identify trends, potential issues, and areas of improvement.

-

Use reports for informed decision-making: Utilize financial data to make informed decisions about budgeting, investments, and cost management.

9. Budgeting and Forecasting

Setting a budget and forecasting future revenue and expenses helps SMEs plan for growth and avoid overspending. Regularly reviewing and adjusting your budget ensures you stay on track to meet financial goals.

-

Set realistic budgets: Establish spending limits and financial targets based on historical data and forecasts.

-

Adjust as necessary: Monitor performance and adjust budgets for unexpected changes or opportunities.

10. Conduct Regular Business Audits

Regular audits allow businesses to assess the effectiveness of their accounting systems and ensure compliance with financial standards. Audits also help identify discrepancies, areas of inefficiency, and opportunities for cost savings.

-

Internal and external audits: Conduct both internal checks and hire external auditors to ensure accuracy.

-

Use audit results to improve: Implement recommendations from audits to enhance your accounting practices and financial strategy.

Several company accounts and auditing practices guide the financial processes and systems. Here are some of the best accounting practices for SMEs:

How to Manage Accounting for SMEs Effectively

Managing finances is crucial for the growth and sustainability of any SME. Here’s an overview of key accounting practices that can help streamline your business finances and ensure consistent success:

1. Set Feasible Financial Targets

Establishing achievable financial goals helps prevent frustration and ensures steady business growth. Setting realistic targets that align with your current resources and performance is key to sustainable success.

-

Assess Current Performance: Understand your current financial health before setting goals.

-

Consider Available Resources: Factor in your growth pace, time, and resources.

-

Achievable Targets: Set goals that are within reach to avoid pressure and promote steady progress.

-

Celebrate Small Wins: Focus on manageable goals to build momentum and maintain motivation.

2. Use Financial Resources Wisely

Businesses must be prepared for financial challenges, especially in their early stages. Clever use of financial resources ensures long-term stability and helps weather unexpected downturns.

-

Prepare for Downturns: Set aside a financial cushion to protect your business during tough times.

-

Spend Wisely: Avoid frivolous spending, even when profits are high.

-

Invest Prudently: Focus on investments that align with your growth strategy.

-

Create an Emergency Fund: Keep reserves to tackle unforeseen challenges.

3. Implement a Dependable Accounting Program

Using reliable accounting software simplifies financial management, reduces errors, and provides valuable insights for more thoughtful decision-making. A tool like Giddh can streamline accounting tasks and enhance efficiency.

-

Manage Finances Efficiently: Use tools like Giddh to track inventory and financial data in real-time.

-

Reduce Errors: Automate routine tasks to minimize inaccuracies.

-

Gain Insights Quickly: Analyze financial data and track investment performance to gain valuable insights.

-

Boost Efficiency: Complete accounting tasks more quickly and focus on driving business growth.

4. Invest in Well-Trained Accounting Staff

Having a skilled accounting team ensures that your technology is fully leveraged and your finances are managed efficiently. Proper training maximizes the value of accounting software and provides effective financial management.

-

Ensure Proper Training: Make sure your accounting team is well-versed in using software like Giddh.

-

Maximize Technology: Equip your team with the knowledge to use advanced tools effectively.

-

Build a Strong Team: Hire resourceful, vigilant individuals to manage your business’s critical financial data.

5. Conduct Regular Business Audits

Regular audits are crucial for monitoring your financial health and identifying areas of improvement. They provide actionable insights that help refine your business strategies for continuous growth.

-

Track Financial Progress: Regular audits enable you to assess the effectiveness of your financial strategies.

-

Identify Areas for Improvement: Use audits to adjust marketing, operational processes, or technology.

-

Ensure Compliance: Audits help verify that your business is following all necessary financial regulations.

-

Plan for Future Growth: Leverage audit results to inform future decisions.

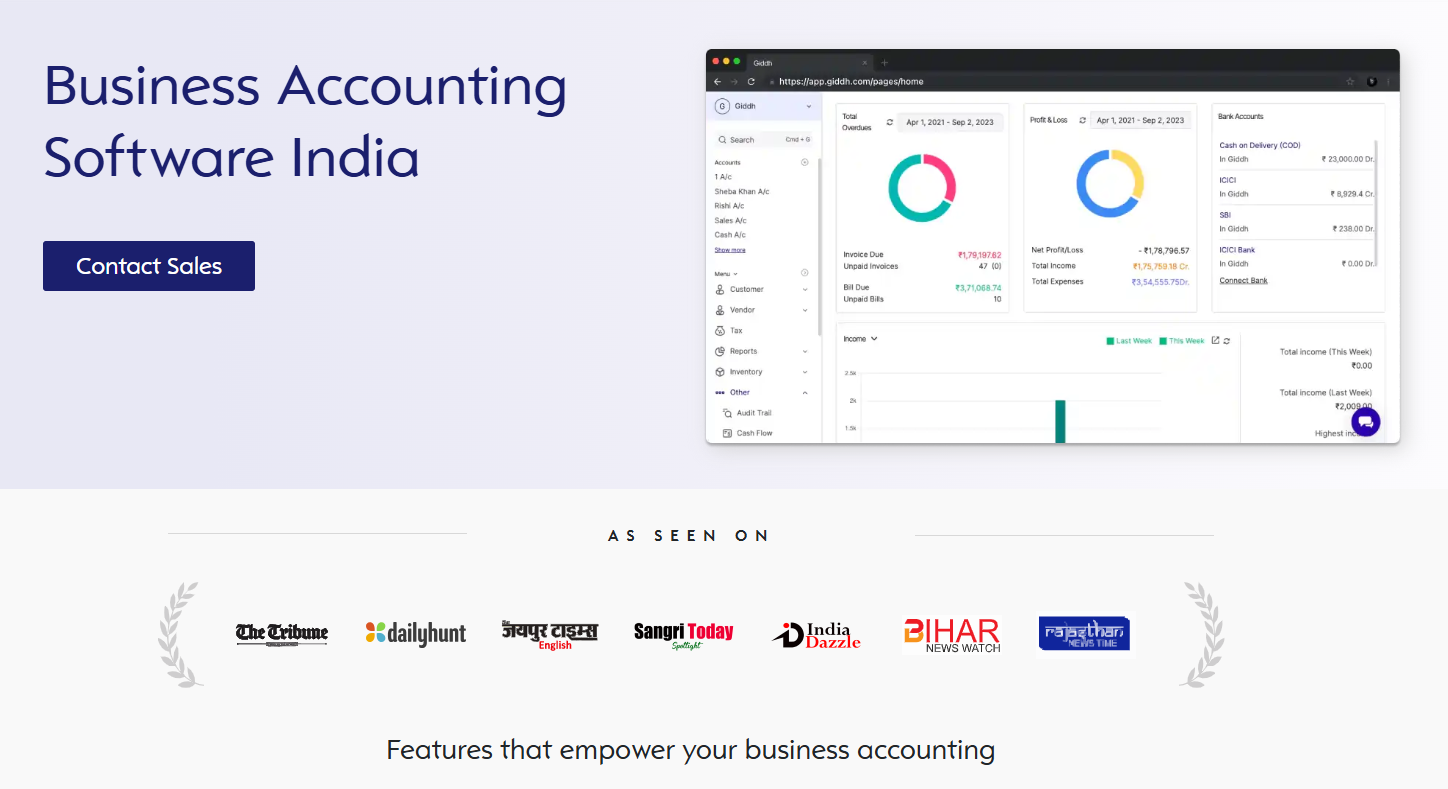

Giddh: Simplify Your SME Accounting

Giddh is a complete accounting software solution designed to cater to the needs of SMEs across various industries. With Giddh, businesses can automate accounting tasks, track transactions, and ensure compliance with tax regulations, whether you're managing a single company or handling multiple entities.

Its user-friendly interface and robust features make it the go-to tool for small and medium-sized businesses looking to optimize their financial management.

How Giddh Relates to Effective Accounting for SMEs

The features of Giddh directly align with the accounting practices we discussed, making it a perfect fit for any SME seeking to improve its financial management. Here’s how Giddh can support your business:

-

Unlimited User Access: Collaborate on your accounting tasks with unlimited user access. Perfect for growing teams, ensuring that everyone can work seamlessly on the platform.

-

Manage Over 100 Companies: Giddh makes it easy to manage multiple businesses under one account, which is ideal for SMEs with a multi-branch or multi-company structure.

-

GST & VAT Compliance: Ensure your business remains tax-compliant with Giddh’s built-in GST and VAT functionality, designed specifically for companies in regions with complex tax laws.

-

Ledger-Based Accounting: Streamline your bookkeeping by using Giddh’s ledger-based system, which automatically records and organizes all your business transactions.

-

Multi-Currency Support: Expand your business globally with seamless multi-currency management, ideal for SMEs involved in international trade or having clients abroad.

-

White-Label Option: Customize the platform with your business’s branding, offering a professional touch while using Giddh’s robust accounting features.

-

Asset Management: Keep track of your business assets with Giddh’s asset management feature, helping you manage depreciation and monitor asset performance.

-

Inventory Management: Effortlessly manage your business inventory, track stock levels, and ensure a smooth supply chain.

-

Bank Reconciliation: Automate your bank reconciliation process to save time and reduce errors.

-

Anytime, Anywhere, Any Device: Giddh’s cloud-based system ensures that you can access your business financials from anywhere, at any time, and on any device.

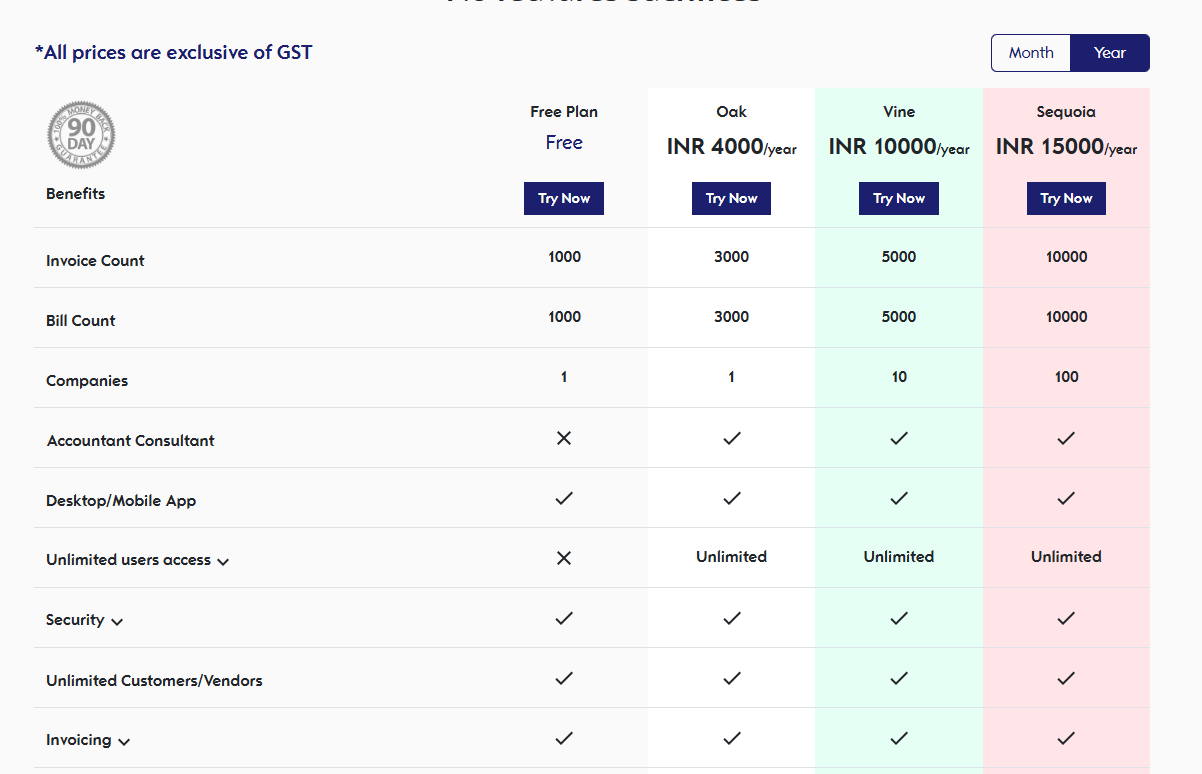

Pricing

Giddh offers various pricing plans to cater to businesses of all sizes. Whether you're just starting or managing multiple companies, you can find a plan that fits your needs.

Conclusion

The best accounting practices for SMEs are not just about balancing the books—they’re about ensuring the financial health of your business. From maintaining accurate records to automating your accounting processes, adopting the proper practices can help you manage your cash flow effectively, stay compliant with taxes, and scale with ease.

Tools like Giddh offer SMEs the technology they need to streamline their accounting, reduce errors, and save time. By leveraging modern accounting solutions, you can focus on growing your business while maintaining complete control over your finances.

Ready to simplify your accounting practices? Try Giddh today and see how it can help you manage your finances effortlessly.

FAQs

1. What Are The Basics Of Accounting Practices?

The basics of accounting practices include maintaining accurate financial records, utilizing the double-entry system, preparing key documents such as balance sheets and income statements, and ensuring compliance with tax regulations. These practices help businesses track their financial performance and make informed decisions.

2. How Does Accounting Software Benefit Small Businesses?

Accounting software helps small businesses automate tasks, reduce errors, track finances in real-time, and ensure tax compliance. It saves time, improves accuracy, and provides valuable insights for informed decision-making.

3. Why Is Accounting Important for Small and Medium Enterprises?

Accounting is crucial for SMEs as it helps track expenses, manage cash flow, ensure tax compliance, and provide insights for business growth. Proper accounting ensures financial health and enables better decision-making.

4. What Are The Best Accounting Practices for SMEs?

Best accounting practices for SMEs include maintaining accurate records, utilizing the double-entry system, preparing financial statements regularly, budgeting effectively, and employing reliable accounting software to ensure efficiency and accuracy.

5. What Are Common Accounting Mistakes SMEs Should Avoid?

Common accounting mistakes SMEs should avoid include neglecting cash flow management, failing to reconcile accounts regularly, misclassifying expenses, and overlooking tax deadlines. These errors can lead to financial mismanagement and legal issues.