How GST Filing Software Helps You Stay Compliant with Government Regulations

In this blog, we'll explore how GST filing software has become essential for businesses. How it streamlines compliance, automates calculations, and keeps up with regulatory changes, letting companies focus on growth.

With over 1.4 crore GST taxpayers registered in India, the shift towards using software solutions is clear.

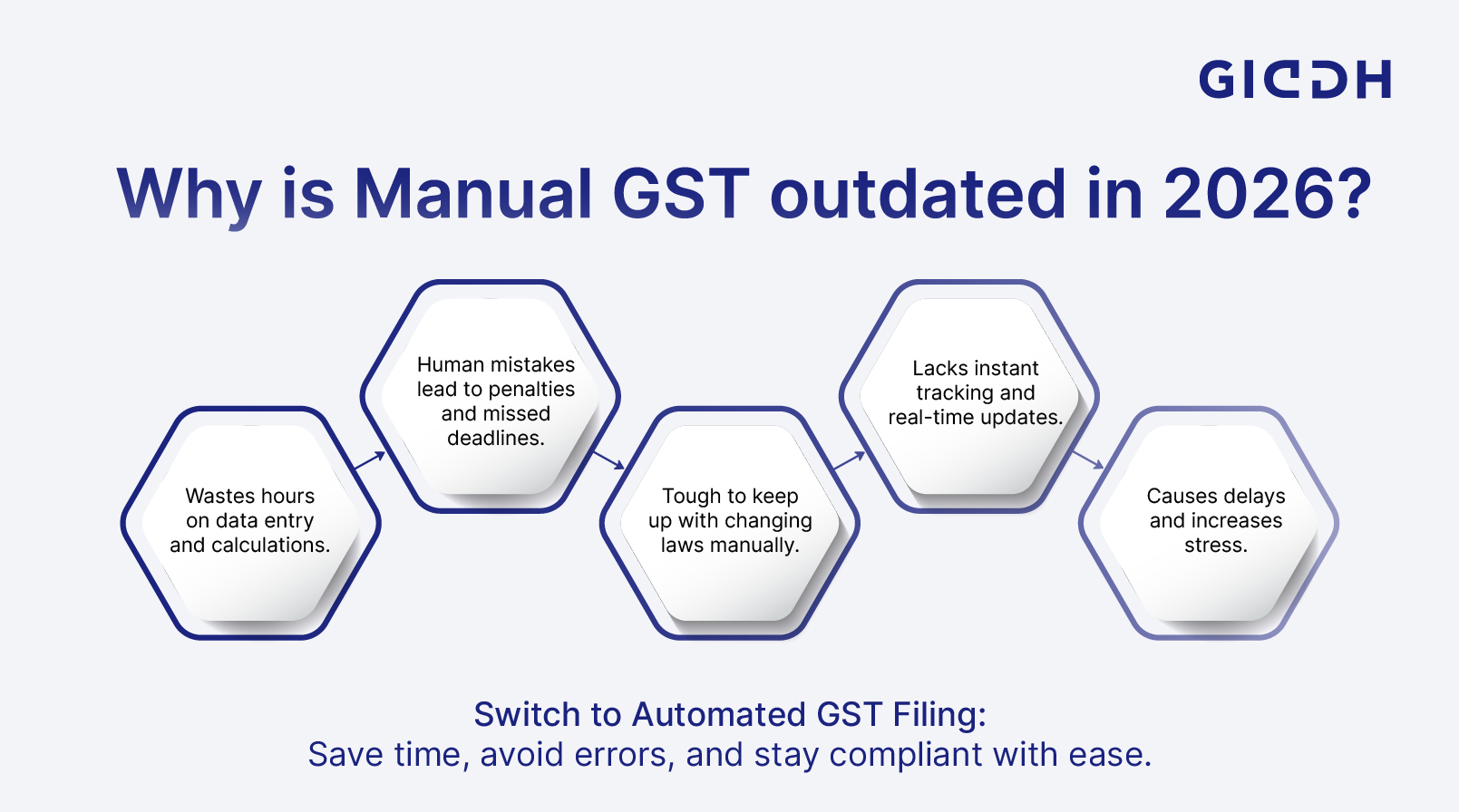

The introduction of GST in India simplified taxation but brought new challenges for businesses. The complexity of GST filings, frequent tax law changes, and managing tax rates (CGST, SGST, IGST) can overwhelm small business owners, increasing the risk of errors and missed deadlines.

This blog aims to help you understand how GST filing software helps businesses stay compliant, ensures accurate filings, and ultimately saves time, effort, and potential penalties.

Whether you are a small business or a growing enterprise, or an accounting/CA firm looking for white-label solutions, this guide will show you how to simplify GST compliance with the best tools available.

How the Best GST Filing Software Helps You Stay Compliant?

1. Automated Calculations and Data Entry: The Foundation of Accuracy

The most common way businesses deal with GST is through manual data entry and calculations, which are highly prone to errors. A simple mistake in calculating CGST, SGST, or IGST can lead to incorrect filings.

For example, a small business owner might forget to factor in certain expenses or input the wrong tax rate, resulting in the wrong GST amount being paid. Mistakes like these can result in penalties or fines, which can significantly affect a business’s financial health.

Software’s Precision

GST filing software simplifies this process by automating the core tasks that were previously done manually. Here’s how it ensures precision and helps businesses stay compliant:

- Automated Tax Calculations: GST filing software automatically calculates the appropriate CGST, SGST, IGST, and cess based on predefined tax rates, transaction details, and input values. This eliminates the risk of human error in tax calculations.

For example, if a business buys goods worth ₹100,000, the software will automatically calculate the applicable taxes and provide the correct GST amount to be paid. - Seamless Data Import: By integrating with existing business systems, businesses can import data directly from invoices, bank statements, and accounting software. This feature eliminates the need for manually entering data into multiple systems, reducing the chances of transcription errors.

For instance, businesses that use ERP or POS systems can directly link these systems, ensuring that all transaction details are captured accurately without manual data input.

The ledger-based entry system within Giddh simplifies the tax filing process by accurately recording every transaction from the point of entry. This ensures that businesses can rely on precise data throughout their GST filing process.

2. Streamlined Return Filing Process: Effortless Submissions

Filing GST returns can be a daunting task. Businesses are required to submit different forms like GSTR-1, GSTR-3B, and GSTR-9, each with its specific requirements and deadlines. Missing a deadline or submitting incomplete or incorrect information could result in fines, penalties, or even an audit.

For small and medium businesses, navigating these forms can be time-consuming and confusing, especially when dealing with multiple deadlines.

Software’s Simplification

GST filing software simplifies this process in several ways:

-

Pre-filled Forms: GST filing software automatically populates GST forms with accurate data from your transactions, eliminating the need for manual entry. Whether it's GSTR-1 or GSTR-3B, the software fills in the fields with correct details, ensuring there’s no need to double-check the same information across different forms.

-

Direct Integration with GST Portal: It connects directly with the GST portal, allowing businesses to file returns without needing to download and upload files manually. This integration enables companies to submit their returns instantly, eliminating the risk of technical issues during uploads.

-

Compliance Alerts and Reminders: The Best GST filing software automatically sends notifications for upcoming deadlines and potential discrepancies. These timely reminders ensure that businesses never miss a filing deadline or overlook a required action, thus helping them avoid penalties and late fees.

What sets Giddh apart is its direct filing capability. Businesses can file their GST returns directly from Giddh to the GST portal, ensuring a streamlined process with zero risk of human error.

Learn more about how to simplify tax filing process today.

3. Improved Input Tax Credit (ITC) Management: Maximising Your Benefits

Input Tax Credit (ITC) is one of the most beneficial aspects of the GST system, allowing businesses to claim credits on the taxes they’ve paid for goods and services.

However, the process of claiming ITC can be tricky. Companies need to reconcile their purchase data with supplier data to ensure they are claiming the correct ITC. Without an automated system, the risk of mismatched invoices, missing data, or clerical errors increases, leading to ITC leakage and financial loss.

Software’s Solution

Online GST filing software addresses these challenges by automating the reconciliation process:

-

Accurate ITC Claims: GST accounting software automatically reconciles purchase invoices with supplier GSTR-2A/2B data, ensuring that businesses claim all eligible ITC. For example, if a company has purchased raw materials worth ₹50,000, the software will ensure the correct ITC is claimed based on the supplier’s filed data.

-

Reduced ITC Leakage: By tracking data in real-time, the software ensures that businesses don’t miss out on eligible ITC due to discrepancies. Real-time reconciliation prevents potential mismatches and ensures companies can claim all credits they are entitled to, thereby optimising cash flow.

*Giddh offers powerful automated reconciliation features that significantly reduce the chances of ITC leakage. The software matches purchase data with supplier GSTR-2A/2B data in real-time, ensuring businesses claim every penny of eligible ITC.*

4. Enhanced Record-Keeping and Audit Preparedness: Integration with accounting software

GST mandates businesses to maintain accurate and detailed records of their transactions for a minimum of six years. Maintaining physical copies of these records, especially for companies with large volumes of transactions, can be challenging. Moreover, companies need to ensure that they have easy access to these records during audits or inspections.

Software’s Contribution

GST software for small businesses helps maintain a central, accessible, and secure repository of their records:

-

Centralised Data Storage: Giddh stores all GST-related documents—like invoices, ledgers, returns, and other vital records in a single, secure location. This centralised storage system ensures that businesses can easily access any document during audits, without the hassle of sifting through physical paperwork.

-

Comprehensive Audit Trails: Every transaction and user action is tracked and logged, ensuring that businesses have a transparent and auditable history of their financial activities. This audit trail is crucial for compliance and can be reviewed during audits or inspections.

*Giddh offers cloud-based storage**, ensuring that your records are encrypted, backed up, and accessible from anywhere.

The multi-user management system allows businesses to assign specific permissions for different team members, ensuring data integrity and accountability.

5. Staying Updated with Regulatory Changes: Future-Proofing Your Business

GST regulations are frequently updated, and businesses must stay on top of these changes to ensure compliance. Manually tracking changes in GST rates, laws, and filing procedures is not only time-consuming but also error-prone.

Software’s Adaptability

Reputable GST filing software providers ensure that their platforms are regularly updated to reflect the latest regulatory changes. This proactive approach ensures that businesses are always compliant, without needing to check for updates or adjust processes manually.

-

Continuous Updates: Giddh automatically updates to incorporate the latest GST rules and amendments, ensuring businesses are always compliant.

-

Proactive Compliance: Giddh helps businesses adapt to changes swiftly, minimising the risk of penalties due to outdated practices.

*Giddh is committed to keeping businesses ahead of regulatory changes by offering real-time updates and proactive compliance features.*

With Giddh, businesses don’t need to worry about tracking every change manually—it ensures they are always aligned with the latest GST rules and regulations.

How Does GST Software for Small Businesses Work?

Challenges Faced:

-

Manual Data Entry: The business was spending hours manually entering purchase and sales data into spreadsheets, leading to human errors and missed deadlines.

-

Complex ITC Claims: The business struggled to ensure it was claiming all eligible Input Tax Credits (ITC) due to mismatched supplier data.

-

Missed Deadlines: With multiple GST forms (GSTR-1, GSTR-3B) and deadlines, ABC Manufacturing often risked filing returns late, which could result in penalties.

How GST Filing Software Helps:

1. Automated Data Import: With Giddh, ABC Manufacturing can integrate its existing accounting systems, automatically importing purchase and sales data. This drastically reduces manual effort and the risk of errors.

2. Accurate Tax Calculation: The software automatically calculates GST on all transactions, ensuring that CGST, SGST, IGST, and cess are accurately applied without human intervention.

3. Seamless Filing: Giddh automatically populates the necessary GST return forms and directly submits them to the GST portal, eliminating the need for manual form filling.

4. ITC Reconciliation: By automating the reconciliation of purchase invoices with supplier data (GSTR-2A/2B), Giddh ensures that ABC Manufacturing claims every eligible ITC, optimising their cash flow and reducing financial losses.

5. Timely Alerts and Notifications: With Giddh's compliance reminders, ABC Manufacturing never misses a filing deadline. The automated notifications ensure that the business stays updated on any required actions.

Invest in Seamless GST Compliance with the Best GST Filing Software Today!

In conclusion, GST filing software is an invaluable tool for businesses looking to stay compliant with GST regulations. With automated calculations, streamlined filing processes, and real-time updates, Giddh makes GST compliance simple and hassle-free. By integrating financial operations, optimising ITC claims, and ensuring secure record-keeping, Giddh empowers businesses to focus on growth while staying compliant with the latest tax laws.

Ready to streamline your GST compliance?

Visit Giddh’s website today to explore our features, start a free trial, or request a demo to see how Giddh can simplify your GST filing process.

FAQs

1. What is GST filing software, and how does it automate tax compliance for businesses?

GST filing software automates the process of calculating, filing, and submitting GST returns, ensuring businesses comply with tax laws efficiently.

2. How can Giddh help my business achieve "zero-error" GST returns and avoid penalties?

Giddh offers accurate calculations, real-time data syncing, and pre-filled forms, reducing errors and ensuring timely filing.

3. What are the essential features to look for when choosing the best GST reconciliation software?

Look for automated reconciliation, seamless integration with accounting systems, and real-time updates to manage ITC and filing.

4. Can GST software streamline multi-branch accounting and ITC claims for large organisations?

Yes, Giddh offers branch accounting and real-time ITC tracking, simplifying multi-branch compliance and reconciliation for large businesses.

5. How does Giddh ensure data security and compliance with the latest GST regulations?

Giddh’s cloud-based platform ensures encrypted data storage and automatic updates to stay in line with the latest GST regulations.