How Bookkeeping and Accounting Help Small Businesses Thrive

Did you know that 82% of small businesses fail due to cash flow issues? At the heart of this problem lies one common culprit: poor financial management. For many small businesses, the line between survival and shutdown often hinges on how well they manage their books.

Bookkeeping and accounting are the financial lifeline of any small business. From tracking every transaction to ensuring compliance with tax regulations, these functions keep operations running smoothly. It gives entrepreneurs a real-time view of their cash position, helps them spot financial red flags early, and supports smarter, faster decisions.

Modern tools like Giddh make this even easier. With features like real-time tracking, seamless invoicing, and automated reporting, small business owners can take control of their finances and get back to focusing on growth.

Let’s look at how bookkeeping and accounting, especially with tools like Giddh, can drive smarter decisions and long-term growth.

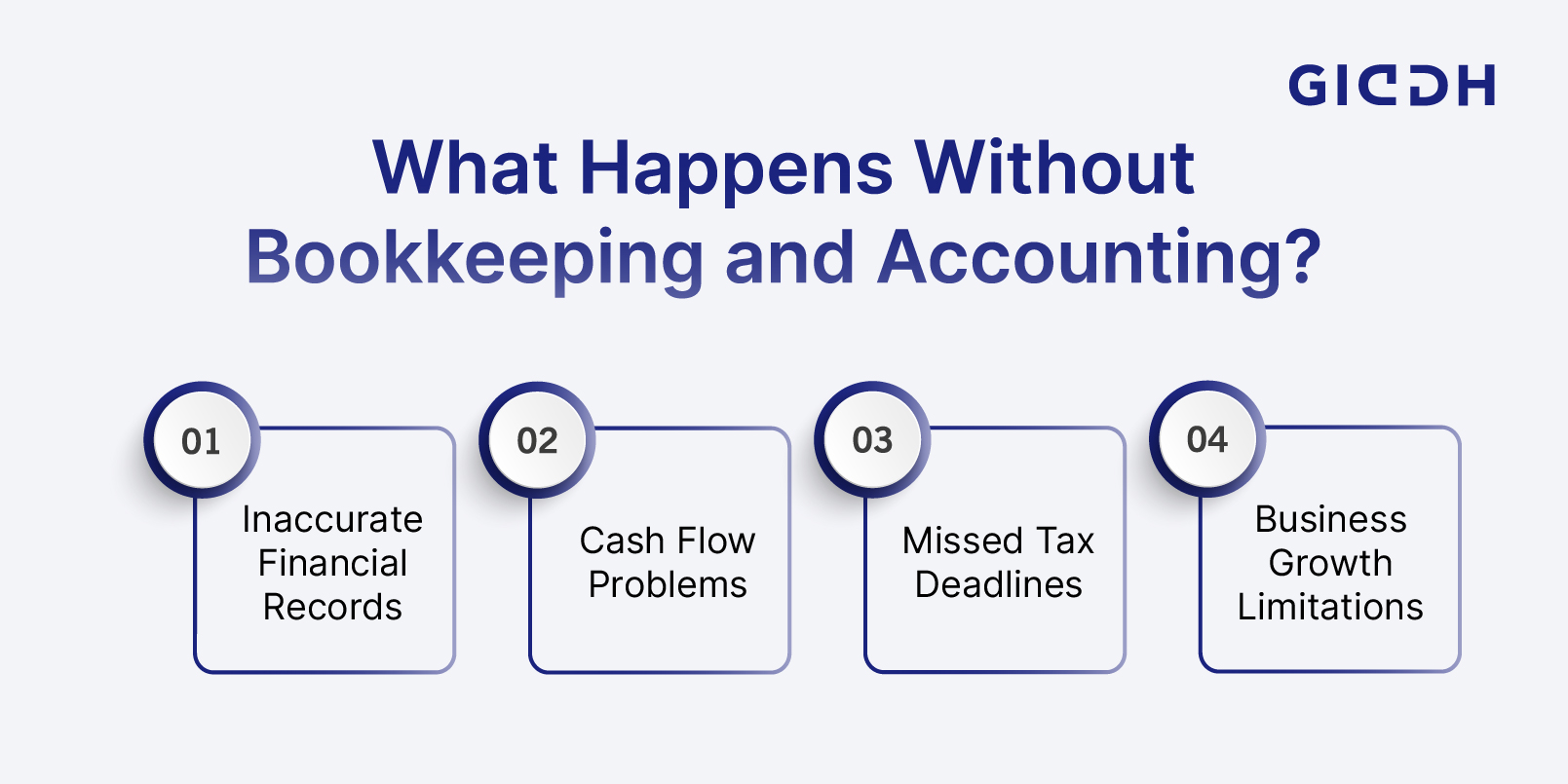

What Happens to Small Businesses Without Proper Bookkeeping and Accounting?

Here are some of the key challenges that small businesses face when they don’t have proper bookkeeping and accounting in place.

- Inaccurate Financial Records

Without proper bookkeeping, small business owners often face inaccurate financial records. It can lead to:

-

Overestimating profits, causing unnecessary reinvestment or overspending.

- Underestimating costs can lead to cash flow problems when unexpected bills arrive.

- A false sense of financial security is preventing necessary business adjustments.

-

Cash Flow Problems

Cash flow issues are one of the most common challenges for small businesses. According to QuickBooks, 61% of small businesses struggle with cash flow management. It can happen due to:

-

Late payments from customers.

- Poor invoicing practices or delayed billing.

- Not having enough funds set aside for unforeseen expenses, which can lead to:

- Missed opportunities.

- Inability to pay suppliers or employees, damaging business relationships.

-

Missed Tax Deadlines

Not keeping track of tax deadlines can lead to serious financial consequences:

-

Missing VAT or income tax filing deadlines can result in penalties.

- The IRS, for example, imposes a 5% per month penalty for late returns, which can quickly accumulate.

- These penalties can have a significant impact on businesses with tight margins, adding unnecessary financial burden.

-

Business Growth Limitations

Without accurate financial records, it becomes challenging to identify growth opportunities, such as:

- Not recognizing profitable areas to invest in or expanding underperforming regions.

- Difficulty securing funding or attracting investors due to poor financial management.

- Challenges in scaling operations or hiring new employees without clear insights into financial health.

How Can Small Businesses Get Started with Bookkeeping and Accounting?

When it comes to managing your business finances, one of the first decisions you’ll need to make is whether to handle bookkeeping and accounting yourself or hire a professional.

For small businesses with straightforward financial transactions, managing bookkeeping on your own might be sufficient. However, if you face complex transactions or tax filing, it's often best to bring in a professional.

Example: during tax season, an accountant can help you navigate the tax codes and ensure you avoid penalties or overpaying. A professional can also assist with year-end financial statements, ensuring everything is correctly accounted for and compliant with tax laws.

Best Practices for Small Business Owners

If you choose to handle bookkeeping yourself, here are a few best practices to keep in mind:

- Track Expenses Regularly: Consistently record every business transaction to avoid surprises when it’s time to reconcile your books.

- Separate Personal and Business Finances: This simple step will make it easier to track business expenses and reduce the risk of confusion at tax time.

- Stay Organized: Keep all receipts, invoices, and financial documents organized. It will save you time and hassle during audits or when preparing reports.

- Use Accounting Software: Invest in user-friendly software that can simplify tracking and managing your finances.

How Does Giddh Make Accounting Easier for Small Business Owners?

One tool that can help simplify accounting for small businesses is Giddh. With its easy-to-use interface, even those without a background in finance can track their business’s finances in real time.

Giddh allows you to record transactions quickly, send invoices, and generate financial reports all from one platform. Its cloud-based system also enables you to access your financial data anytime, anywhere, making it easier to stay on top of your business’s financial health.

What Are the Best Tools to Simplify Bookkeeping and Accounting for Small Businesses?

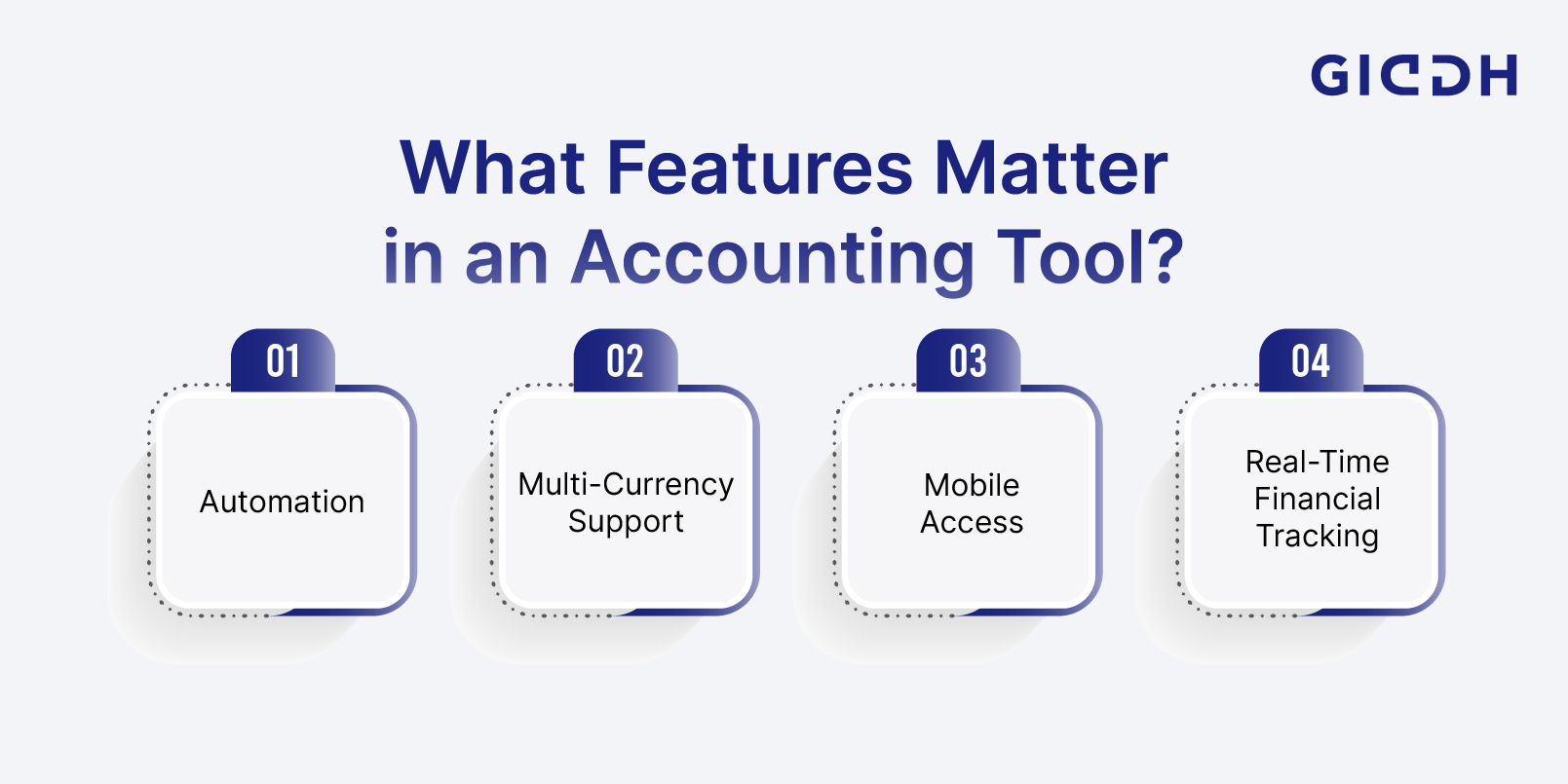

Choosing the right accounting tool can make all the difference for small businesses. The right software can streamline your financial processes, reduce errors, and help you stay on top of your finances.

Here are the key features to look for when selecting an accounting tool:

- Automation

Look for tools that automate tasks such as invoicing, expense tracking, and financial reporting. Automation not only reduces the risk of human error but also frees up your time, allowing you to focus on growing your business instead of managing finances manually.

- Multi-Currency Support

If you’re working with international clients or suppliers, multi-currency support is crucial. This feature allows you to handle transactions in different currencies without the need for manual conversions, ensuring accurate financial records and smoother international dealings.

- Mobile Access

With the increasing need for flexibility, having access to your accounting software on mobile devices is a game-changer. It allows you to track expenses, view reports, and manage finances wherever you are, whether at a meeting, traveling, or working remotely.

- Real-Time Financial Tracking

Real-time tracking ensures that your business finances are always up-to-date. By having access to current data on income, expenses, and cash flow, you can make informed decisions quickly and avoid surprises when it’s time to file taxes or review your financial health.

What Makes Giddh a Smart Bookkeeping Solution for Small Businesses?

Giddh is a powerful bookkeeping and accounting software that simplifies financial management for small businesses. The software’s automation tools for invoicing and expense tracking save you time and reduce errors. With multi-currency support, companies can easily manage international transactions.

- GST Compliance Made Easy

Giddh helps businesses effortlessly track and file GST reports, ensuring accurate tax calculations and timely compliance without hassle.

- Mobile Accounting for On-the-Go

With Giddh’s mobile app, business owners can access financial data anytime, anywhere, with real-time updates, fast invoicing, and easy expense tracking.

- Advanced Inventory Management

Giddh streamlines inventory control with real-time tracking, warehouse management, and instant reporting, keeping you on top of stock levels, sales, and purchases.

- Instant Financial Reports

Generate accurate financial reports, including profit & loss, balance sheets, and trial balances, instantly for better business insights and decision-making.

- Customer Portal for Simplified Billing

Manage client interactions effortlessly with a customer portal that provides real-time statements, invoice management, payment tracking, and multi-member access.

Conclusion

Bookkeeping and accounting are the foundation of a small business's financial health. By maintaining accurate records, tracking cash flow, and staying on top of tax deadlines, businesses can make informed decisions to ensure long-term success.

Proper financial management helps identify opportunities, avoid costly mistakes, and ensure the business remains compliant with regulations.

Start your free trial with Giddh today and experience how easy it can be to manage your books with real-time tracking, automation, and mobile access. Take the first step towards better financial management and a more organized future for your business.