Boost Businesses With Bookkeeping And Accounting Software

Bookkeeping plays a vital role in managing a successful business by tracking financial transactions, recording income and expenses, and maintaining overall financial health. However, traditional manual bookkeeping can be tedious, prone to errors, and challenging to scale as your business grows.

With the advancement of technology, financial management has become more efficient, enabling businesses to optimize operations and save time. Bookkeeping software is a key tool that can help achieve these objectives.

For businesses like yours, bookkeeping software India is the answer. It streamlines financial management by automating manual processes, reducing errors, and offering real-time insights that empower informed decision-making.

In this article, we explore the role of bookkeeping software, key features to look for, and how Giddh stands out as a reliable solution for your business's financial needs.

Let’s explore how bookkeeping software can make this happen.

Why Financial Health Matters for Your Business

Financial health is crucial for the success and longevity of any business. It enables companies to make informed decisions, manage cash flow effectively, and maintain profitability. Poor financial health can lead to operational inefficiencies, missed opportunities, and even bankruptcy.

By accurately tracking income, expenses, and taxes, businesses can identify areas for improvement and ensure they’re prepared for future growth. Maintaining good financial health is key to sustainability and thriving in a competitive market.

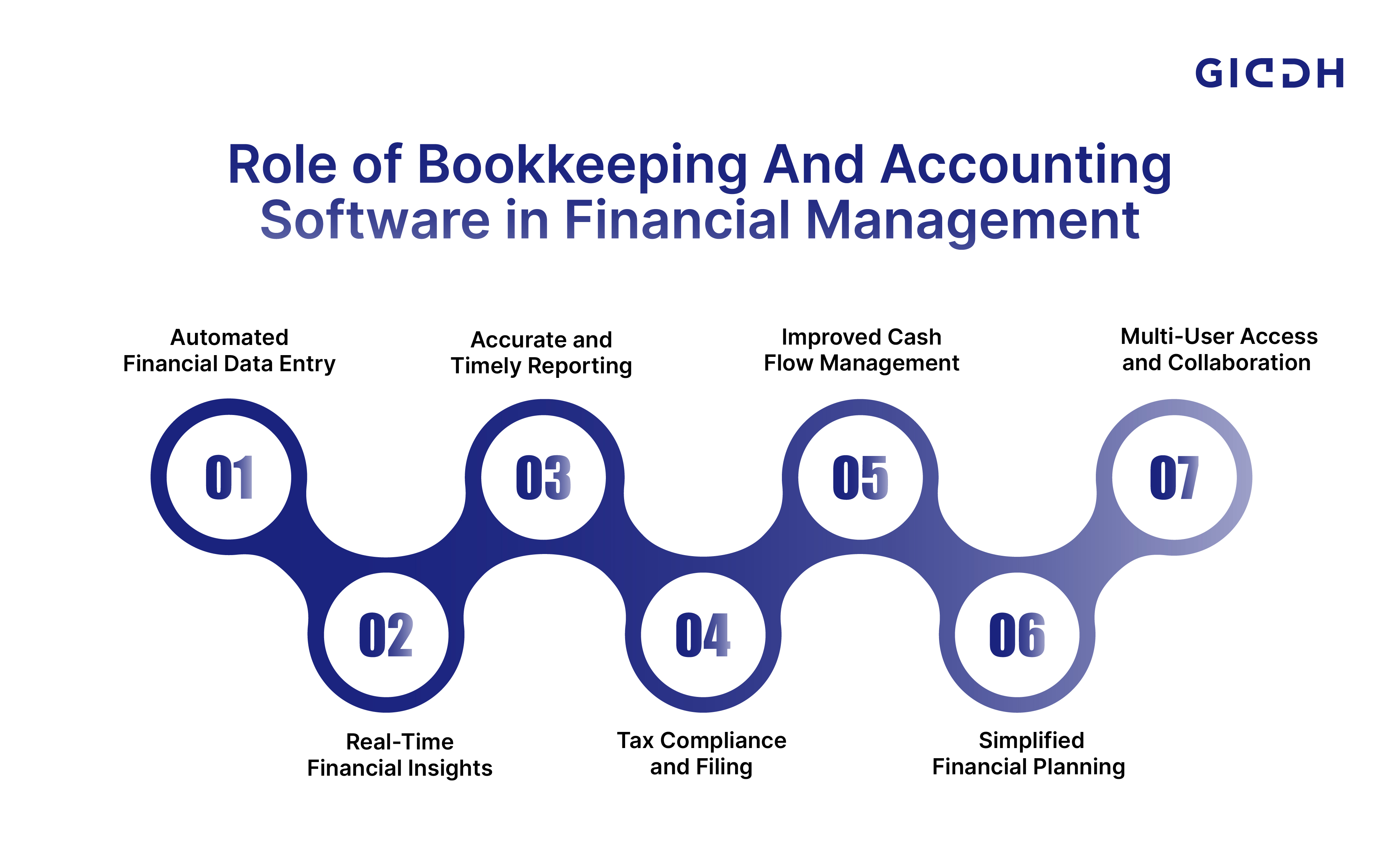

How Bookkeeping And Accounting Software Improves Business Financial

Financial performance tracking software simplifies the complex task of managing financial data, making it more accurate, accessible, and actionable. It allows business owners, accountants, and consultants to focus on strategic growth rather than being bogged down by tedious manual accounting tasks.

Let’s explore the role of bookkeeping software in modern financial management and how it enhances business operations.

1. Automated Financial Data Entry

Bookkeeping software eliminates the need for manual data entry by automatically recording transactions, thereby reducing the risk of human error and ensuring data consistency.

-

Automated expense and income tracking

-

Minimized errors from manual data entry

-

Streamlined reconciliation process

2. Real-Time Financial Insights

Having access to real-time financial data is crucial for making informed business decisions. Financial performance tracking software provides instant access to key metrics, such as cash flow, profit margins, and outstanding invoices.

-

Instant updates on financial standing

-

Better financial planning with accurate data

-

Quickly identify financial issues before they escalate

3. Accurate and Timely Reporting

Bookkeeping software generates essential financial reports, including balance sheets, profit and loss statements, and cash flow reports. These reports are crucial for evaluating a business's health and making informed, data-driven decisions.

-

Customizable reports tailored to business needs

-

Simplified tax filing with accurate reports

-

Helps monitor business performance and growth over time

4. Tax Compliance and Filing

One of the most critical roles of bookkeeping software India is ensuring compliance with local tax regulations. Automated tax calculations and the generation of GST-compliant invoices help businesses stay on top of their tax obligations.

-

Automated GST calculations and filing

-

Ensures timely and accurate tax returns

-

Avoids penalties and audits related to tax errors

5. Improved Cash Flow Management

Bookkeeping software helps businesses manage their cash flow by providing real-time visibility into income and expenses. This enables business owners to make more informed decisions regarding spending, investments, and resource allocation.

-

Track receivables and payables effortlessly.

-

Monitor cash flow patterns and trends.

-

Make informed decisions on capital allocation.

6. Simplified Financial Planning and Budgeting

Bookkeeping software helps create budgets and financial forecasts based on actual data. By providing accurate insights into business expenses and revenue, businesses can plan more effectively for the future.

-

Create and track budgets in real-time.

-

Align financial goals with business objectives.

-

Predict future financial outcomes based on historical data.

7. Multi-User Access and Collaboration

Many bookkeeping software India allows multiple users to access the platform, facilitating collaboration among team members. This is particularly useful for businesses with various departments or external accountants.

-

Secure access for multiple users

-

Efficient collaboration between team members

-

Customizable permissions and controls for sensitive data

5 Ways Bookkeeping Software Drives Business Efficiency

Bookkeeping software in India helps businesses automate routine tasks, reducing manual effort and minimizing the risk of errors. Here’s how it contributes to improved efficiency:

-

Automates Data Entry: Manual data entry is prone to mistakes. Bookkeeping software automatically captures and categorizes transactions, saving time and ensuring accuracy.

-

Real-Time Financial Insights: With real-time reporting features, businesses can access up-to-the-minute financial data at any time. This enables quicker decision-making and improved cash flow management.

-

Improves Tax Compliance: Bookkeeping software India helps businesses stay on top of tax regulations by automatically calculating taxes and generating GST-compliant invoices.

-

Streamlines Reporting: Generating financial reports, such as balance sheets, profit & loss statements, and cash flow reports, is significantly faster, enabling businesses to analyze their financial performance with ease.

-

Enhanced Collaboration: Cloud-based systems enable multiple users to access financial data simultaneously, facilitating collaboration across teams and departments.

In addition to these benefits, small business accounting tools like Giddh provide an integrated, scalable solution that grows with your business, ensuring that your accounting processes remain efficient as your operations expand.

Key Features to Look For In Bookkeeping Software for Your Business

Choosing the right bookkeeping software for financial management is crucial for the success and efficiency of your business. However, not all bookkeeping software India options are created equal, so it’s essential to understand the Giddh features that will have a significant impact on your business’s financial health.

1. User-Friendly Interface

The software should be intuitive, allowing you to navigate financial tasks without feeling overwhelmed.

-

Easy navigation for non-accountants

-

Simple setup and implementation

-

Clear, visually appealing dashboards for quick access to financial data

2. Automated Income and Expense Tracking

One of the main advantages of bookkeeping software India is automation. Look for software that automatically records and categorizes transactions, saving you time and reducing the risk of errors from manual data entry.

-

Automatic tracking of income and expenses

-

Real-time updates on financial activities

-

Customizable categories for transaction classification

3. Real-Time Financial Reporting

Look for software that provides instant, customizable financial reports such as profit and loss statements, balance sheets, and cash flow reports.

-

Instant access to financial reports

-

Customizable report generation based on specific business needs

-

Real-time updates for better decision-making

4. GST Compliance and Tax Filing Support

It ensures the software supports automatic GST calculations and generates GST-compliant invoices. This feature will save you time and prevent costly errors during tax filing.

-

Automated GST calculations based on current rates

-

GST-compliant invoices for easy tax filing

-

Track GST payments and returns efficiently.

5. Multi-User Access

The ability to grant different access levels ensures that your team can collaborate securely and efficiently.

-

Multiple users with different roles and permissions

-

Secure access control for sensitive financial data

-

Collaboration between team members and accountants

6. Seamless Integration with Other Business Tools

This integration will ensure that all your business data is unified, reducing manual data entry and improving workflow efficiency.

-

Integrates with inventory management and other business systems

-

Unified financial data across platforms

-

Streamlined processes with minimal manual intervention

7. Customizable Invoicing and Billing

Look for software that allows you to create professional, customizable invoices tailored to your business needs. Features such as recurring invoices, reminders, and the ability to accept multiple payment methods can make your invoicing process more efficient and streamlined.

-

Customizable invoice templates

-

Recurring invoices for subscription-based services

-

Automated payment reminders to improve cash flow

8. Cloud-Based Access

Cloud-based bookkeeping software offers the flexibility of accessing financial data from anywhere, at any time, using any device.

-

Access from anywhere with an internet connection

-

Real-time data synchronization across devices

-

Automatic backups to prevent data loss

9. Data Security and Backup

It ensures that the software uses encryption and secure servers to protect your business’s sensitive data. Automatic backups will also ensure that your data is safe from loss or corruption.

-

High-level data encryption for financial security

-

Regular backups to protect against data loss

-

Secure cloud storage to keep data safe

10. Customer Support and Training

Opt for bookkeeping software India that offers responsive customer service and comprehensive training resources, so you can get the most out of the tool and address issues quickly.

-

24/7 customer support for troubleshooting

-

Online training resources such as tutorials and webinars

-

User forums for community-driven assistance

How Giddh’s Bookkeeping Software Can Help Your Business

Managing finances is crucial for small businesses, but it often becomes challenging as the company grows. Giddh’s bookkeeping software India simplifies accounting tasks and helps firms maintain financial health, saving time and minimizing errors.

Designed to cater to small and medium-sized businesses, Giddh offers a comprehensive suite of features that streamline financial management and ensure seamless operations.

Key Features of Giddh’s Bookkeeping Software for Small Businesses:

GST Compliance

Giddh makes managing GST compliance effortless. Businesses can directly file GST returns from within the software, reducing the hassle of manual tax filing.

-

Track and view GSTR reports effortlessly

-

Direct GST filing from within Giddh

-

Accurate tax calculations to avoid errors

Smart Mobile Accounting App

With Giddh’s mobile app, you can manage your finances on the go. The app offers real-time updates, easy invoicing, and expense tracking, ensuring your business runs smoothly no matter where you are.

-

Access anytime, anywhere for full control

-

Instant financial updates with real-time reports

-

Fast invoicing with WhatsApp integration

-

Secure cloud storage for encrypted data protection

Inventory & Warehouse Management

This feature is designed to streamline your operations, making it easier to stay updated on inventory and generate detailed reports quickly.

-

Real-time stock tracking and updates

-

Multi-warehouse management with seamless transfers

-

Instant inventory reports and adjustments

Accurate Financial Reports

From profit and loss statements to trial balances, Giddh simplifies financial tracking, ensuring your records are accurate and up-to-date.

-

Trial Balance, Profit & Loss, and Balance Sheet reports

-

Sales and Purchase Registers for detailed tracking

-

Customer and Vendor reports for easier transactions

Customer Portal for Simplified Billing

Customers can view financial statements, manage invoices, and track payments in real-time, making client interactions more straightforward and more efficient.

-

Access and manage invoices easily

-

Payment tracking with pending dues visibility

-

Multi-member access for better collaboration

Step-by-Step Guide to Get Started with Giddh Free Bookkeeping Software

Getting started with Giddh is fast and straightforward. Follow these steps to begin managing your finances with ease:

Step 1: Sign up with your business details

Create an account on Giddh with your basic business information to set up your bookkeeping profile.

Step 2: Set up your financial accounts

Input your business’s financial data, including expenses, sales, and tax details, to configure your accounting system.

Step 3: Start creating invoices, managing expenses, and tracking your cash flow

Generate invoices, track expenses, and maintain a clear view of your cash flow with real-time updates.

Step 4: Leverage real-time reports and insights

Use Giddh’s powerful reporting tools to generate profit & loss statements, balance sheets, and more to make informed business decisions.

By using Giddh, small businesses can streamline their bookkeeping process and stay organized, while gaining the financial insights needed to grow.

Conclusion:

Bookkeeping software is not just a tool; it’s a game-changer for businesses seeking to enhance their financial performance. By automating tedious tasks, ensuring tax compliance, and providing real-time insights it enables business owners to make informed, strategic decisions that can propel their business forward.

With Giddh’s bookkeeping software India, companies can achieve financial clarity, improve cash flow, and focus on growth. Make the switch today and see the difference it can make.

FAQ Section

1. How can bookkeeping and accounting software help track business finances?

Bookkeeping software automates the tracking of income, expenses, and invoices. It generates real-time reports, providing an accurate snapshot of your business’s financial health. Giddh streamlines this process, providing easy access to financial data at any time.

2. How can bookkeeping software improve financial performance?

By automating tasks such as invoicing and reporting, bookkeeping software helps maintain accurate records, enabling better decision-making and improved cash flow management. Giddh provides real-time insights that will allow businesses to identify and address financial issues promptly.

3. Can bookkeeping software handle multiple businesses?

Yes, Giddh’s software enables you to manage multiple businesses under a single account, streamlining your financial processes.

4. What are the costs associated with bookkeeping software India?

The cost depends on the software you choose, but Giddh offers flexible pricing plans based on your business size and requirements.

5. How do I get started with Giddh’s bookkeeping software?

Visit Giddh’s website to sign up for a free trial and experience the benefits of automated bookkeeping.