How Cloud Bookkeeping Software Makes Tax Season Easier for Small Business Owners

As tax season approaches, are you feeling the pressure of handling piles of paperwork? Small business owners often struggle with staying organized, meeting deadlines, and avoiding costly mistakes during this busy time.

Cloud bookkeeping software provides a practical solution to help small business owners stay on top of their finances. With the right accounting software for small businesses, you can easily track income and expenses, automatically calculate taxes, and have access to real-time financial data.

However, many small business owners face challenges like missing deductions, making data entry errors, and spending excessive time on manual bookkeeping tasks. The fear of penalties from incorrect filings or missing deadlines adds stress to an already hectic period.

In this blog, we will discuss how cloud bookkeeping software can solve these issues by helping you manage your finances with ease and efficiency during tax season.

Why Tax Season is a Struggle Without Cloud-Based Accounting for Small Businesses

For many small business owners, tax season can feel overwhelming. Here are some common pain points:

- Lack of visibility into financial health

Many small business owners struggle to track their finances in real-time, making it challenging to monitor income and expenses accurately. Without this insight, it’s easy to overlook essential tax deductions or miss opportunities for financial improvement.

- Difficulty understanding tax laws

The complexity of tax regulations, especially with frequent changes, can be overwhelming. Small business owners often struggle to stay updated on new laws and tax requirements, which increases the risk of non-compliance or costly mistakes.

- Time-consuming manual processes

Sorting through receipts, entering data manually, and calculating taxes by hand are all tasks that take up valuable time. These manual processes often result in errors, missed deadlines, and unnecessary stress.

- Risk of costly mistakes

Without accurate financial records and automated calculations, even small errors can lead to penalties or missed deductions.

Traditional bookkeeping doesn’t fully address these challenges. Here’s why:

-

Limited flexibility: Traditional desktop accounting systems or manual bookkeeping require constant updates and oversight. These systems lack the flexibility of cloud solutions, forcing small business owners to manually input and adjust their records.

-

No automatic updates: Unlike cloud-based solutions, traditional tools don’t automatically update to reflect changes in tax laws. Business owners must manually incorporate new tax rules and rates, increasing the risk of non-compliance.

-

Prone to errors: Manual bookkeeping and desktop systems are more vulnerable to human errors, such as missing or double-counting entries. Even the most organized business owners can make mistakes that can lead to significant tax issues.

-

Time-consuming: Updating ledgers, reconciling accounts, and preparing reports are all done manually, often consuming hours each week. This means business owners are spending time on tasks that could be automated, rather than focusing on growing their business.

Cloud bookkeeping software solves these problems by offering real-time data tracking, automated tax calculations, and automatic updates to tax laws, ensuring compliance and making tax season much easier to manage.

How Cloud Bookkeeping Software and Online Bookkeeping Tools Ease Tax Filing

1. Real-Time Data Access

Cloud bookkeeping software offers immediate access to your financial data, which is one of its greatest advantages. Unlike traditional methods, where you rely on reports generated at the end of the month or year, cloud tools let you track income, expenses, and taxes as they occur.

Whether you’re in the office or working remotely, you can access your financial information anytime. This makes it easier to stay on top of your financial health and avoid last-minute surprises when tax season arrives. This constant visibility also supports budget planning and forecasting, enabling small businesses to make smarter financial decisions throughout the year.

Key Benefits:

- Access anytime, anywhere: Review your financial data from any location, on any device.

- Track income and expenses continuously: Keep tabs on your financial status throughout the year, not just at tax time.

- Mobile management: Manage finances on the go, ensuring you're always in control, even while traveling.

2. Accuracy and Error Reduction

One of the biggest challenges in tax preparation is avoiding mistakes. Cloud bookkeeping software reduces errors by automating key tasks, such as calculating taxes and categorizing transactions.

This minimizes the risk of human error, making your tax filings more accurate. The software also generates reports that are ready to be submitted, giving you confidence that your filings are complete and correct.

Key Benefits:

- Automated calculations: Reduce the chance of misreporting income or expenses.

- Accurate financial records: Automatically categorize transactions to reduce errors.

- Confidence in your filings: Automated reports ensure your tax returns are accurate and ready for submission.

3. Streamlined Tax Filing

Cloud bookkeeping platforms like Giddh simplify the tax filing process. These platforms automatically generate reports and summaries for tax filing, making it easy to submit your tax forms correctly and on time.

Since the software integrates directly with tax filing systems, you don't have to worry about formatting issues or missing data. With just a few clicks, you can prepare financial statements such as profit and loss reports, balance sheets, and GST summaries without hiring a dedicated accountant.

Key Benefits:

- Automatic report generation: Financial reports and tax summaries are automatically created and ready for filing.

- Correct file formatting: The system ensures your reports are correctly formatted for tax submissions.

- Faster filing process: Spend less time preparing tax documents, speeding up the filing process.

4. Audit Trail & Data Security

Security is a significant concern when dealing with financial data, especially for small business owners. Cloud bookkeeping software provides an audit trail, which records every change made in your financial data. This means you can track updates and easily spot any discrepancies.

In addition, cloud systems back up your data automatically, which protects your records in case of technical issues or failures. This ensures that your data is always safe, secure, and ready for review if needed.

Key Benefits:

- Audit trail: Tracks changes to your financial records for easy verification and accountability.

- Automatic backups: Protect your data from being lost due to technical issues or system failures.

- Data security: Your sensitive financial information is securely stored, reducing the risk of unauthorized access.

5. Collaboration and Accessibility

With cloud bookkeeping, multiple people can access the same data at the same time, which is ideal for small business owners who work with accountants or financial advisors. Everyone can see the identical, up-to-date records, making it easier to collaborate.

Whether you're sharing information with an accountant or a team member, cloud software ensures everyone stays on the same page, reducing the chances of miscommunication.

Key Benefits:

- Real-time collaboration: Allow accountants, advisors, and team members to work together in real time.

- Centralized access: All users can access the same data, ensuring consistency and reducing the risk of mistakes.

- Better communication: Everyone involved in managing finances is on the same page, making the tax season smoother.

6. Cost Savings

Using cloud bookkeeping software can help reduce the cost of hiring external accountants for routine tasks. Small business owners often pay a premium for accountants to handle tax filing and bookkeeping.

With cloud-based tools, many of these tasks can be handled internally, saving money in the long run. By automating invoicing and expense tracking, cloud bookkeeping tools help improve cash flow management, which is crucial during the crunch of tax season.

Key Benefits:

- Reduced reliance on external accountants: Handle basic bookkeeping tasks without needing to hire expensive services.

- Lower accounting costs: With automated features, the need for additional accounting support is minimized.

- Long-term savings: Though there’s an initial investment, the ongoing savings outweigh the costs.

Why Choose Giddh for Cloud Bookkeeping?

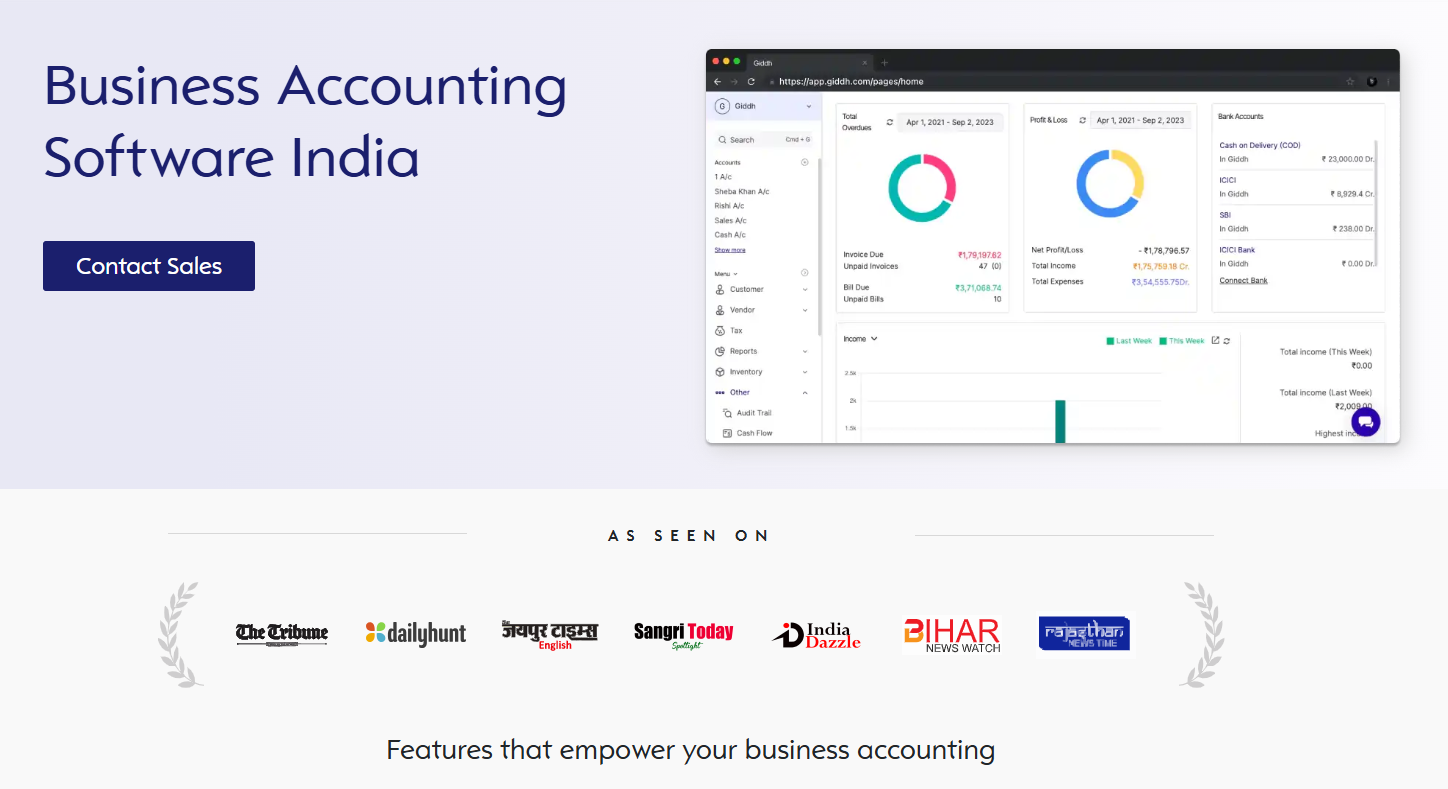

Cloud bookkeeping software like Giddh is one of the most efficient online bookkeeping tools available for Indian small businesses. It offers a simple and efficient solution to manage business finances while ensuring GST compliance.

Giddh is user-friendly, even for business owners with no prior accounting experience, and its free version makes it an excellent choice for small businesses looking to streamline their accounting processes.

Key Features of Giddh:

-

GST Compliance:

-

Automatically generates GST reports and tracks transactions.

-

Ensures accurate tax calculations and simplifies GST filing directly from the software.

-

Saves time and reduces the stress of staying compliant.

-

-

Smart Mobile Accounting App:

-

Manage accounts, track payments, and create invoices from anywhere.

-

Real-time updates for quick access to financial data and business insights.

-

View financial health at a glance and manage invoices and expenses on the move.

-

-

Financial Reports Made Simple:

-

Quickly generate accurate profit & loss statements, balance sheets, and more.

-

Access key financial insights with just a few clicks.

-

Get an instant snapshot of your business’s financial performance.

-

-

Collaboration and Access Control:

-

Invite team members, accountants, or clients to collaborate in real time.

-

Supports multi-member access for efficient teamwork.

-

Customer portal for simplified billing and payment tracking.

-

Conclusion

Cloud bookkeeping software like Giddh offers small business owners a powerful way to manage their finances, especially during tax season. By providing real-time access to financial data, automating tax calculations, and ensuring GST compliance, Giddh makes tax season simpler and more accurate.

Cloud bookkeeping gives you the power to simplify tax season and manage your finances with ease throughout the year. Take control of your accounting today and focus on what matters most.

Start your free trial today and experience stress-free tax preparation with Giddh.