Why Collaborative Accounting Is Changing Business Finance

For many small to mid-sized businesses, financial management often means relying on outdated tools that cause inefficiencies, delays, and errors. Teams struggle with slow reporting, manual data entry mistakes, and difficulty collaborating in real time, which can make it challenging to respond to changes quickly and make data-driven decisions.

This is where collaborative accounting software comes in as the solution. By centralizing your financial data, automating routine tasks, and enabling seamless collaboration across departments, this software transforms the way your team works together.

In this blog, we’ll explore how this technology solves common pain points and introduces a more efficient and collaborative approach to financial management.

The Challenges of Traditional Accounting Systems

Why Are Traditional Accounting Tools Slowing Your Business Down?

Many small and mid-sized businesses are still stuck using outdated, siloed accounting tools that hold back progress and increase the risk of errors. Let’s dive into the specific challenges you may be facing:

-

Slow Financial Reporting: Disconnected systems and manual entry result in delayed financial reports, which are critical for quick decision-making.

-

Manual Data Entry Errors: Mistakes in financial reporting and invoicing are common when using manual processes. These errors not only slow down operations but also impact the reliability of your financial data..

-

Lack of Collaboration Across Teams: When departments like finance, operations, and HR are using different systems, it’s tough to collaborate efficiently, which leads to delays and confusion in decision-making.

Real-World Example: A tech startup that still uses spreadsheets for accounting finds it nearly impossible to generate accurate monthly reports on time. As a result, the finance team misses key opportunities to review expenses and optimize cash flow, ultimately affecting business growth.

Introducing Collaborative Accounting Software

What Is Collaborative Accounting Software?

Collaborative accounting software is a modern solution designed to break down the barriers of traditional accounting tools. Unlike isolated systems, this software centralizes all your financial data in one accessible location and allows multiple users to collaborate seamlessly in real-time.

What are the Features of Collaborative Accounting Software?

-

Centralized Platform: All financial data is stored in one place, ensuring accuracy and reducing the need for duplicating efforts across systems.

-

Real-Time Collaboration: Multiple users—whether finance, HR, or operations—can view, edit, and update financial information simultaneously, ensuring teams are aligned at all times.

-

Automation: Routine processes like integration with invoicing, payroll, and inventory tracking are automated, freeing up your team from manual data entry and reducing errors.

*Real-World Example: A growing retail business adopts collaborative accounting software, enabling the finance team to access updated cash flow data instantly. This allows them to identify areas of improvement and take corrective action before issues escalate.*

How Does Collaborative Financial Management Software Improve Financials?

Real-time access to financial data enables your finance team to make decisions faster and with greater confidence. Here’s how:

-

Faster Decision-Making: With real-time data access, finance teams can analyze trends and make decisions without waiting for outdated reports. This accelerates the time it takes to take action on opportunities or address challenges.

-

Improved Accuracy: Collaboration ensures that all teams are working from the same data, reducing the risk of duplicate entries, manual errors, and conflicting reports. This means fewer discrepancies and more reliable financial insights.

-

Streamlined Collaboration: By providing a single platform for multiple users, online accounting software for teams allows collaboration without delays. The ability to comment on reports, share insights, and track updates ensures everyone stays on the same page.

*Example: A retail business uses collaborative accounting software to share updated sales data with the operations team. This enables both departments to quickly adjust purchasing strategies and make faster decisions about product launches, improving cash flow.*

Why Collaboration Is Key in Financial Management

Effective financial management goes beyond just tracking numbers—it requires cross-department collaboration. Here’s why it’s essential:

-

Breaking Down Silos: Collaborative accounting software promotes teamwork by integrating departments like finance, HR, and operations into one platform. This ensures that financial insights are aligned across the company and reduces miscommunication or delays.

-

Strategic Advantages for SMBs: For small to mid-sized businesses, the ability to react quickly to market changes can be the difference between success and failure. By providing real-time access to critical financial data, teams can collaborate on strategy and make faster, more proactive decisions.

Strategic Benefits for SMBs:

-

React faster to changes in the market.

-

Make proactive decisions based on real-time data.

-

Ensure financial health and stability.

*Example: A professional services firm uses collaborative accounting software to centralize its financial data. Finance, HR, and project management teams can view the same reports and adjust staffing or pricing strategies quickly based on real-time insights.*

The Future of Accounting: Automation and AI

How Will Automation and AI Shape the Future of Financial Management?

The future of accounting will be powered by automation and artificial intelligence (AI). Here's how these technologies will enhance financial management software:

-

Automating Routine Tasks: Tasks like invoicing, payroll, and inventory management are being automated, allowing finance teams to focus on more strategic work. This minimizes the need for manual input and reduces errors.

-

AI for Forecasting and Planning: AI-powered features within accounting software can help businesses forecast trends, plan for taxes, and optimize cash flow. These tools make it easier for finance teams to predict future business needs and proactively plan.

*Example: A growing retail business uses AI-driven predictive features to anticipate demand and adjust inventory levels. This leads to better decision-making and more accurate financial planning.*

How to Choose the Right Collaborative Accounting Software

Not all collaborative accounting software is created equal. When choosing the right tool, look for these essential features:

-

Real-Time Data Access: Ensure that all users can access the most current financial data at any time.

-

Prioritize Real-Time Collaboration: Choose software with instant data syncing, role-based access, and live reporting. This prevents delays, reduces errors, and keeps all stakeholders aligned.

-

Check Integration Capabilities: Ensure compatibility with ERP systems, CRM tools, banking APIs, and e-invoicing platforms. Smooth integration saves time and prevents data duplication.

-

Evaluate User Experience: Look for intuitive dashboards, easy navigation, and automated financial workflows. A user-friendly interface shortens the learning curve and boosts adoption.

-

Assess Security Measures: Opt for software with end-to-end encryption, secure cloud hosting, and regular backups to protect sensitive financial data.

-

Review Scalability & Flexibility: Choose a platform that grows with your business, supports unlimited transactions, and adapts to changing compliance regulations.

-

Compare Pricing & Support: Balance cost with features. Prioritize providers offering free trials, transparent pricing, and 24/7 support for technical and operational needs.

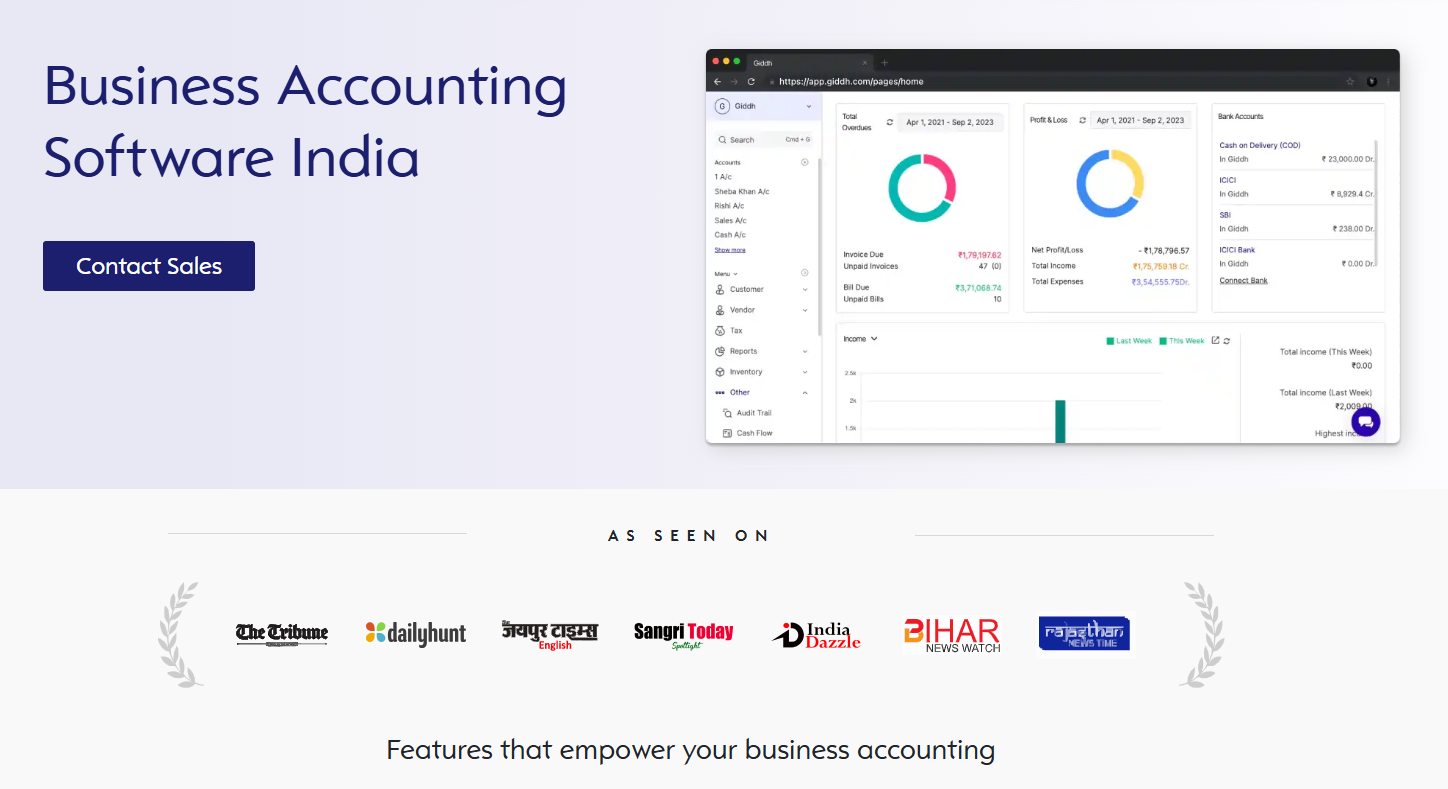

Giddh’s collaborative accounting software ticks all the boxes, providing small and mid-sized businesses with a centralized platform for collaboration, automation, and real-time decision-making.

Giddh: Empower Collaboration with Multi-User Accounting Software

Giddh's multi-user accounting software elevates financial management by enabling seamless collaboration across teams, departments, and even external stakeholders.

Whether you're managing a small business or overseeing a growing team, Giddh ensures that everyone stays on the same page while keeping control over sensitive financial data. Here’s how Giddh’s collaborative accounting functionality can transform the way your business operates:

Real-Time Collaboration Across Departments and Locations

With Giddh, your finance team, sales staff, and external accountants can collaborate in real-time, ensuring faster decision-making and reducing delays.

The Financial management software allows multiple users to access and update financial data simultaneously, eliminating bottlenecks caused by waiting for reports or approvals.

-

Seamless Cross-Department Collaboration: All teams can collaborate effortlessly, whether they’re in finance, operations, or HR.

-

Instant Updates: Everyone stays aligned with real-time access to financial data to improve transparency and communication.

Secure User Roles and Permissions

Control who can access, view, and edit sensitive financial data with Giddh’s secure user roles and permissions. Invite external accountants or internal teams and assign them specific access levels to ensure your financial data remains protected.

-

Custom Permissions: Define access levels for different departments, ensuring secure data handling.

-

Granular Access Control: Assign specific access to financial modules like profit/loss statements, tax filings, or trial balances.

Scalability for Growing Teams

As your business grows, Giddh makes it easy to add new users without disrupting the flow of your accounting processes. This scalability ensures your system remains efficient as your team expands.

-

Effortless User Addition: Easily scale your accounting system as your team grows, adding new users in minutes.

-

Flexible Role Assignment: Ensure each department has the tools they need to stay organized and efficient as your business expands.

Access from Anywhere, Anytime

Since Giddh is cloud-based, your team can access financial data from anywhere at any time. Whether in the office or working remotely, Giddh ensures your business stays operational without disruption.

-

Cloud-Based Flexibility: No matter where your team is, they can access financial data in real-time.

-

Remote Accessibility: Stay productive even when working from home or on the go.

Ledger Sharing with Magic Link

Giddh’s ledger sharing feature allows you to share your financial reports with external accountants, clients, or partners securely. The Magic Link ensures that the shared ledger is accessible for only 24 hours, keeping sensitive data protected.

-

View-Only Ledger Sharing: Share your ledger securely with external parties for transparent communication.

-

Magic Link Security: The shared ledger link expires after 24 hours, ensuring access is time-sensitive and secure.

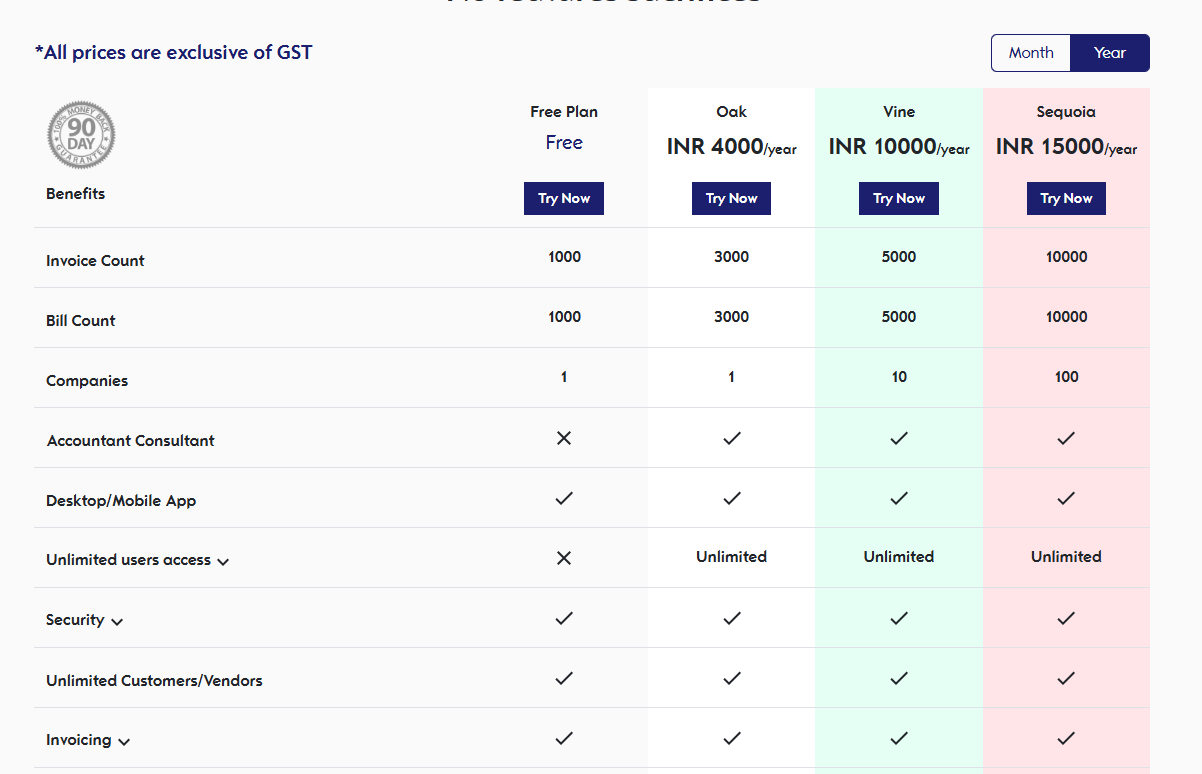

Pricing:

Giddh offers powerful accounting at prices every business can afford. Whether you're just starting or scaling your business, Giddh’s pricing plans ensure you get the most value for your investment.

Ready to revolutionize your financial management? Try Giddh’s accounting software today and see how it can help you automate financial workflows, improve accuracy, and enhance collaboration.

Wrapping Up:

Collaborative accounting software is reshaping the way businesses manage their financial operations. By providing real-time access, automating routine tasks, and enhancing collaboration across departments, this software empowers finance teams to make quicker, more accurate decisions.

Imagine a future where financial reporting is streamlined, errors are minimized, and your team can collaborate effortlessly. With the right tools like Giddh, this future is within reach.

Take the next step in modernizing your financial management processes by exploring Giddh’s collaborative accounting software. Start a free trial to see how it can benefit your team.