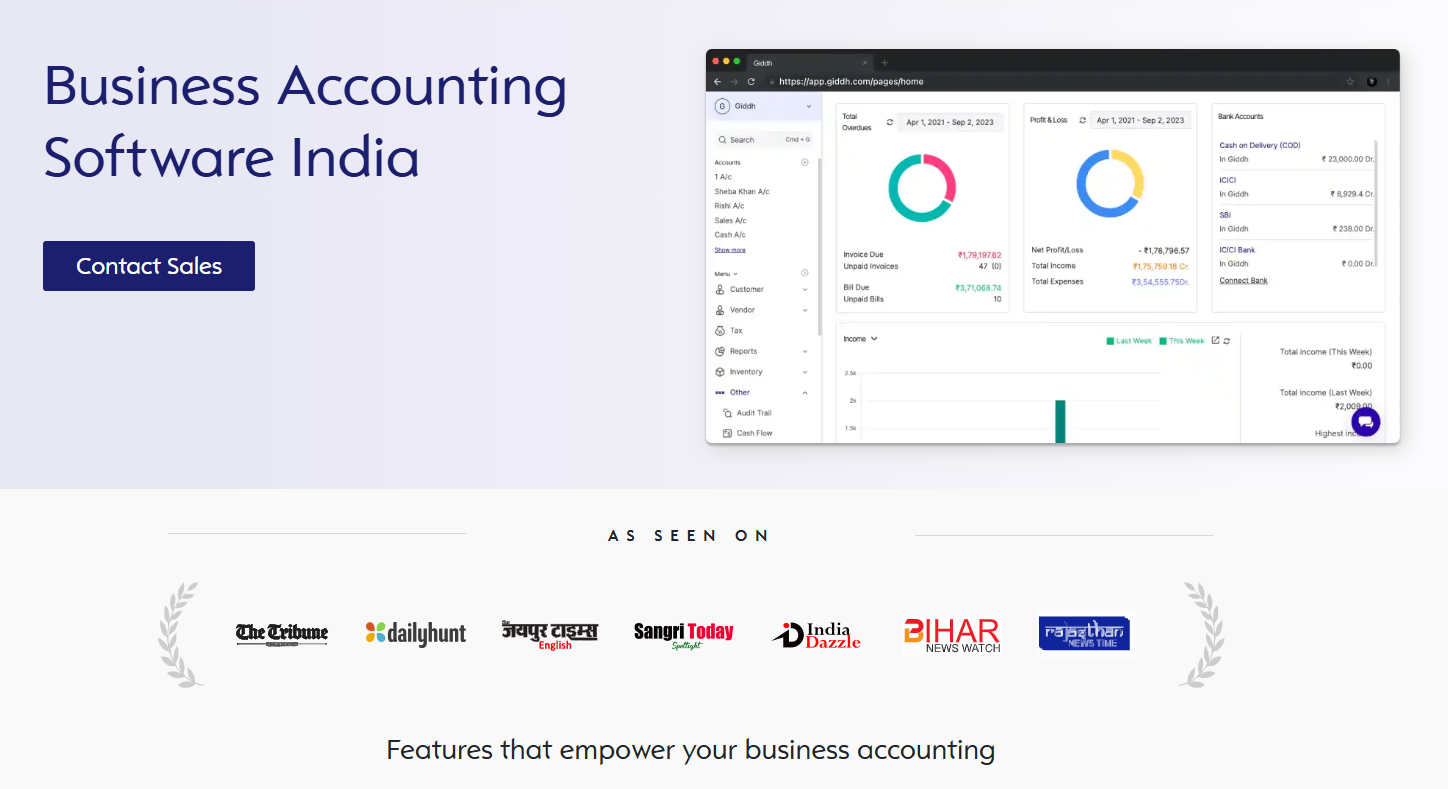

The Most Powerful Features in Online Accounting Software

According to a study by the National Association of Software and Service Companies (NASSCOM), over 50% of businesses in India are now leveraging cloud-based accounting systems.

As businesses grow, so does the complexity of managing finances. Choosing the right online accounting software can be the difference between staying ahead in the competitive market and struggling with operational inefficiencies. This software doesn’t just simplify accounting; it automates critical processes, ensures compliance with the latest tax laws, and helps business owners make informed decisions faster.

So, what features should your online accounting software include to stay ahead of the curve and manage your business finances with ease?

Why Choose Online Accounting Software Over Traditional Methods?

Traditional accounting methods come with their own set of challenges, including manual data entry, high chances of errors, and time-consuming processes. In India, businesses often face difficulties in maintaining accurate records due to the ever-changing tax regulations like GST. This makes manual accounting not only inefficient but also risky.

Online accounting software offers the flexibility of cloud-based solutions, automating processes like data entry, invoicing, and reconciliation. This ensures accurate financial records in real time, enabling businesses to focus on growth.

Cloud-based systems allow instant updates, accessibility from anywhere, and integration with other tools, making the management of finances much easier for Indian businesses, regardless of their size.

Essential Features Every Online Accounting Software Should Have

1. GST Compliance and Tax Features

One of the key aspects of online accounting software in India is its ability to manage GST compliance effortlessly. The software should auto-calculate taxes, generate GST-compliant invoices, and directly integrate with government portals for easy GST filing. This is critical for businesses to stay compliant with Indian tax laws and avoid penalties.

Key features to look for:

-

Auto-generation of GST returns

-

GST invoice generation with tax calculations

-

GST audit reports

Example Tool: Giddh’s GST-ready software handles all aspects of GST compliance, simplifying tax filing for Indian businesses.

2. Bank Integration and Reconciliation

Bank reconciliation is a time-consuming and often tedious task when done manually. Online accounting software should be capable of syncing with Indian banks to provide real-time transaction updates and enable easy reconciliation.

Key features to consider:

-

Auto-sync with Indian banks

-

Automatic bank reconciliation

-

Quick identification of discrepancies

Example Tool: Giddh offers seamless bank integration, allowing businesses to match transactions with ease and improve financial accuracy.

3. Security Features and Data Protection

Security is paramount when dealing with sensitive financial data. Your online accounting software should provide top-tier security features like multi-factor authentication, SSL encryption, and compliance with India’s data protection laws (e.g., the IT Act, 2000).

Key features to ensure security:

-

SSL encryption for secure transactions

-

Two-factor authentication (2FA)

-

Data protection compliance (Indian regulations)

Example Tool: Giddh ensures your financial data is fully encrypted and secure, giving business owners peace of mind.

4. Invoicing and Payment Management

Invoicing is a core part of accounting, and the software should automate this process, generating GST-compliant invoices, sending reminders for overdue payments, and integrating with various payment gateways.

Key features to look for:

-

Automated invoicing and reminders

-

Customizable invoices with company branding

-

Integration with payment gateways

Example Tool: Giddh’s invoicing system allows for the easy generation of professional invoices that are GST-compliant, and businesses can manage recurring payments effortlessly.

5. Multi-User Access and Role Management

For businesses that involve multiple stakeholders, online accounting software should allow multi-user access with role-based permissions to ensure that sensitive financial data is shared only with authorized individuals.

Key features:

-

Role-based access control

-

Permissions for different users (Accountant, Manager, etc.)

-

Collaboration tools for teams

Example Tool: Giddh allows businesses to assign different roles, enabling smooth collaboration between accountants, managers, and other stakeholders.

6. Cloud-based Accessibility and Mobility

Businesses in India need the flexibility to access financial data anytime and from anywhere. Cloud-based online accounting software provides this freedom, allowing business owners and accountants to stay updated on financial status even when working remotely.

Key features:

-

Access to financial data from any device

-

Real-time data syncing

-

Backup and recovery features

Example Tool: Giddh’s cloud-based system enables access to accounting data from anywhere, whether in the office or on the go.

7. Reporting and Analytics Tools

The ability to generate detailed financial reports is crucial for understanding business health. Your online accounting software should offer customizable reports on profit & loss, balance sheets, and tax reports.

Key features:

-

Customizable financial reports

-

Real-time analytics

-

Profit & Loss, Balance Sheet, Tax Reports

Example Tool: Giddh provides easy-to-understand financial reports that can be tailored to your business needs, ensuring you always have the right insights at your fingertips.

8. Customizable Chart of Accounts

Businesses in India often deal with multiple revenue streams, such as e-commerce, retail, and services. Your accounting software should offer flexibility to create a customized chart of accounts that suits your business structure.

Key features:

-

Customizable chart of accounts

-

Categorization for different revenue streams

-

Easy-to-use categorization tools

Example Tool: Giddh offers businesses the flexibility to create a custom chart of accounts, tailored to your business operations and industry requirements.

9. Customer Support and Training

Customer support is an often-overlooked yet essential online accounting software feature. When businesses face issues related to taxes, compliance, or technical difficulties, prompt customer support is crucial.

Key features:

-

24/7 customer support

-

Dedicated account managers

-

Support through multiple channels (email, phone, chat)

Example Tool: Giddh provides exceptional customer support, available 24/7 to assist businesses with accounting queries and technical issues.

How To Choose the Right Online Accounting Software for Business in India?

Choosing the right online accounting software for your business is crucial for streamlining financial management, ensuring tax compliance, and improving overall efficiency. In India, with varying business needs and tax regulations (like GST), it’s essential to consider several factors before making the decision.

Here are seven key points to guide you in choosing the right accounting software for your business.

1. GST Compliance and Tax Features

Ensuring the software supports GST compliance is vital for businesses in India, as it simplifies tax filing and invoicing, and helps you stay updated with the latest regulations.

-

Auto-generation of GST-compliant invoices.

-

Direct integration with the GST portal for easy filing.

-

Support for GST tax reports (GSTR-1, GSTR-3B, etc.).

-

Regular updates to stay aligned with evolving GST laws.

2. User-Friendliness and Accessibility

-

The software should be intuitive and easy to use, even for individuals with minimal accounting knowledge, enabling smooth adoption across your team.

-

Simple user interface with easy navigation.

-

Quick onboarding process with helpful tutorials.

-

Cloud-based for remote access anytime, anywhere.

-

Multi-device compatibility (mobile, tablet, desktop).

3. Bank Integration and Reconciliation

-

Bank integration allows for automatic synchronization of bank transactions with your accounting software, saving time and ensuring accurate financial records.

-

Seamless integration with Indian banks (HDFC, ICICI, SBI, etc.).

-

Automatic reconciliation of bank statements with accounting entries.

-

Easy identification of discrepancies or errors in transactions.

-

Support for both local and international payments.

4. Security Features

-

Security is paramount as you’ll be storing sensitive financial information. The software should offer robust encryption and data protection measures.

-

SSL encryption for secure data transfer.

-

Two-factor authentication (2FA) for account security.

-

Regular backups and secure data storage.

-

Compliance with Indian data protection laws (IT Act, 2000).

5. Customization and Scalability

-

As your business grows, your accounting software should scale with your needs. Customizable features are crucial for adapting the software to your business type.

-

Ability to create customized charts of accounts.

-

Flexible reporting options to suit different business models (e-commerce, retail, service).

-

Scalable for businesses of various sizes—small, medium, and large.

-

Multi-currency and multi-language support if your business operates internationally.

6. Support for Multiple Users and Role Management

-

Your accounting software should support multiple users with varying levels of access to ensure smooth collaboration within your team.

-

Role-based access control (e.g., accountant, manager, admin).

-

Permissions to restrict access to sensitive financial data.

-

Ability to add unlimited users as your team expands.

-

24/7 customer support for resolving any issues.

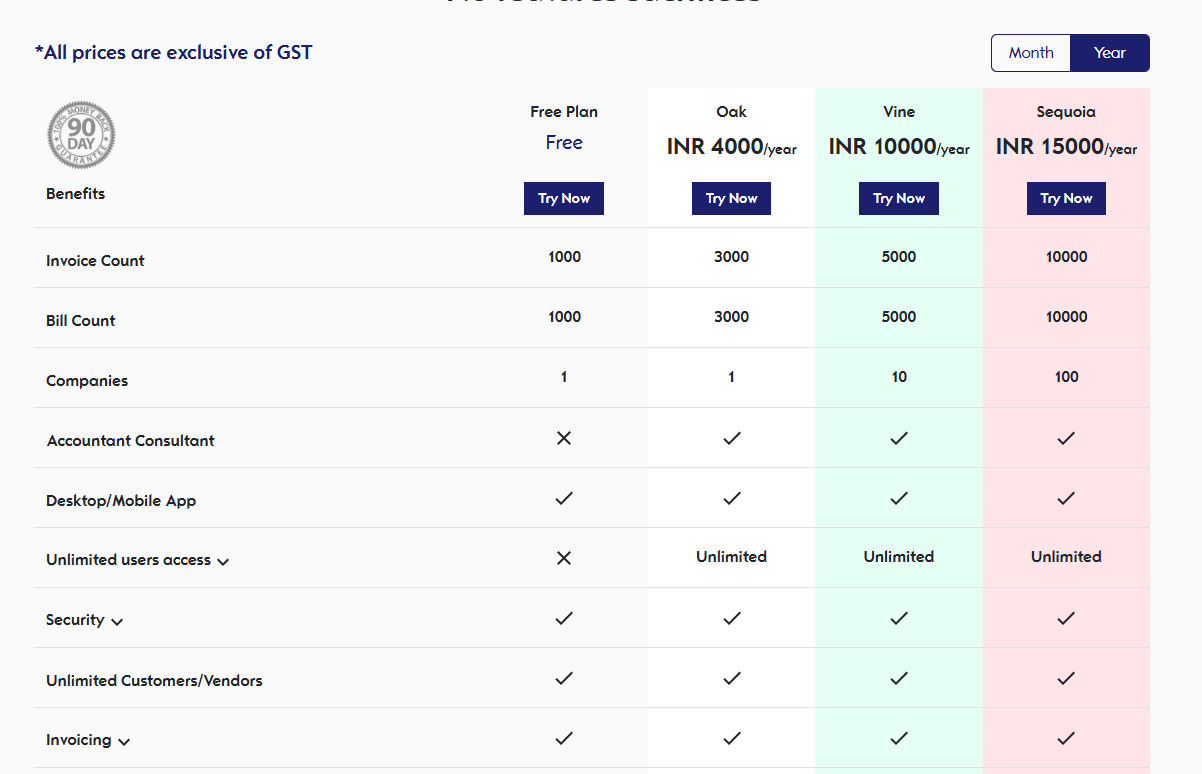

7. Cost and Value for Money

-

The software should offer great value for the price, considering both the number of features provided and the overall impact on your business operations.

-

Transparent pricing with no hidden fees.

-

Subscription-based pricing to suit businesses of all sizes.

-

Free trials or demo versions for evaluation before purchasing.

-

Value-added features like payroll integration, expense tracking, and financial forecasting.

-

Why Giddh is the Best Choice for Online Accounting Software in India

Giddh is an intuitive, secure, and scalable online accounting software designed to meet the unique needs of Indian businesses. Here’s why it’s the best choice for your business:

GST Compliance

-

Automated GST-compliant invoices and reports.

-

Easy filing with government portals.

-

Regular updates to match changing GST laws.

User-Friendly Interface

-

Simple dashboard with easy navigation.

-

Quick onboarding with tutorials.

-

Accessible on mobile, tablet, and desktop.

Bank Integration & Reconciliation

-

Syncs with Indian banks.

-

Automatic bank reconciliation in real-time.

-

Quick transaction matching and error identification.

Security Features

-

SSL encryption for secure data.

-

Two-factor authentication (2FA).

-

Regular backups and secure data storage.

Scalability & Customization

-

Customizable chart of accounts.

-

Scalable for businesses of all sizes.

-

Multi-currency and multi-language support.

Comprehensive Reporting

-

Customizable financial reports (P&L, balance sheet, tax reports).

-

Real-time financial analytics for better decision-making.

24/7 Customer Support

-

Access to live chat, email, or phone support anytime.

-

Detailed knowledge base and resources.

Affordable Pricing Plans

-

Starter Plan: Ideal for small businesses.

-

Growth Plan: For growing businesses with advanced features.

-

Enterprise Plan: Comprehensive features for large enterprises.

-

Free trial available!

Benefits of Using Giddh

-

Ledger-Based Accounting

- Easily organize and track transactions with a ledger-based system for clear financial records.

-

Multi-Currency Support

- Manage international transactions effortlessly with automatic currency conversion.

-

White-Label Option

- Customize the software to reflect your brand with personalized logos and designs.

-

Unlimited User Access

- Allow unlimited users with customizable roles and permissions for better collaboration.

-

Manage Over 100 Companies

- Handle finances for multiple businesses or clients from a single account.

-

Multiple Platform Support

- Access Giddh on any device, whether it’s Mac, Windows, or mobile.

Giddh offers flexibility, collaboration, and customization for efficient business management.

Conclusion:

Choosing the right online accounting software can have a significant impact on your business’s financial management. With the right features, you can ensure compliance, streamline operations, and make data-driven decisions. Giddh is the ideal choice for Indian businesses, offering an all-in-one solution that grows with your company.

Try Giddh for free and experience the best online accounting software designed for Indian businesses. Visit Giddh.com to get started.

FAQ

1. What are the essential features of online accounting software?

Essential features of online accounting software include automated invoicing, real-time financial reporting, expense tracking, GST compliance, and integration with banking and payment systems. These features help businesses manage finances efficiently, reduce errors, and improve accuracy.

2. What is the role of GST compliance in online accounting software?

GST compliance in online accounting software ensures accurate calculation, invoicing, and reporting according to tax laws. It automates the application of GST rates, generates compliant invoices, and simplifies tax filing, helping businesses stay compliant and avoid penalties.

3. What benefits do cloud-based accounting software offer?

Cloud-based accounting software offers accessibility from anywhere, automatic updates, enhanced data security, and seamless integration with other business tools. It reduces IT costs and improves collaboration, ensuring real-time financial management for businesses of all sizes.