Free Business Accounting Software For VAT Filing In UK

![]()

As a small business owner, you may face numerous challenges, particularly in managing finances effectively and staying compliant with regulations. Accounting is essential for any enterprise, but for many industries, it can feel overwhelming and costly. It is where Giddh comes in.

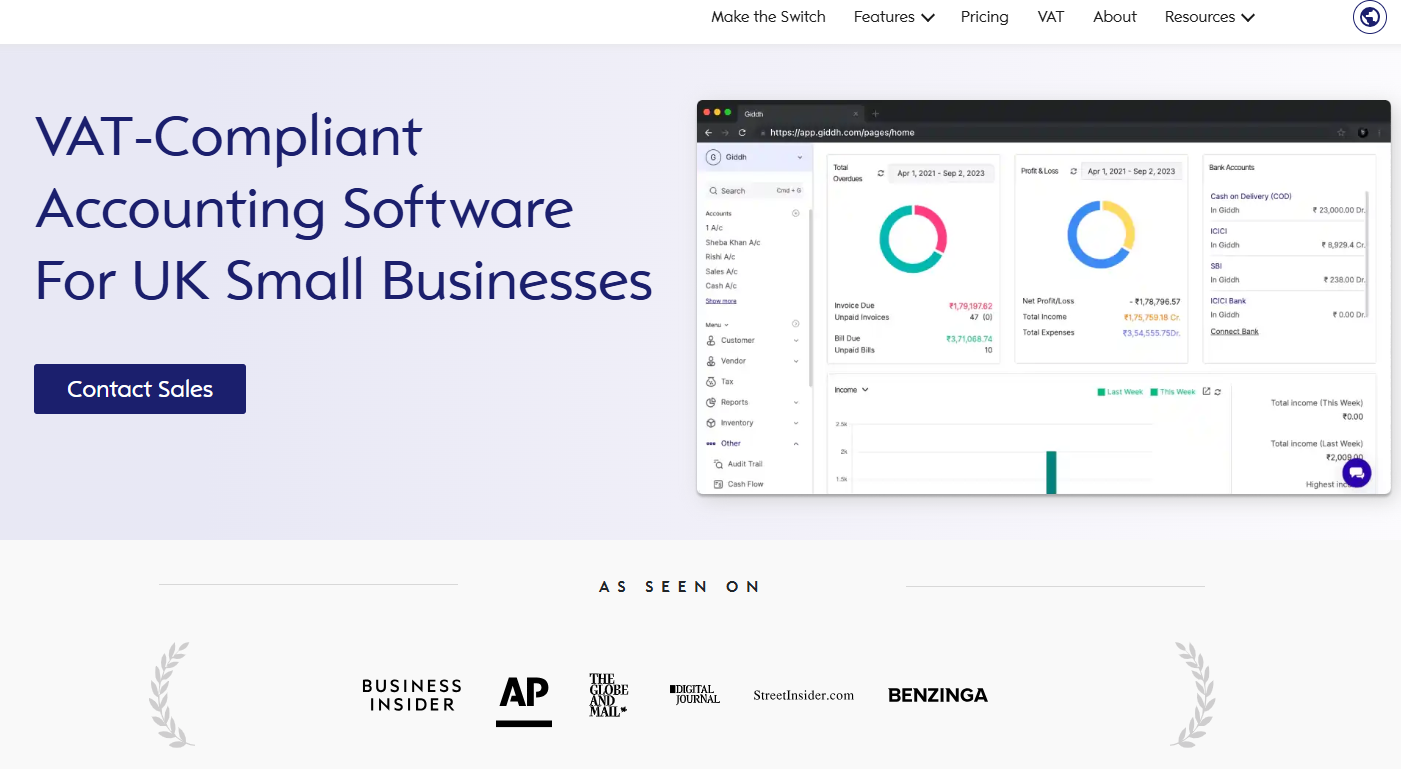

Giddh is an innovative VAT tracking software for businesses that simplifies accounting processes, streamlines financial tasks, and empowers small businesses to operate more efficiently.

Maximizing Small Business Efficiency with Giddh: Free Accounting Software with Real-Time UK VAT Filing.

With Giddh’s free offering for small businesses and real-time UK VAT filing feature, business owners can access powerful tools without a big financial commitment.

Here’s a closer look at how Giddh is changing accounting for small businesses.

Best Accounting Software for Small Businesses: Giddh

When it comes to managing finances, small businesses require accounting software that is both reliable and user-friendly. Giddh’s free access for small businesses stands out as one of the ideal solutions.

With tools for invoicing, expense tracking, tax management, and real-time VAT filing, Giddh enables firms to focus on growth rather than getting bogged down by accounting tasks.

Key Features That Make Giddh Stand Out

1. Free for Small Businesses

Giddh offers unique features and free access to its powerful accounting software tailored for small businesses. Unlike other platforms that require costly subscriptions, Giddh provides startups and small businesses with essential accounting tools at no cost, allowing them to manage their finances without incurring significant expenses.

- Access core features like invoicing, expense management, and tax calculations at no cost.

- Reduce financial barriers by utilizing a top-tier platform with no upfront fees.

- Free accounting tools that enable business owners to invest resources where it matters most.

2. Real-Time VAT Filing

Giddh’s real-time VAT filing feature is designed to simplify the complex VAT filing process for UK businesses. This VAT tracking software automatically updates VAT data, ensuring businesses comply with HMRC regulations while saving time and reducing the risk of errors.

-

Automated VAT updates keep you compliant with the latest UK VAT regulations.

-

Eliminates manual steps involved in VAT filing, saving you valuable time.

-

Accurate VAT data enables businesses to avoid fines and make informed financial decisions.

3. Simplified Invoicing and Expense Tracking

Giddh streamlines invoicing and expense tracking to help businesses stay organized and maintain healthy cash flow. The platform’s intuitive VAT tracking software enables users to quickly create invoices, track expenses, and categorize transactions, thereby simplifying financial management.

-

Fast and simple invoicing allows users to create, send, and track invoices within minutes.

-

Expense tracking helps categorize spending, monitor cash flow, and create detailed reports.

-

VAT tracking software ensures that all expenses are aligned with VAT regulations, making tax filing easier.

4. Bank Reconciliation

Giddh’s automatic bank reconciliation tool eliminates the manual effort required to track bank transactions. By syncing with your bank account, it pulls in real-time transaction data, ensuring accuracy and reducing errors, making it a valuable feature for businesses with limited accounting staff.

- Real-time syncing of bank transactions to maintain accurate records.

- Automatic reconciliation reduces the risk of human error and improves financial accuracy.

- Greater control over finances without the need for a dedicated accounting team.

5. Easy Financial Reporting

Giddh’s financial reporting tools provide business owners with clear, actionable insights into their financial health. With customizable reports, users can generate profit and loss statements, balance sheets, and cash flow reports to make informed decisions.

- Track profitability with customizable reports that suit your business needs.

- Assess cash flow and identify growth opportunities with detailed financial insights.

- Easy-to-understand financial reports enable informed decision-making.

6. Cloud-Based Access

As a cloud-based platform, Giddh offers flexibility by allowing business owners to access their financial data at any time, from anywhere.

Whether managing a remote team or traveling, Giddh ensures secure and convenient access to all your accounting tools from any device.

- Access data anytime, anywhere—whether you’re at the office or on the go.

- A flexible platform that adapts to the needs of remote teams or frequent travelers.

- Cloud security ensures your data is safe and always available when needed.

Giddh: Benefits Of Using Free Cloud-Based Accounting Software For Vat Filing In The Uk

-

Cost Efficiency: With Giddh’s free access, small businesses save on the costs typically associated with accounting software. It allows them to direct resources to other areas of growth and innovation.

-

Time Savings: Automating processes such as VAT filing, bank reconciliation, and invoicing frees up time, allowing business owners to focus on growth rather than administration.

-

Enhanced Compliance: Real-time UK VAT filing enables small businesses to meet VAT requirements, reducing the risk of penalties and audits, and providing peace of mind.

-

Financial Insights: Giddh’s reports offer a comprehensive snapshot of the business’s economic health, enabling data-driven decision-making and informed strategic planning.

-

User-Friendly Interface: With Giddh’s intuitive design, small business owners can manage their finances without needing extensive accounting knowledge. This ease of use is a significant advantage for business owners who juggle multiple responsibilities.

Comparison Table

| Features | Giddh | Competitors |

|---|---|---|

| Multi-User & Multi-Company Access | ✅ Unlimited users & multi-company support under one plan | ❌ Khata and Vyapar lack structured multi-company and user flexibility |

| Cloud-Based Accessibility | ✅ 100% cloud-based, accessible anytime | ❌ Tally and Busy rely on offline or semi-cloud setups |

| One-Step Ledger Entries (No Voucher Screens) | ✅ Simple, fast ledger-based entries | ❌ Voucher-heavy accounting slows down entries in Tally, Busy, and Zoho |

| GST/VAT Compliance (India, UAE, UK) | ✅ Built-in GST/VAT for multiple regions | ❌ Competitors require manual setup or offer region-limited compliance |

| Tally Integration | ✅ Seamless sync with Tally data | ❌ Competitors often need manual exports/imports for Tally integration |

| Comprehensive Financial Reporting | ✅ Full suite: P&L, Balance Sheet, Aging, Tax Reports | ❌ Basic or limited reporting in Khata, Vyapar, and lower plans of Busy |

| Aging Reports (30/60/90+ Breakdowns) | ✅ Built-in, detailed aging analytics | ❌ Limited or no aging breakdowns in Vyapar and Khata |

Ready to simplify your accounting and VAT filing? Start using Giddh for free and experience seamless financial management with real-time VAT tracking.

Giddh: Smart Free Accounting for UK Businesses

Giddh is an accounting and VAT software for small businesses. With its user-friendly interface, setting up Giddh is quick and straightforward. Users can create an account, link their bank account, and begin managing their finances with minimal effort.

Giddh offers essential features, including VAT tracking software, invoicing, expense tracking, and real-time VAT filing, all integrated into a single platform to streamline financial operations.

Whether you're new to accounting or looking for a more efficient system, Giddh provides the tools you need to succeed.

Here’s how you can get started with Giddh:

- Create your Giddh account and link your bank account.

- Explore features like invoicing, VAT filing, and expense tracking.

- Integrate accounting tools into your daily business operations to streamline your financial management.

- Leverage customer support for setup assistance and any questions.

- Start tracking VAT in real-time with Giddh’s powerful VAT tracking software.

How to Choose Free Accounting Software for VAT Filing in the UK

When managing finances for a small business in the UK, staying compliant with VAT regulations is crucial. Choosing the right free accounting software that supports VAT filing can simplify your financial processes, save time, and help you avoid costly mistakes. Here’s how to choose the best VAT tracking software for VAT filing in the UK:

1. Ensure MTD (Making Tax Digital) Compliance

Since VAT-registered businesses in the UK must file VAT returns digitally through the Making Tax Digital (MTD) system, it’s essential to choose VAT tracking software that integrates with HMRC. The software should be fully MTD-compliant, allowing for seamless VAT filing.

Key Feature: Look for software that provides real-time updates for VAT data and is integrated with HMRC's MTD platform for smooth filing.

2. Real-Time VAT Tracking and Filing

Effective VAT tracking software should allow you to track VAT in real-time, ensuring that all your VAT-related information is up-to-date and automatically synced with your records. This feature can help you stay ahead of VAT filing deadlines and avoid errors.

Key Feature: Select software that automatically updates VAT data and enables you to file VAT returns directly from the software, ensuring accuracy and timely compliance.

3. Easy-to-Use Interface

Since many small business owners lack accounting experience, the software should be intuitive and user-friendly. It should make VAT filing straightforward, rather than adding complexity to an already challenging process.

Key Feature: Choose a platform with a clean and straightforward interface that enables easy navigation between key features, including VAT tracking, invoicing, and expense management.

4. Transparent Pricing

Look for software that offers free access to VAT filing and VAT tracking. Be cautious of hidden fees or unnecessary add-ons that could increase costs later. Ensure the free version includes essential VAT-related features.

Key Feature: Verify that the free version of the software provides VAT tracking and filing capabilities without charging for basic functions.

5. Customer Support and Resources

Even with an intuitive platform, there may be times when you need help. Choose VAT tracking software that provides excellent customer support to guide you through any issues with VAT filing or other accounting tasks.

- Key Feature: Ensure there is accessible support via email, chat, or phone, and check if they have a knowledge base or guides for VAT filing.

6. Cloud-Based Accessibility

Cloud-based software offers flexibility, allowing you to access your financial data from any device, whether you're in the office or on the go. It is essential for small business owners who travel or work remotely.

Key Feature: Opt for a cloud-based VAT tracking software, ensuring you can access your VAT data anytime, anywhere, with secure data storage.

7. Integration with Other Business Tools

Good accounting software should easily integrate with your bank account, payment platforms, and other business tools you use. It reduces the need for manual data entry, ensuring that VAT tracking remains accurate and reliable.

Key Feature: Look for software that syncs with your business bank account and payment tools to pull in transaction data, reducing manual work automatically.

8. Reviews and Reputation

Before committing to a free accounting software, check customer reviews and ratings to ensure the software is reliable and efficient. Positive feedback about VAT tracking software can give you confidence in its ability to manage VAT returns efficiently and accurately.

Key Feature: Look for reviews that mention accurate VAT filing, ease of use, and good customer service.

Final Thoughts

Small businesses often struggle to find accounting software that meets their needs without overburdening their budget. Giddh addresses these challenges with a comprehensive, accessible accounting solution.

By offering a free version, real-time VAT filing, and a range of user-friendly features, Giddh enables small businesses to handle accounting tasks efficiently and accurately.

In short, Giddh is more than just software; it’s a financial partner dedicated to the success of small businesses. From improving compliance to streamlining day-to-day tasks, Giddh gives small business owners the tools they need to focus on what they do best—growing their business.

Ready to simplify your accounting? Get started with Giddh today and take control of your VAT filing and financial management with ease!

FAQs

1. How Secure is Free Accounting Software for Storing Financial Data?

Most free accounting and VAT tracking software use encryption, backups, and access control to secure your financial data. Select software that supports SSL, two-factor authentication, and data privacy compliance, such as the General Data Protection Regulation (GDPR).

2. How Does Free Accounting Software Ensure VAT Compliance?

Free VAT tracking software ensures compliance by automating VAT calculations, applying correct tax rates, and generating VAT-ready reports based on regional rules (UK, UAE, India).

3. How Can I File VAT Returns for Free?

You can file VAT returns using free VAT tracking software that supports tax filing features. Some platforms allow direct submission to tax portals, while others export VAT-compliant reports for upload.

4. Do I Need Accounting Software to Submit VAT Return?

No, but VAT tracking software simplifies the process by calculating VAT, preparing reports, reducing errors, saving time, and ensuring accuracy.