What is General Ledger? A Quick Guide For Businesses

How can you define a ledger in accounting? The meaning of "ledger" in accounting refers to the daily business transaction records that accountants maintain. General ledger account examples include debt, depreciation, cash, inventory, salaries, fixed assets, income tax expense, accounts payable, accounts receivable, and stockholders’ equity. The beginning and ending balances are part of a ledger account, and adjustments to these balances are made during the accounting period. A transaction number is often associated with each transaction in the ledger account.

A General Ledger is the building block of financial records for a business. It is used to track all monetary transactions within the industry and is extremely useful for generating the business’s Income Statement and Balance Sheet. A single glance at the General Ledger should provide the reader with a quick idea of a company’s financial activity at any given point in time.

What Is General Ledger Accounting?

General ledger accounting is the process of recording, organizing, and summarizing all financial transactions of a business into structured accounts. It serves as the backbone of accounting under key categories like assets, liabilities, equity, revenue, and expenses. A general ledger account contains every transaction of a business, and so it is used for record-keeping during the life of a company.

The accounts in the general ledger can be used to create a balance sheet, an income statement, and other financial reports that are useful to the business.

-

Central System: Foundation of business accounting and record-keeping.

-

Account Categories: Revenue, assets, liabilities, expenses, equity.

-

Transaction Tracking: Consolidates entries from sub-ledgers to provide a comprehensive view of transactions.

-

Financial Reporting: The basis for reports such as the balance sheet and income statement.

-

Decision Support: Enables data-driven business insights and compliance.

-

Lifecycle Record: Maintains full financial history of the company.

How to Prepare a General Ledger Account

You must understand the general ledger format and the rules for ledger posting. Business transactions are initially recorded in a journal and then posted to the general ledger. The posting process involves entering general journal entries into the ledger accounts. General ledger accounts group transactions that fall under the same account.

When the posting takes place, the journal entry is divided into two sections: debit and credit. The debit entry is written on the debit side of the account it belongs to, and the credit entry is written on the credit side of the account it belongs to in the general ledger.

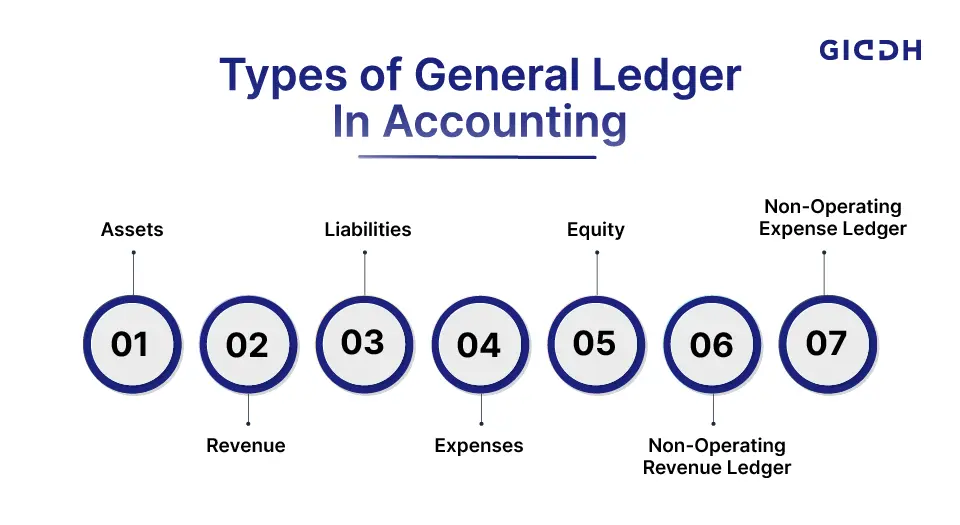

Types of general ledgers

As stated earlier, the general ledger can be divided into five categories: assets, liabilities, revenue or income, expenses, and equity or capital.

Assets

Assets are resources owned by a business that are used for its operations. These are categorized as current (short-term) or non-current (long-term), further split into tangible and intangible assets.

-

Current Assets: Easily convertible to cash (e.g., inventory, receivables).

-

Non-current Assets: Long-term (valid over a year).

-

Tangible: Physical assets like buildings, computers.

-

Intangible: Non-physical, like patents, trademarks.

-

Revenue

Revenue accounts reflect the income earned by a business. It includes earnings from core operations or secondary, non-operational sources.

-

Operating Revenue: Income from primary activities (e.g., sales, rent).

-

Non-operating Revenue: Income from external sources (e.g., interest, dividends).

-

Helps track business profitability and performance.

Liabilities

Liabilities are obligations the business owes to others. These are categorized into current (short-term) and non-current (long-term) liabilities.

-

Current Liabilities: Payable within 1 year (e.g., salaries, accounts payable).

-

Non-current Liabilities: Due after 1 year (e.g., long-term loans).

-

Crucial for assessing financial obligations and creditworthiness.

Expenses

Expenses are costs incurred by a business to generate revenue. These include both direct and indirect costs necessary for operations.

-

Direct Expenses: Tied to production (e.g., raw materials).

-

Indirect Expenses: General business costs (e.g., rent, utilities).

-

Affect profit margins and operational efficiency.

Equity

Equity represents the owner’s share or interest in the business. It reflects the residual value after all liabilities are deducted from assets.

-

Capital Account: Tracks owner investment and withdrawals.

-

Credit Balance: Indicates profits or capital inflow.

-

Debit Balance: Indicates losses or capital withdrawal.

-

Found at the bottom of the balance sheet.

Non-Operating Revenue Ledger

Captures income not related to core operations, such as interest income, dividends, or asset sales.

-

Tracks secondary income sources

-

Useful for complete financial reporting

-

Shows total earning capacity of the business

-

Helps differentiate operational vs. non-operational profits

Non-Operating Expense Ledger

Records expenses not tied to day-to-day operations, such as interest paid on loans, penalties, or lawsuit settlements.

-

Identifies non-core costs

-

Helpful in adjusting net income

-

Aids in expense classification

-

Helps assess actual operational efficiency

Difference Between General Ledger, Journal & Trial Balance

| Criteria | General Journal | General Ledger | Trial Balance | Balance Sheet |

|---|---|---|---|---|

| Purpose | Records transactions chronologically as they occur | Classifies transactions by account for reporting | Summarizes ending balances of all ledger accounts | Presents financial position (assets, liabilities, equity) |

| Type of Entry | Book of original entry | Book of final entry | Internal summary report | Formal financial statement |

| Content | Raw, unclassified transactions by date | Organized data by accounts: assets, revenue, etc. | Debit and credit totals from all ledger accounts | Uses data from the ledger to show financial health |

| Flow/Sequence | First step in the recording process | Follows journal; used to post entries into accounts | Follows the ledger; verifies the ledger accuracy | Follows the trial balance to generate a summary report |

| Error Checking | Not used for validation | Helps identify transaction-level issues | Used to check if debits = credits | Not for error checking |

| Usage | Initial transaction capture | Ongoing financial tracking and categorization | Ensures books are balanced before final reporting | Used by stakeholders and for external reporting |

| Common Users | Accountants/bookkeepers during daily entry | Accountants for monthly/quarterly reviews | Auditors and accountants for validation | Investors, banks, auditors, and management |

How Can Giddh's Cloud Accounting Software Help In Managing General Ledger

Accounts?

Giddh is a robust cloud-based accounting software designed for modern businesses. It offers seamless invoicing, multi-user access , GST compliance , real-time reporting, and secure data access from anywhere. With features such as auto bank feeds, multi-currency support , and role-based access, Giddh streamlines financial management and fosters collaboration. Its intuitive interface and scalable structure make it ideal for startups and enterprises.

General Ledger Of Giddh’s:

Giddh’s General Ledger feature ensures organized, real-time tracking of all financial transactions, making your accounting accurate and audit-ready.

Key Highlights:

- Auto-Linked Entries: Automatically links journal entries to ledger accounts.

- Real-Time Updates: View updated account balances instantly.

- Easy Navigation: Quickly search and filter transactions by date, account, or amount.

- Downloadable Reports: Export ledgers in PDF or Excel format for analysis or audit purposes.

- Error Reduction: Minimizes manual data entry, reducing the risk of errors.

- Cloud Access: Access your ledger securely from any device at any time.

Why do I need a general ledger?

A general ledger helps you track all financial transactions in one place, ensuring accuracy and transparency in your accounting. It’s essential for generating key financial statements, monitoring business performance, preparing for audits, and filing taxes correctly. A general ledger has many benefits, and three of the main benefits are as follows:

Financial Statements

The general ledger account serves as the foundation for preparing key financial statements. It helps businesses track performance over time and make data-driven decisions.

-

Main Statements: Balance sheet, income statement, cash flow statement.

-

Purpose: Assess financial health and business performance.

-

Data Source: All figures are derived from general ledger entries.

-

Decision Support: Enables comparison and strategic planning.

Convenience

The general ledger transactions simplify the process of locating financial data. Instead of sifting through scattered documents, you can quickly access transactions in one central location.

-

Centralized Record: All transactions are stored in a single location.

-

Quick Access: Easy to trace any financial activity.

-

Efficiency: Saves time compared to manual methods, such as processing receipts or invoices.

-

Organization: Streamlined and categorized data for each account.

Tax Filing

The general ledger account is essential for accurate and efficient tax filing. It contains all income and expense data required to compute taxes correctly.

-

Comprehensive Records: Revenue, expenses, payments—all in one place.

-

Tax Accuracy: Reduces the risk of errors and omissions.

-

Supports Compliance: Essential during audits or tax reviews.

-

Ease of Use: Helpful in identifying deductible expenses and reporting contractor payments.

Conclusion

To add convenience to financial monitoring, Cloud Accounting tools offer business owners and accountants the ability to easily create, organise, and view general ledgers in the cloud. This eliminates unnecessary paperwork, prevents record loss in the event of a natural disaster, and enables easy retrieval and sorting according to your various business needs.

Want to make your accounting smarter and faster? Try Giddh’s cloud accounting software and take control of your finances—anytime, anywhere. Book a Demo to see how does a general ledger works!

FAQs

1. What is a General Ledger?

A general ledger is a master accounting record that tracks all of a business’s financial transactions across various accounts, including assets, liabilities, equity, revenue, and expenses.

2. How Does a General Ledger Work?

A general ledger account works by recording transactions from journals into categorized accounts. It helps summarise financial data for creating reports, such as balance sheets and income statements.

3. What Are the Key Components of a General Ledger?

The main components of a general ledger include assets, liabilities, equity, revenue, and expenses. Each account records all related transactions, including debit and credit entries.

4. How Can I Ensure the Accuracy of My General Ledger?

Ensure accuracy by regularly reconciling the general ledger account, utilising accounting software, verifying journal entries, and conducting periodic audits.

5. How Can General Ledger Software Improve Accuracy in Financial Reporting?

General ledger software automates entries, reduces manual errors, ensures real-time updates, and generates accurate financial statements quickly.