GST About To Turn One! Still Confused How GST Works?

As we near GST’s first birthday, let’s revisit on how Cloud Accounting Software gives business owners automation on one hand and GST filing compliance in the other.

Almost one year after the rollout of GST(Goods and Service Tax), there is still an air of confusion about the tax reform although lesser than the initial stages. Thanks to the efforts of the government like GST Awareness Campaign, Manthan and various appointed GST Suvidha Provider, new entrepreneurs are less skeptical as to how GST works.

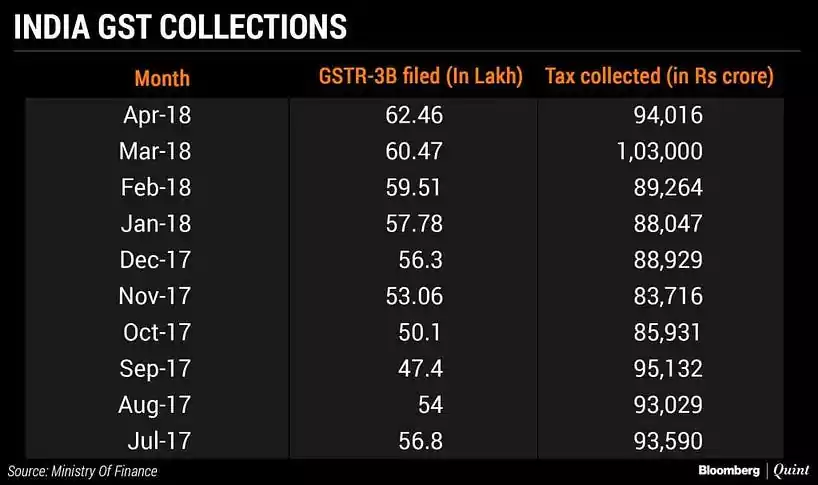

The numbers too paint a favourable picture and as per the reports, the total gross revenue collected in May was Rs 94,016 crore which was more than average of Rs 89,885 crore a month in 2017–18.

To simplify further and automate process related to GST filling and adherence, an accounting software that offers complete tax filing solution along with inventory management and tax compliant invoice generation is a must for all SME and other Medium Scale Enterprises.

This post will shed a light on a few reasons why businesses should look out for a complete GST filing solution which complies with all GST norms.

- Empowering Progress by Automation

From banking to the service industry, everything is getting the power of automation. Why should then accounting lag behind when its the cornerstone of a prosperous business & company?

Automation is the call of the hour as the country is healthily obsessed with minimising cost & implementing seamless integration.

Cloud based accounting software supports all kinds of businesses , starting from automatically recording transactions, adding entries till the final invoicing stages. Giddh has automated the business process with transparency and visibility and its GST integration is almost an icing on the cake for its users.

- Ease in Document Management

The document management processes including payments, registration & return under GST is completely digital. Thus, adapting to an online accounting software for this new tax regime is more a necessity than a luxury.

With Giddh’s GST return filing partners like JIOGST and ClearTax, business owners can take the sigh of relief as their return filing is reduced down to just a few clicks and all their documents are safe on cloud efficiently categorised.

- Compliance- No More Complex

Compliance is a major part of new GST reforms in India. Small and medium enterprise owners are still finding it difficult to adopt the post-GST effects like destination-based taxation, multi-states conformity, etc.

Thus, the integration of GST filing in an accounting software you use will not only help your companies in meeting the new regulations but also support in maintaining correct financial records.

- Data Security

Complete data security is the most critical aspect of the today’s digital world. In the world of zeroes and ones, using an offline accounting software makes you immensely vulnerable to data corruption and even data theft & manipulation.

With using an offline accounting software, you are just one coffee spill on your workstation or one malware infection away from having your data corrupted or even worse, get lost forever.

Thus, buying a safe cloud-based GST software is a brilliant choice to run your business in the bright light of the new system. With Giddh, your data will be safely stored on the cloud that is secured by high level encryption making it next to impossible to be hacked.

In Conclusion

The first year of GST was all about the introduction of the new tax reform and the chaos that ensued because of it. The second year is expected to usher in the stabilisation phase of GST where more and more businesses become organised and cloud based accounting software like Giddh are here to make compliance simple and safe for businesses across the country.