GST Filing Automation - How GST-Compliant Accounting Software Helps

If you’re managing your GST returns manually, you’re probably familiar with the stress of missing deadlines, dealing with complex returns, and trying to avoid penalties. In fact, according to a survey, most SMEs still handle their GST filing manually, exposing themselves to delays, errors, and costly mistakes.

As businesses grow, it becomes increasingly difficult to keep up with GST compliance, especially when tax laws and filing requirements grow. The good news is that GST-compliant accounting software can help you automate the entire process, saving you time and reducing the risk of costly errors.

Let’s dive more in-depth into the true cost of manual filing and how automating GST returns can simplify your workflow.

What is the Real Cost of Manual GST Filing?

Managing GST filing manually can seem like a manageable task in the beginning, but as your business grows, the process becomes time-consuming and prone to errors. Here's a breakdown of why continuing to manage your GST filings manually is a bad investment in the long run:

1. Time-Consuming Data Entry

Manual GST filing involves a lot of data entry: updating invoices, verifying tax calculations, and entering all the details into the GST portal. This takes hours every month, time that could be better spent on growing your business or focusing on core operations.

For instance, every time you make a sale or purchase, you’ll need to manually track these transactions and ensure that GST is applied accurately. The result? A lot of time is wasted on repetitive tasks.

2. Risk of Human Error and Penalties

The most significant risk of manual GST filing is human error. A misplaced decimal, missed invoice, or incorrect tax rate can lead to mistakes that have a financial impact. According to a report, about 50% of businesses that manage their GST manually incur fines or penalties due to errors. It only takes one mistake to trigger an audit or incur significant penalties.

For example, a simple error like failing to apply the correct GST rate for certain products could lead to an incorrect filing, triggering fines and extra paperwork. With manual systems, these errors are more common—and much more costly.

3. Difficulty Managing GSTR-1, GSTR-3B, GSTR-9, and Other Returns

As a small business, you’ll need to file multiple GST returns: GSTR-1, GSTR-3B, and GSTR-9. Each has its own set of requirements and complexities, especially when dealing with various types of goods and services. Trying to manually track, calculate, and report all the information for each return without software can feel like navigating a maze.

- GSTR-1 is about reporting sales.

- GSTR-3B is a summary return that requires both sales and purchases.

- GSTR-9 is the annual return, which consolidates all filings throughout the year.

Manually managing these forms without a system is complex and error-prone, making it easy to miss deadlines or file inaccurate returns.

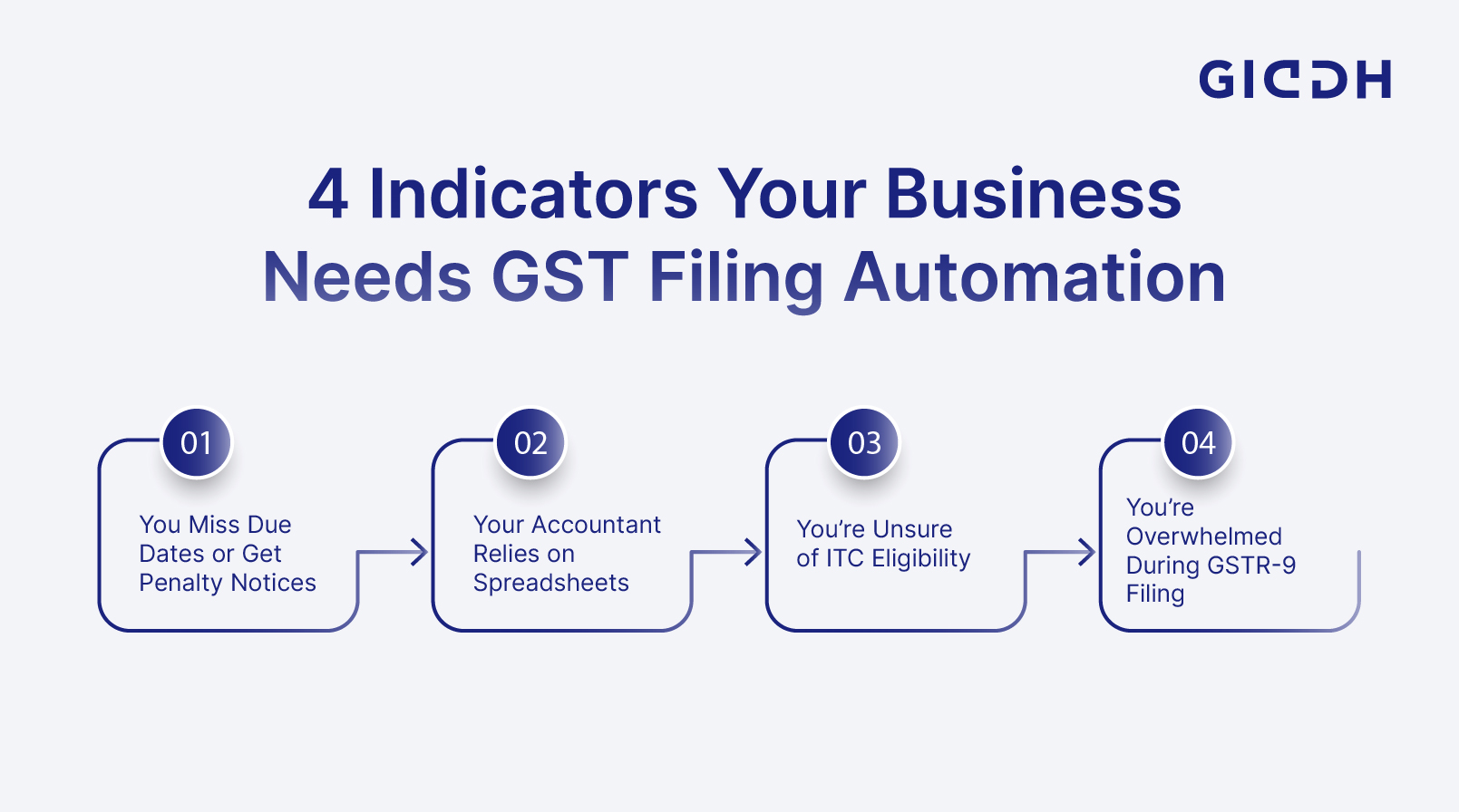

4 Signs Your Business Needs to Automate GST Filing

If any of the following sounds familiar, it’s a clear sign your business should automate its GST filing:

1. You Miss Due Dates or Get Penalty Notices

Missing GST filing deadlines can result in heavy penalties, and frequent mistakes could prompt audits. Automation ensures you never miss a deadline or forget a filing again.

2. Your Accountant Relies on Spreadsheets

While spreadsheets are helpful, they’re prone to human errors. If your accountant is using spreadsheets to track GST returns, there’s a higher likelihood of mistakes. Automation significantly reduces these risks by pulling the necessary data from your accounts directly.

3. You’re Unsure of ITC Eligibility

Input Tax Credit (ITC) is a mechanism that allows businesses to offset the GST paid on purchases against the GST collected on sales. Manual tracking of ITC eligibility can be tedious and prone to oversight, leading to missed opportunities for tax savings.

4. You’re Overwhelmed During GSTR-9 Filing

Filing GSTR-9 can be especially overwhelming for small businesses, as it involves consolidating all your GST filings for the year. If this process stresses you out each year, it’s a clear indicator that it’s time to switch to a more efficient, automated system.

What is GST Compliant Accounting Software? A Simplified Explanation

So, what exactly is GST-compliant accounting software, and why does it matter?

GST-compliant accounting software is specifically designed to ensure that businesses comply with all GST regulations while automating critical accounting functions. Unlike generic accounting software, which may not be updated regularly with changing tax laws, GST-compliant software automatically adjusts to ensure that your business remains compliant.

Key Features of GST-Compliant Accounting Software

Here are the standout features that make GST-compliant accounting software essential for small businesses:

1. Automated GST Return Filing (GSTR-1, GSTR-3B)

Automating returns like GSTR-1 and GSTR-3B allows you to easily generate and submit returns directly from your software. All necessary data is pulled from your accounting records, reducing the time spent on manual entry and ensuring accuracy.

2. Real-Time ITC Reconciliation

The software helps you ensure that your Input Tax Credit (ITC) claims are valid. Real-time reconciliation with the GST Network (GSTN) ensures you can claim the maximum ITC available without the risk of errors.

3. Smart Data Validation (e.g., GSTN Validation)

GST-compliant software validates your invoices and transactions against the GST Network to ensure all details are correct before filing. This reduces the chances of discrepancies and helps to avoid errors.

4. Compliance with Local Regulations

Aside from meeting GST requirements, the software also complies with local tax regulations, ensuring that you’re always up to date with the latest legal standards.

Why It’s a Must for Small Businesses

Adopting GST-compliant accounting software is no longer optional for growing businesses. Not only does it streamline your operations and reduce errors, but it also helps your firm avoid the financial risks associated with manual GST filing. It allows you to focus on growth while staying compliant.

Key Features to Look for in a GST-Compliant Accounting Software

When evaluating GST-compliant accounting software, make sure it includes these critical features:

1. Auto-Generated GSTR-1, 3B, and 9

Look for software that automatically generates all the required GST returns. Whether it’s GSTR-1, GSTR-3B, or GSTR-9, the software should pre-fill these forms, saving you valuable time.

2. ITC Reconciliation

Automated ITC reconciliation helps track eligible input tax credits and avoid errors during the filing process.

3. Invoice Validation with GSTN

Ensure your software validates invoices with the GST Network to ensure every sale and purchase is accurately recorded and compliant with GST laws.

4. Real-Time Error Checking

Choose software that offers real-time error checking to highlight discrepancies before submission, reducing the chances of penalties or re-filing.

5. Multi-User Support and Role-Based Access

If you have multiple employees involved in managing your finances, look for software that offers multi-user support with role-based access. This ensures that each team member only has access to the features they need.

How Giddh Makes GST Filing Hassle-Free for Indian Businesses

Giddh is one of the leading GST-compliant accounting software solutions that simplifies GST filing for small businesses in India. From automated tax calculations and error-free invoice generation to real-time compliance tracking, it eliminates manual hassles and reduces filing errors. With secure cloud access, detailed reports, and easy integration with your existing systems, Giddh ensures businesses stay compliant, save time, and focus on growth instead of paperwork.

Here's how Giddh can help:

GST Billing & Invoicing: Generate GST-compliant invoices for B2B, B2C, and exports, with automatic CGST, SGST, and IGST calculations, plus customizable formats and e-invoice generation.

E-Invoicing Integration: Seamlessly generate and validate e-invoices with real-time API integration and auto-generation of IRN and QR codes.

GST Return Filing: Auto-populate GSTR forms, reconcile invoices, and file returns directly via the GSTN API or upload templates for filing.

Multi-Branch & Multi-GSTIN Support: Manage multiple GSTINs under one account with consolidated or branch-wise reporting and accurate GST mapping for inter-state transfers.

E-Way Bill Generation: Generate and track e-way bills directly from the software with pre-filled data and real-time validity updates.

Real-Time Reconciliation Dashboard: Reconcile invoices and detect discrepancies with a real-time dashboard to ensure accurate filing.

Audit Trail & Access Logs: Track user changes and maintain audit logs for up to 8 years, ensuring compliance.

Alerts & Notifications: Receive timely reminders for due dates, filing deadlines, and reconciliation tasks.

Reports & Analytics: Access GST reports and analytics to track your compliance and download them in multiple formats.

Mobile, Desktop & Cloud Access: Manage GST filings on the go with mobile, desktop access, and secure cloud syncing.

*BONUS TIP: “Giddh reduces GST filing time by over 60%—while keeping you compliant, stress-free, and focused on growth.”*

Practical Benefits of Switching to a GST Compliant Tool

Here’s how automating your GST filing with the right software can benefit your business:

1. Saves 10–15 Hours per Month

Automating your filing reduces the hours spent on tax-related tasks each month, freeing up time to focus on your business.

2. Reduces Audit-Related Stress

Automated software ensures that all filings are accurate and compliant, eliminating the risk of audits or errors.

3. Minimizes Tax Penalties

With accurate filings and timely submissions, you’ll avoid costly penalties and interest charges.

4. Helps in Accurate ITC Claims

Automated reconciliation ensures that your ITC claims are accurate and maximized, helping you save on taxes.

Implementation Checklist: How to Switch Smoothly

Ready to transition to automated GST filing? Here’s a step-by-step checklist to ensure a smooth switch:

1. Evaluate Your Current Accounting System

Understand how your current system works and identify the gaps where automation can help.

2. Shortlist Top GST-Compliant Tools

Look for GST-compliant software that aligns with your business needs. Compare features, pricing, and ease of use.

3. Migrate Past Data

Migrate your past accounting data into the new system to ensure continuity.

4. Train Your Team

Provide training to your team members to ensure they are comfortable using the new software.

5. Run a Test Return

Before filing your first return, test the software with a sample set of data to ensure everything works correctly.

Conclusion: It’s Time to File GST the Smart Way

Automating your GST filing process is one of the most intelligent decisions you can make for your business. The benefits—time savings, reduced errors, and hassle-free compliance—are undeniable. By switching to GST-compliant accounting software, you can focus on growing your business while leaving the complexities of tax filing to the experts.

Ready to ditch manual GST filings? Try Giddh for free today and experience seamless GST compliance.

FAQs

What is GST-compliant accounting software?

GST-compliant software is designed to help businesses stay compliant with the Goods and Services Tax regulations. It automates tasks like GST calculation, return filing, and ITC reconciliation.

Can GST returns be filed directly from accounting software?

Yes, with GST-compliant accounting software like Giddh, you can file your returns directly from the platform.

How does automation help in GST compliance?

Automation ensures accurate GST calculations, timely filings, and ITC reconciliation, significantly reducing errors and the risk of penalties.

Is Giddh approved for GST filing?

Yes, Giddh is fully approved for GST filing in India and ensures compliance with all government regulations.

How secure is online GST return filing?

GST return filing through secure platforms like Giddh uses bank-grade encryption to protect sensitive financial data, ensuring safe and reliable filing.