New Deadlines for Filing GST Returns: Important Dates to Track

This post recaps 2020 COVID-19 GST extensions for March-May filings, plus a 2025 compliance calendar overview for ongoing deadlines. In 2020, the government extended GST return filing for March, April, and May to provide relief to businesses

In this blog, we will walk you through those GST return filing rules and deadlines for different businesses, and how Giddh GST filing software can make the process easier for you. Let’s break down what you need to know to file your returns on time and avoid penalties.

What is a GST Return and Why Is It Important?

A GST return is a comprehensive document containing the details of all the GST invoices, payments, and receipts for a particular period. By law, taxpayers are required to declare every transaction related to their business revenue, which helps determine the amount of tax they owe. Business owners can file GST returns online by logging on to the official portal provided by GSTN.

Key Details Required for Filing GST Returns:

- Total Sales: Include all taxable sales made during the period.

- Total Purchases: Record details of purchases made by the business.

- Output GST: The GST collected from customers during sales transactions.

- Input Tax Credit (ITC): The GST paid on purchases, which businesses can claim back.

After filing, business owners can check the status of their GST return filing online through the official GST portal. Ensure that all the required fields are completed accurately and that you meet the necessary requirements for each return form.

What Is the Purpose of Filing GST Returns?

Filing GST returns is essential because it helps the government track every taxable transaction made by a business. When you file your GST returns, you report your sales, purchases, tax collected, and tax paid, which ensures transparency and accurate tax calculation.

Important Notes for GST Return Filing:

-

Choose the Correct Form: There are 11 types of GST returns, each with a different purpose and due date.

-

Example: If you're required to file GSTR-1, you need to report details of outward supplies of taxable goods. The due date for GSTR-1 is the 11th of every month (turnover >₹1.5 Cr).

-

Know Your GST Number: Before proceeding, ensure that you have your GST number to correctly fill out the appropriate return form.

By understanding these requirements and deadlines, businesses can easily choose the right GST return form and file GST returns online on time.

What Are the New GST Return Filing Deadlines?

In 2020, Finance Minister Nirmala Sitharaman announced June 30 as the extension for March-May GST returns amid the pandemic. The extension of GST return filing dates and the deferral of e-invoicing and aided business recovery, with some regions at June 27/29.

Key Highlights of the Extension:

-

New Deadline: The filing deadline for GST returns has been extended to 30th June 2025, with some regions having different dates, such as 27th June and 29th June.

-

Waiver of Penalties: Businesses with a turnover of less than Rs 5 Crore will benefit from a waiver on interest, late fees, and penalties if they file their GST returns by 30th June 2025. Larger companies will be required to pay interest at a reduced rate of 9%, but penalties will not apply for late filings made by the extended deadline.

-

Extension of Compliance Deadlines: In addition to GST return filing, the deadline for other compliance requirements, including filing of appeals, notices, and reports, which would have expired between 20th March and 29th June 2025, has been extended to 30th June 2025.

-

Support for Small Businesses: The government's relief measures, such as the waiver of late fees and penalties, are designed to assist small businesses. Industry leaders have welcomed these measures, though there is also a call for the government to consider temporarily exempting GST on essential commodities to ensure they remain affordable during this challenging period.

What Are the Due Dates for GST Return Filing in 2020?

The government regularly announces GST return filing due dates to ensure proper taxation and clearance, helping businesses stay compliant and avoid penalties. By staying updated on these dates, taxpayers can prevent late fees and interest charges. It's also important to note that GSTR 1 and GSTR 3B must be filed every month, making it crucial to track these dates closely and avoid any delays.

List of Extended GST Return Filing Dates for 2020

The extended deadlines for GST return filings in 2020 apply to various returns, based on turnover and filing frequency. Here’s a breakdown of the new filing dates:

-

For GSTR 6, GSTR 7, GSTR 8, and GSTR 1 (Turnover > Rs 1.5 Crore):

The filing deadline for March to May 2020 has been extended to 30th June 2020. -

For GSTR 1 (Turnover ≤ Rs 1.5 Crore):

The quarterly filing period for GSTR 1 has been extended to 30th June 2020. -

For GSTR 3B Filing:

-

Annual turnover > Rs 5 Crore: The due date for February to April 2020 is 24th June 2020.

-

Annual turnover > Rs 1.5 Crore but ≤ Rs 5 Crore: The due date for February to March 2020 is 29th June 2020.

-

Annual turnover ≤ Rs 1.5 Crore: The due date for February 2020 is 30th June 2020.

-

-

For GSTR 5 and GSTR 5A (Monthly Filing from February to May 2020):

The due date for these returns is 30th June 2020.

2025 GST Return Filing Deadlines (Current Standard)

Standard deadlines now apply in 2025, such as:

GST Return Type | Turnover / Category | Filing Frequency | Due Date Example (for October 2025 filings) |

|---|---|---|---|

| GSTR-1 | > ₹1.5 Crore | Monthly | 11th November 2025 |

| GSTR-1 | ≤ ₹1.5 Crore | Quarterly | 13th January 2026 (Q3) |

| GSTR-3B | All | Monthly | 20th November 2025 |

| GSTR-5 & 5A | Non-resident | Monthly | 13th November 2025 |

Businesses should always verify specific deadlines on the official GST portal gst.gov.in as these may be updated.

Overwhelmed by GST return dates? If you are wondering how to file GST returns or how many you have to file, here’s a refresher to help you out.

Who Should File GST Returns and What Are the Different Types of Returns?

Business owners and dealers who are registered under the GST system are liable to file their GST returns depending on their business and transactions. The types of GST returns are mentioned below.

Regular Businesses

- GSTR 1 – This consists of the details of the tax return made for outward supplies during the tax period, which can include inter-state stock transfers, interstate and intrastate B2B and B2C sales, etc.

- GSTR 2 – This carries the details of the inward supplies received, including information about the taxpayer, period of return, and final invoice-level purchase.

- GSTR 3 – This includes basic information about the taxpayer, details about the return period, turnover, tax liability under CGST, SGST, IGST, interests, penalties, etc.

- GSTR 3B – The government introduced this as a relaxation for businesses for a smooth transition to GST. It consists of a summary return of inward and outward supplies.

- GSTR 9 – The GSTR 9 is the annual consolidated tax return that holds the details of the income and expenditure of the taxpayer 6.

- GSTR 9C – The GSTR 9C is an audit form that taxpayers need to file to get their annual reports audited, provided that they have a turnover of more than Rs 2 Crores in a financial year.

Businesses That Have Opted For The Composition Scheme

- GSTR 4 – This carries the details of the total value of supply made during the period of return, the tax paid at the compounding rate not exceeding one per cent of the aggregate turnover, and imported and purchased inward supplies from normal taxpayers.

- GSTR 9A – The GSTR 9A is the annual composition return form that every taxpayer enrolled in the composition scheme is liable to file.

Note: GST annual return filing is divided into three types – GSTR 9, GSTR 9A, and GSTR 9C, and it is mandatory for every business with GST registration to file the returns irrespective of their activity, sales, or profits.

Other Types Of Businesses

- GSTR 5 – This contains detailed information regarding the taxpayer, period of return, as well as every invoice detail of the sold and purchased goods and services for the registered period.

- GSTR 6 – The GSTR 6 is a monthly return form that carries the details of the taxpayer, period of return, ITC received by an ISD, as well as other documents issued for the distribution of ITC.

- GSTR 7 – This consists of monthly returns for TDS transactions, including the taxpayer’s information, the period of return, the supplier’s GSTIN, invoices of tax deducted under SGST, CGST, and IGST, and other interests and penalties.

- GSTR 8 – The GSTR 8 return form is the monthly return form for e-commerce operators, consisting of taxpayer information, return period, details of supplies made through the e-commerce portal, customer information, tax collected at source, payable, and paid tax.

- GSTR 9B – E-commerce operators have to file the annual GSTR 9B form if they collect tax at the source.

- GSTR 10 – This is the final GST return that has to be filed to cancel GST registration or when the business activities are being permanently terminated.

- GSTR 11 – The GSTR 11 is the variable tax return that needs to be filed by the persons who have been issued a UIN or Unique Identity Number.

Amendments

- GSTR 1A – This form is used to update or rectify any details made earlier to the GSTR 1 document.

Auto-Drafted Returns

- GSTR 2A – The GST portal automatically generates the GSTR 2A tax return according to the details of the purchases and inward supplies mentioned within the GSTR 1 of their suppliers.

- GSTR 4A – This is a purchase-related tax return for composition dealers. The GSTIN portal automatically generates GSTR-4A based on the details reported in GSTR-1, GSTR-5, and GSTR-7 of their suppliers.

Tax Notice

GSTR 3A – The GSTR 3A is not a tax return. It is a notice generated by the tax authority issued to taxpayers who fail to file their GST returns for a particular tax period on time.

Penalty For Late Filing Of Returns

In case the taxpayer failed to file the returns on time, a penalty or a late fine is levied on them. The GST Law has set the late fee to Rs 100 each day after the due date for CGST and SGST. Hence, the taxpayer will have to pay Rs 200 per day as the total fine. Any changes in this rate will be announced through notifications.

Rs 5,000 is the maximum amount that can be collected as a fine. But in the case of integrated GST or IGST, there is no late fee if the return filing is delayed. In addition to the late fee, taxpayers will also have to pay interest at 18 per cent p.a. The interest rate is usually calculated based on the amount of tax that is to be paid, and the time period is calculated from the deadline to the actual date of making the payment.

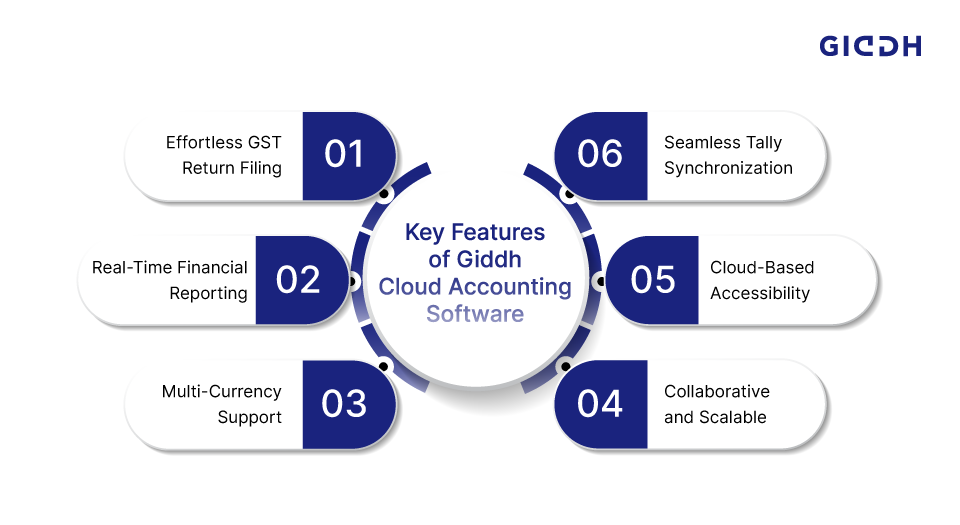

Simplify GST Return Filing with Giddh Cloud Accounting Software

If you're feeling overwhelmed by how to file GST returns online, Giddh Cloud Accounting Software is here to simplify the process. With its powerful and intuitive features, Giddh helps businesses seamlessly handle GST return filing, financial management, and compliance—effortlessly. Here are the key features of Giddh Cloud Accounting Software:

-

Effortless GST Return Filing: Giddh makes it easy to file GST returns online with automated calculations for Output GST, Input Tax Credit (ITC), and GST liabilities. Simply upload your invoices and data to generate the required forms, such as GSTR-1, GSTR-3B, and others.

-

Real-Time Financial Reporting: With Giddh, get instant access to key business reports like Profit and Loss, Balance Sheets, and GST reports, so you’re always on top of your financial health.

-

Multi-Currency Support: Manage international transactions with automated multi-currency conversion, making it ideal for global businesses or those with international operations.

-

Collaborative and Scalable: Whether you're running one company or managing over 100 companies with multiple branches, Giddh allows you to handle everything under a single subscription, offering unlimited user access and role-based permissions.

-

Cloud-Based Accessibility: Access your accounting data from anywhere, on any device, whether it’s your desktop, tablet, or smartphone. Stay compliant and efficient no matter where you are.

-

Seamless Tally Synchronization: Easily sync your accounting data with Tally to eliminate manual entry errors and ensure smooth data transfer between systems.

Final Thoughts

GST is probably the biggest tax reform that has ever been introduced in India. Although it had a negative impact on many businesses due to their unfamiliarity with the new tax reporting structure, businesses are now adapting to it and developing strategies to make the most out of it.

As every transaction will be reported through a common invoice for both the seller and the recipient of goods and services, it is now easier to record everything in one place and collate data for the taxpayer. Moreover, the processes have been simplified, and many taxes have been removed.

The Goods and Services Tax Network or GSTN, deployed by the Finance Ministry, will hold the information of sellers and buyers and help to manage the huge influx of data.

It is anticipated that GST will boost the economy of our nation and increase our GDP over the long run. To look at its immediate impacts, it has made taxation easier and broadened the taxpayer base. The online taxation system will certainly ensure better accountability and tax compliance and lower the chances of tax fraud.

Experience a stress-free GST filing experience with Giddh cloud accounting software. Reach out to us for a free trial today.