Key Features to Look for in Multi-Currency Accounting Software for Global Expansion

As you expand your business globally, have you considered that managing finances across multiple currencies could impact your operations?

In Fact, the global accounting software market was valued at approximately USD 24.5 billion to USD 29.8 billion by 2032, growing at a CAGR of about 10%. This growth underscores the growing demand for accounting solutions that can efficiently manage multiple currencies, minimize errors, and ensure compliance as your business expands globally.

Without the right tools, businesses often struggle to maintain accurate financial records, ensure compliance with various tax regulations, and effectively manage currency exchange fluctuations. These challenges can lead to errors, inefficiencies, and missed opportunities in global markets.

This blog will highlight the essential features to look for in multi-currency accounting software that can streamline international transactions, enhance financial accuracy, and simplify the complexities of global expansion.

What is Multi-Currency Accounting?

Multi-currency accounting refers to the process of managing financial transactions in different currencies. This is essential for companies that operate internationally or deal with clients, suppliers, or partners across multiple countries.

Multi-currency financial management software simplifies this process by automating currency conversions, updating exchange rates in real-time, and ensuring compliance with local tax laws.

Why Is Multi-Currency Accounting Critical For Global Expansion?

As industries expand, Global accounting software with multi-currency support plays a crucial role in automating financial processes, ensuring accuracy in real-time currency conversions, and maintaining compliance with international regulations.

By leveraging such software, businesses can efficiently handle global operations, reduce manual work, and focus on strategic growth.

- Global Market Access: Supports international expansion.

- Simplified Conversion: Automates currency exchange processes.

- Informed Decisions: Provides accurate financial data in real-time.

Businesses face challenges like exchange rate fluctuations, tax compliance, and real-time currency tracking. These issues can lead to unexpected costs and errors, but with the right software, they can be managed effectively.

- Volatility Risk: Exchange rate swings can affect profits.

- Tax Compliance: Navigating different tax laws.

- Manual Tracking: Manually tracking currencies can be prone to errors.

What Are The Key Features To Look For In Multi-Currency Accounting Software

A. Real-Time Currency Conversion

Accurate financial reporting depends on up-to-date exchange rates. Without real-time currency conversion, businesses may end up with incorrect financial data, leading to costly mistakes.

How It Helps:

- Tracks and converts transactions in real-time, ensuring accuracy.

- Reduces the risk of errors from outdated exchange rates.

- Saves time by automating currency conversions, eliminating the need for manual checks.

Example/Tool Mention:

Multi-currency invoicing tools for businesses, such as Giddh, make real-time currency conversion seamless, allowing firms to process transactions globally without worrying about fluctuating exchange rates.

B. Multi-Language and Multi-Country Support

Global businesses operate in different regions with unique languages and local regulations. Having the ability to localize accounting systems is critical for smooth operations.

How It Helps:

- Supports multiple languages, making the system accessible to global teams.

- Customizes the accounting process to fit regional regulatory requirements.

- Ensures smooth operation across various regions, enhancing efficiency and mitigating compliance risks.

Real-World Example:

Giddh offers seamless multi-language and multi-country support, helping businesses handle localized accounting requirements and comply with regional financial regulations.

C. Automated Exchange Rate Management

Exchange rate fluctuations can lead to inconsistencies in financial records, particularly for businesses that operate across multiple currencies. Automating this process ensures accuracy.

How It Helps:

- Automatically updates exchange rates to ensure accuracy at all times.

- Prevents manual errors in currency conversions.

- Keeps financial records consistent, regardless of changes in exchange rates.

Example/Tool Mention:

Giddh simplifies this process by automatically updating exchange rates, ensuring accurate financial records that comply with international financial regulations.

D. Integration with International Banks and Payment Gateways

Multi currency accounting systems with international banks and payment gateways help reduce manual data entry, which can lead to errors and inaccuracies. A seamless integration improves the accuracy of financial transactions and reconciliation processes.

How It Helps:

- Facilitates easy payment processing and account reconciliation across multiple currencies.

- Reduces manual entry errors by automating transaction data entry.

- Ensures accurate financial records by syncing with global payment systems.

Example/Tool Mention:

Giddh integrates effortlessly with popular international banks and payment gateways, making global transactions smoother and more accurate.

E. Tax Compliance and Reporting

For businesses expanding internationally, compliance with local tax laws is a critical component of financial management. Tax laws differ from country to country, and failing to stay compliant can result in penalties.

How It Helps:

- Automatically calculates taxes based on country-specific tax rates.

- Reduces the risk of errors in tax reporting by automating the process.

- Ensures compliance with global tax regulations to prevent costly penalties.

Example/Tool Mention:

Giddh handles tax complexities with ease, providing automatic tax calculations tailored to multiple regions and ensuring your business stays compliant with international tax laws.

How Multi-Currency Accounting Software Enhances

Business Efficiency

Multi currency accounting software enables businesses to manage financial transactions in multiple currencies effectively. It helps streamline operations, improve accuracy, and reduce operational costs, particularly for companies looking to scale globally. Let's explore the key benefits it provides:

1. Operational Efficiency

Multi-currency online accounting software automates the complex tasks involved in handling multiple currencies, reducing the need for manual data entry. By streamlining workflows, businesses can improve their accounting speed and accuracy.

- Automation: Automates currency conversion and reporting.

- Reduced Errors: Lowers the risk of manual mistakes.

- Faster Processing: Speeds up the accounting process.

2. Cost Savings

The software reduces reliance on third-party services and manual labor, resulting in significant savings. It ensures financial data is consistently accurate, preventing costly errors in currency conversion and transaction reporting.

- Minimized Errors: Prevents costly financial mistakes.

- Lower Operational Costs: Reduces manual effort and outsourcing.

- Efficient Resource Use: Frees up staff time for other tasks.

3. Scalability

With multi-currency accounting software, businesses can easily scale their operations internationally. As your business expands, the software can adapt to manage accounting, new currencies, regions, and complex financial needs seamlessly.

- Adaptable: Easily scales as the business grows.

- Global Reach: Supports expansion into new markets.

- Centralized Control: Handles global transactions from one platform.

4. Improved Financial Visibility

Multi-currency software consolidates reports from different currencies, providing clear visibility into overall business performance. This centralized approach allows for better decision-making and effective cash flow management.

- Consolidated Reports: Easy-to-read financial statements.

- Real-Time Updates: Instant insights into financial data.

- Better Cash Flow Management: A Clear View of Finances Across Regions.

5. Regulatory Compliance

Staying compliant with tax laws and accounting standards in different countries is challenging. Multi-currency accounting software ensures businesses meet local tax regulations automatically, reducing the risk of penalties.

- Automatic Tax Calculation: Ensures accurate tax reporting and compliance.

- Country-Specific Reporting: Complies with local regulations and laws.

- Prevents Penalties: Reduces the risk of compliance errors.

6. Better Decision-Making

Having access to real-time financial insights allows businesses to make more informed decisions. With the ability to analyze data across multiple currencies, decision-makers can quickly adjust strategies to capitalize on opportunities.

- Real-Time Insights: Up-to-date financial data.

- Informed Decisions: Data-driven decision-making.

- Proactive Strategy: Adjust strategies based on current data and insights to optimize performance.

7. Customer Satisfaction

Multi-currency accounting software enables businesses to invoice customers in their local currency, creating a smoother and more customer-friendly payment process. It simplifies transactions and builds trust with international clients.

- Local Currency Billing: Makes transactions easier for customers.

- Faster Payments: Reduces payment delays.

- Improved Relationships: Strengthens client trust and satisfaction.

How to Choose the Right Multi-Currency Accounting Software

Selecting the right multi-currency accounting software is crucial for businesses that operate across borders. International accounting solutions for businesses ensure smooth financial management, accurate reporting, and compliance with international standards. Here's how to choose the best solution:

✅ 1. Currency Support

Currency conversion accounting tools support all the currencies your business deals with. It should automatically update exchange rates and offer seamless conversion.

- Multiple currency support and automatic exchange rate updates.

- Prevents conversion errors and ensures accurate financial reporting.

✅ 2. Real-Time Conversion

Look for software that syncs exchange rates in real-time or at least on an hourly basis to maintain financial accuracy.

- Real-time or hourly currency rate updates.

- Ensures up-to-date conversions to minimize discrepancies in financial records.

✅ 3. Regulatory Compliance

Verify that the multi-currency accounting software accommodates tax rules, invoicing, and reporting across multiple countries, particularly if you operate internationally.

- Compliance with global tax laws and country-specific regulations.

- It helps avoid fines and ensures your business adheres to local standards.

✅ 4. Integration Options

Ensure the software integrates seamlessly with your existing systems, such as CRMs, ERPs, banks, and payment gateways.

- Easy integration with existing business tools.

- Streamlines operations and reduces manual data entry, improving accuracy.

✅ 5. Custom Reporting

Your software should offer customizable reports, with options to consolidate data or break it down by region or currency.

- Customizable reports and detailed breakdowns.

- Provides clear insights into global financial performance, helping with strategic planning.

✅ 6. User Access Control

Ensure that the software allows you to assign different access levels based on roles and regions, helping maintain data security and integrity.

- Role-based access and permissions.

- Protects sensitive financial data by limiting access to authorized personnel.

✅ 7. Customer Support

Responsive customer support is crucial, particularly in the context of global financial operations and currency management. Look for providers with expertise in multi-currency accounting.

- 24/7 support and global finance expertise.

- Ensures timely resolution of issues and keeps your operations running smoothly.

Giddh: Multi-Currency Accounting Software For Businesses

Giddh is a multi-currency accounting software designed to simplify financial management for businesses of all sizes. It offers an intuitive platform that streamlines bookkeeping, multi-currency accounting, and reporting.

With real-time insights, seamless integrations, and multi-company management, Giddh helps businesses automate their financial workflows, making global expansion and compliance effortless.

Key Features of Giddh

- Effortless Ledger-Based Accounting

Simplify your bookkeeping process with one-step ledger entries, reducing manual work and saving your team valuable time.

- Manage Multiple Companies & Branches

Easily manage multiple companies and branches under a single subscription, all within one platform, streamlining your business operations.

- Detailed Business Reports in Real-Time

Stay on top of your finances with instant access to up-to-date P&L, balance sheets, aging reports, and tax reports—enabling quick, data-driven decisions.

- Automated Multi-Currency Support

Handle international transactions seamlessly with automated multi-currency support, making it easier for businesses to expand globally without the complexities of manual currency conversion.

- White-Label Option

Personalize Giddh with your branding, including a customized mobile app, for a tailored and professional user experience.

- Integrations & API Access

Connect with bank accounts, Shopify, and Tally, and integrate with CRMs, ERPs, and other essential business tools through flexible APIs for smoother operations.

- Multi-Currency Accounting Feature

Giddh's multi-currency accounting feature enables businesses to track, convert, and report transactions across multiple currencies. The software supports real-time exchange rate updates, ensuring accurate and up-to-date global financial management.

- Automatic Currency Conversion: Instantly convert transactions to your home currency.

- Real-Time Exchange Rates: Stay informed about the latest currency values.

- Global Compliance: Adheres to local tax and reporting standards in various countries.

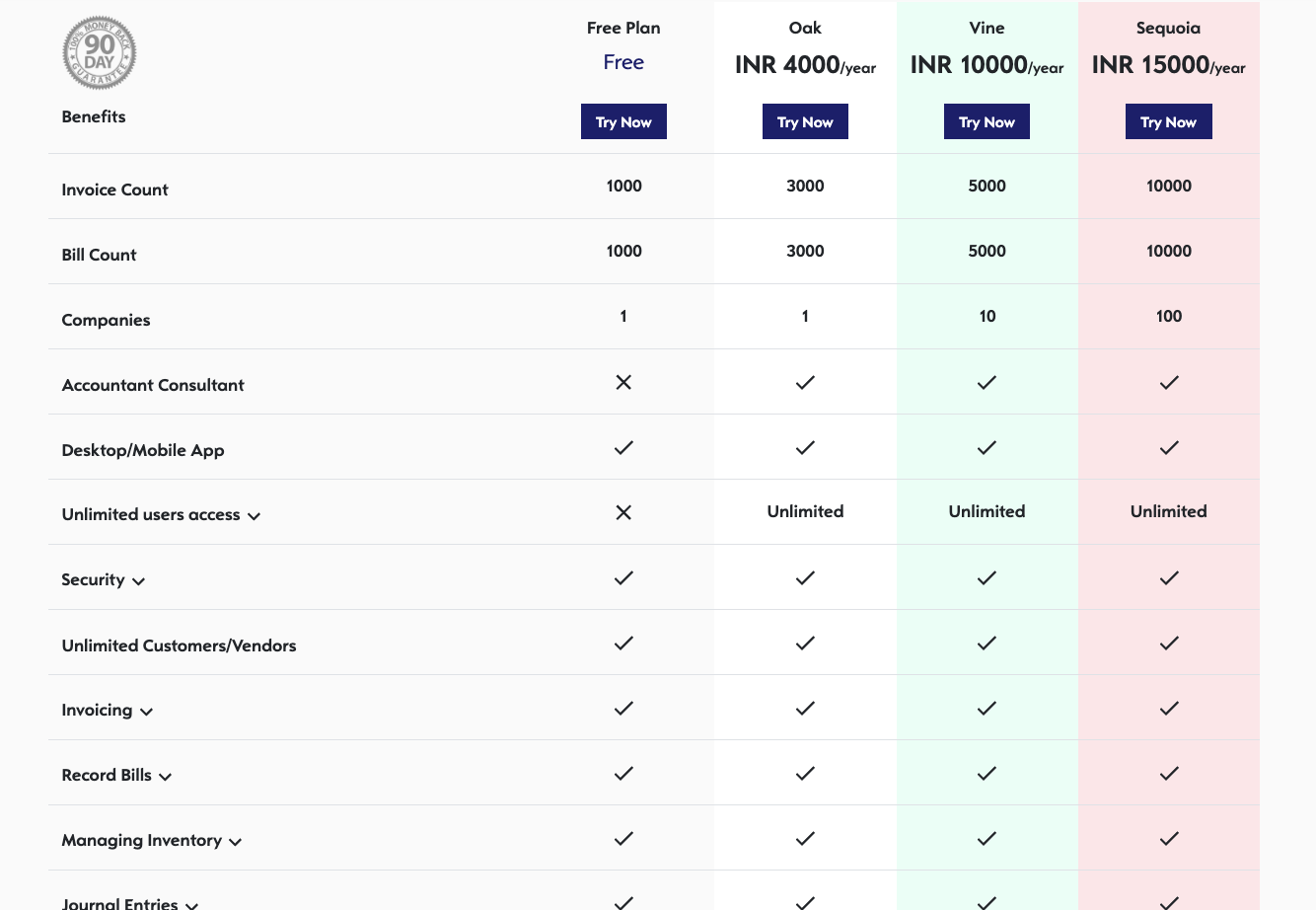

Pricing:

Giddh offers flexible pricing plans to suit businesses of all sizes, from startups to enterprises. Each Plan includes key features like multi-currency support, automated reporting , and integrations. Choose the right Plan based on your needs:

- Basic Plan: $50 per year. Perfect for small businesses.

- Pro Plan: $150 per year. Ideal for growing businesses with advanced features.

- Enterprise Plan: $ 250 per year. Tailored for large organizations with custom needs.

Conclusion

As we know, selecting the right multi-currency accounting software is crucial for businesses seeking to expand globally. It helps streamline financial processes, ensures accurate currency conversions, and ensures compliance with international regulations. With the right solution, managing global accounting becomes easier, enabling you to focus on growing your business.

Explore Giddh's demo or schedule a consultation to see how it can simplify your global accounting needs. Let Giddh help you manage multi-currency transactions with ease and confidence as you scale.

Ready to simplify your global expansion? Start your journey with Giddh today.

FAQ Section

1. What are the costs associated with multi-currency accounting software?

The costs of multi-currency accounting software typically depend on the provider, features, and scale of your business. Subscription plans may range from basic tiers, starting at $10–$50 per month, to more advanced options priced at $ 100 or more per month. Enterprise solutions with custom features could involve additional costs. Always review the software's features and scalability to determine the best fit for your business.

2. How does multi-currency accounting software handle exchange rate fluctuations?

Multi-currency accounting software automatically updates exchange rates in real-time or at scheduled intervals, ensuring accurate conversions and financial records. This helps businesses manage fluctuations without manual adjustments, providing consistent and up-to-date economic data for better decision-making.

3. Can multi-currency software help with global tax compliance?

Yes, multi-currency accounting software is designed to comply with international tax regulations by automatically calculating taxes based on the local laws of the countries you operate in. It ensures accurate reporting of VAT, GST, and other tax obligations, reducing the risk of non-compliance.

4. How do I know if my business is ready for a multi-currency accounting system?

Your business is ready for multi-currency accounting software if you operate in multiple countries or deal with international clients or suppliers. If you face challenges in tracking and managing transactions across different currencies or struggle with global tax compliance, it’s time to implement a multi-currency solution.