5 Best Multi-Currency Reporting Tools for SMEs

Managing multi-currency transactions is no small feat for small and medium-sized enterprises (SMEs). Financial reporting becomes especially daunting when it involves navigating complex currency conversions, real-time exchange rate fluctuations, and ever-changing tax regulations. Did you know that SMEs can lose up to 10 hours each week due to manual currency conversion and reporting errors?

CFOs and finance managers are under constant pressure to ensure that their financial reports are not only accurate but also compliant with international tax laws. While these challenges are significant, the right multi-currency reporting tool can help alleviate the burden of manual processes, streamline workflows, and minimize risks.

In this blog, we’ll delve into five of the best multi-currency reporting tools that help SMEs handle international transactions seamlessly, saving time, reducing errors, and ensuring accuracy in financial reports.

5 Best Multi-Currency Reporting Tools for SMEs?

Here’s a deeper look at the five best multi-currency reporting tools designed to automate financial workflows, reduce errors, and ensure compliance.

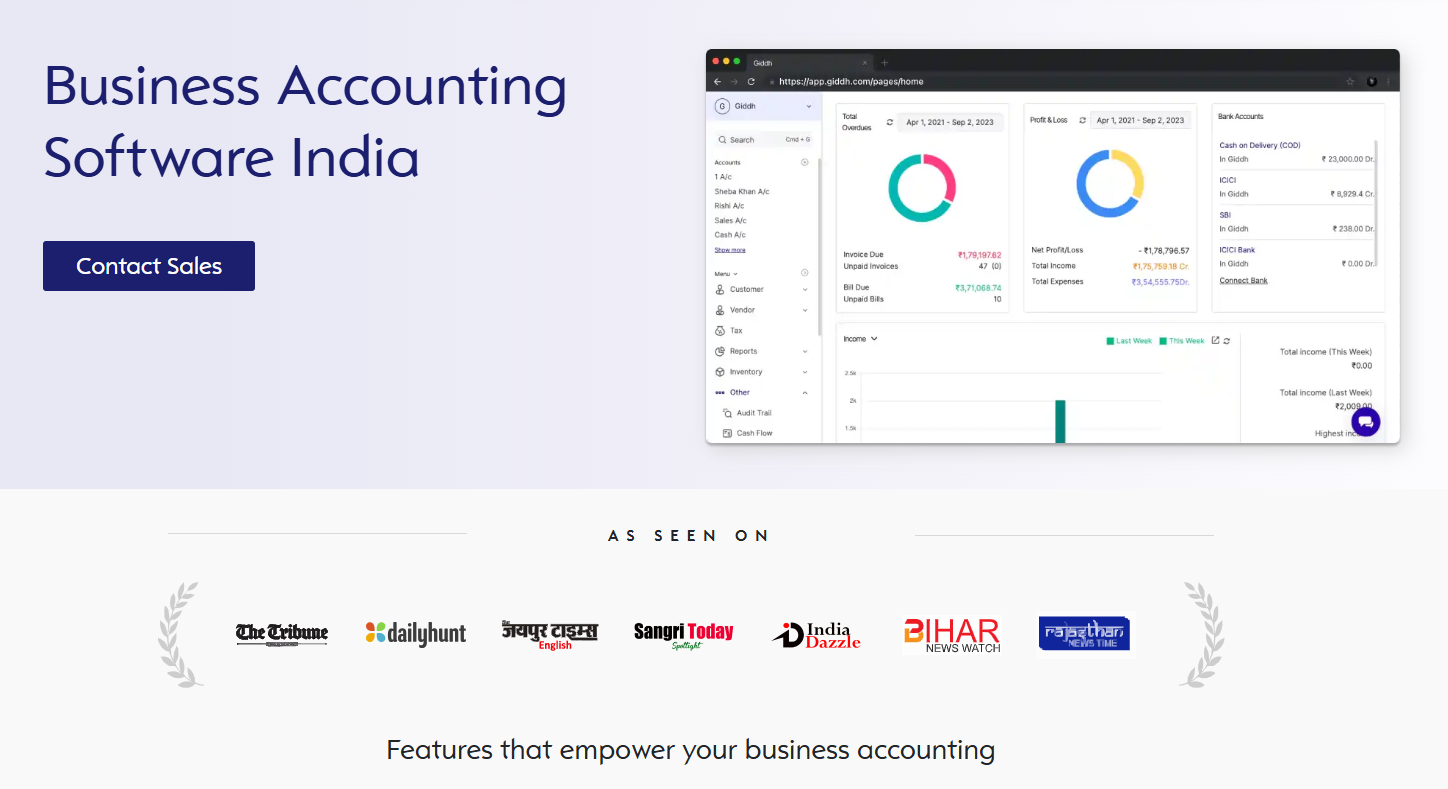

1. Giddh: The Complete Solution for Multi-Currency Reporting

Giddh simplifies global business transactions with powerful multi-currency reporting tools designed for SMEs, exporters, importers, and service-based companies. From automatic currency conversion to custom rate settings, it ensures accuracy, transparency, and smooth financial management across borders.

Key Features:

Eliminate Currency Confusion with Automatic Conversion

-

Converts international transactions to your base currency in real-time.

-

Allows manual rate entry for complete control over conversions.

Easy International Customer Invoicing

-

Send invoices in your customer’s currency.

-

Accept international payments effortlessly while maintaining books in your business currency.

Default Currency for Business Accounts

-

Assign a preferred foreign currency to specific customer or vendor accounts.

-

Automatically generate invoices and reports in the set currency.

Dynamic Business Reporting

-

Generate trial balance, profit & loss, and balance sheet in base currency.

-

Accurate and up-to-date financial insights for better decision-making.

Real-Time Exchange Rate Integration

-

Integrated with live exchange rate APIs for precise conversions.

-

Option to update rates automatically or set custom ones.

Multi-Currency Payment Tracking

-

Track receivables and payables in multiple currencies.

-

Identify currency-wise outstanding balances with ease.

Multi-Currency Bank Reconciliation

-

Match bank statements with transactions in the respective currency.

-

Detect discrepancies instantly and reconcile faster.

International Tax Compliance

-

Ensures financial reports align with local and international tax standards, such as GST and VAT.

-

Simplifies cross-border tax reporting and compliance.

Secure Cloud-Based Access

-

Access and manage multi-currency reports anytime, anywhere.

-

Role-based access for accountants, finance teams, and management.

Benefits:

-

Minimizes manual reporting: Automating processes reduces human error and increases productivity.

-

User-friendly interface: No steep learning curve, allowing finance teams to get up to speed quickly and efficiently manage multi-currency reporting.

-

Comprehensive financial management: Generates multi-currency financial statements and supports real-time transaction reconciliation.

Why Giddh is Ideal for SMEs:

Giddh offers a highly scalable solution for SMEs seeking both simplicity and depth. Whether you’re dealing with a handful of currencies or a more complex global operation, Giddh provides the multi-currency reporting tool to scale as your business grows without costly add-ons or extensive training.

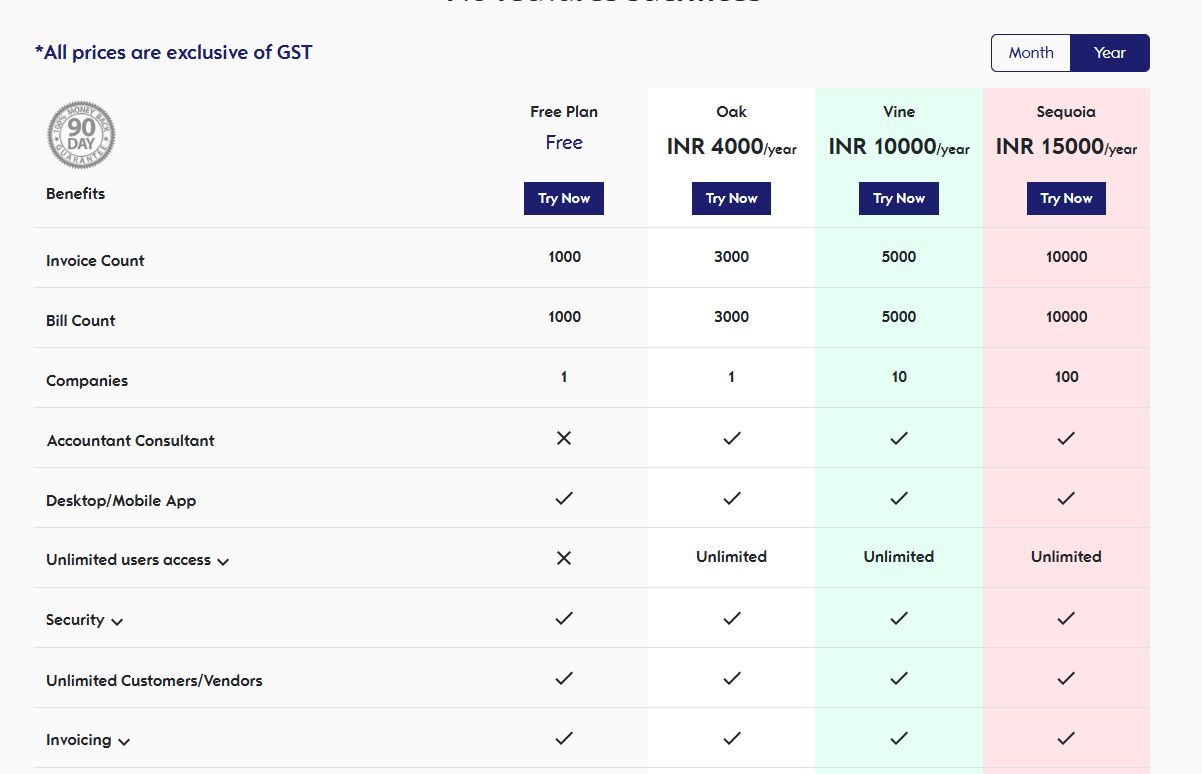

Pricing:

Giddh delivers powerful, GST-ready accounting at prices every business can afford. All plans include unlimited users, cloud access, invoicing, inventory, and real-time collaboration.

Plans:

-

Free / Birch – ₹0, ideal for students, CAs, NGOs.

-

Oak – ₹4,000/year, consultant support, and more.

-

Vine & Sequoia – ₹10,000–₹15,000/year, multi-company access, high transaction limits, enterprise features.

2. QuickBooks: Multi-Currency Reporting with Full Integration

Key Features:

-

Multi-currency support: Handles both income and expenses in various currencies, allowing for comprehensive multi-currency financial reporting software.

-

Automatic currency conversion: QuickBooks integrates real-time exchange rates to ensure accurate conversions for each transaction.

-

Customizable reports: Tailor your financial reports based on different currencies to get precise insights.

Benefits:

-

Global transaction management: Track multi-currency transactions seamlessly across customers, vendors, and bank accounts.

-

Integration with invoicing, payroll, and inventory: QuickBooks automatically integrates with payroll, inventory, and invoicing, making it an excellent choice for SMEs with international teams or clients.

-

Time-saving features: The automated exchange rate conversion reduces the time spent manually adjusting reports or tracking discrepancies.

Why QuickBooks is Ideal for SMEs:

For SMEs with international customers or vendors, QuickBooks offers a robust solution to automate and simplify the often-complex task of multi-currency accounting, making it an ideal choice for businesses that need an integrated financial management tool.

3. Xero: A Flexible Option for SMEs with Global Operations

Key Features:

-

Multi-currency support: Easily handle invoicing, payments, and reporting in multiple currencies.

-

Payment platform integration: Xero integrates with various payment systems (PayPal, Stripe, etc.) to ensure smooth processing of international payments.

-

Mobile-friendly: Xero’s app allows you to monitor exchange rates and generate reports on the go so that you can manage your finances from anywhere.

Benefits:

-

Streamlined invoicing and payments: Xero supports automated invoicing in different currencies, making it easier to track foreign transactions.

-

Easy exchange rate management: The software automatically updates exchange rates, so you don’t have to worry about manually calculating conversions.

-

Global accessibility: With mobile access, your finance team can track and manage reports in real-time, from any location.

Why Xero is Ideal for SMEs:

Xero offers a user-friendly and flexible platform, perfect for SMEs that require access to real-time data and want to streamline their multi-currency reporting and invoicing processes. It is particularly suited for businesses with global teams or clients.

4. Sage Business Cloud Accounting: Built for Global Businesses

Key Features:

-

Multi-currency invoicing and reporting: The multi-currency reporting tool automatically converts foreign transactions and generates reports in different currencies.

-

Real-time exchange rate updates: Keep your reports up to date with the latest market rates.

-

Customizable financial reporting: Tailor reports to suit your business needs and ensure accuracy.

Benefits:

-

Global compliance: Sage Business Cloud Accounting helps SMEs adhere to international accounting standards (e.g., IFRS and GAAP), ensuring all reports are compliant.

-

Integrated financial management: It simplifies the process of managing multi-currency reports while maintaining accurate records of invoices, expenses, and payments.

-

Increased accuracy: The tool automates the conversion process, reducing the risk of human errors and discrepancies.

Why Sage is Ideal for SMEs:

Accounting and reporting software for global businesses, Sage offers robust reporting capabilities and keeps businesses compliant with international financial standards, making it ideal for companies that need to manage complex multi-currency transactions.

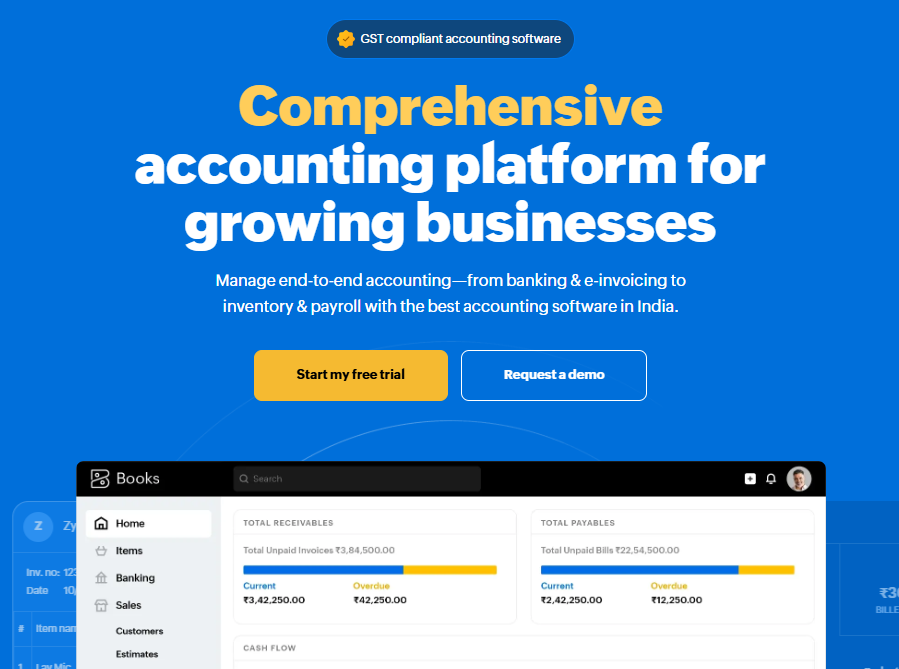

5. Zoho Books: Simplicity Meets Power for SMEs

Key Features:

-

Multi-currency support: Zoho Books enables you to handle invoices, payments, and expenses in various currencies, making it easier to manage global transactions.

-

Automatic exchange rate updates: Exchange rates are automatically updated to ensure your financial data is accurate.

-

Seamless banking integration: Zoho Books integrates easily with banking platforms to reconcile foreign transactions automatically.

Benefits:

-

Simple, yet powerful: Zoho Books offers a straightforward user experience with powerful capabilities for SMEs managing global operations.

-

Automatic reconciliation: The integration with banks helps reconcile multi-currency transactions automatically, reducing manual effort.

-

Cost-effective solution: Zoho Books is an affordable choice for SMEs looking for a multi-currency reporting tool that balances power with cost-efficiency.

Why Zoho Books is Ideal for SMEs:

For SMEs seeking a simple yet effective solution for international transactions, Zoho Books is ideal. It’s easy to use and provides automatic exchange rate updates to keep your financial reports accurate.

Factors to Consider When Choosing Multi-Currency Reporting Tools

When evaluating multi-currency reporting tools, it's essential to consider the following factors to ensure you select the best fit for your business:

Factors to Consider:

-

Business size and growth potential:

- Choose a tool that can scale as your business grows to accommodate more currencies and transactions.

-

Volume of international transactions:

- Higher transaction volumes require more robust automation and real-time exchange rate integration.

-

Integration with other systems:

- Look for a tool that easily integrates with your accounting, banking, and ERP systems to streamline workflows.

-

Security and compliance:

- Ensure the tool complies with local and international tax laws (e.g., VAT, GST) and accounting standards (e.g., IFRS, GAAP).

Key Evaluation Criteria:

-

Ease of use:

- The interface should be intuitive and accessible for your finance team, ensuring quick adoption and minimal training time.

-

Compliance:

- Does the tool keep you compliant with both local and international accounting regulations and tax laws?

-

Scalability:

- Can the tool handle an increasing volume of transactions and currencies as your business expands?

-

Cost-effectiveness:

- Does the tool offer the features you need at a price point that fits within your SME budget?

How Multi-Currency Reporting Tools Simplify Financial Reporting for SMEs?

The right multi-currency reporting tool can dramatically simplify the process of managing international transactions and ensure that financial reporting is accurate and compliant. Here’s how these tools help:

-

Automated currency conversion with real-time exchange rates:

- Saves time by automatically updating rates, eliminating the need for manual adjustments.

-

Multi-currency financial statement consolidation:

- Easily consolidate financial statements from various currencies into one, making it easier to analyze performance.

-

Integration with accounting software:

- Tools like Giddh and QuickBooks integrate seamlessly with other software, reducing manual entry and improving efficiency.

-

Compliance with international accounting standards:

- Multi-currency tools ensure that reports comply with IFRS, GAAP, and local tax regulations, reducing the risk of errors and penalties.

How These Tools Address Common Pain Points:

-

Eliminate manual currency conversion errors: Automation ensures accuracy and eliminates the risks of human errors.

-

Save time in generating reports: Pre-set templates and automated workflows reduce the need for manual input and calculation.

-

Increase accuracy and reduce compliance risks: By ensuring tax compliance and accurate currency conversions, these tools significantly mitigate financial reporting risks.

Best Practices for Implementing Multi-Currency Reporting Tools

Here are a few best practices to help you optimize your multi-currency reporting:

Tips for Optimizing Your Workflow:

-

Regularly update exchange rates: Keep exchange rates up to date to ensure your reports reflect the most current data.

-

Train your finance team: Ensure your team is trained on the software to avoid mistakes and maximize its potential.

-

Monitor reports regularly: Regularly review financial reports for discrepancies or inconsistencies.

-

Leverage automation: Use automation features to handle routine tasks, reducing manual work and improving efficiency.

Leveraging Support and Resources:

- Take full advantage of customer support and educational resources offered by your tool provider to ensure smooth implementation and address any challenges.

Final Thoughts:

Managing multi-currency transactions is undeniably complex and time-consuming for SMEs. However, the right multi-currency reporting tools can ease this burden by automating processes, ensuring accuracy, and maintaining compliance with local and international regulations.

Ready to streamline your multi-currency financial reporting? Explore Giddh’s multi-currency reporting platform now and see how it can help your SME stay ahead of the competition.

Have you used any multi-currency reporting tools in your SME? Share your experiences in the comments below!