How Multi-User Accounting Software Can Help You Avoid Common Pitfalls

Managing finances efficiently is one of the most pressing challenges faced by small and medium-sized businesses. Nearly 60% of small businesses in India struggle with cash flow management, and around 40% face errors due to manual accounting processes.

Additionally, a lack of oversight and inefficient collaboration between teams often results in missed opportunities and delayed decision-making. These issues not only slow down growth but also hinder accurate financial forecasting.

This is where Multi-User Accounting Software comes in. Designed to address these common issues, it provides real-time collaboration, error reduction, and enhanced visibility into financial data, enabling businesses to manage their finances more effectively and make informed decisions more quickly.

Are you ready to streamline your financial processes and eliminate these obstacles? A solution like.

What is Multi-User Accounting Software?

Multi-user accounting software is a powerful tool designed to streamline financial operations by allowing multiple users to access and manage accounting data simultaneously. It ensures that updates to financial records are instantly reflected across all users, promoting accuracy and efficiency.

Benefits Overview

This type of software enhances business operations by simplifying complex financial tasks. It enables seamless communication between team members, improving productivity and reducing errors. Key benefits include:

-

Improved Collaboration: Multiple users can access and update records, ensuring everyone is working from the same information.

-

Better Financial Control: Streamlined processes make it easier to track income, expenses, and other financial metrics.

-

Informed Decision-Making: Real-time data helps management make timely, well-informed business decisions.

How It Works

Multi-user accounting systems are designed to support a range of roles with varying access permissions. Each user can view or edit specific sections of financial data based on their responsibilities. The core system includes:

-

Role-Based Access: Users, such as accountants or financial managers, can have varying levels of access to data.

-

Real-Time Updates: Changes made by one user are immediately visible to others, ensuring up-to-date information.

-

Secure Data Handling: With built-in security features, the software ensures sensitive financial data remains protected across all users.

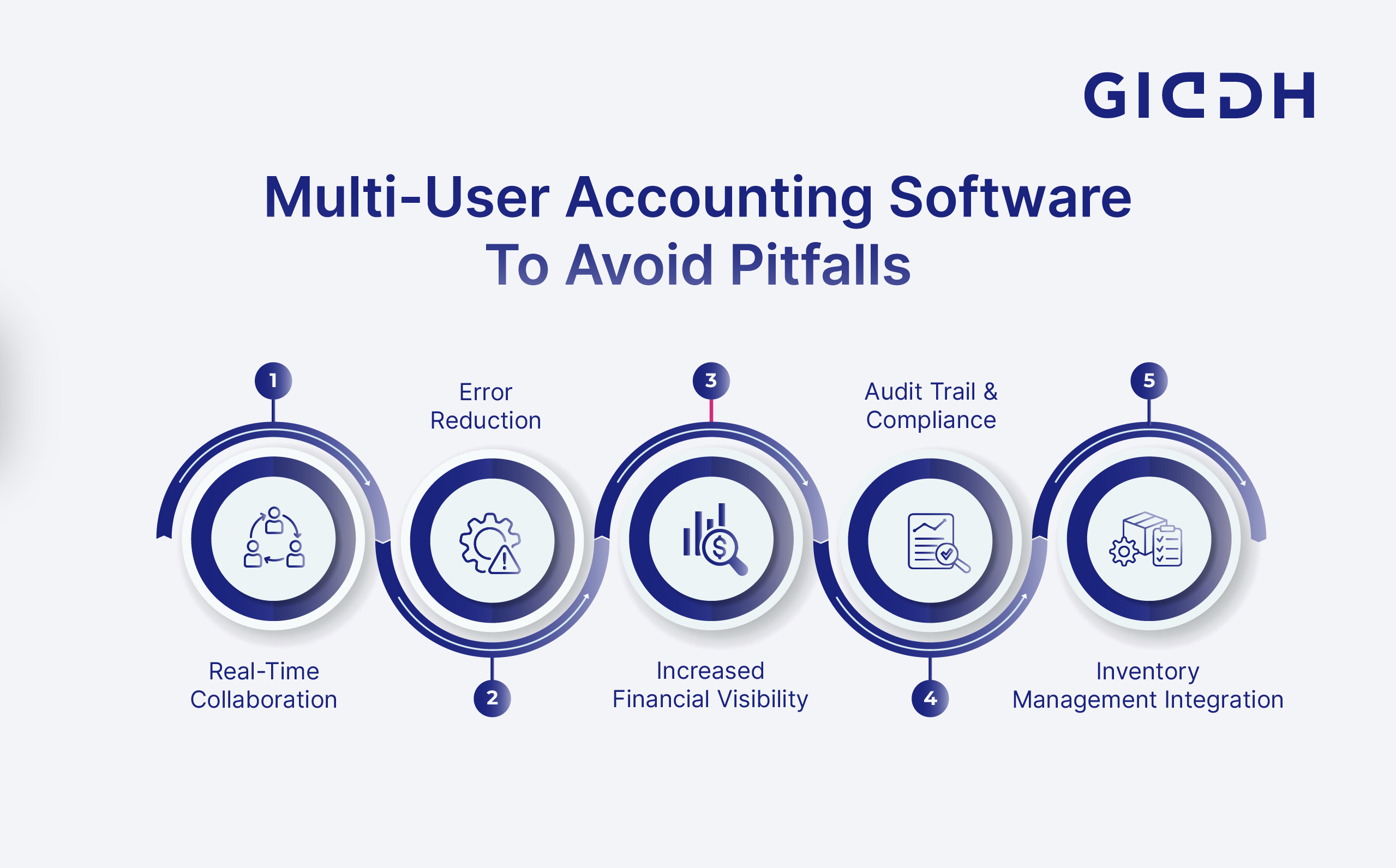

How Multi-User Accounting Software Helps Overcome These Challenges

Multi-user accounting software offers a robust solution to the various challenges faced by businesses today. Here’s how this type of software can help address common financial management issues, including real-time collaboration, error reduction, and better visibility.

Real-Time Collaboration

One of the most significant advantages of multi-user accounting software is its ability to facilitate real-time collaboration among multiple users. Multi-user accounting software eliminates this challenge by allowing all authorized users to work simultaneously on the same financial documents.

-

No Conflict on Updates: Changes made by one user are instantly visible to others, avoiding conflicts or duplicated efforts.

-

Improved Team Collaboration: Teams can communicate effectively without relying on external tools, resulting in a more fluid overall process.

-

Increased Productivity: Real-time access to data speeds up decision-making and reduces delays in financial reporting.

Error Reduction

Human errors are a common challenge in accounting, and even the slightest mistake can lead to significant financial discrepancies. Multi-user accounting software helps minimize these risks by utilizing automated data entry, validation rules, and error-checking features that ensure the accuracy of the data entered.

By reducing the manual effort required to enter information, businesses can enjoy enhanced accuracy and fewer costly mistakes.

-

Automated Data Entry: Reduces the risk of human error by automating repetitive tasks such as data entry and calculation.

-

Error-Checking Tools: Built-in validation tools flag potential discrepancies or mistakes, ensuring that data remains accurate.

-

Consistency Across Departments: All users work with the same up-to-date data, eliminating discrepancies caused by outdated information.

Increased Financial Visibility

Financial transparency is crucial for making informed decisions, particularly when multiple departments or teams rely on the same set of data. Multi-user accounting software ensures that every authorized user can access up-to-date financial information, promoting greater transparency across the organization.

With real-time updates, business leaders can quickly assess financial health, identify areas for improvement, and make well-informed decisions.

-

Instant Access to Financial Data: All team members can view up-to-date reports, reducing delays in accessing crucial information.

-

Transparent Financial Reporting: Promotes accountability and allows for better oversight across various business operations.

-

Better Decision Making: Up-to-the-minute data enables managers to make informed, data-driven decisions that positively impact the company’s success.

Audit Trail & Compliance

Compliance with financial regulations and maintaining an audit trail are essential for any business. Multi-user accounting software with built-in audit trail features tracks every change made to financial records, ensuring transparency and accountability.

This creates a transparent record of all edits, making it easier for businesses to stay compliant with local regulations. Additionally, it enables auditors to track and verify financial transactions, ensuring that all updates are accurately logged.

-

Complete Change Log: Every modification made by any user is logged and timestamped, ensuring full accountability.

-

Regulatory Compliance: Helps businesses comply with industry regulations by providing the necessary documentation for audits.

-

Easy Traceability: Simplifies the process of tracking down errors or discrepancies by providing a clear record of all actions taken.

Inventory Management Integration

Managing inventory is another complex area where multi-user accounting software provides substantial benefits. Many businesses struggle with tracking the relationship between sales, expenses, and stock levels.

Multi-user accounting software that integrates with inventory management systems ensures that all relevant data is kept in sync, preventing discrepancies between what’s sold and what’s in stock.

-

Seamless Integration: Inventory levels, sales, and financial data are automatically synchronized, reducing the risk of errors between departments.

-

Accurate Stock Tracking: Real-time updates to inventory levels help businesses avoid stockouts or overstocking situations.

-

Improved Financial Planning: With an accurate view of inventory and expenses, businesses can forecast more effectively and make better financial decisions.

Common Pitfalls in Managing Business Finances

Managing business finances can be challenging, especially for businesses that rely on manual processes and outdated systems. Here are some common pitfalls that can hinder financial efficiency and growth.

Data Entry Errors

Manual accounting processes are prone to human error, and even a minor mistake can result in significant financial discrepancies. The risk of miscalculations, duplicate entries, or incorrect data is always present when handling accounts manually.

-

Increased Risk of Errors: Manual data entry often results in input errors, compromising financial accuracy.

-

Financial Discrepancies: Small mistakes can snowball into larger issues, affecting budgeting and forecasting.

Lack of Oversight

Business owners often face difficulties in gaining complete visibility into their financial operations. Without proper tools to track and monitor financial data, important details may go unnoticed, leading to costly mistakes or missed opportunities.

-

Limited Visibility: Without real-time updates, business owners struggle to gain a clear understanding of the big picture.

-

Missed Opportunities: A lack of oversight can lead to delays in identifying profitable opportunities or potential threats.

Inefficient Collaboration

In businesses where departments work in isolation, collaboration on financial data can become cumbersome. Siloed financial processes hinder teamwork and make it more difficult for teams to identify discrepancies early on.

-

Disjointed Processes: Lack of collaboration makes it difficult for teams to align on financial goals and strategies.

-

Delayed Issue Resolution: Without shared access to data, discrepancies or issues may go unnoticed for extended periods.

Delayed Decision-Making

When financial data is not easily accessible or up-to-date, decision-makers are forced to make choices based on outdated information. This delay in accessing accurate financial data can significantly affect business growth and agility.

-

Slow Response Time: Incomplete or delayed financial data leads to sluggish decision-making.

-

Missed Growth Opportunities: Poor financial visibility prevents timely actions that can drive growth or mitigate risks.

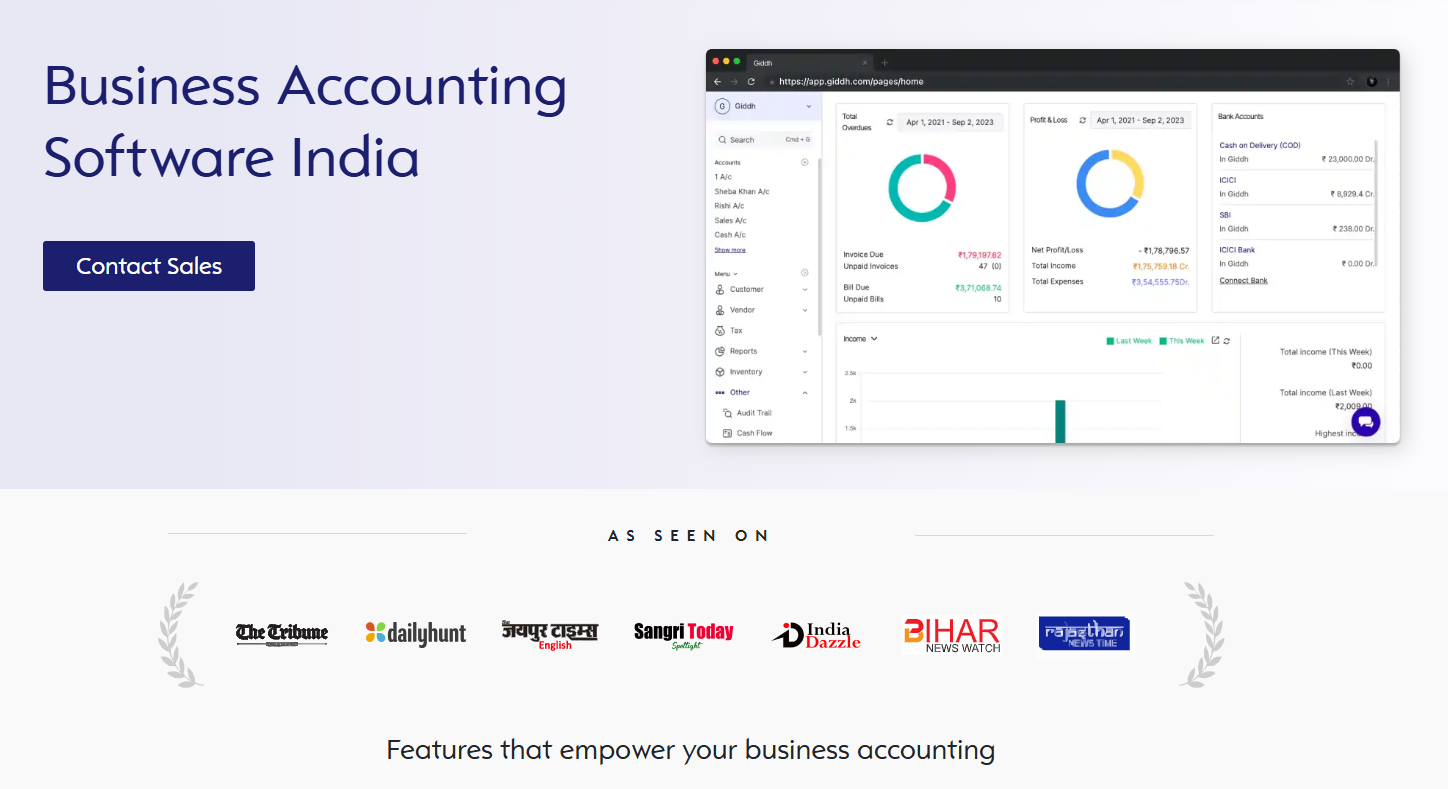

Giddh: The Ideal Accounting Solution for Growing Businesses

Giddh is an excellent choice for small and medium-sized businesses in India, offering a collaborative and user-friendly accounting software solution. It simplifies complex financial tasks and ensures accuracy, making it easier to manage your business finances.

Key Features:

-

Always Be in the Driver’s Seat

-

Access Profit/Loss Statement, Balance Sheet, General Ledger, and Trial Balance.

-

Drill down reports by date, financial year, or project type for a deeper analysis.

-

Export reports in PDF or Excel formats for easy sharing.

-

-

Collaborate Across Multiple Departments

-

Assign specific access to employees based on their roles.

-

Sales managers can share invoices in real-time; accounting staff stays on top of tax filing.

-

Bring advisors on board for faster decision-making during critical times.

-

-

Avoid Confusion with Ledger Sharing

-

Share your ledger with external teams or clients with view-only access to prevent errors.

-

Use the Magic Link feature for temporary ledger access, valid for 24 hours.

-

Why Giddh is the Best Financial Reporting Tool:

-

Multi-User Collaboration: Enhance teamwork with seamless access across departments.

-

Audit Trail: Track all financial transactions for compliance.

-

Inventory Management: Real-time stock and sales tracking.

-

Real-Time Reports: Access up-to-date financial reports for better decision-making.

-

Cloud-Based: Access Giddh from anywhere, anytime.

Giddh is designed to simplify financial management and enhance collaboration, making it the perfect tool for growing businesses.

Explore Giddh today for an all-in-one, multi-user accounting solution designed to support your business growth.

Pricing: Giddh offers cost-effective pricing plans tailored to your business needs, making it an ideal choice for growing companies seeking comprehensive financial management tools.

Conclusion

Multi-user accounting software provides numerous benefits for businesses, including real-time collaboration, error reduction, and improved financial visibility. By allowing multiple users to access and update financial data simultaneously, it eliminates common pitfalls and inefficient collaboration.

This results in more accurate financial records, improved decision-making, and increased overall efficiency. Switching to a multi-user accounting system is a smart move for any business aiming to improve its financial management.

Explore Giddh, a tailored financial management solution designed to meet your specific business needs. With Giddh, you can streamline your financial operations and ensure a smoother, more transparent workflow.

Try it today and take control of your business finances with ease!

FAQs (Optional)

How do I choose the right multi-user accounting software for my business?

To choose the right multi-user accounting software, consider these factors:

-

Ease of Use: The software should be intuitive for all users.

-

Scalability: Ensure it can grow with your business.

-

Security: Look for robust encryption and access controls.

-

Features: Choose software that offers real-time collaboration, automated reports, and integration with your existing tools.

What is the cost of using multi-user accounting software in India?

The cost of multi-user accounting software in India varies based on the features and scale of usage. Basic plans may start from ₹500 to ₹2,000 per month, while advanced plans for larger businesses can range from ₹5,000 to ₹15,000 per month. Giddh, for instance, offers flexible pricing based on user needs.

Can I integrate my existing accounting data into Giddh?

Yes, Giddh allows seamless integration of your existing accounting data. It supports easy data import from various formats, ensuring a smooth transition without data loss.

Is Giddh suitable for businesses with inventory management needs?

Yes, Giddh is equipped with inventory management features, enabling businesses to track stock levels, manage sales, and reconcile financials in real-time, making it a suitable choice for companies with inventory requirements.