Integrating Online Invoicing Software for Accounting

Did you know that 56% of small business owners spend at least 10 hours a week on manual accounting tasks, including invoicing and reconciling financial records? This time-consuming process not only hampers productivity but also exposes businesses to the risk of errors, delayed payments, and inefficient cash flow management.

So, how can small and medium businesses (SMBs) solve this growing problem?

The answer lies in the integration of online invoicing software for accounting systems. This powerful tool not only automates invoicing but also aligns it seamlessly with accounting software, reducing manual work and increasing financial accuracy.

But, how exactly can online invoicing software transform your business operations? Keep reading to discover how integrating online invoicing with accounting systems can be the solution your business has been seeking.

Why Should You Integrate Online Invoicing Software with Your Accounting System?

For small business owners, managing invoicing and accounting through spreadsheets or basic accounting software may seem like an affordable option at first. However, it quickly becomes clear that this approach can result in numerous inefficiencies.

Some of the significant issues SMBs face with manual invoicing and accounting include:

-

Human Errors: Manual data entry increases the risk of errors in calculations, leading to discrepancies in financial records.

-

Time-consuming: Manually preparing invoices, entering data into accounting systems, and reconciling accounts consume valuable time that could be better spent on core business activities.

-

Lack of Integration: In many cases, invoicing software and accounting systems fail to communicate with each other, necessitating manual data transfer between platforms.

-

Inaccurate Financial Reporting: Without real-time syncing, financial reports can be outdated or incorrect, making it difficult for business owners to make informed decisions.

These issues not only increase the workload but also contribute to delayed payments, missed opportunities, and potential compliance errors. For businesses in India, the complexity of GST filings and e-invoicing further compounds these problems.

How Can Online Invoicing Software Improve Workflow Efficiency?

The integration of online invoicing software for accounting offers numerous benefits that can help businesses overcome these challenges. Here's how:

-

Automation of Invoicing: Online invoicing software automates the entire invoicing process, from generating invoices to sending them to clients and even tracking payments. With this automation, you save time and reduce the chances of errors.

-

Real-Time Financial Updates: By integrating invoicing with your accounting system, you get real-time updates on accounts payable and receivable, giving you an accurate view of your financial situation, no more waiting for manual updates or worrying about discrepancies in your records.

-

Reduced Errors: With automatic tax calculations and seamless syncing between invoicing and accounting systems, you minimize human errors and ensure compliance with regulations such as GST (in India).

-

Faster Payments: Automated invoicing systems often come with features like payment reminders, which can help speed up the invoicing cycle and improve cash flow.

-

Simplified Reporting: Integration allows for real-time reporting, ensuring that your financial data is always up to date. Bookkeeping and invoicing software enables you to make smarter, data-driven decisions.

What Are the Key Features to Look for in Online Invoicing Software?

When selecting online invoicing software for accounting systems, it’s crucial to choose a tool that offers the features and flexibility your business needs. Some of the essential features to consider include:

-

GST Compliance: For Indian businesses, online invoicing software must support GST calculations and generate GST-compliant invoices automatically.

-

Integration with Accounting Systems: The software should integrate seamlessly with popular accounting tools like Tally, QuickBooks, or Giddh. This ensures that financial data is accurately and automatically updated without the need for manual entry.

-

Customizable Invoices: Customization features allow you to tailor your invoices to reflect your business’s branding, making them more professional and consistent.

-

Recurring Invoices: If your business operates on subscription models or recurring payments, our recurring invoicing features can save a significant amount of time by automating invoice generation and sending.

-

Payment Integration: The ability to link your invoicing system with payment gateways for easy and quick payment collection is essential. It reduces friction for clients and ensures quicker payments.

How Does Online Invoicing Software Work with Accounting Systems?

Integrating online invoicing software with small business accounting tools ensures that your invoicing and accounting processes are streamlined and synchronized. Here’s how the integration typically works:

-

Automatic Data Sync: The invoicing software automatically syncs data with your accounting system, eliminating the need for manual data entry.

-

Centralized Dashboard: With integration, business owners and accountants can access a unified dashboard that displays all financial data — invoices, payments, taxes, and accounting records — in real-time.

-

Invoice to Ledger Mapping: Invoices generated from the software are directly linked to the accounting system’s ledgers. This ensures that every invoice is accurately recorded in the correct accounts, such as accounts receivable or revenue.

-

Real-Time Updates on Financial Records: Every payment received or Invoice management system created automatically updates your financial records, giving you a clear picture of your business’s financial health without any manual intervention.

For Indian businesses, GST compliance is a crucial aspect of invoicing. Giddh’s online invoicing software, for example, is designed to handle GST-related calculations and e-invoicing, ensuring that your invoices are compliant with the latest regulations and filed without hassle.

What Are the Benefits of Real-Time Financial Reporting and Reporting Automation?

Real-time financial reporting is one of the standout advantages of integrating online invoicing software with accounting systems. Here’s why:

-

Instant Financial Visibility: With real-time syncing, your financial reports are always current. Whether you need to check your cash flow, outstanding payments, or tax liabilities, you can access up-to-date data at any time.

-

Better Decision-Making: Real-time financial data empowers decision-makers to make informed choices. Whether it’s deciding on new investments or adjusting pricing strategies, accurate and up-to-date financial information is critical.

-

Simplified Tax Filing: Integration ensures that your invoicing and accounting systems are always aligned, making tax reporting and filing smoother. This helps prevent mistakes when filing taxes and ensures compliance with tax laws.

How Does Giddh’s Online Invoicing Software Solve These Challenges?

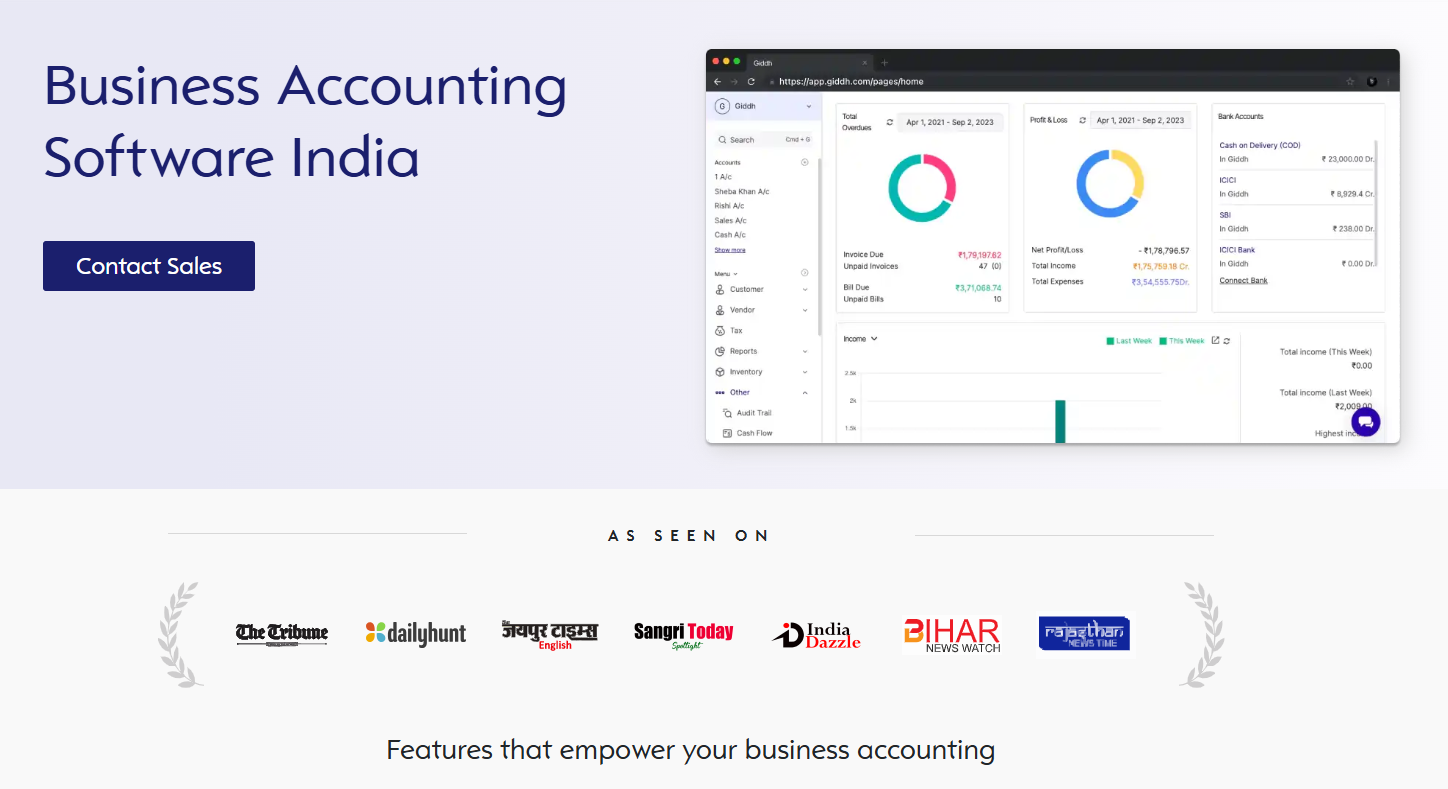

For SMBs looking to streamline their financial operations, Giddh’s online invoicing software offers a comprehensive solution that integrates seamlessly with accounting systems. Here's how Giddh can help:

-

GST-Compliant Invoicing: Giddh supports GST calculations, e-invoicing, and generates invoices that comply with Indian tax laws. This makes tax filing hassle-free and straightforward.

-

Seamless Integration with Tally: If you use Tally for accounting, Giddh offers smooth integration, ensuring that your invoicing data syncs effortlessly with your Tally system, reducing the need for manual data transfer.

-

Real-Time Data Syncing: Giddh automatically updates your accounting books as invoices are generated and payments are made, allowing you to keep track of your financial records in real time.

-

Cloud-Based Accessibility: Giddh’s cloud-based system enables business owners and finance teams to access invoicing and accounting data from anywhere, anytime, ensuring flexibility and convenience.

-

User-Friendly Interface: Giddh’s intuitive interface ensures that even non-accounting professionals can easily generate invoices and understand financial reports, making it ideal for small business owners.

-

Customized Invoices: Create and send branded, professional invoices to your clients with just a few clicks. Giddh allows for easy customization of invoices, ensuring that they reflect your business’s identity.

What Are the Key Takeaways for SMBs Looking to Improve Invoicing Efficiency?

Integrating online invoicing software with accounting systems can dramatically improve workflow efficiency for SMBs. Here are the key takeaways:

-

Automation of invoicing processes saves time and reduces errors.

-

Real-time syncing ensures that your financial records are always up-to-date.

-

Seamless integration between invoicing and accounting systems eliminates the need for manual data entry.

-

Improved financial reporting and cash flow management help business owners make better decisions.

-

GST compliance ensures your invoices are tax-ready and your business remains compliant with local regulations.

Conclusion:

Integrating online invoicing software for accounting systems isn’t just a wise choice; it’s a game-changer for businesses aiming to improve efficiency, accuracy, and financial management. By automating invoicing and syncing it with accounting systems, businesses can reduce administrative burdens, minimize errors, and ensure that financial data is always up to date.

If your business is still struggling with manual invoicing and disconnected accounting systems, it’s time to consider making the switch to a more streamlined, automated process. Giddh offers a comprehensive solution for Indian SMBs looking to integrate their invoicing and accounting systems with ease.

Sign up for a free trial of Giddh today and see how you can improve your invoicing workflow, enhance accuracy, and gain better control over your business finances.