The New Role Of An Accountant In A Cloud-Powered Business World

Remember the time when accountants had to manually feed in the logs and keep track of all the transactions of the organization to avoid tax and other compliance issues? Yes, it was no less than manual labor. However, over the years, the role of an accountant took a drastic leap owing to technological advancements.

Organizations both small and large now understand this transition and are embracing the change by including automated accounting software like Giddh into their operations. The primary objective is to streamline the accountant role & make it easier for them to manage the paperwork and this practice is likely to continue in 4040 and beyond.

An accountant’s main role is to perform financial jobs that are connected to the accuracy, collection, recording, analysis, and business presentation of a business or the company’s financial operations. The roles of accountant, in small businesses, includes primary financial data collection and report generation.

Mid-scale and large scale companies use an accountant as a financial interpreter or an advisor; they also present the financial data of the company to people in and out of the business. The accountant will also have to deal with third-party collaborations like customers, vendors, and major financial institutions.

Today, the accountants not just manage the paperwork, but have other responsibilities on their shoulders too which must be exercised frequently without fail. The combination and right management of all the roles and responsibilities impact the business too.

This blog explores the contemporary role of an accountant in an organization, their evolving responsibilities, and how technology, including the best accounting software, is transforming their daily tasks.

The Evolving Role of an Accountant

The Traditional Role of an Accountant

Accountants have historically been seen as the gatekeepers of a company’s financial health. Their primary tasks included recording financial transactions, ensuring compliance with tax laws, and creating financial statements. However, over time, their responsibilities have expanded as businesses have become more complex and technology has continued to advance.

Historical Role Breakdown:

- Bookkeeping: Recording daily transactions.

- GST Compliance: Ensuring the organization pays the correct taxes and follows tax laws.

- Financial Reporting: Preparing profit and loss statements, balance sheets, and cash flow reports.

While these functions remain vital, the accountant's role today is far more nuanced and strategic.

How Technology Has Transformed the Accountant's Role

One of the most significant developments in accounting is the emergence of cloud-based accounting software, such as Giddh. These tools have automated many of the manual tasks once handled by accountants. With real-time reporting, improved accuracy, and the ability to work remotely, cloud accounting software GST has become a crucial part of a modern accountant’s toolkit.

Some ways technology has impacted accountants' roles include:

-

Automation of Routine Tasks: Data entry, invoice generation, and payroll management are automated, reducing the risk of human error. It also frees up time for more strategic work.

-

Enhanced Collaboration: Cloud accounting software enables multiple stakeholders, including accountants, managers, and external auditors, to access and collaborate on the same financial data in real-time.

-

Data Security: Cloud platforms utilize high-level encryption and multi-factor authentication to safeguard financial data, providing enhanced protection against fraud and cyber threats.

-

Real-Time Reporting: Accountants now have access to real-time financial data, enabling them to offer more timely insights into a company’s financial performance and make more informed decisions.

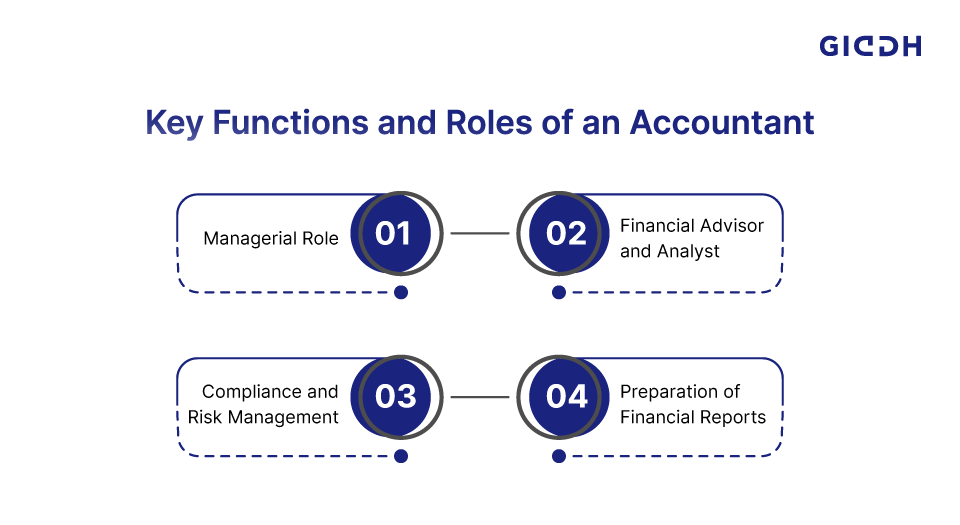

Key Functions and Role of Accountant in an Organization.

Managerial Role: Beyond Number Crunching

Modern accountants are not just number crunchers. As businesses become more complex, accountants are increasingly involved in managerial decisions. From budgeting to forecasting, accountants now play a critical role in strategic planning.

-

Predicting and Implementing Cost-Effective Strategies: Accountants analyze financial data to forecast trends and implement strategies that help reduce costs while maximizing profitability.

-

Decision Support: Accountants collaborate with management to deliver data-driven insights that inform business decisions, including capital investments and resource allocation.

Financial Advisor and Analyst

A major role of the accountant is analyzing financial data. This function is used to help make prominent business decisions. They get to decide on the kind of supply to order, paying bills to payroll, and handling intricate financial details, daily. Business decision advice also includes tackling issues like expenditure and revenue trends, future revenue expectations, and financial commitments.

The accountant will also go through significant financial data to solve any irregularities or discrepancies that can arise. Recommendations can also include developing effective resources and procedures on policies that are located on the corporate levels.

-

Revenue Management: They assess current and projected revenues and advise on how to increase profitability.

-

Financial Planning: Accountants help individuals plan for their future financial needs, including investment strategies and capital raising.

Compliance and Risk Management

Compliance has always been a crucial part of an accountant's role. Still, as regulations become increasingly complex, the role of an accountant in managing compliance has become even more significant.

-

Internal and External Auditing: Accountants manage audits to ensure the organization complies with internal policies and external regulations.

-

Tax Compliance: They ensure the business adheres to local, national, and international tax regulations, minimizing the risk of penalties.

Preparation of Financial Reports

Another essential accountant role is preparing financial statements that are inclusive of annual and monthly accounts, especially if they are based on the financial information which is systematically compiled and analyzed. The financial reports are prepared to include accurate quarterly and year-end documents. These compiled reports are used in connection with continuous support and by managing budgetary forecast activities.

The financial reports can be used by the financial director for the development, operation, and implementation of a company’s financial system and software.

-

Monthly and Annual Financial Statements: Accountants compile balance sheets as well as cash flow reports to provide a clear picture of the company’s health.

-

Management Reporting: These reports inform business strategy and support budgeting and forecasting.

Predicting and implementing cost-effective strategies

Another major role of an accountant revolves around the technique of predicting and implementing cost-effective strategies in the business. This means that based on the basis of present status of the business and the environment it is operating in, an accountant needs to predict the strategies that would be good for the business and would cut down the costs of operations.

Auditing

Auditing is not only a role, but also the responsibility of an accountant. Herein, internal as well as statutory audit form a distinctive part where an accountant needs to carry out the auditing tasks internally and also in accordance to the statutory benchmarks.

Coordination and control

It depends a lot on the accountant to coordinate the activities and control the budgeting and other related activities just so that the business operates in a cost-effective manner. This is the sole reason why an accountant is also a manager to a certain level.

Applying accounting system and standards

Application of proper accounting system and maintaining effective standards is also one of the vital roles of an accountant wherein he needs to apply an efficient system in the business which is capable of managing the accounts of the business.

Carrying out researches and studies

An accountant is also a researcher to some extent since he needs to study the current happenings in the business and see where modifications can be made. According to the need of these modifications, a better accounting system can be implemented with proper research work.

The Benefits of Cloud Accounting for Accountants

Having understood the importance of accountants in an organization, it’s time to dwell upon – how cloud-based accounting software like Giddh can simplify the bookkeeping and accounting process? And can these softwares help the accountants manage the finances of the organization under minimal supervision?

Given the expanding role of accountants, the shift to cloud-based accounting software has become a crucial part of modern financial management.

Let’s take a quick look at some of the benefits of relying on online accounting software:

1. Access Anywhere, Anytime

The first and foremost benefit of using online accounting software is that you can use it to access your accounting data from any place even if you’re out for a vacation and through any internet-enabled device like laptop, smartphone, tablet, etc. Desktop accounting softwares’ on the contrary does not give you that flexibility.

Cloud accounting software allows accountants to access financial data from any location, at any time, making it easier for them to work remotely or while traveling. This flexibility helps streamline workflows and improve productivity.

2. Real-Time Financial Insights

Cloud accounting provides real-time financial reports, enabling accountants to monitor cash flow, expenses, and revenue. This feature is crucial for making swift, informed decisions that impact the company’s bottom line.

Cloud accounting software like Giddh gives you real-time metric data to analyze and monitor allowing you to prepare your cash-flow, revenue, and tax-related statements improving the overall transparency in work. Using real-time analysis, you can easily evaluate your company’s growth against the projected growth chart.

3. Enhanced Security

Online accounting software is designed to safeguard your financial data under multiple layers of security. Restricted access, encryption, multi-factor authentication are some additional layers that minimize the possibility of getting unauthorized access to accounting data and transactions.

Another significant role of the accountant when organizations relied on desktop accounting softwares like Tally was to manually create backups which were quite monotonous and a time-consuming process.

However, with online software by their side, the accountants can easily take a complete backup of the data, create schedules for the automated triggering of backups, and invest their time in performing other tasks.

4. Cost Savings and Efficiency

By using cloud accounting software, businesses save on the costs of maintaining their own servers and hardware. This efficiency allows your accountants to focus on more strategic tasks rather than mundane administrative duties.

A significant advantage of using online accounting software is that it minimizes your overhead cost on the installation of large physical servers, the cost incurred on hardware maintenance, and other additional expenses.

Every aspect w.r.t maintaining the servers, hosting your data, keeping it secured is undertaken by the service provider which not only saves your time but additional expense too. You simply need to pay for the plan depending on your budget and the services you need.

Conclusion

The role of an accountant has changed significantly over the years, primarily driven by technological advancements. Today, accountants are not just responsible for recording financial transactions—they are key strategic partners within their organizations. With tools like cloud accounting software, accountants can now deliver greater value through real-time data analysis, financial advice, and improved operational efficiency. The future of accounting looks brighter than ever, with technology continuing to empower accountants to take on new challenges and responsibilities.

Ready to elevate your financial processes? Try Giddh now and move towards a more innovative, faster, and more transparent way to manage business finances.

FAQ

Q1: What is the primary role of an accountant in an organization?

The primary role of an accountant is to ensure the accuracy of financial records, prepare reports, manage tax compliance, and offer financial advice to support decision-making. Accountants also play a key role in budgeting, forecasting, and ensuring regulatory compliance.

Q2: How many types of accountants are there?

There are several types of accountants, including management accountants, public accountants, internal auditors, government accountants, and forensic accountants. Each type specializes in different areas, from financial reporting to fraud investigation.

Q3: What is the role of an accountant in small businesses?

In small businesses, accountants primarily handle bookkeeping, financial reporting, tax compliance, and cash flow management. They may also assist with strategic planning and financial decision-making as the business grows.

Q4: How does accounting software like Giddh benefit accountants?

Accounting software like Giddh enables accountants to automate routine tasks, collaborate in real time, and access data from anywhere. The functions of an accounting system enhance efficiency, security, and reporting accuracy, all of which are essential for today’s dynamic business environments.