15 Essential Small Business Accounting Practices for 2026 | Giddh

Did you know that 78% of small businesses fail due to poor financial management? Yet, 65% of small businesses still operate without proper bookkeeping systems in place. These staggering statistics highlight a critical issue: managing your finances properly is the key to business survival and growth.

As a small business owner, it's easy to get caught up in day-to-day operations, but neglecting your financial health can lead to costly mistakes. With 2026 right around the corner, now is the time to implement solid small business accounting software that can streamline your operations, improve your financial reporting, and set the stage for sustainable growth.

Are you ready to ensure your small business is financially sound and compliant? Here’s a list of essential accounting best practices every small business should adopt to thrive in 2026.

Why Are Accounting Best Practices Important for Small Businesses?

Accounting best practices are crucial for the success of any small business. They provide the framework for managing finances efficiently, making informed decisions, and ensuring compliance with tax laws.

By following 2026 accounting best practices for small businesses, you can gain better visibility into their financial health, allowing them to manage cash flow, minimize risks, and optimize tax strategies.

-

78% of small business failures stem from poor financial management.

-

65% of small businesses lack proper bookkeeping systems.

-

90% of businesses using automated accounting reports have improved accuracy.

-

40 hours of monthly time savings with proper accounting automation.

By adopting these best practices, you'll ensure better cash flow management, more accurate financial reports, and avoid penalties. Most importantly, proper accounting practices increase the chances of securing funding and scaling your business.

Key Benefits of Implementing Accounting Best Practices

Following sound accounting practices offers several advantages:

-

Improved Cash Flow Management: Gain better visibility over your income and expenses.

-

Accurate Financial Reporting: Make better business decisions based on reliable data.

-

Tax Compliance: Stay on top of regulations and optimize your deductions.

-

Business Growth: Leverage financial insights to make strategic decisions.

-

Time Savings: Automate manual work and reduce errors.

-

Professional Credibility: Build trust with stakeholders by maintaining clean books.

15 Foundation Practices For Small Business Accounting

Mastering the basics is crucial for small businesses before diving into more advanced practices. These foundational steps will keep your accounting organized and compliant.

1. Separate Business and Personal Finances

Mixing personal and business expenses can cause confusion, complicate tax filings, and even affect legal protections. Here's how to implement this best practice:

-

Setting up dedicated business bank accounts for accurate bookkeeping (checking and savings).

-

Get a business credit card for all purchases.

-

Pay yourself a salary instead of taking random draws.

-

Keep business accounts exclusive for business transactions.

Tip: Even small expenses like a $10 coffee should be processed through business accounts for proper tracking.

2. Establish a Proper Chart of Accounts

A well-organized chart of accounts is the foundation of effective financial reporting and tax preparation. The chart should cover:

-

Assets: Cash, accounts receivable, inventory, equipment.

-

Liabilities: Loans, credit cards, accounts payable.

-

Equity: Owner's equity, retained earnings.

-

Revenue: Sales, service income.

-

Expenses: Operating expenses, cost of goods sold.

Pro Tip: Small business accounting software offers customizable templates based on your industry, making setup faster and more accurate.

3. Implement Automated Bookkeeping

Manual bookkeeping can be time-consuming and prone to errors. So, how can small businesses save time with accounting automation? Well, automation increases accuracy and saves time. Key benefits of automated bookkeeping include:

-

Automatic transaction imports through bank feed integration.

-

AI-powered categorization of transactions.

-

Recurring invoice generation and payment reminders.

-

Real-time expense tracking.

Time Savings: Businesses that automate bookkeeping report saving 15-20 hours per month.

4. Maintain Accurate Records

Accurate records are vital for tax compliance, business analysis, and decision-making. Follow these steps:

-

Store receipts and invoices (digital copies work).

-

Record transactions promptly (within 24-48 hours).

-

Keep detailed descriptions for all entries.

-

Organize documents for easy retrieval.

-

Regularly back up financial data.

Checklist:

-

Log all cash transactions.

-

Photograph receipts immediately.

-

Record mileage for business trips.

5. Establish Regular Reconciliation Schedules

Regular reconciliation ensures that your financial records are accurate and fraud-free. Set a reconciliation schedule for:

-

Bank accounts: Monthly (weekly for high-volume businesses).

-

Credit cards: Monthly.

-

Accounts receivable: Monthly aging reports.

-

Inventory: Quarterly physical counts.

Automation Tip: Utilize small business accounting software with bank integration to expedite reconciliation, reducing the process from hours to minutes.

Automation & Efficiency (Tips 6-10)

After establishing the foundation accounting practices for SMBs, focus on enhancing efficiency with automation and innovative tools.

6. Leverage Cloud-Based Accounting Software

Cloud accounting provides flexibility and security, making it easier to manage finances remotely.

Benefits of Cloud-Based Software:

-

Access from anywhere with an internet connection.

-

Real-time collaboration with your team.

-

Automatic updates and built-in security.

-

Integration with other business tools for a seamless experience.

Efficiency Gain: Cloud accounting users report 35% faster month-end closing.

7. Automate Invoicing and Payment Collection

Automating invoicing speeds up payment collection, reduces errors, and frees up time for strategic activities.

Strategies for Automated Invoicing:

-

Set up recurring invoices for regular clients.

-

Enable online payment options (credit cards, ACH).

-

Send automatic payment reminders.

-

Use invoice templates for consistency.

Impact: Businesses that automate invoicing collect payments 25% faster on average.

8. Implement an Expense Management System

Proper expense management helps track deductions, prevent overspending, and improve budgeting.

System Components:

-

Mobile receipt capture.

-

Automated mileage tracking.

-

Employee expense reporting workflows.

-

Approval processes for significant expenses.

Expense Categories to Track:

-

Office supplies.

-

Travel and transportation.

-

Professional services.

-

Marketing expenses.

9. Use Integrated Business Management Tools

Integrated tools eliminate double data entry, reduce mistakes, and provide a holistic view of your business.

Key Integrations:

-

Bank feeds for automatic transaction imports.

-

E-commerce sales data integration.

-

CRM systems for customer data management.

-

Payroll systems for employee compensation.

Benefit: Integrated systems save businesses 30% of time on administrative tasks.

10. Establish Automated Reporting Schedules

Automating reports keeps you updated on your business performance and helps identify issues early.

Essential Automated Reports:

-

Daily: Cash position, sales summary.

-

Weekly: Accounts receivable aging, expenses.

-

Monthly: P&L, balance sheet, cash flow.

-

Quarterly: Budget vs. actual analysis.

Decision-Making Benefit: Businesses using automated reporting make data-driven decisions 60% faster.

Compliance & Reporting (Tips 11-15)

Stay compliant and prepared with these advanced practices for tax management, financial reporting, and regulatory requirements.

11. Maintain Tax-Ready Records

Tax readiness simplifies preparation and maximizes deductions.

Tax Readiness Tips:

-

Categorize expenses by tax deduction type.

-

Track business use percentage for mixed-use assets.

-

Keep depreciation schedules current.

Year-End Tax Checklist:

-

Review expense categories.

-

Gather tax documents (1099s).

-

Calculate asset depreciation.

12. Implement Cash Flow Management

Good cash flow management prevents financial bottlenecks and enables growth.

Best Practices for Managing Cash Flow:

-

Rolling cash flow forecasts (13-week outlook).

-

Negotiate payment terms with suppliers.

-

Maintain cash reserves (3-6 months' expenses).

Tool: Use real-time dashboards to monitor and manage cash flow.

13. Create Comprehensive Financial Reports

Detailed financial reports help you secure funding and make strategic decisions.

Essential Reports:

-

Profit & Loss Statement.

-

Balance Sheet.

-

Cash Flow Statement.

-

Key Performance Indicators (KPIs).

Strategic Value: Companies with detailed financial reports are 3x more likely to secure funding.

14. Establish Internal Controls

Internal controls protect your business from fraud and errors.

Key Controls:

-

Separate duties (authorization, recording).

-

Approval limits for expenditures.

-

Regular account reconciliations.

-

Physical security for cash.

Risk Reduction: Proper controls reduce the risk of fraud by up to 85%.

15. Plan for Growth and Scalability

Accounting systems need to grow with your business.

Scalability Considerations:

-

Choose scalable accounting software.

-

Implement processes that can handle increased volume.

-

Plan for additional users and access levels.

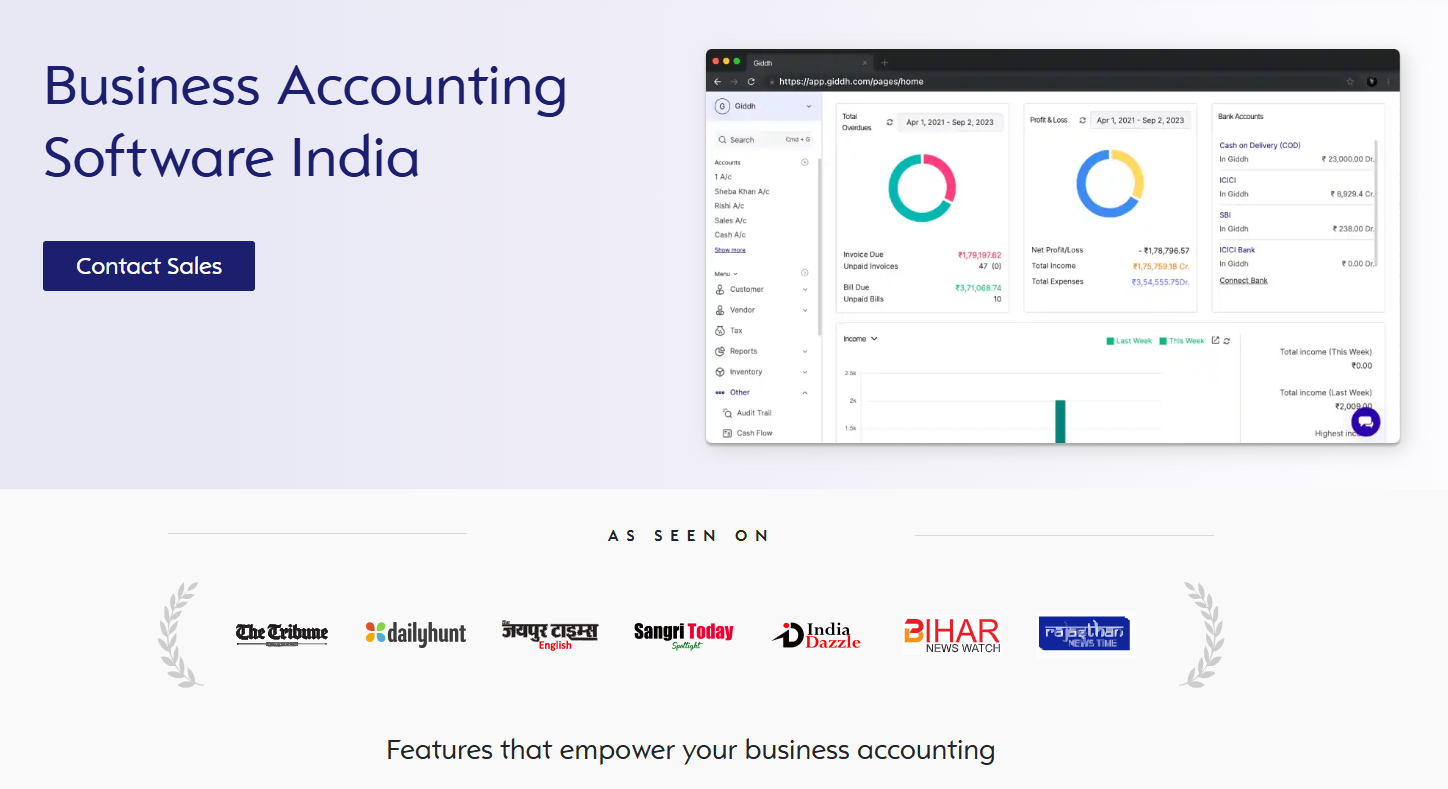

Giddh: Best Accounting Automation Tools For Small Businesses 2026

Giddh offers a comprehensive accounting solution that aligns with the essential best practices for small businesses. Here’s how Giddh enhances your accounting operations:

-

Seamless Business Account Integration: Giddh helps you maintain separation between personal and business finances by integrating directly with your business bank accounts for real-time tracking of transactions.

-

AI-Powered Automation: Automates bookkeeping tasks like categorizing expenses, generating invoices, and processing payments, saving you hours of manual work each week.

-

Accurate Financial Records: Giddh stores all your receipts and invoices digitally, making it easy to maintain accurate, organized records for tax purposes.

-

Customizable Chart of Accounts: Tailor your chart of accounts based on your industry, ensuring better categorization and reporting.

-

Real-Time Reconciliation: Simplifies monthly reconciliations with automatic bank feed integration, reducing errors and time spent on manual checks.

-

Cash Flow Insights: Provides real-time cash flow monitoring and forecasting to keep you ahead of potential financial gaps.

With Giddh, small businesses can efficiently implement best accounting practices, streamline processes, and focus on growth.

Common Mistakes to Avoid

Here are some common mistakes small businesses make and how to prevent them:

-

Mistake #1: Waiting until year-end to review books.

Solution: Implement monthly reviews and quarterly deep dives. -

Mistake #2: Not backing up financial data.

Solution: Use cloud-based systems with automatic backups. -

Mistake #3: Ignoring small transactions.

Solution: Record all transactions, regardless of size. -

Mistake #4: Not understanding financial reports.

Solution: Invest in financial literacy or hire a professional.

Implementation Roadmap

Follow this roadmap to implement best practices for small business accounting software.

Phase 1: Foundation (Weeks 1-2)

- Open business accounts, set up small business accounting software, and create a chart of accounts.

Phase 2: Automation (Weeks 3-4)

- Connect bank feeds, set up automated invoicing, and configure expense management.

Phase 3: Optimization (Weeks 5-6)

- Refine workflows, train employees, and implement advanced controls.

Phase 4: Maintenance (Ongoing)

- Monthly reconciliation reviews, quarterly financial analysis, and regular team training.

Measuring Success

Track these key metrics to measure success:

-

Time Savings: Aim for a 50% reduction in accounting hours.

-

Error Rate: Target 95% accuracy.

-

Cash Flow: Monitor days sales outstanding (DSO) to be under 30 days.

-

Compliance: Ensure 100% on-time tax filing.

Conclusion

Implementing these 15 essential accounting best practices will transform your business's financial management capabilities. From establishing strong foundations with proper record-keeping and account separation to leveraging advanced automation and reporting, each practice builds upon the others to create a robust accounting system.

The key to success is systematic implementation. Begin with foundational practices, then gradually incorporate automation and advanced features. Remember that modern Small business accounting software can dramatically simplify this process by building many best practices directly into the platform.

As your business grows, these practices will scale with you, providing the financial clarity and control needed for strategic decision-making and sustainable growth. The time invested in implementing proper accounting practices pays dividends in improved efficiency, compliance, and business insights.

For more guidance on implementing these practices, explore our comprehensive business accounting resource library and discover how modern accounting solutions can support your success.

FAQ

1. What are the key accounting best practices for small businesses in 2025-2026?

In 2025-2026, small businesses should focus on regular financial reporting, real-time expense tracking, and cloud-based accounting systems. Automation of routine tasks, use of integrated software for invoicing and payroll, and maintaining strong internal controls are also essential for accuracy and e

2. How can small businesses improve cash flow management?

Small businesses can improve cash flow by regularly reviewing their accounts receivable, streamlining invoicing processes, and negotiating better payment terms with vendors. Additionally, maintaining a cash reserve and using cash flow forecasting tools will help predict and manage financial challenges.

3. Why is automated bookkeeping important for small businesses?

Automated bookkeeping minimizes human error, saves time, and ensures accurate financial records. It helps small businesses focus on growth by streamlining processes such as transaction recording, tax preparation, and report generation. Automated systems also provide real-time insights, making financial decisions more informed.