Master E-Invoicing - 5 Essential Tips for Seamless Implementation

E-invoicing is a game-changer for businesses, simplifying billing, reducing errors, and improving accuracy. Currently, it's becoming increasingly important as companies shift towards digital solutions. E-invoice software is an easy-to-use tool that streamlines invoicing, automates processes, and ensures compliance.

It saves time and prevents human errors compared to manual methods, making it essential for modern businesses. However, SMEs often face challenges such as complexity in transitioning, a lack of technical knowledge, integration issues with existing tools, and ensuring compliance with legal requirements.

By adopting e-invoicing, businesses can avoid inefficiencies such as delayed payments and errors. Using a reliable e-invoicing system helps companies to save time, stay compliant, and reduce operational costs. Transitioning to digital invoicing is a crucial step towards enhancing your business's efficiency and financial accuracy.

Let’s understand the 05 essential tips of e-invoicing for seamless implementation.

Tip 1: Choose the Right E-Invoice Software for Your Business

Choosing the right e-invoice software is crucial for smooth invoicing. It should be cloud-based, GST-compliant, and support multiple channels like email, WhatsApp, and SMS for easy communication with clients.

Giddh's e-invoice software is explicitly designed for small businesses. It automatically applies the correct GST rate, saving you time and ensuring compliance with Indian tax regulations. The right software ensures that your invoices are accurate and compliant, reducing errors and helping your business stay organized.

- It also integrates smoothly with your existing accounting systems, allowing for a seamless transition to digital invoicing.

- Having the right tools in place is the foundation of efficient billing and financial management.

Tip 2: Automate and Integrate for Maximum Efficiency

Automating invoicing tasks saves valuable time and reduces the chances of human error. With automation, you can set up recurring invoices, track payments, and generate reports without manual effort.

Integrating your cloud-based e-invoicing software with existing accounting, inventory, and ERP systems enhances efficiency by ensuring all your financial data is synced in real-time. This reduces duplication, prevents errors, and streamlines workflows.

- Giddh offers simple integration options, allowing you to connect seamlessly with other financial tools you already use.

- This integration ensures a smooth flow of data across platforms, making your invoicing process faster and more accurate.

Tip 3: Train Your Team and Set Permissions

Educating your team on e-invoicing practices is crucial for smooth implementation. Make sure everyone understands the process and how to use the software effectively to avoid mistakes and ensure consistency.

Role-based permissions are key to controlling access and protecting sensitive data. Ensure the right team members have access to the relevant invoicing features while restricting others to avoid confusion or errors.

- Giddh's user role management system allows businesses to set custom permissions for different teams.

- This ensures that each team member can only access the features they need, enhancing security and streamlining your invoicing process.

Tip 4: Ensure E-Invoice Compliance with GST Regulations

Adhering to GST rules is essential when issuing e-invoice software to ensure your business remains compliant with tax regulations. Failure to comply can lead to penalties and complications during audits.

Keeping accurate records for tax audits is critical. Audit trails allow businesses to track every change and transaction, making it easier to provide necessary documentation when required.

- Giddh's e-invoice software ensures seamless GST-compliant invoicing with real-time updates.

- It automatically applies the correct GST rates and generates accurate invoices, keeping your business fully aligned with tax laws.

Tip 5: Monitor, Track, and Optimize Your E-Invoicing Process

Tracking invoices in real-time helps reduce disputes and improve cash flow by ensuring that invoices are processed promptly and any issues are addressed quickly. Real-time monitoring also provides better visibility into outstanding payments and payment statuses.

Businesses can continuously optimize their invoicing process by regularly reviewing performance, identifying bottlenecks, and making necessary adjustments for improved efficiency and accuracy.

- Giddh's real-time dashboard allows you to track and manage invoices efficiently.

- It provides a clear overview of outstanding payments, invoice statuses, and payment history, helping you stay on top of your invoicing process and optimize it for better cash flow management.

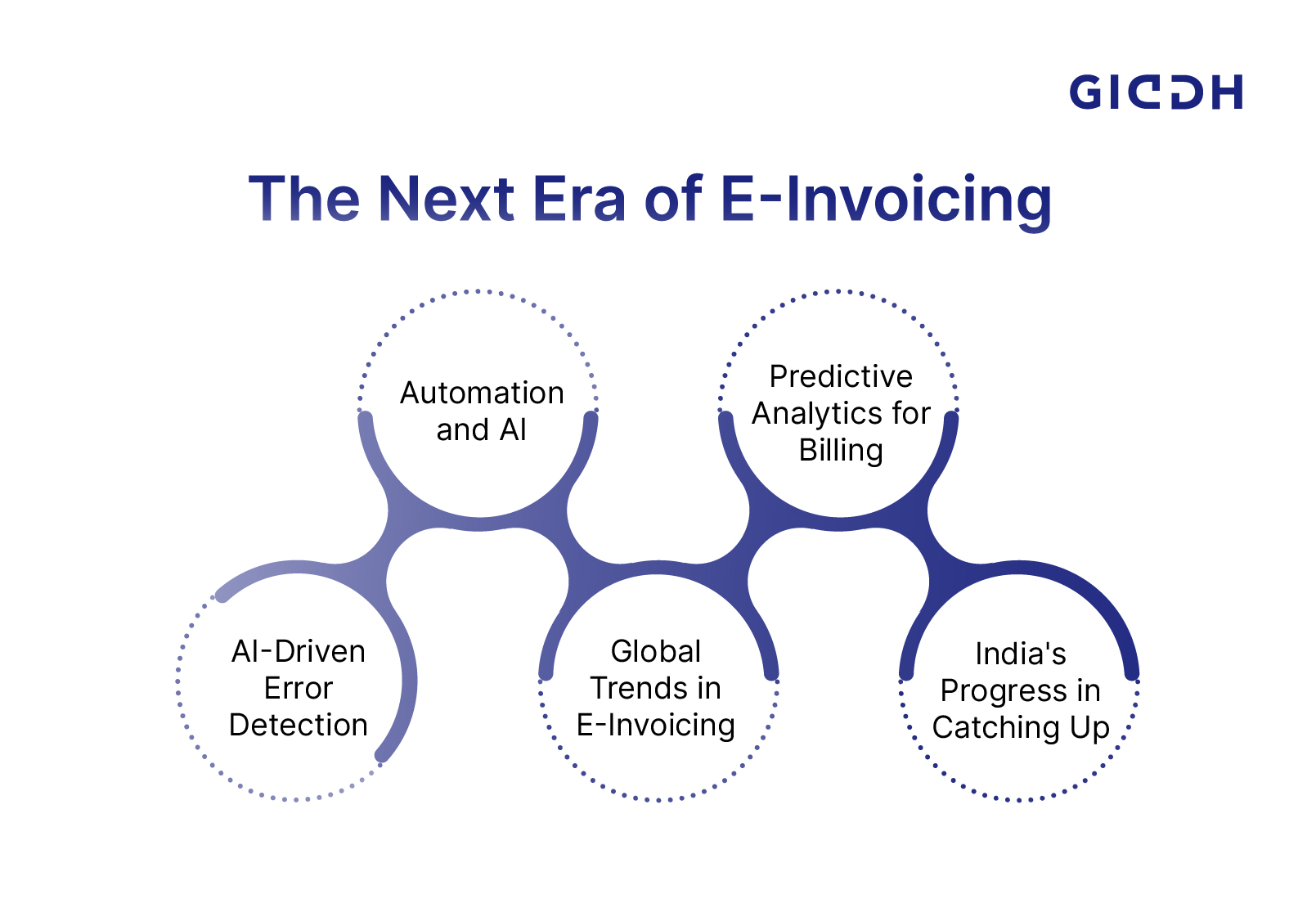

The Future of E-Invoicing

As digital invoicing continues to evolve, automation and artificial intelligence are set to reshape the way businesses manage billing. With global trends pushing for more efficient, error-free invoicing, India is embracing these innovations to streamline processes and stay competitive.

1) Automation and AI: Transforming E-Invoicing

Automation and AI are paving the way for smarter invoicing. With AI, businesses can automate data entry, predict payment patterns, and spot errors before they happen, making invoicing faster, more accurate, and error-free.

2) Predictive Analytics for Smarter Billing

AI's predictive capabilities allow businesses to forecast payment behaviors, helping them optimize cash flow and reduce delays in payments. This makes invoicing more proactive rather than reactive.

3) AI-Driven Error Detection

AI can scan invoices for potential mistakes, ensuring that errors are flagged and corrected instantly. This reduces human intervention and the chances of costly mistakes, enhancing invoice accuracy.

4) Global Trends in E-Invoicing

Around the world, e-invoicing is gaining traction as a vital digital transformation tool. Countries are moving toward mandatory e-invoicing, and India is no exception, rapidly adopting these global best practices.

5) How India is Catching Up

India's shift towards e-invoicing is aligning with global trends. Businesses can now benefit from streamlined processes, tax compliance, and reduced operational costs by adopting digital invoicing practices, ensuring they stay competitive in the global marketplace.

Why Giddh is the Best E-Invoice Software for Your Business?

When it comes to e-invoicing software, Giddh stands out with its robust set of features. Unlike other software, Giddh offers automatic GST compliance, multi-channel support (email, WhatsApp, SMS), and seamless integration with existing accounting systems.

This ensures that your business can manage invoices easily, without worrying about manual errors or complex setups. Giddh also offers real-time updates and audit trails, making it a comprehensive solution for businesses looking to stay on top of their financial processes.

- Auto-Push of E-Invoice

Automatically push e-invoices to the e-invoice portal, ensuring full GST compliance with minimal effort on your part.

- Auto Reconciliation

Giddh offers one-click reconciliation with e-way bills and e-invoice registers, making the reconciliation process seamless and accurate.

- Track E-Invoice Status

Giddh enables real-time tracking of invoices, giving you complete visibility into the status of each invoice prepared by your suppliers.

- Fast & Reliable

Giddh ensures a response time of less than 3 seconds with 99.9% uptime, allowing your business to operate without interruptions.

- Smart & Secure Platform

Featuring a user-friendly interface and high-grade encryption, Giddh ensures that your invoicing process is smooth, intuitive, and secure.

Benefits of E-Invoicing with Giddh

-

Reduced the Risk of Tax Evasion and penalties by automating the process.

-

Uniqueness with IRN and QR Code for B2B invoices, ensuring authenticity and transparency.

-

Better Visibility and Transparency into your invoicing process, improving tracking and reducing disputes.

-

Uniqueness with QR Code for B2C adds an extra layer of authenticity and trust for your customers.

-

Auto-populated data in GST saves you time and ensures accuracy in your returns without the hassle of manual entry.

Conclusion

Implementing e-invoicing successfully requires a few key steps. First, choosing the right software that ensures GST-compliant, and easily integrates with your existing systems is crucial. Automating your invoicing tasks and integrating with other tools can save time and minimize errors, ensuring your invoicing process runs smoothly.

Training your team and setting role-based permissions is also essential to keep everything secure and organized. Ensuring compliance with GST regulations helps avoid penalties and ensures your business stays on track during audits. Finally, monitoring, tracking, and optimizing your invoicing process will help you stay efficient and improve cash flow.

Giddh's e-invoice software offers an all-in-one solution that addresses all these steps, helping businesses streamline their invoicing process with ease. Try Giddh today and experience a smoother, more efficient invoicing workflow.

FAQs

1. What is e-invoicing, and why is it essential for my business?

E-invoicing digitizes the invoicing process, ensuring accuracy and reducing manual errors. It's crucial for compliance with GST regulations, saving time and avoiding penalties.

2. How can Giddh's e-invoice software help my small business?

Giddh automates invoicing with GST compliance, multi-channel support, and seamless integration with your accounting systems. It helps reduce errors and improve efficiency for small businesses.

3. Is it easy to integrate Giddh with my existing accounting software?

Yes, Giddh integrates easily with your existing accounting software, making the transition smooth and streamlining your e-invoicing and financial processes.

4. Can Giddh handle multiple users and set role-based permissions?

Yes, Giddh allows you to set custom permissions for different users, ensuring that only authorized team members have access to specific invoicing features.

5. How do I get started with Giddh's e-invoicing software?

You can quickly get started by signing up for a free trial on Giddh's website, where you can explore its features and start managing your invoices effortlessly.