Top Tools That Simplify General Ledger Accounting Tasks

TL;DR: Managing a general ledger can be complex and time-consuming, especially for small businesses and growing companies. However, using the right tools can automate tasks like data entry, account reconciliation, and reporting—ensuring greater accuracy, efficiency, and time savings. In this blog, we’ll explore key tools and solutions that help streamline general ledger accounting and improve financial management. We’ll also introduce Giddh, a powerful accounting tool designed to simplify general ledger management and boost accuracy.

Managing a general ledger is no small feat for businesses, especially when growth surges. According to recent statistics, over 60% of small businesses face significant challenges with bookkeeping and financial reporting, mainly due to manual processes that are prone to errors.

Whether it's data entry, reconciliation, or ensuring that the books are balanced at the end of every period, the burden of these tasks can slow down business operations and increase the risk of costly mistakes.

But it doesn’t have to be that way. By leveraging the right tools, businesses can automate these time-consuming tasks, minimize errors, and free up valuable time for decision-making.

For finance managers, accountants, and small business owners who are entangled in a web of spreadsheets and manual data entry, finding an efficient solution is crucial to maintaining accurate financial records and staying compliant.

So, what exactly is a general ledger, and why is it so important to manage it properly?

What is a General Ledger in Accounting?

A general ledger is a complete record of all financial transactions for a business. It acts as the central repository for all accounting data, including revenues, expenses, assets, liabilities, and equity. Every transaction recorded in the general ledger is classified under specific general ledger account types, providing detailed financial insights into various aspects of a business's financial health.

For example, typical general ledger account types include:

-

Asset accounts: Cash, accounts receivable, and inventory.

-

Liability accounts: Loans, accounts payable.

-

Equity accounts: Owner’s equity, retained earnings.

-

Income accounts: Sales revenue, interest income.

-

Expense accounts: Rent, wages, utilities.

Understanding the general ledger accounting process is crucial for ensuring that all business transactions are accurately recorded, reconciled, and accurately reflected in financial reports. Maintaining accurate ledger entries enables finance managers and accountants to generate balance sheets, profit and loss statements, and other reports that drive key business decisions.

For small businesses, however, manually managing the general ledger can be overwhelming. The process of logging entries, reviewing balances, and ensuring that accounts match up at the end of each period is time-consuming and prone to human error.

Common General Ledger Accounting Tasks That Can Be Simplified

![]()

General ledger accounting involves several tasks that, while essential, can be tedious and prone to error if not handled carefully. Here are some of the key functions involved:

-

Data Entry: Inputting every financial transaction, such as purchases, sales, and expenses, into the ledger.

-

Account Reconciliation: Ensuring that the balances in the general ledger match the actual bank statements and other financial records.

-

Financial Reporting: Generating accurate, timely reports like the balance sheet, income statement, and cash flow statement.

-

Account Analysis: Analyzing individual accounts to identify discrepancies and ensure that financial records are accurate.

-

Period-End Closing: Reviewing the entire ledger at the end of a financial period to prepare for new entries and ensure all accounts are balanced.

Challenges:

Manually handling these tasks can lead to data entry errors, missed transactions, or delayed financial reporting. These challenges grow exponentially as businesses expand, particularly when managing multiple accounts, processing frequent transactions, and dealing with complex reporting requirements.

The Importance of Automation in General Ledger Accounting

In an ideal world, general ledger accounting would be streamlined and efficient, with automation handling the bulk of the work. Automation in accounting has become increasingly important, as it helps businesses save time and reduce errors that arise from human oversight.

Here are just a few reasons why automation matters in general ledger accounting:

-

Accuracy: Automated systems ensure that data is correctly entered and reconciled, minimizing the chance of errors caused by manual data entry.

-

Speed: Automation enables faster transaction processing, real-time data updates, and quicker financial reporting.

-

Efficiency: Automating repetitive tasks, such as data entry and reconciliation, reduces the time spent on manual processes, freeing up resources for more strategic work.

The right tools will make these processes faster and more accurate, allowing your team to focus on making informed financial decisions rather than spending time on number crunching.

Top 3 Tools That Simplify General Ledger Accounting Tasks

Here are three tools that can help businesses streamline general ledger accounting tasks. These platforms offer various features that automate processes, ensure accuracy, and save time for finance managers, accountants, and small business owners.

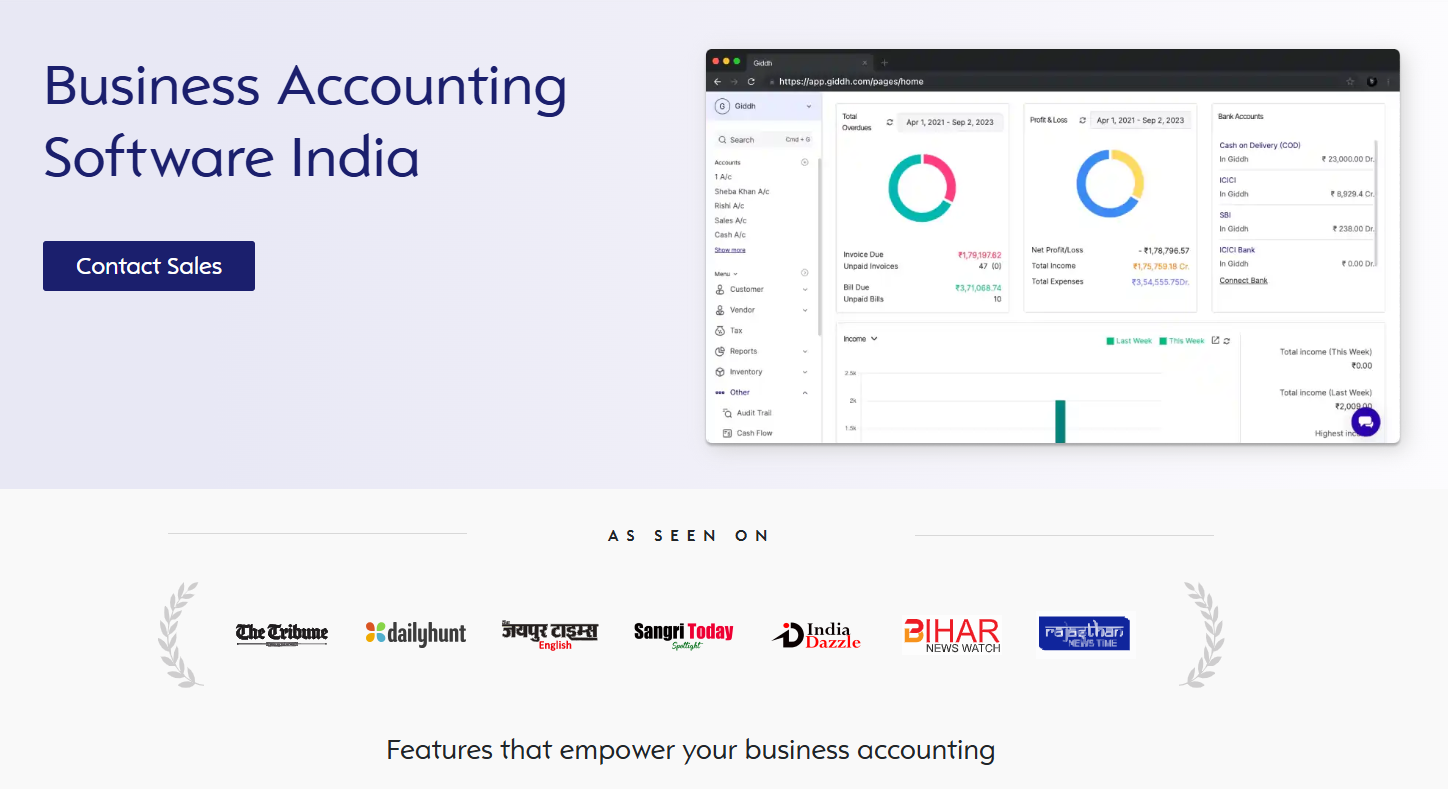

1. Giddh

Giddh is a cloud-based accounting platform designed for small to medium-sized businesses. It offers a comprehensive set of features that help businesses automate accounting tasks, including managing the general ledger. Giddh is known for its ease of use, seamless integration with other financial tools, and real-time collaboration features.

Features:

-

Automated General Ledger Management: Automates reconciliation, posting, and financial reporting.

-

Integration with Other Systems: Syncs with bank accounts, payment gateways, and other accounting systems.

-

Multi-Currency Support: Ideal for businesses operating internationally.

-

Real-Time Collaboration: Allows teams to work together on the same financial data in real-time.

-

Reports and Dashboards: Provides detailed financial reports, including balance sheets and profit & loss statements.

Benefits:

-

Streamlined Processes: Reduces manual entry and reconciliations, saving valuable time.

-

Improved Accuracy: Minimizes human error through automation.

-

Collaboration: Teams can work together in real-time, making financial cooperation easy.

-

Cloud-Based: Accessible anywhere, on any device, with secure cloud storage.

Pros:

-

User-friendly interface.

-

Affordable pricing for small businesses.

-

Strong customer support.

-

Great for collaboration.

Cons:

-

Limited advanced features for large enterprises.

-

Some users report integration issues with specific third-party apps.

2. QuickBooks Online

QuickBooks Online is one of the most popular cloud-based accounting software options for small businesses and accountants. It offers an array of features designed to simplify general ledger accounting, from automated bookkeeping to financial reporting and analysis.

Features:

-

Automated General Ledger: Quickly create and maintain your general ledger with automation.

-

Real-Time Bank Feed: Automatically syncs with your bank account and categorizes transactions.

-

Expense Tracking: Tracks expenses and helps manage bills and invoices.

-

Financial Reporting: Generates detailed balance sheets, P&L, and tax reports.

-

Mobile App: Manage your accounts on the go with QuickBooks’ mobile app.

Benefits:

-

Time-Saving Automation: Automates key tasks like data entry and account reconciliation.

-

Financial Insight: Helps you monitor business performance with customizable reports.

-

Integration: Works with a wide range of other tools and applications.

-

Cloud-Based: You can access your general ledger and other financial data from anywhere.

Pros:

-

Intuitive and easy to use for small businesses

-

Strong reporting features

-

Integrates well with other apps and services

-

24/7 customer support

Cons:

-

Pricing can be higher for advanced features

-

Some advanced features may require a steep learning curve for beginners

-

Limited payroll features in lower-tier plans

3. Xero

Xero is another leading accounting software platform, designed for small and medium-sized businesses. It automates general ledger accounting tasks and integrates seamlessly with various financial systems to provide a complete picture of your business's financial health.

Features:

-

Automated Bank Reconciliation: Automatically imports and matches transactions to your general ledger.

-

Invoicing and Billing: Create and send invoices directly through the platform, and track payments.

-

Financial Reporting: Generate a variety of reports, including balance sheets, income statements, and tax reports.

-

Multi-Currency Support: Ideal for international businesses with clients in multiple countries.

-

Mobile App: Manage your business finances from anywhere with the mobile app.

Benefits:

-

Scalability: Can grow with your business as you expand.

-

Real-Time Data: Keep track of all financial activity in real-time.

-

Customizable Reports: Generate detailed reports tailored to your business’s needs.

-

Collaboration: Enables multiple users to work together and access data simultaneously.

Pros:

-

User-friendly with excellent navigation.

-

Strong integration with third-party apps.

-

Great for international businesses with multi-currency support.

-

Affordable pricing.

Cons:

-

Limited features in the lower-tier plans.

-

Sometimes it can be slow to sync with banks.

-

Steep learning curve for new users.

How to Choose the Right Tool for Your Business

Choosing the right general ledger tool is crucial for improving efficiency and accuracy. When considering a tool for your business, think about the following factors:

-

Business Size and Complexity: Smaller businesses with simpler accounting needs may not require a complex tool, while larger companies with multiple departments might need a more robust system.

-

Integration with Other Accounting Systems: Ensure that the tool integrates smoothly with your existing financial software, such as payroll systems or invoicing tools.

-

Scalability and User Experience: Select a tool that can scale with your business growth and is easy for your team to adopt and utilize.

Quick Tips:

-

Look for a tool with real-time financial reporting.

-

Ensure the tool offers customizable features to suit your business’s unique needs.

-

Check for integrations with other software to streamline workflows.

Benefits of Simplified General Ledger Management

By implementing the right tools, businesses can enjoy several benefits:

-

Improved Accuracy: Automation helps ensure fewer errors, making your financial records more reliable.

-

Time Savings: Automating tedious tasks, such as reconciliation and reporting, saves hours of manual work.

-

Better Decision-Making: With real-time financial data and automated reporting, you can make more informed decisions faster.

Download our free checklist of top accounting tools to help you get started with simplifying your general ledger management today!

Conclusion

Managing your general ledger doesn’t have to be a complex, time-consuming task. By utilizing the right tools, businesses can streamline accounting tasks, minimize errors, and enhance overall financial visibility.

Whether you're a small business owner or a finance manager in a growing company, finding the right solution is essential for improving efficiency and ensuring accurate financial reporting.

If you’re ready to simplify your general ledger accounting, start your free trial with Giddh today and experience how automation can transform your financial workflows!

FAQ

Q1: What is a general ledger in accounting?

A general ledger is a comprehensive record of all financial transactions for a business, categorized by account type. It serves as the foundation for generating financial statements.

Q2: How do general ledger account types impact financial reporting?

General ledger account types categorize transactions into assets, liabilities, equity, income, and expenses. These categories are crucial for accurate financial reporting and analysis.

Q3: What are the benefits of automating general ledger accounting tasks?

Automation reduces human error, speeds up data entry and reconciliation, and enhances real-time reporting, ultimately saving time and improving financial accuracy.

Q4: How do I choose the right tool for my general ledger accounting?

Consider factors such as the size and complexity of your business, the tool’s integration capabilities with other systems, and its scalability for future growth.