Which Is The Best Accounting Software To Simplify Tax Calculation

In India, compliance with the Goods and Services Tax (GST), or simply GST, remains a critical challenge for businesses across sectors. According to recent data from the GST Council, over 10 million GST taxpayers are registered under the new system.

However, many still struggle with the complexities of GST tax calculation and filing. With the constant changes to GST rates and laws, businesses often find themselves caught in a cycle of errors, penalties, and missed deadlines.

But how can you ensure your business remains compliant, accurate, and efficient with GST? The answer lies in the right accounting software.

In this blog, we’ll explore how the best accounting software for business can help automate GST tax calculation, streamline filings, and provide the audit trail you need for full compliance.

We’ll also discuss Giddh, a robust online accounting tool that simplifies GST tax calculation and streamlines the filing process.

What is GST Tax Calculation?

GST tax calculation is the process by which businesses determine the amount of Goods and Services Tax they owe or are eligible to claim back. The calculation structure varies depending on the type of transaction and the business location. In India, GST has three types:

-

CGST (Central GST)

-

SGST (State GST)

-

IGST (Integrated GST)

Basic formula for GST calculation:

-

CGST = (Taxable Value × GST Rate) ÷ 2

-

SGST = (Taxable Value × GST Rate) ÷ 2

-

IGST = Taxable Value × GST Rate

This structure allows businesses to split the tax between the central and state governments, or, in the case of

inter-state transactions, pay IGST, which is later divided between the Center and the state.

Common Mistakes Businesses Make When Choosing GST Software

Mistake 1: Choosing Basic GST Filing Software

Many businesses opt for GST filing software that only handles invoicing and filing, without focusing on the broader accounting needs. While filing is critical, companies require an integrated solution that handles GST tax calculations and provides a comprehensive audit trail.

Giddh is an example of accounting software that integrates GST tax calculation and filing, ensuring your business stays compliant without missing critical steps.

Mistake 2: Not Considering Cloud-Based Solutions

Offline software can limit your business’s ability to scale. Cloud-based accounting solutions offer several benefits, including remote access, instant updates, and the ability to scale. These solutions ensure that your team can access the latest data and file returns from anywhere.

Giddh, as a cloud-based solution, provides businesses with flexibility and scalability, eliminating concerns about outdated software or data access issues.

Mistake 3: Not Accounting for Growth

Businesses evolve, and so should your accounting tools. It’s crucial to select the right software that can scale with your business. A small business may begin with basic features, but as your company grows, the software should accommodate advanced features, multi-user access, and multi-currency support.

Giddh grows with your business, offering unlimited user access, multi-currency support, and the flexibility to manage multiple companies under a single account.

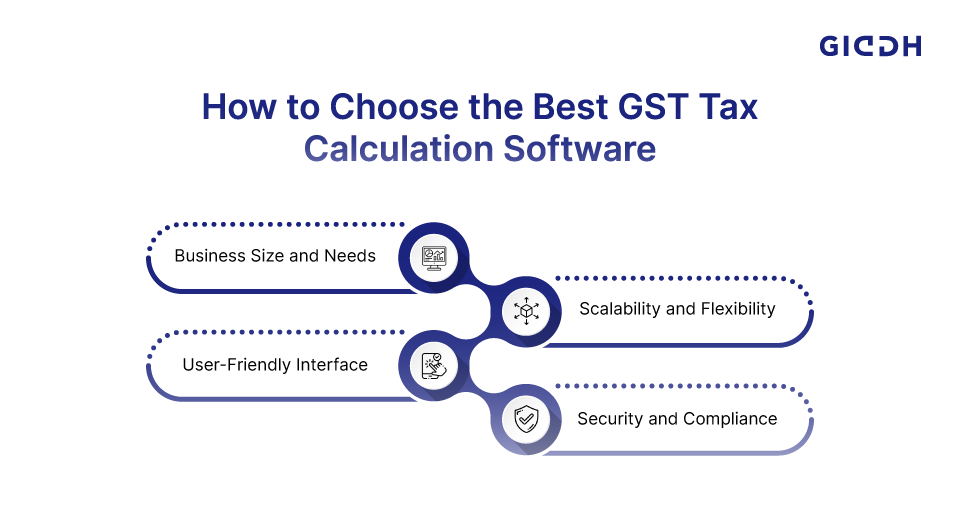

How to Choose the Best GST Tax Calculation Software for Your Business

Business Size and Needs

The software requirements of a business differ based on its size. Small businesses often need straightforward GST tax calculation tools, while medium to large enterprises require more comprehensive software that integrates with other business processes. For example, Giddh is suitable for both SMBs and even large enterprises due to its scalability and pricing plans.

Scalability and Flexibility

As your business grows, your accounting needs grows as well. It’s essential to choose the right software that can scale with your business, allowing for increased user capacity, advanced features, and seamless integration with other systems. With Giddh, companies can add new users, manage multiple accounts, and access tools that support growth.

User-Friendly Interface

The ease of use is a crucial factor in selecting the right software. Businesses should opt for GST tax calculation tools that require minimal training for users. Giddh offers an intuitive interface that enables anyone, regardless of accounting experience, to navigate the system efficiently.

Security and Compliance

Security is very important when dealing with financial data. Also, make sure that the software you choose complies with the latest GST regulations and offers secure data storage. Giddh meets all security standards and is continuously updated to reflect any changes in GST laws. Therefore, businesses remain compliant with the latest regulations.

Why GST Automation Is No Longer Optional

GST compliance is getting tougher each year, and manual accounting systems like Excel and outdated desktop tools can’t keep up. Frequent GST rule changes, new e-invoice rules, and strict filing timelines make automation essential for every business. This is why many companies are now switching to cloud tools and the best accounting software online to stay compliant without stress.

In 2025, the GSTN system is pushing real-time data validation. That means even the smallest mismatch can lead to penalties or blocked input tax credit. Manual work increases the risk of errors, missed filings, and incorrect tax entries. Startups feel this pressure even more, which is why choosing the best accounting software for startups is now a smart and necessary move.

Here’s why automation is no longer optional:

- Frequent GST rule changes make manual tracking difficult.

- E-invoice and e-way bill rules require accuracy and timely updates.

- Real-time GSTN matching flags even minor mistakes.

- Penalties for late filing are now higher and more frequent.

- Audit trails are mandatory, and manual systems rarely maintain them correctly.

Giddh: The Best Accounting Software for Small Business in India

Giddh is an all-in-one accounting tool designed to streamline the GST tax calculation process. Here are some key features that set Giddh apart:

-

Automated GST Tax Calculation: Giddh automates the GST tax calculation process, reducing the likelihood of errors and saving valuable time.

-

GST-Ready Invoicing and Filing: The software supports seamless GST invoicing and filing, ensuring compliance with all relevant requirements.

-

Multi-Currency and Ledger-Based Accounting: Giddh supports businesses operating in multiple currencies and provides robust ledger-based accounting.

-

Unlimited User Access and Multi-Company Management: Easily manage multiple companies and invite an unlimited number of users to access the system without incurring additional charges.

Conclusion

Navigating the complexities of GST tax calculation can be a daunting task, but it doesn’t have to be. By selecting the right software, businesses can automate calculations, streamline filings, and ensure compliance with GST regulations. Giddh is an ideal solution, offering automated GST tax calculation, seamless filing, and cloud-based flexibility to businesses of all sizes.

Ready to simplify your GST tax calculation with the best accounting software for GST? Explore Giddh today and start streamlining your GST compliance process.

FAQs

1. What is the best GST software for large businesses in India?

The best GST software for large businesses in India should offer features like multi-company management, integrated GST tax calculation, seamless filing support, and scalability. Giddh is an ideal choice, offering automated GST tax calculation, multi-user access, and real-time compliance updates, making it suitable for enterprises with complex needs and multiple transactions.

2. How can accounting software in India simplify GST compliance for businesses?

Accounting software in India can simplify GST compliance by automating tax calculations, generating GST-compliant invoices, and providing real-time updates on GST laws. Tools like Giddh integrate GST filing with accounting, ensuring businesses stay compliant while saving time on manual tasks.

3. What features should large enterprises look for in GST software?

Large enterprises should look for scalability, automation of GST tax calculation, seamless integration with other business systems, and real-time compliance updates. Giddh provides all these features, offering multi-currency accounting, unlimited user access, and advanced reporting capabilities that cater to large businesses.

4. How does GST accounting software help with accurate tax reporting and filing?

GST accounting software facilitates accurate tax reporting and filing by automating tax calculations based on real-time transaction data, thereby reducing the risk of manual errors. It generates GST-compliant invoices and helps track tax credits. Giddh integrates with GST filing systems, ensuring accuracy and timely submissions.