10 Best Zoho Books Alternatives & Competitors in 2026

Have you ever felt that your accounting software holds back your business instead of helping it grow? Many small businesses, freelancers, and accountants in India rely on Zoho Books for managing invoices, expenses, and compliance.

While it’s a widely used tool, users often discover limitations when their business starts scaling. Issues such as limited customization, restricted integrations with industry-specific tools, and rising costs with add-ons make many look for Zoho Book alternatives that better match their needs.

The purpose of this blog is simple: to help business owners and professionals find accounting solutions that offer more flexibility, affordability, and scalability. Whether you need GST-ready invoicing, better reporting, or seamless multi-user access, the following list highlights the best Zoho Books alternatives in 2026.

Continue reading to discover which software can provide your business with the clarity, control, and efficiency that Zoho Books may be lacking.

Top 10 Alternatives To Zoho Books For Small Businesses In 2026

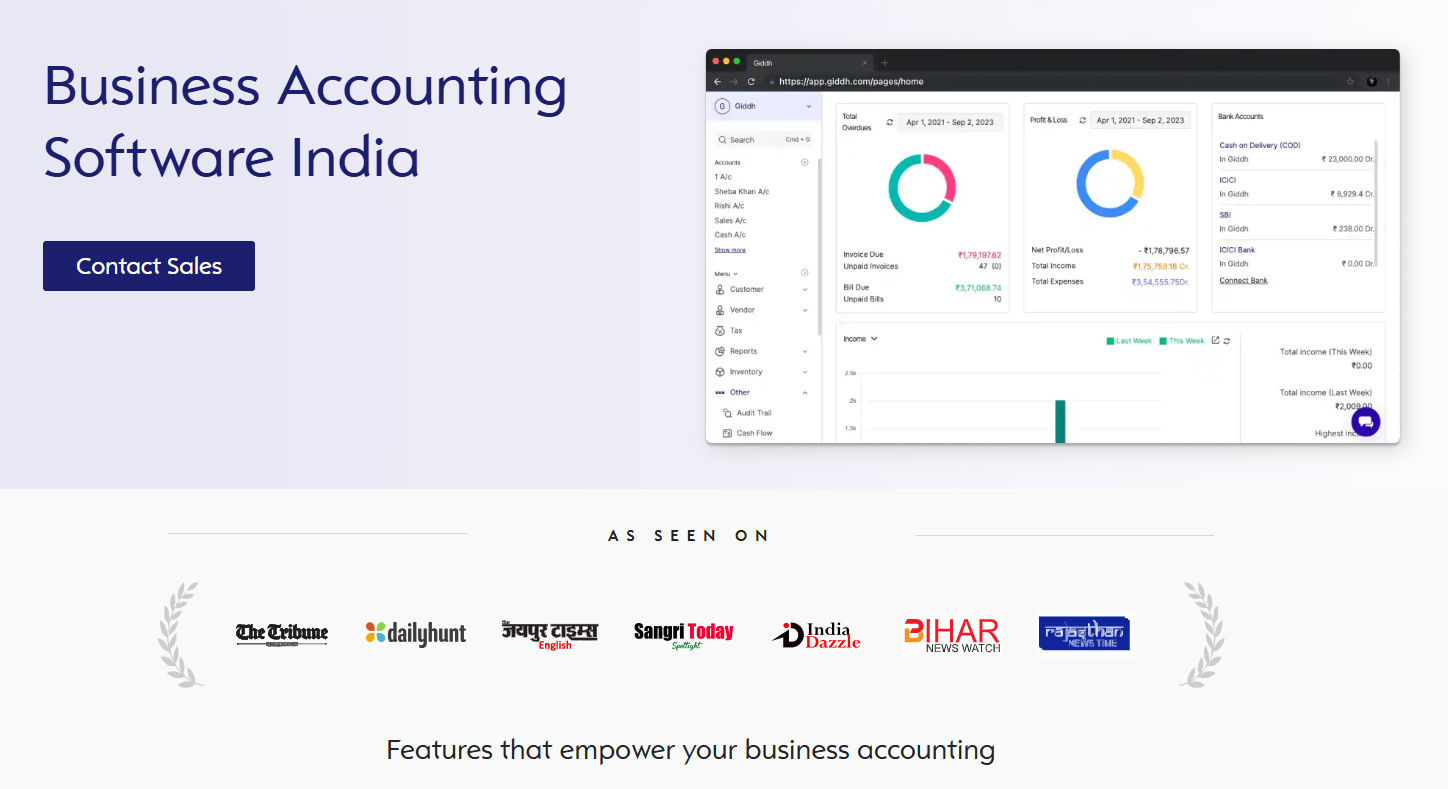

1. Giddh

Giddh is one of the best Zoho Book alternatives, and a cloud-based accounting software designed for small businesses and freelancers, particularly in India. It focuses on simplicity, scalability, and seamless GST compliance, making it an excellent choice for companies seeking flexibility and easy integration.

Key Features:

-

Real-time ledger and financial reporting.

-

Multi-user and role-based access.

-

GST-compliant invoicing and filing.

-

Cloud-based access with bank reconciliation.

-

Scales easily as businesses grow.

-

Ledger-Based Accounting.

-

Multi-Currency Support.

-

White-Label Option.

-

Unlimited User Access.

-

Manage Over 100 Companies.

Why Choose Giddh Over Zoho Books?

-

Transparent pricing without costly add-ons.

-

Seamless GST filing automation for Indian businesses.

-

Scalable for multi-user access and expanding teams.

Pros:

-

Comprehensive GST compliance for Indian businesses.

-

Affordable pricing with flexible plans.

-

Easy to use, even for non-accountants.

Cons:

-

Limited advanced features compared to enterprise solutions.

-

Not as customizable as some competitors.

Accounting Software Comparison Table (2026)

| Software | Best For | Cloud / Offline | GST Support | Pricing (Approx.) | Scalability |

|---|---|---|---|---|---|

| Giddh | SMEs, Startups | Cloud | ✔ Yes | Affordable | High |

| QuickBooks | Startups, SMEs | Cloud | Partial | Higher | High |

| TallyPrime | SMEs, Retail | Offline / Cloud | ✔ Yes | Mid-range | Medium |

| Vyapar | Micro & Small Biz | Both | ✔ Yes | Budget | Low |

| FreshBooks | Freelancers | Cloud | ✖ Limited | High | Medium |

| Busy | SMEs, Enterprises | Desktop / Cloud | ✔ Yes | Mid-range | High |

| Xero | Startups, Global | Cloud | ✖ Limited | High | High |

| Wave | Freelancers | Cloud | ✖ Limited | Free | Low |

| Marg ERP | Retail, Pharma | Desktop | ✔ Yes | Mid-range | Medium |

| Sage | Medium Businesses | Cloud | ✖ Limited | High | High |

2. QuickBooks Online

QuickBooks Online is one of the most popular accounting solutions, offering a broad range of features suitable for small to mid-sized businesses. It is particularly known for its user-friendly interface and integration with a wide range of third-party apps.

Features:

-

Invoicing and expense tracking.

-

Bank and credit card integration.

-

Advanced financial reporting.

-

Payroll management and tax calculations.

-

Mobile access with dedicated apps.

Pros:

-

Excellent for small to mid-sized businesses.

-

Strong customer support.

-

Great integration with third-party apps.

Cons:

-

It can be expensive for smaller businesses.

-

Lacks some advanced features for larger businesses.

3. TallyPrime

TallyPrime is a widely recognized accounting software competitors in India, offering robust features that cater to GST compliance and inventory management. It's ideal for businesses seeking a comprehensive accounting solution tailored specifically to the Indian market.

Features:

-

GST-compliant invoicing and filing.

-

Inventory management and stock tracking.

-

Multi-user support.

-

Advanced financial reporting.

-

Easy bank reconciliation.

Pros:

-

Deep integration with Indian tax laws and GST.

-

Highly customizable.

-

Trusted by Indian businesses for decades.

Cons:

-

Steep learning curve for beginners.

-

It can be overwhelming for small businesses.

4. Vyapar

Vyapar is an accounting software that focuses on providing seamless invoicing, inventory management, and GST compliance for small businesses, especially in India. It enables seamless integration with banking systems and features a mobile app for convenient access.

Features:

-

GST-compliant invoicing and reports.

-

Inventory management and stock tracking.

-

Multi-device access with mobile apps.

-

Customizable templates for invoices.

-

Simple and intuitive user interface.

Pros:

-

Perfect for Indian businesses and traders.

-

Affordable and straightforward to use.

-

Good customer support.

Cons:

-

Limited features for larger businesses.

-

Lacks advanced accounting tools.

5. FreshBooks

FreshBooks is an intuitive accounting software tailored for freelancers, small businesses, and service providers. Its simple interface makes it easy to use for non-accountants, focusing on invoicing, time tracking, and expense management.

Features:

-

Automated invoicing and recurring billing.

-

Expense tracking and reporting.

-

Time tracking for projects.

-

Mobile app for invoicing and expense management.

-

Client management tools.

Pros:

-

User-friendly and simple to navigate.

-

Excellent for freelancers and small service-based businesses.

-

Strong time tracking and invoicing features.

Cons:

-

Limited scalability for larger businesses.

-

Lacks advanced accounting features.

6. Busy Accounting Software

Busy Accounting Software is a comprehensive accounting solution designed for small and mid-sized businesses. It is well-known for its detailed reporting, GST compliance, and inventory management features.

Features:

-

GST-compliant invoicing.

-

Inventory and stock management.

-

Multi-user access.

-

Financial reporting and tax calculation.

-

Supports multi-currency transactions.

Pros:

-

Excellent for inventory management.

-

Easy to use and set up.

-

Suitable for businesses needing GST compliance.

Cons:

-

Limited integrations with third-party apps.

-

It can be expensive for smaller businesses.

7. Xero

Xero is an accounting software known for its ease of use and cloud-based features. It offers a robust set of tools for small to medium-sized businesses, including advanced financial reporting and strong integration capabilities.

Features:

-

Multi-currency support.

-

Cloud-based access for easy collaboration.

-

Payroll and tax management.

-

Invoicing and expense tracking.

-

Integration with over 800 third-party apps.

Pros:

-

Excellent for growing businesses and international operations.

-

Scalable and flexible features.

-

User-friendly with strong reporting tools.

Cons:

-

High price point for small businesses.

-

May require add-ons for advanced features.

8. Wave Accounting

Wave Accounting is a free solution for small businesses, offering basic accounting features such as invoicing, expense tracking, and financial reporting. It is particularly suited for businesses on a budget.

Features:

-

Free invoicing and accounting tools.

-

Receipt scanning for easy expense tracking.

-

Real-time financial reporting.

-

Payroll and tax tools (paid).

-

Bank integrations.

Pros:

-

Entirely free for basic features.

-

Easy-to-use interface.

-

Great for startups and freelancers.

Cons:

-

Limited features for larger businesses.

-

Paid options for payroll and tax tools.

9. Marg ERP

Marg ERP is an accounting and ERP solution that’s widely used in India for managing GST, inventory, and financial operations. It's highly customizable and designed to support businesses of various sizes.

Features:

-

GST-compliant invoicing.

-

Inventory and stock management.

-

Multi-user and multi-location support.

-

Financial and tax reporting.

-

Real-time data synchronization.

Pros:

-

Ideal for Indian businesses with complex needs.

-

Highly customizable.

-

Strong inventory management.

Cons:

-

Complex for small businesses.

-

It can be expensive for startups.

10. Sage Accounting

Sage Accounting offers cloud-based accounting solutions suitable for small to mid-sized businesses. It provides a range of features, including invoicing, payroll, and financial reporting.

Features:

-

Real-time financial data and reporting.

-

Simple payroll management.

-

Bank integration for easy reconciliation.

-

Multi-currency support.

Pros:

-

Comprehensive and scalable.

-

Good customer support.

-

Integrates with other Sage products.

Cons:

-

It can be costly for smaller businesses.

-

Limited features for tiny businesses.

How to Choose the Right Accounting Software for Your Business

Choosing the right accounting software is essential for streamlining your business processes. When exploring Zoho Book alternatives, it's important to consider the following factors to ensure you select the best solution for your needs:

-

Scalability

Will the software be able to handle your growing business? As your operations expand, your accounting needs will become more complex. Ensure the software can handle increasing transaction volumes and user numbers without compromising performance.-

Handles growing transaction volumes.

-

Easy upgrades as business needs evolve.

-

-

Ease of Use

The software should be user-friendly, even for those without accounting expertise. A steep learning curve can lead to delays and mistakes, impacting your productivity.-

Simple, intuitive interface.

-

Minimal training required for non-accounting staff.

-

-

Integrations

Look for software that integrates well with your existing tools like CRM, eCommerce platforms, and payment gateways. Smooth integrations save time and improve accuracy in financial data management.-

Integrates with popular business tools.

-

Automates data flow across platforms.

-

-

Customization

Every business has unique needs. Ensure the software offers customization options to tailor reports, invoicing, and other features to fit your industry-specific requirements.-

Customizable reports and templates.

-

Flexible features suited to your business model.

-

-

Cost

Assess the pricing structure and ensure it aligns with your budget. While affordable options are available, make sure you don’t compromise on essential features.-

Transparent, predictable pricing.

-

Flexible plans to suit small to medium-sized businesses.

-

By considering these factors, you can select the ideal Zoho Book alternative that aligns with your business needs and helps you remain efficient and compliant.

Final Thought:

Finding the right accounting software is crucial for the success and efficiency of any business. Zoho Books is a popular choice among small businesses, freelancers, and accountants, offering features like invoicing, tax filing, and expense tracking.

However, as businesses grow, many users experience limitations such as scalability issues, a lack of advanced integrations, and restricted customization options.

Fortunately, businesses now have a range of Zoho Book alternatives that can better meet their evolving needs. Whether you're seeking enhanced reporting features, more flexible integrations, or a platform that grows with your business, the options available in 2026 can provide precisely what you need to stay ahead.

While Zoho Books serves many, it's essential to explore the alternatives that offer improved functionality and scalability for a smoother accounting experience in 2026. Get started with Giddh to simplify and enhance your financial management.