How to check GSTR-2 in Giddh?

To view and download GSTR-2 report in Giddh, log in to your Giddh account

To search anything in Giddh just press Ctrl+g (for Windows) or cmd+g (for Mac)

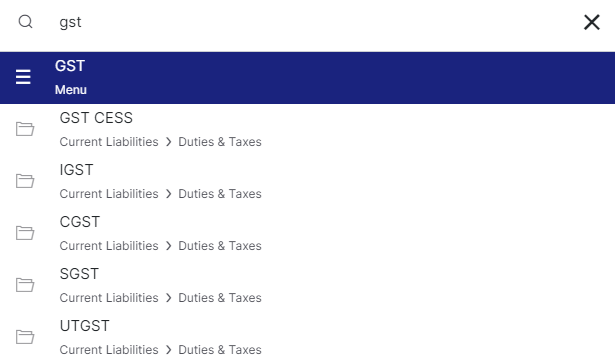

Press Ctrl+g or Cmd+g and search "GST"

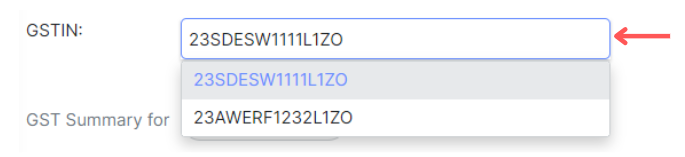

You are on the GST Dashboard, if you have multiple GSTIN then click on the GST number to select the required GSTN for the reports

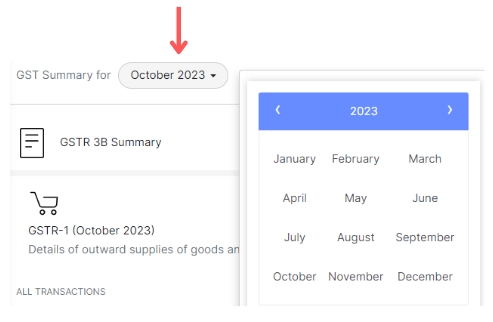

Click on the Period button to select the particular year and month for the reports

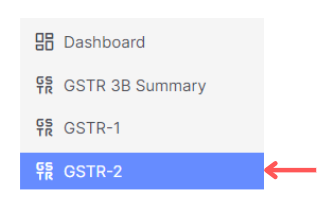

Select GSTR-2

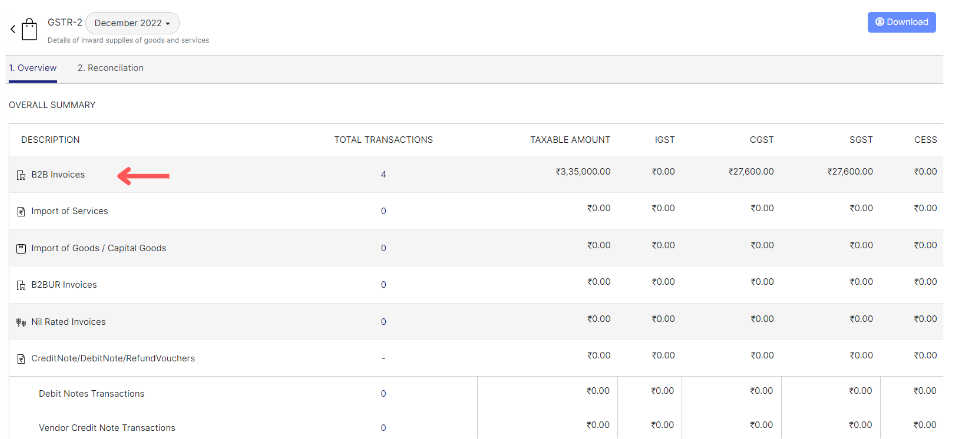

Now you are on the GSTR-2 page, here you can view its month-wise report

You can also see the list of transactions that come under a particular section by just clicking on it

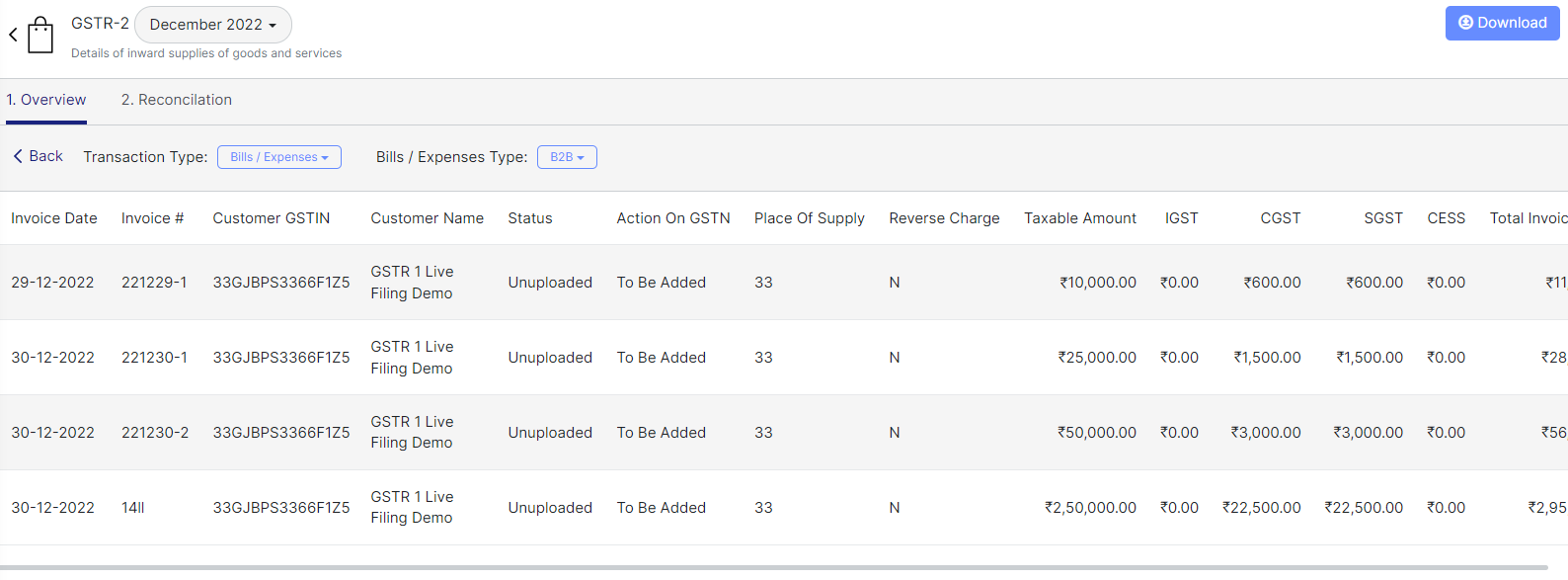

Here you can see the detailed view of all the B2B invoices of the selected period

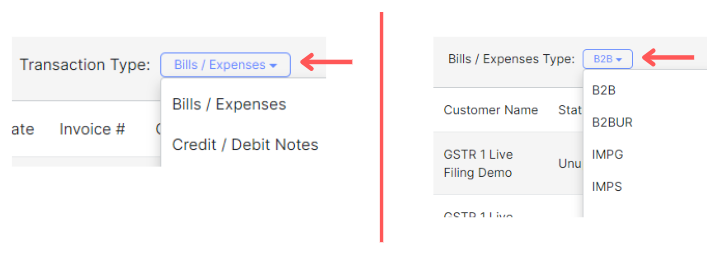

You can apply the filter of the Transaction type and the Invoice type as per your requirement too

To reconcile the GST-2R report with the GST portal, click on "Reconciliation"

Note: You can only file your return when you are on Consolidated mode

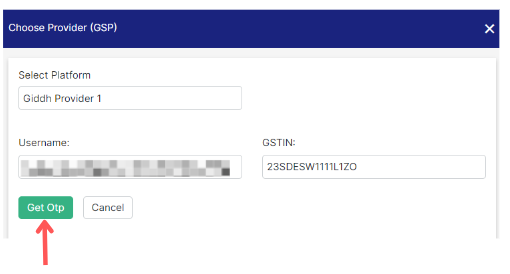

Click on "Authenticate" button

Fill the GST username, and click on "Get OTP" button

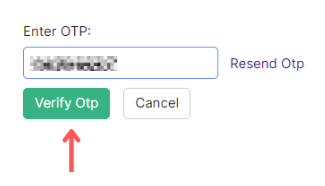

An OTP will be sent to your registered mobile number,

Fill the OTP > Click on "Verify OTP" button

Now your GST portal is Authenticated with Giddh,

Click on the "Pull from GSTN" button to pull the data from GST portal

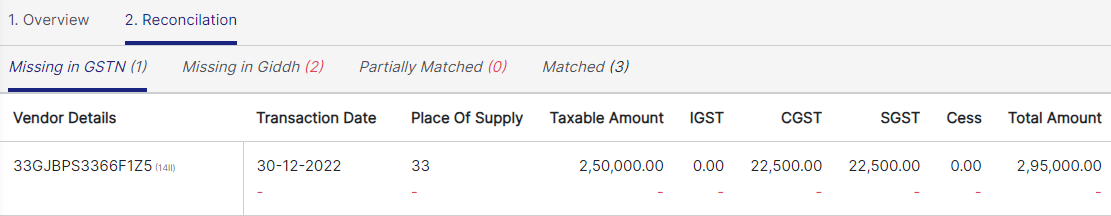

Now your data is pulled from the GST portal, and you will be able to see the following information:

Missing in GSTN: This refers to data that is present in GIDDH but missing in the GSTN portal.

Missing in Giddh: This indicates data that is present in the GSTN portal but missing in Giddh.

Partially matched in Giddh with GSTN: This shows data that is partially matched between Giddh and the GSTN portal.

Matched in both GSTN and Giddh: This represents data that is successfully matched between Giddh and the GSTN portal.

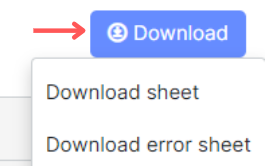

Click on the "Download" button to download the reports

Download Sheet: To download the report

Download error sheet: to download the error sheet