How to record purchase bill payments with TDS?

There are two methods to record purchase bill payments with TDS.

1. Deduct TDS while recording the payment of an already existing purchase bill.

2. How to record TDS while recording the purchase bill

Here we will see both the methods in detail:

Deduct TDS while recording the payment of an already existing purchase bill.

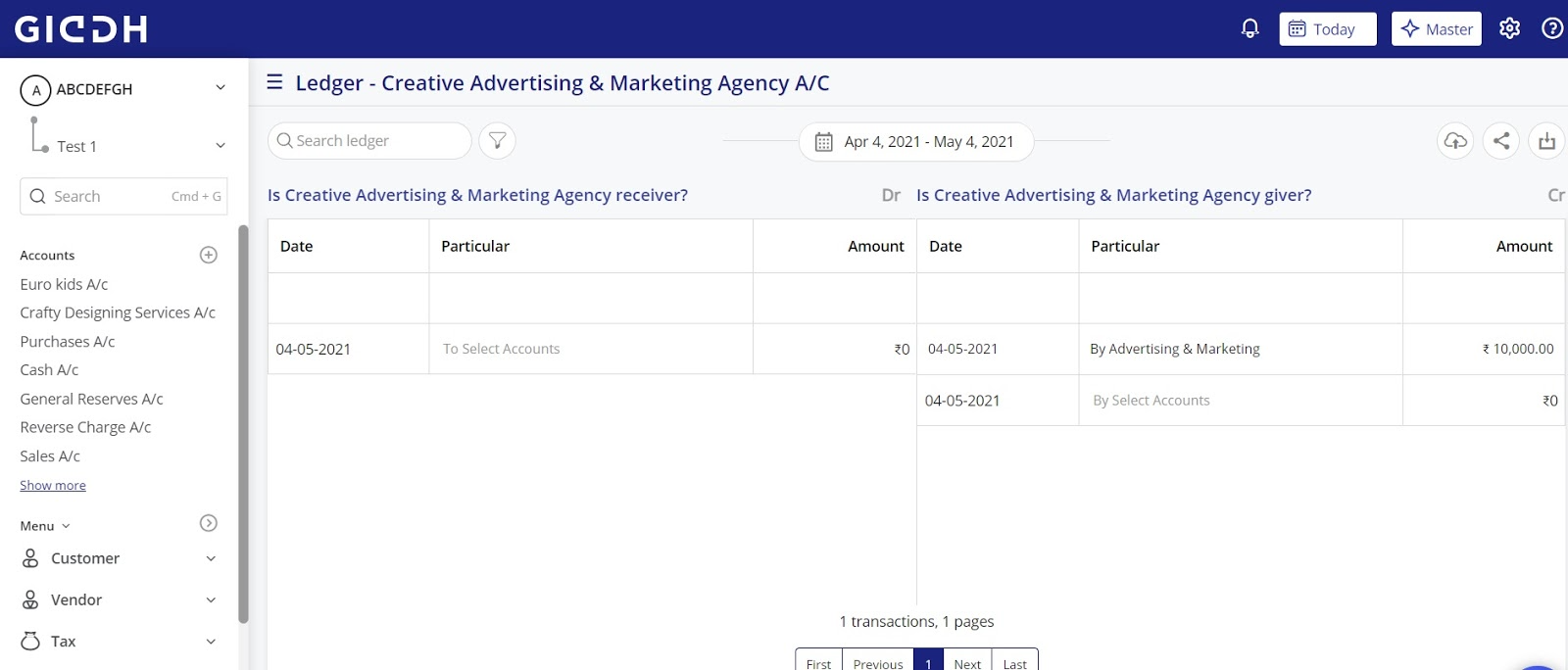

Type Ctrl+G or Command+G and search the vendor ledger

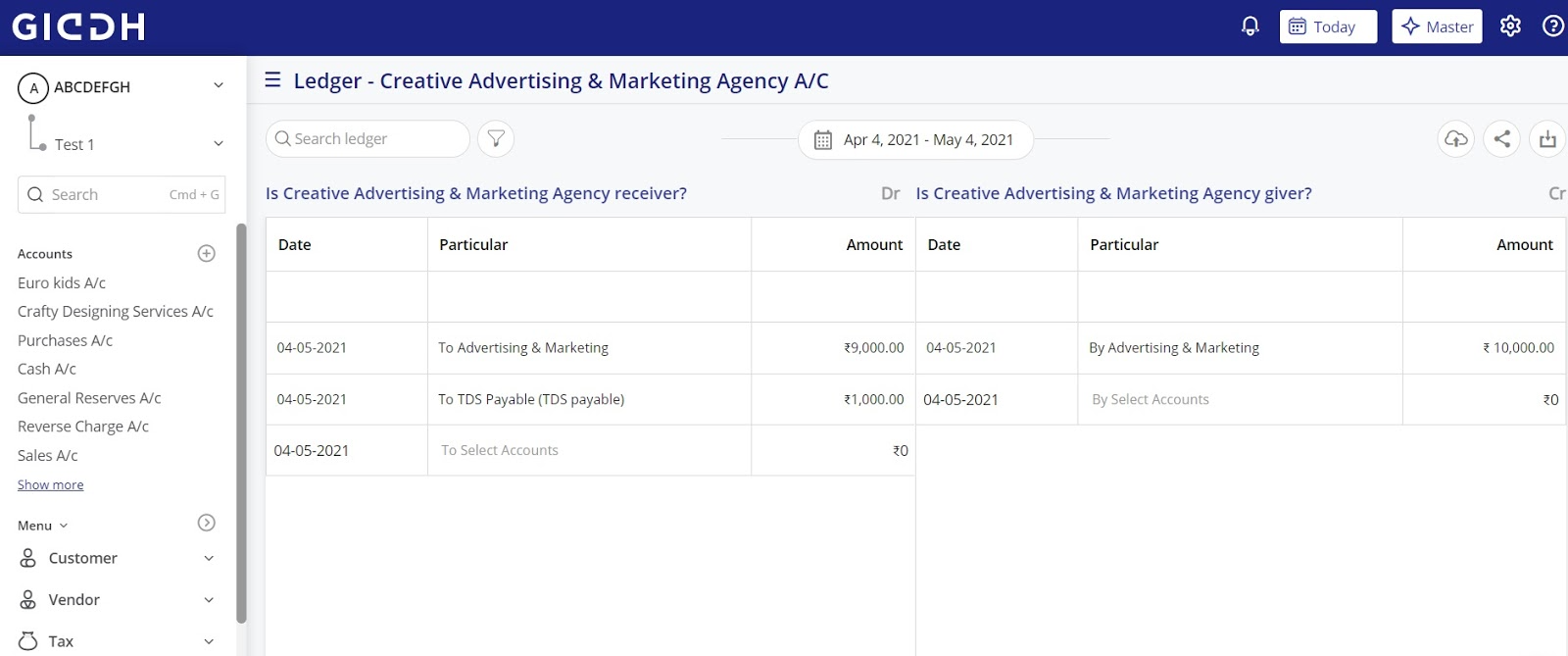

The vendor ledger will open

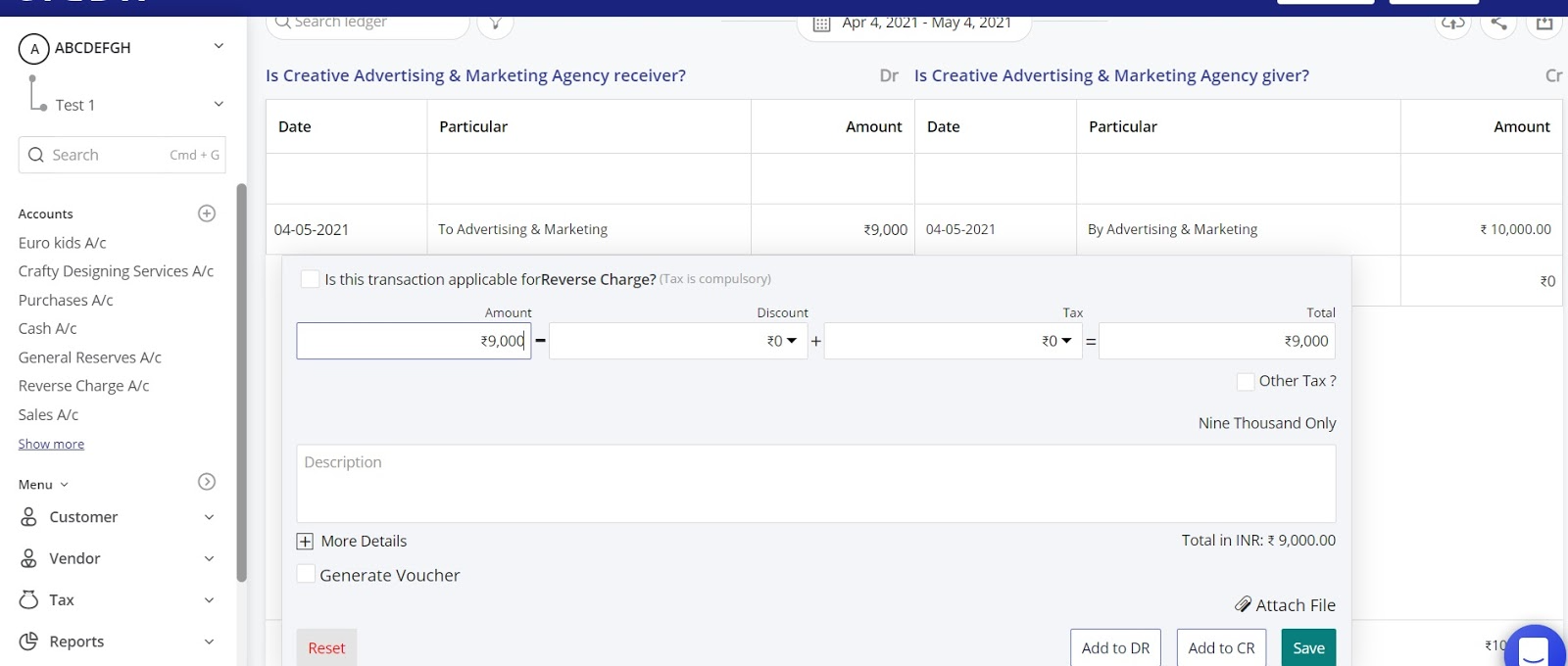

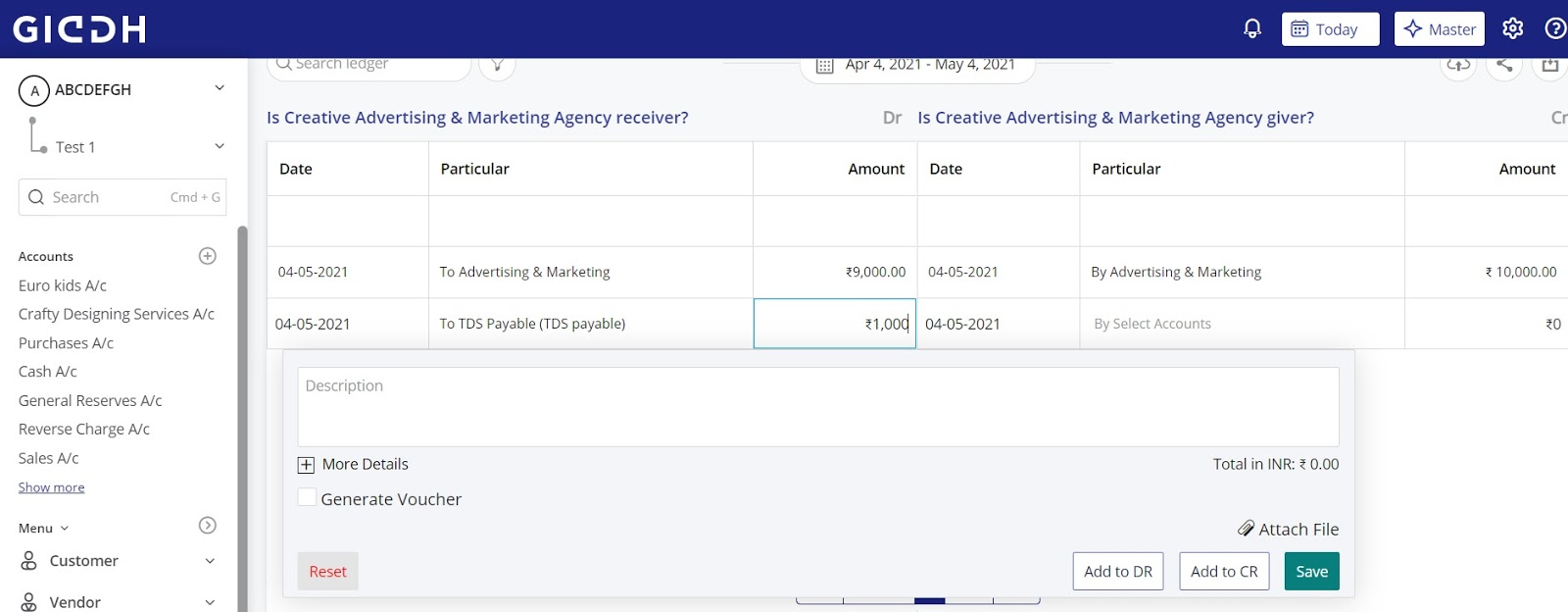

Make the entry of the amount on the receiver side of the ledger and hit “add to DR”

Select TDS payable from the dropdown in the particular field and enter the TDS amount.

Your TDS entry directly from the ledger is done.

2. How to record TDS while recording the purchase bill

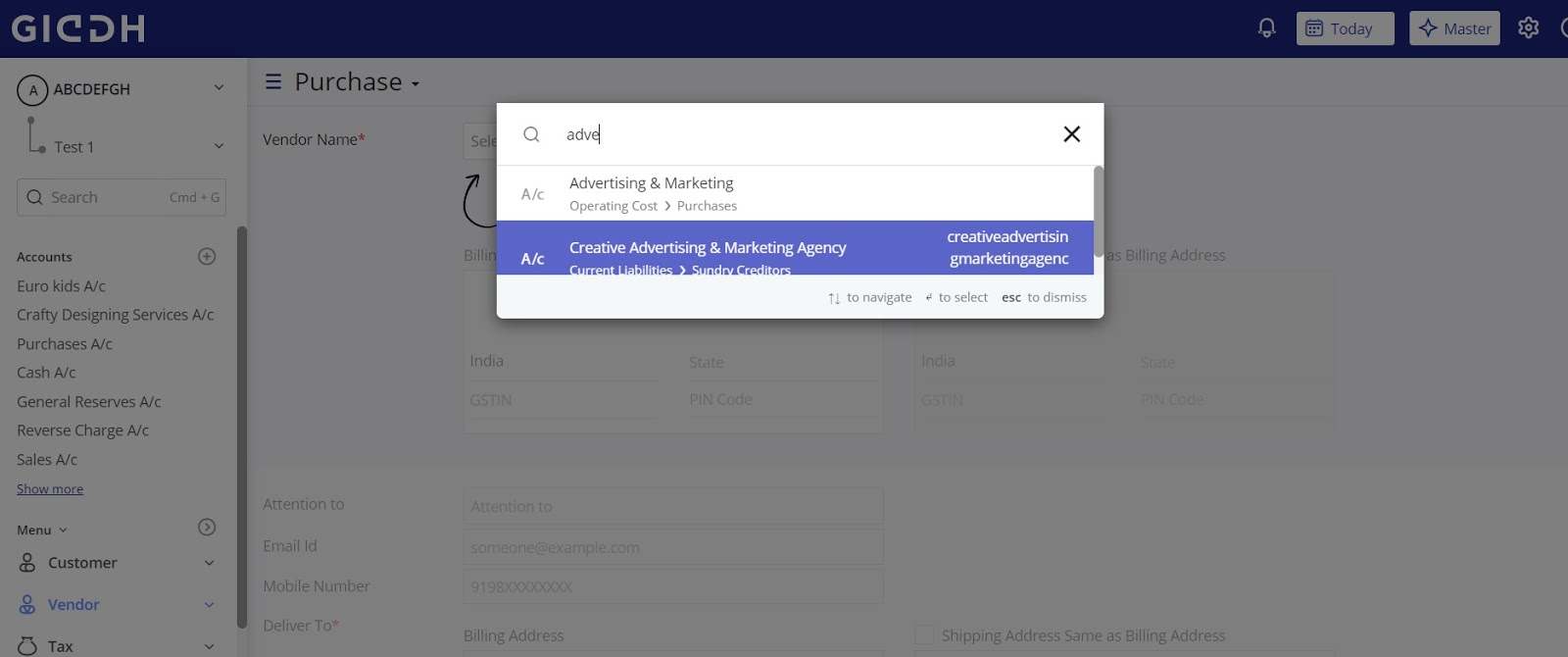

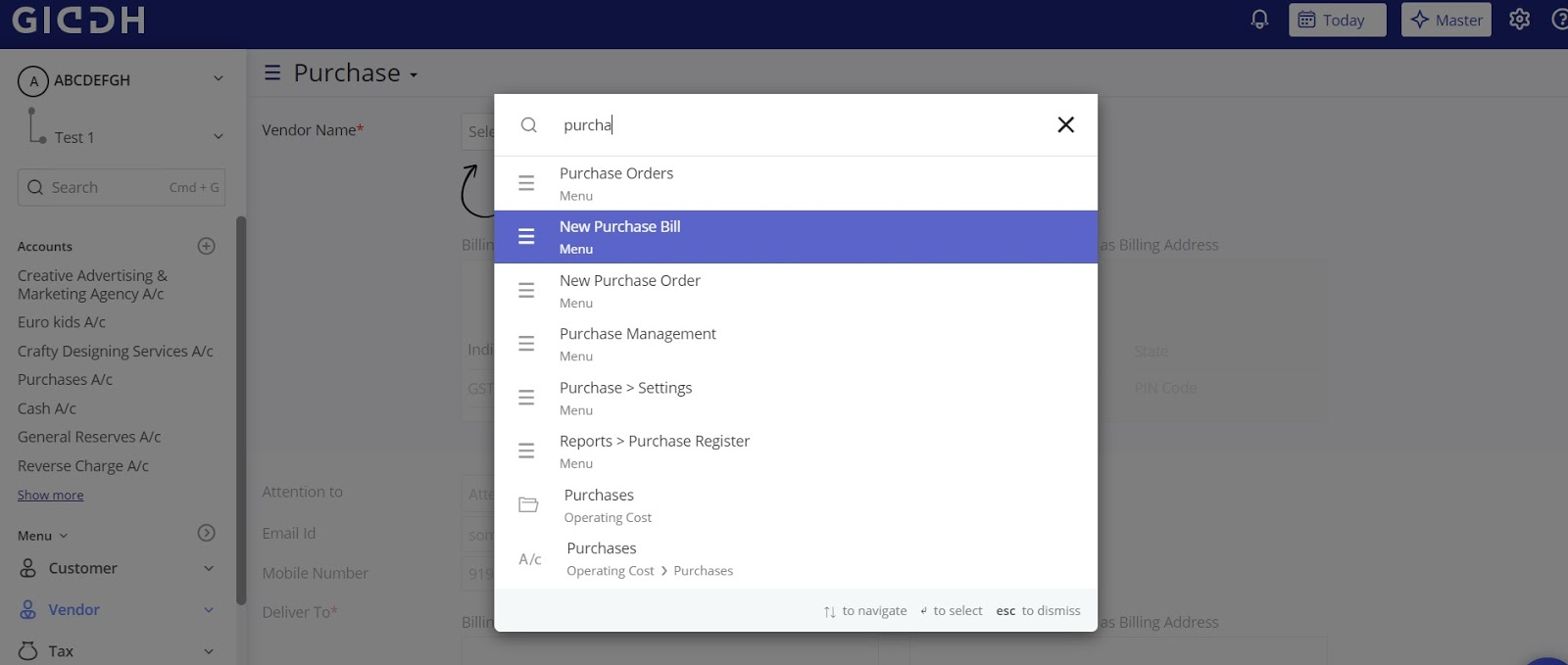

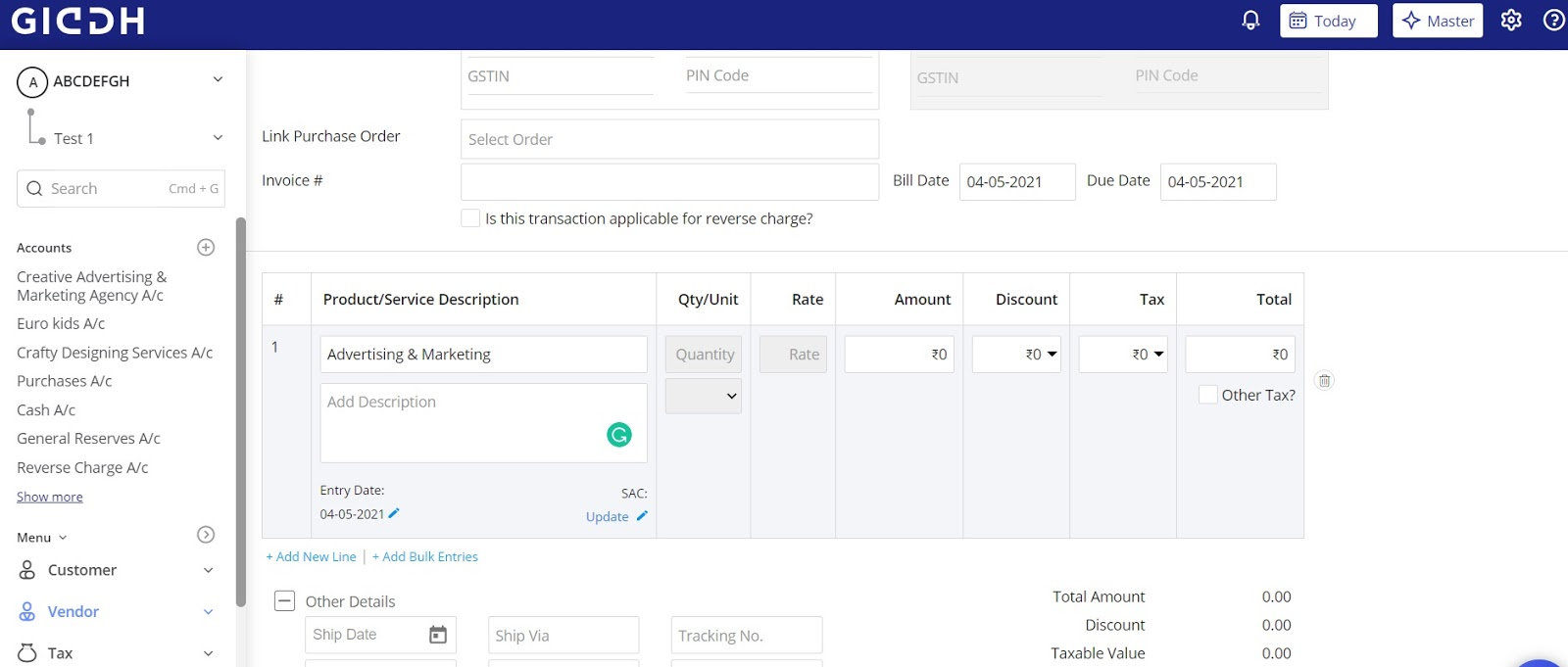

Press Ctrl+G or Command+G and go to the new purchase bill

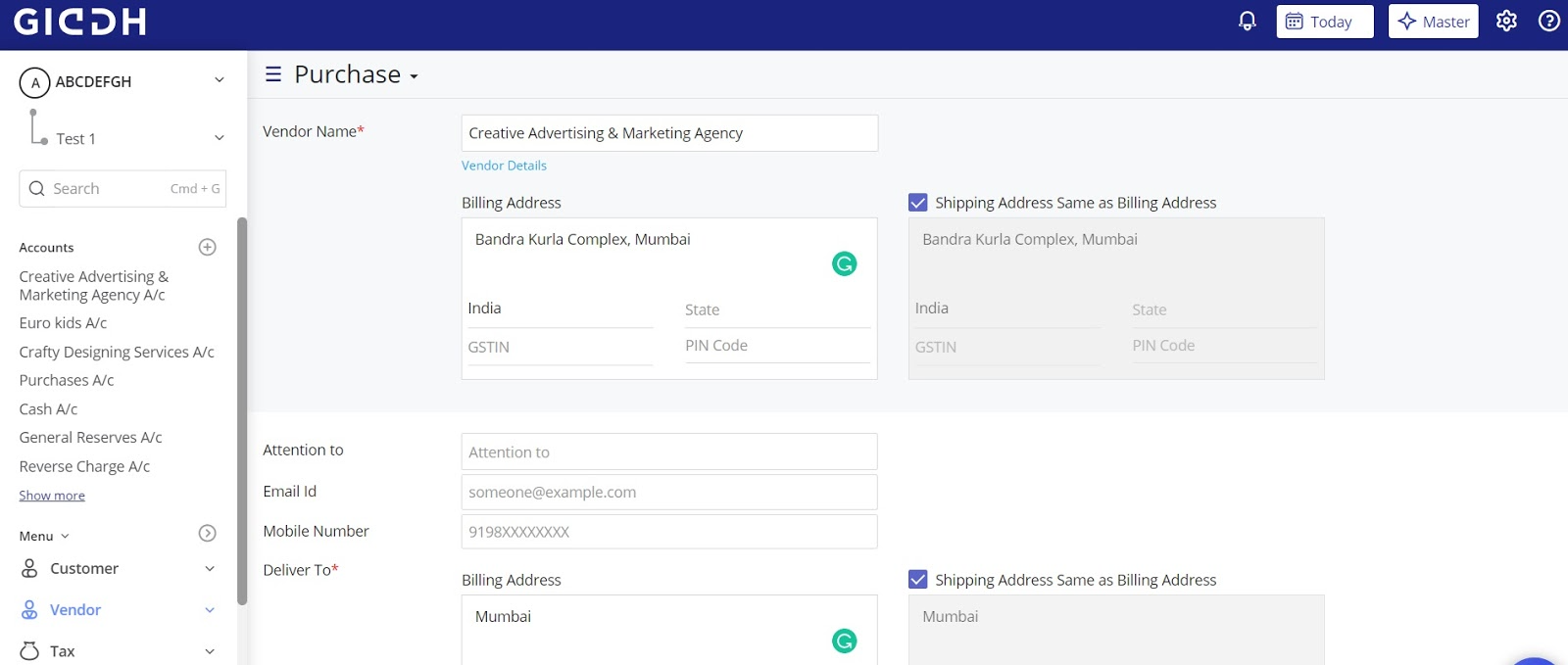

Select the vendor name from the drop-down for whom you want to create the purchase bill.

Select the product/ service description of the vendor.

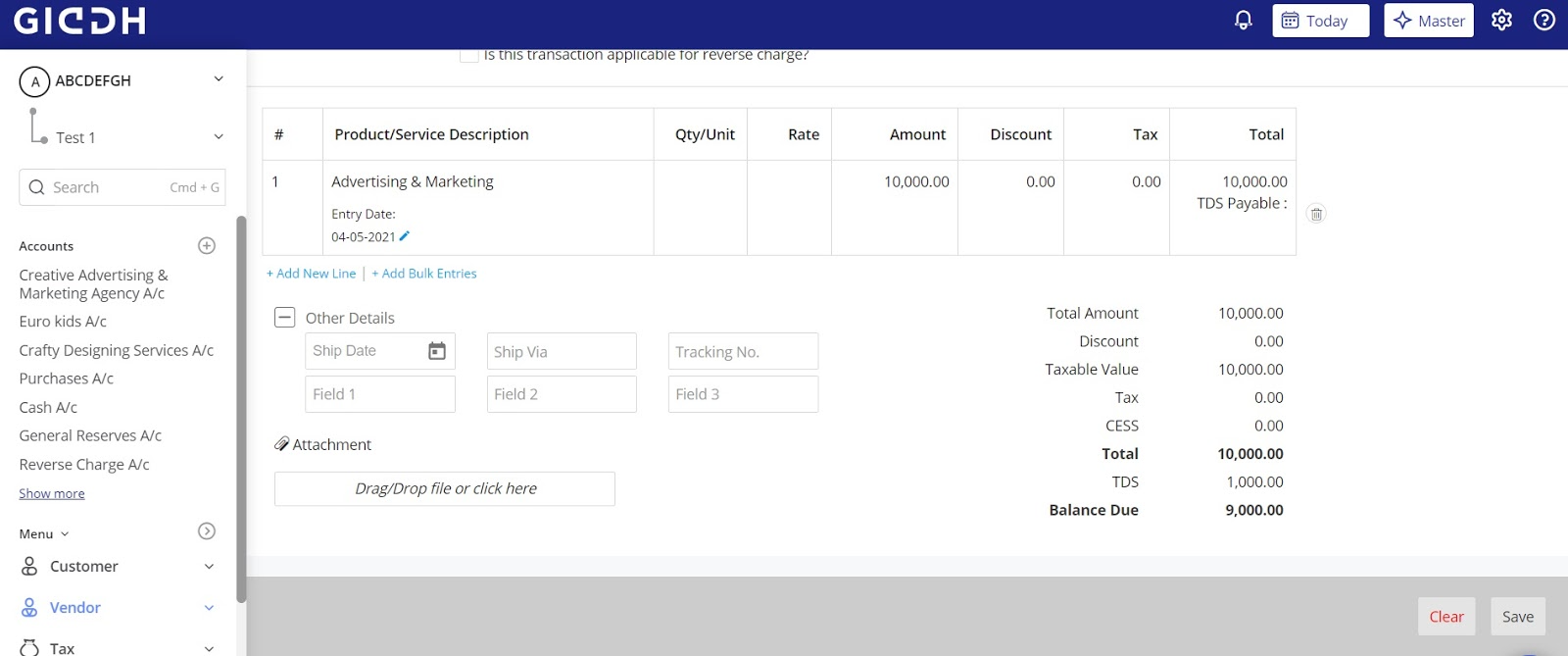

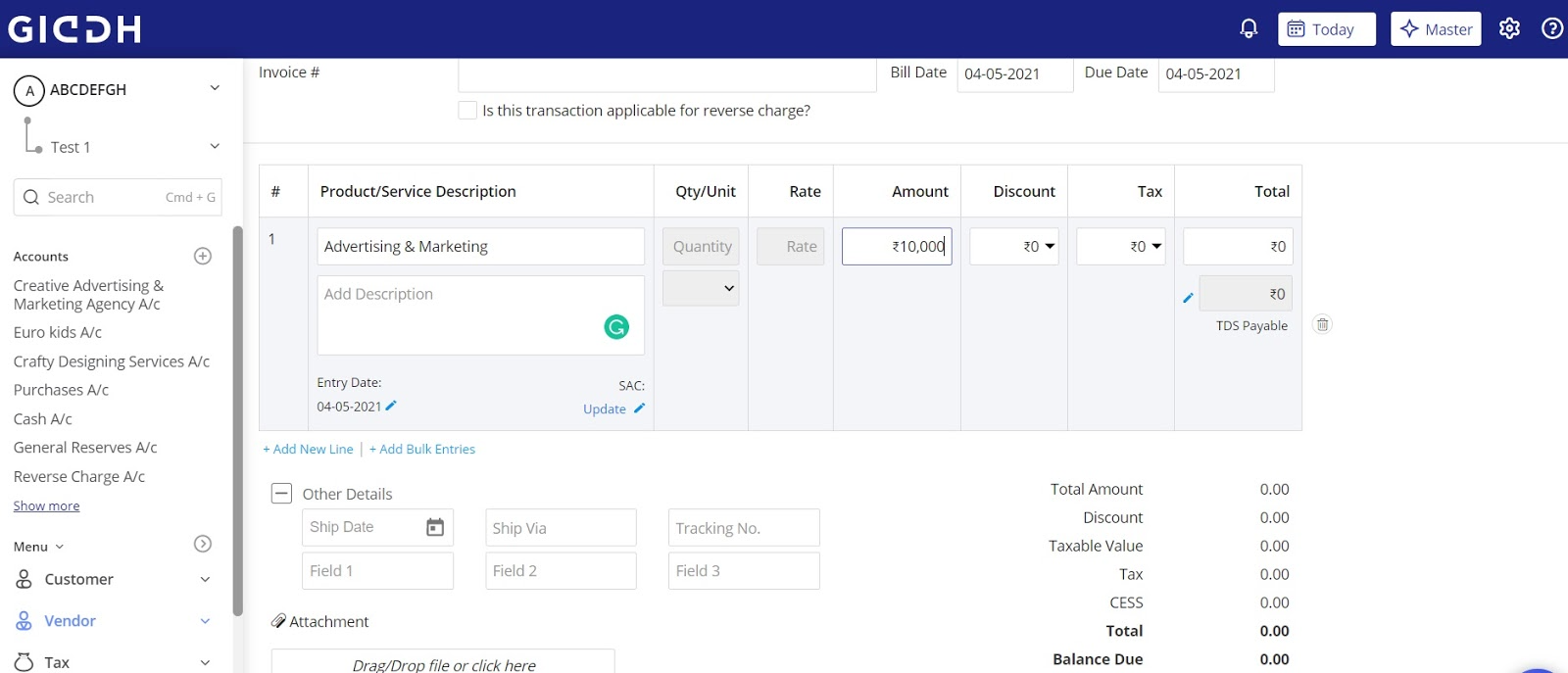

Enter the total amount to be paid in the amount field and then click the checkbox of “other tax” for TDS.

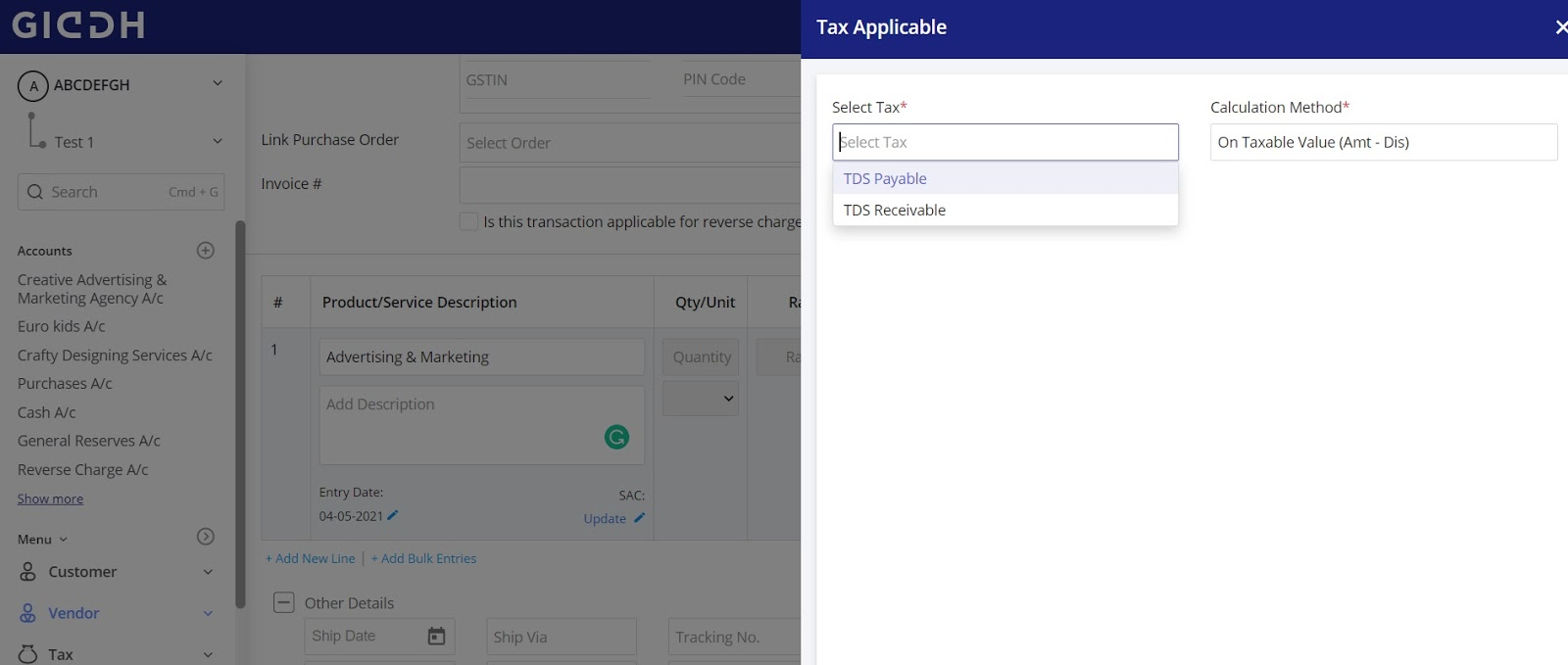

A pop-up appears where you have to select the type of TDS (payable/receivable).

You can check the total amount and then save the bill from the bottom right corner.