Want to Increase the Value of Your Business? Accurate Accounting is the Answer.

Accurate accounting plays a bigger role in business growth than most owners realize. It’s not just about filing taxes or organizing receipts; accurate accounting helps you understand where your money is going, when to invest, and how to control costs with confidence.

Whether you’re a small business owner or managing multiple branches, having accurate accounting and clean financial records helps you forecast revenue, plan budgets, and avoid costly mistakes. This is where modern tools, including accurate accounting software and accurate accounting solutions, make a major difference by automating repetitive tasks and giving you real-time visibility.

In this blog, we’ll break down why maintaining accurate in accounting matters and how it impacts marketing, staffing, investments, customer experience, and long-term business stability.

How Accurate Accounting Increases Business Value

As a small business owner, you will know that your company requires accurate accounting techniques, and this is where you will have to understand the importance of accounting for business.

So, if you have been procrastinating about making the transition towards more accurate and automated accounting, we have listed down ways how it can help a business be more valuable:

1. Effective Marketing

If you are uninitiated in the entrepreneurship world, you might believe accounting is only about numbers and has little effect on marketing or business operations. But here’s the part many business owners miss:

Accurate accounting, every single day, helps you prepare reliable revenue and earnings forecasts. These forecasts are essential not just for budgeting but also for understanding whether your current marketing efforts are working or missing the mark.

Without updated financial data on earnings, expenses, and cash flow, there is no way to know whether you can afford to launch a new campaign.

Once you maintain accurate accounting records, you start getting real answers to critical marketing questions like:

- When is the right time to launch a campaign?

- How will pricing changes and promotions affect revenue?

- Which marketing channel has the best ROI?

This is one of the biggest reasons growing companies choose accurate accounting solutions or accurate accounting software, as it gives clarity that directly impacts marketing success.

2. Stability Throughout Your Customer Base

A business without accurate accounting is like a ship drifting at sea without a captain—you never know when it might hit an iceberg. Customers don’t want to board a sinking ship, so it’s crucial to maintain accurate data, manage your budget well, and keep the overall customer experience stable.

When money gets tight, businesses often cut costs in ways that affect customer service—layoffs, delayed deliveries, longer response times, and reduced quality.

Accurate accounting services help you:

- Predict cash shortages early

- Avoid poor customer experience caused by reactive cost-cutting

- Maintain consistent service quality

Customer loyalty depends heavily on financial stability, even if customers don’t see it directly.

3. Investments That Improve Quality and Efficiency

Accurate accounting helps you understand how money enters and leaves your business. It also prepares you with enough cash reserves to survive a slowdown. But one of the most underrated benefits is its role in making smarter investment decisions.

Accurate accounting gives clarity on:

-

Whether new equipment will improve output

-

Whether enterprise software can increase team efficiency

-

Whether your business can afford a major upgrade

-

How an investment will affect future cash flow

With timely data from accurate accounting software, business owners can take advantage of opportunities at the right moment instead of guessing or delaying decisions out of fear.

4. Uncompromised Security = Uncompromised Accessibility

Businesses that store accounting data in spreadsheets on a single computer are always at risk. One infected USB, one corrupt file, or one stolen laptop can wipe out years of financial information.

But when your business uses cloud-based, accurate accounting solutions, your financial data stays:

- Safe

- Encrypted

- Accessible anytime from any device

If your computer crashes, you simply log into another device—and everything is still there. Accurate accounting on the cloud ensures your data is always protected and available when your clients need you.

5. Creating and Controlling Budgets

One of the biggest reasons accurate accounting is essential for business is its ability to help create and control budgets. A company without a budget is like a ship drifting without direction.

Accurate accounting helps you:

- Forecast revenue more confidently

- Understand market conditions

- Know when expenses are safe to make

- Avoid financial decisions that put your business at risk

When companies can forecast revenues accurately, they stay prepared for market changes and make smarter financial choices.

6. Personnel Decisions

Accurate accounting services help businesses make better staffing decisions. When you know exactly how much you spend on payroll, taxes, and employee costs, you can confidently decide:

- When to hire new staff

- When to delay hiring

- When restructuring is needed

- How to plan sustainable team growth

These decisions determine whether the business remains profitable or overspends on talent.

7. Monitoring Effective Business Growth

Accurate accounting gives business owners a clear view of their financial health. By understanding assets, liabilities, and cash on hand, you can track your growth more effectively and plan future strategies with confidence.

It becomes easier to:

- Measure performance

- Compare month-over-month growth

- Identify strengths and weaknesses

- Build a roadmap for the next growth phase

Accurate accounting is the foundation of long-term business success.

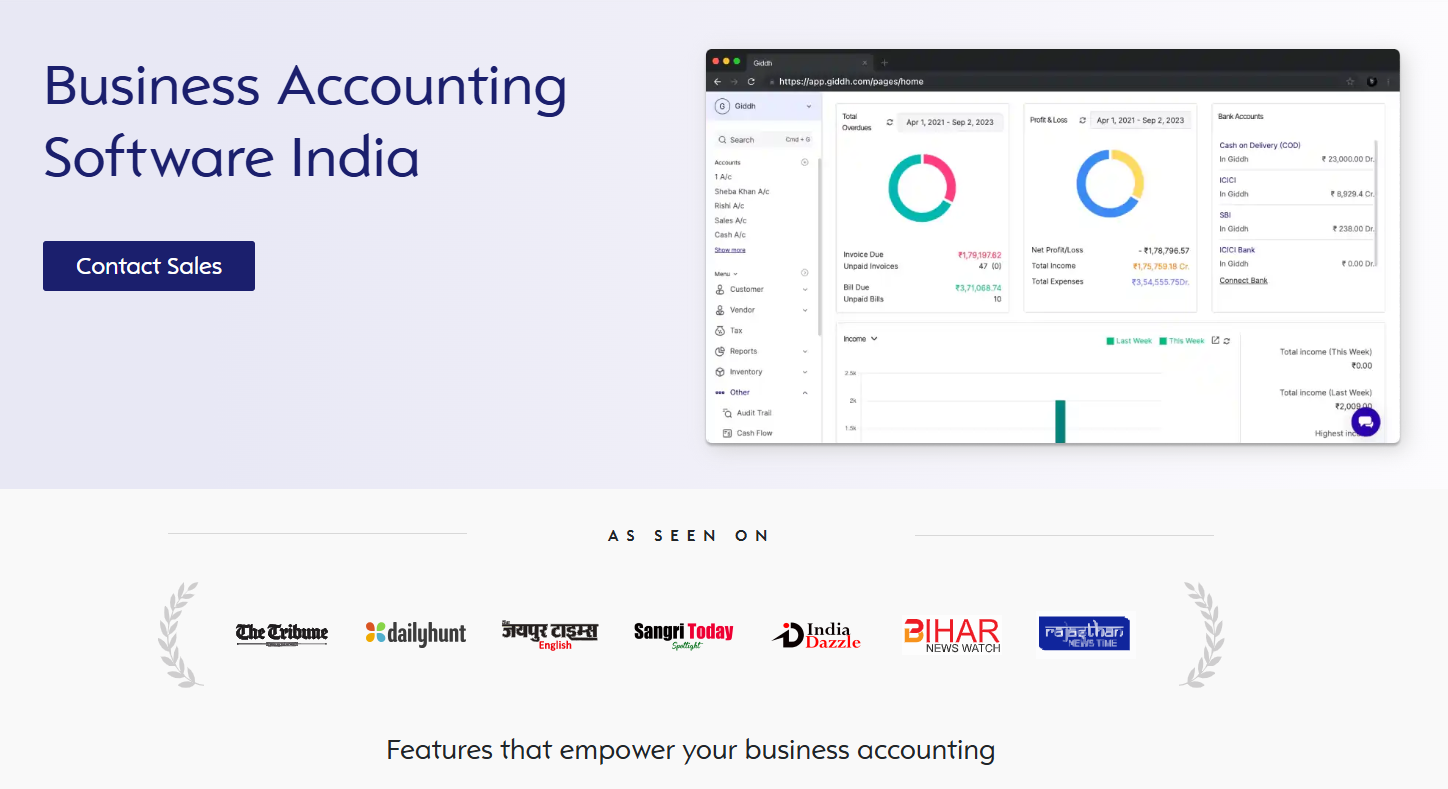

Why Giddh is the Smart Choice for Accurate Accounting

Accurate accounting is the backbone of business success, and Giddh is designed to simplify and automate your financial operations. With Giddh, you can easily manage accounting, taxes, invoicing, and more from a single intuitive platform.

Key Features of Giddh for Accurate Accounting

-

Simplified Ledger-Based Accounting: Streamline your workflow with easy, quick ledger entries, saving time on manual tasks.

-

Real-Time Data on Any Device: Access your financial data from anywhere, anytime, with Giddh’s cloud-based platform and mobile apps.

-

GST Compliance Made Easy: Automate your GST calculations and generate accurate GST reports, ensuring hassle-free tax filing.

-

Multi-Currency Support: Automatically convert currencies for seamless international transactions and accurate financial records.

-

Top-Notch Security: Your accounting data is stored securely with encrypted cloud storage and automatic backups.

-

Manage 100+ Companies: Handle multiple companies under a single subscription, perfect for growing businesses and franchises.

-

Unlimited User Access: Add unlimited users with role-based permissions for efficient collaboration across departments.

Giddh is the ultimate solution for businesses looking to streamline their accounting processes with accurate accounting software. Get started today and keep your financials in perfect order.

Bonus: Sustaining Positive Relationships

Relationships with vendors and customers play an enormous role in the success of any business.

When vendors question why a bill hasn’t been paid, or customers ask why the service they ordered hasn’t been fulfilled, a cloud-accounting platform can help you quickly look for information, find the most relevant data that answers those questions, and serve those customers and vendors without hassles.

This ensures that the relationship between you and your customers/vendors will always be constructive in nature.

Conclusion

You started your business to serve your customers and do what you love. That probably doesn’t include spending hours on accounting and bookkeeping.

Fortunately for you, accurate accounting doesn’t have to take hours out of every week. There’s an ever-growing suite of productivity tools and technologies that can take the pain of managing invoices, bills, and receipts and ultimately give you more time to work on your business instead of in your business.

Got thoughts on ways to increase the value of a business? Don’t sit back and take the discussion to the comment board below!