Top 5 Accounting Software For Businesses In 2026

Running a business comes with its fair share of challenges, and managing finances shouldn’t be one of them. That's where the best accounting software for businesses steps in to simplify the process. For companies in India, finding the right tool can make all the difference in staying organized, ensuring compliance, and making data-driven decisions.

Whether you're a small startup or a growing enterprise, the right accounting solution keeps you on top of your finances and reduces the stress that comes with financial management. Reliable accounting software for business management does more than track numbers. It streamlines financial operations, reduces errors, and provides the valuable insights you need to steer your business in the right direction.

As digital financial management continues to grow, the demand for efficient tools has skyrocketed. According to a 2024 report by Statista, accounting software can help firms grow at a substantial rate in the coming years, reflecting the increasing adoption of cloud-based solutions among businesses of all sizes.

Now, let's dive into the key factors you should consider to pick the best accounting software for businesses.

Top 5 Business Accounting Software in India 2026

In 2026, business owners across India will have a variety of robust accounting tools at their disposal. Whether you're running a startup, a small business, or a large enterprise, there is a solution to streamline your financial processes.

Here's a closer look at the top 5 best accounting software for businesses that are gaining traction in India, focusing on features, benefits, and pricing to help you choose the right fit for your business.

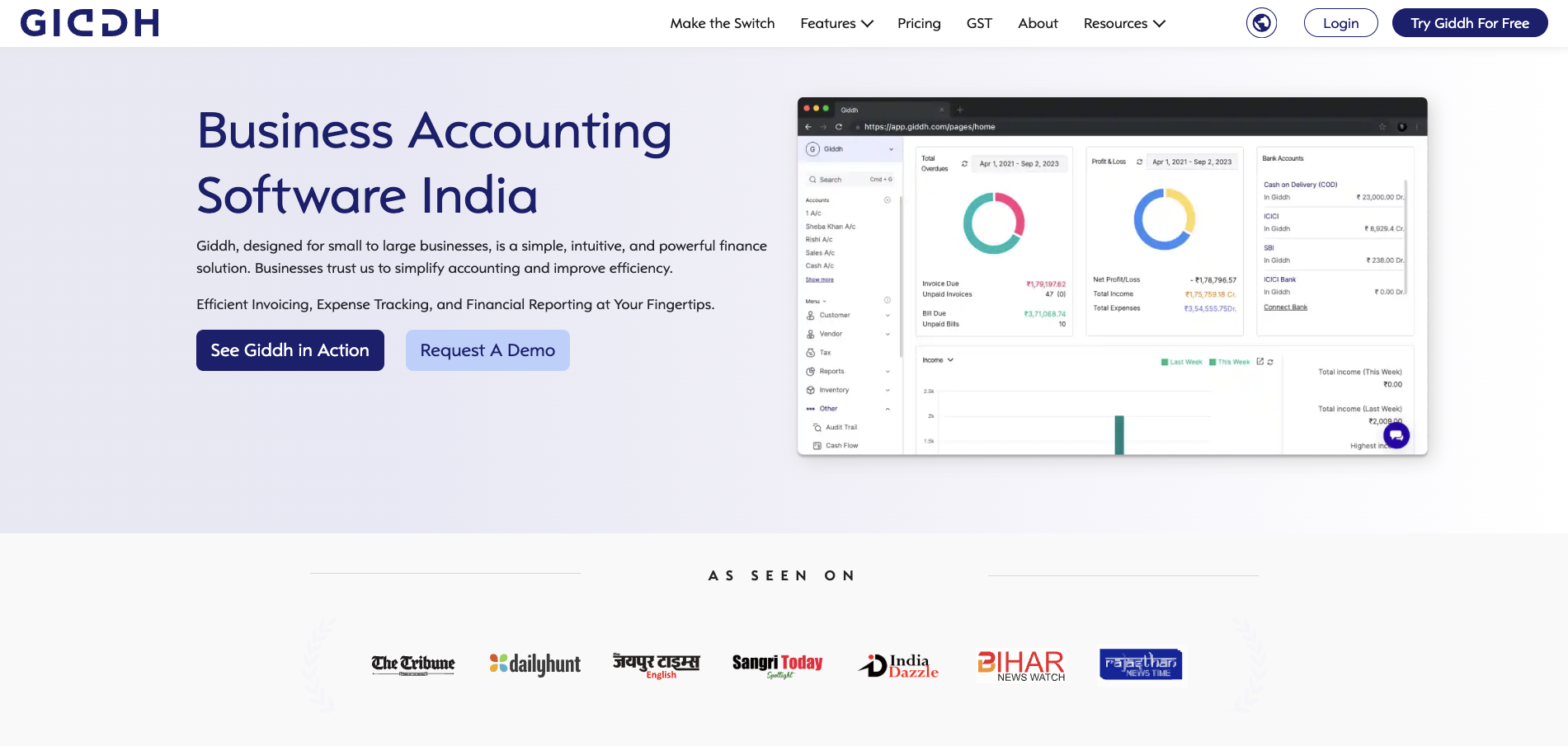

1. Giddh – Best for Small to Medium-Sized Businesses

Giddh is an accounting software that provides a powerful yet affordable solution for managing accounting needs. With strong security measures, automated processes, and scalable solutions, Giddh is the go-to platform for businesses looking to streamline their accounting operations and make informed financial decisions.

Giddh is a versatile feature option for businesses seeking to scale.

- Simplified Ledger-Based Accounting

Giddh organizes financial transactions into ledgers, making it easy to track income, expenses, and liabilities, simplifying financial reporting.

- Automatic Currency Conversion

Real-time currency conversion ensures accurate transactions for international dealings, saving you time on manual updates.

- Manage Over 100 Companies

Easily manage financial operations for up to 100 companies under one account, making it perfect for growing businesses with multiple branches or divisions.

- Unlimited User Access

Giddh allows unlimited users, so you can manage and collaborate with your team without restrictions, assigning access as needed.

- Built-In White Label Option

Rebrand Giddh with your logo and colors for a seamless, professional experience, ideal for accountants offering client services.

- Open & Public API Access

Integrate Giddh with other tools or custom software using its open API, streamlining workflows and data management across platforms.

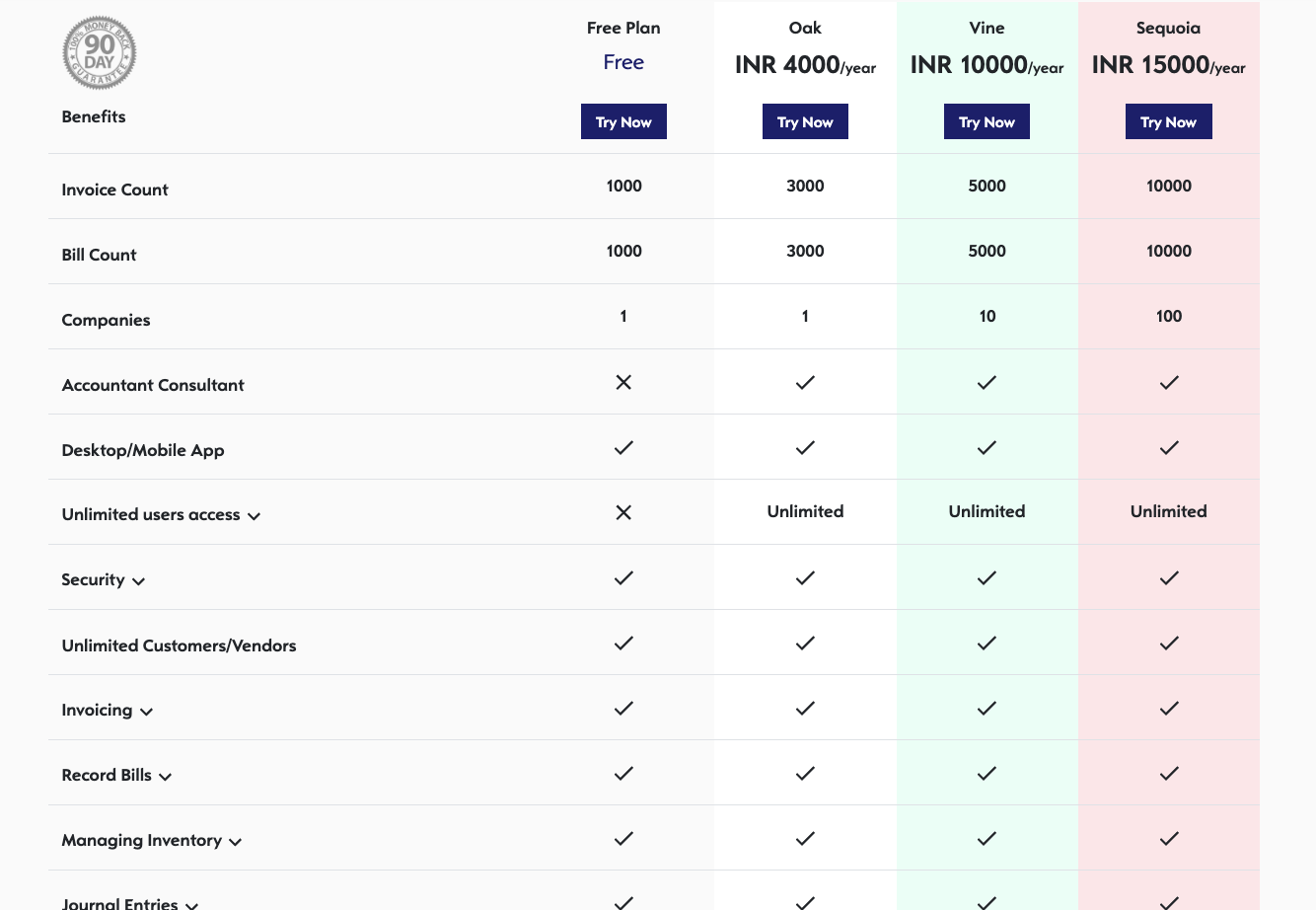

Pricing:

Giddh, as the best accounting software for businesses, offers a free plan with access to core features, and paid plans start at just 400 per month, scaling up to support 100 companies and 1 lakh transactions.

Pros:

- Easy to use with minimal setup.

- Great for multi-branch and multi-company management.

- Strong reporting features.

Cons:

- Over-Reliance on Automation.

2. Tally Solutions – Ideal for Established Businesses

Tally Solutions is an accounting software solution designed for larger businesses that require comprehensive financial management, compliance, and reporting capabilities. It offers powerful GST features, financial management tools, and scalability.

Pricing

Pricing starts from ₹18,000 per year, with advanced plans available for larger businesses.

Pros

- Excellent for financial compliance and GST.

- Robust and customizable reporting features.

- Secure and reliable.

Cons

- Steep learning curve for new users.

- Lacks modern cloud features for remote access.

3. Zoho Books – A Well-Rounded Solution

Zoho Books is a versatile accounting software offering that includes expense tracking, reporting, and automation. It's an ideal invoice software for small businesses , especially those already using Zoho apps.

Pros

- Multi-currency support.

- Strong automation features.

- User-friendly interface.

Cons

- Limited payroll features.

- Pricing can be higher for small businesses.

4. QuickBooks India – Tailored for Indian Business Needs

QuickBooks India enables businesses in India to meet their needs, offering features such as GST filing, payroll management, and simplified tax compliance. It's a reliable option for companies looking for a comprehensive financial tool.

Pros

- GST filing and payroll management tailored for India.

- Simple to use with minimal setup.

- Great customer support.

Cons

- Expensive for businesses with minimal accounting needs.

- Lacks customization options compared to others.

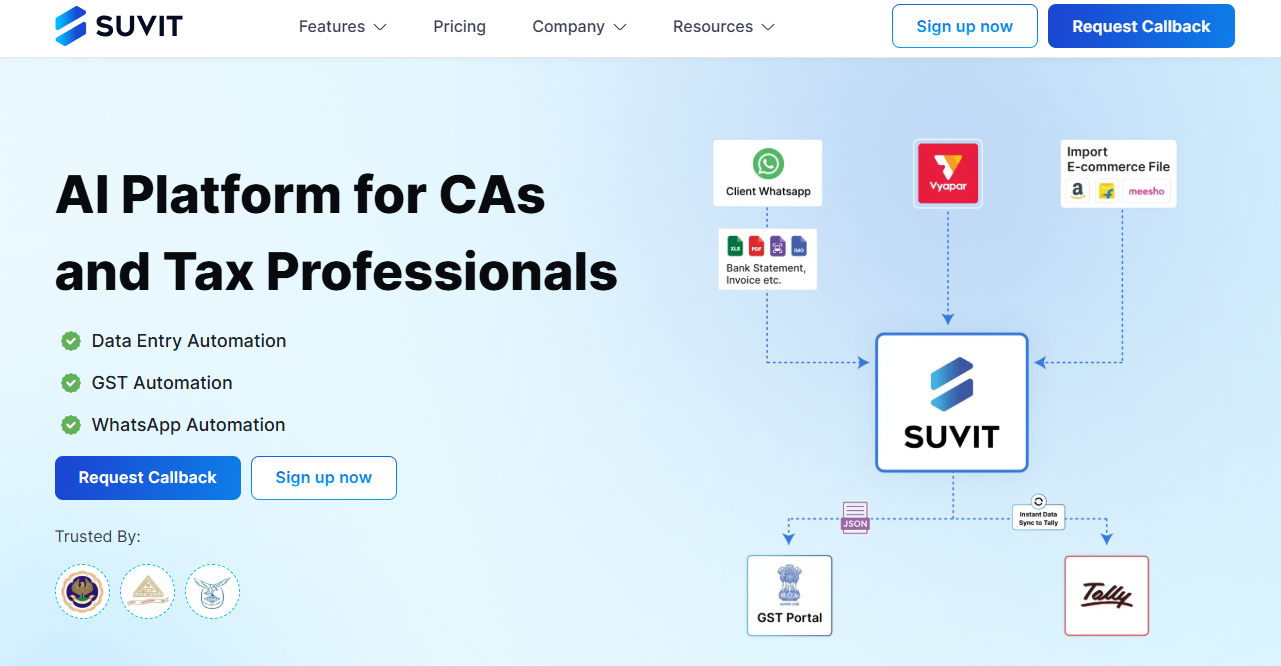

5. Suvit – A Strong Tool for Startups

Suvit is an accounting and tax filing software designed specifically for startups, focusing on financial management. It's affordable and straightforward, making it an ideal choice for companies just starting.

Pros

- Simple and easy to use.

- Affordable for startups.

- Great for tax filing.

Cons

- Lacks advanced features like multi-currency support.

- Not scalable for larger businesses.

What Are the Features to Look for in Accounting Software?

Selecting the best accounting software for businesses is a crucial decision that can streamline operations, ensure compliance, and help companies stay financially on track. Here's a comprehensive overview of the key features to consider when choosing cloud-based accounting software, particularly for small businesses or growing enterprises.

Key Features to Look for in Accounting Software

1. GST/VAT Compliance

Compliance with local tax laws, such as the Goods and Services Tax (GST) in India, is non-negotiable. The software should automate tax calculations, ensure accurate filings, and help businesses stay compliant with the latest regulations.

- Automatic tax calculations based on current GST/VAT rates.

- Simplified GST filing and reporting.

- Timely updates for tax law changes.

2. Multi-User Access

If your business has multiple employees, multi-user access is essential for collaboration. The software should allow different team members to access the system with varying levels of permission, ensuring security while improving team productivity.

- Different user roles with varying levels of permissions.

- Secure access control to safeguard sensitive financial data.

- Collaborative features for team-based work.

3. White-Label Option

The best accounting software for businesses typically includes a white-label option, which enables you to rebrand the software as your own. This feature is handy for accountants and companies that offer financial services to their clients. This feature helps deliver a seamless, branded experience.

- Rebrand the interface with your logo and design.

- Use the platform as part of your service offerings.

- Retain complete control over client interactions and data.

4. Real-Time Tally Sync

For businesses that need accurate, up-to-date financial data, real-time tally sync ensures that all records are updated instantly. This feature is crucial for companies that process multiple transactions throughout the day.

- Automatic syncing of entries and transactions in real-time.

- Reduced risk of errors due to outdated information.

- Instant access to financial data for informed decision-making.

5. Ledger-Based Accounting

Ledger-based accounting involves categorizing all financial transactions accurately and systematically. This approach enables businesses to utilize the best accounting software, allowing them to maintain accurate records, track expenses, and manage their income in a structured manner.

- Well-organized financial records for easy tracking.

- Simplifies audits and tax filings.

- Clear breakdowns of income, expenses, and liabilities.

6. Automated Reports (P&L, Balance Sheets)

Automated financial reports, such as Profit and Loss (P&L) statements and Balance Sheets, are essential for gaining quick insights into the economic health of the business. These reports can automatically save time and reduce the risk of human error.

- Real-time generation of reports.

- Customizable formats based on business needs.

- Automatic updates that reflect changes in financial data.

7. Inventory Management

For product-based businesses, inventory management is critical. Accounting software with this feature helps track stock levels, manage reorders, and integrate this data with overall accounting records for better decision-making.

- Track inventory in real-time with seamless integration to accounting records.

- Automatic alerts for low stock levels.

- Manage supplier orders and customer deliveries.

8. Integration with Banks and Payment Systems

To simplify financial operations, your best accounting software for businesses should integrate with your bank accounts and payment systems. This integration helps automate transactions and improves accuracy when reconciling financial records.

- Sync transactions directly from your bank account.

- Seamless integration with online payment gateways.

- Automated reconciliation of payments and receipts.

9. Cloud-Based Access and Data Security

Cloud-based accounting software allows you to access your financial data anytime and anywhere. The added benefit of data security ensures that your sensitive business information is safe with encryption and secure access protocols.

- Cloud-based access for flexibility and remote work.

- Strong data encryption for privacy and security.

- Regular data backups prevent loss.

10. Importance of Scalability

As your business grows, so will your accounting needs. The software you choose should be scalable, offering the flexibility to accommodate more users, transactions, and features without compromising performance.

- Ability to add new users, companies, and branches as needed.

- Easily upgrade to more advanced features.

- Support for more complex financial operations as the business grows.

With Giddh, you get all the accounting solutions that can support your business growth while maintaining robust financial management.

Start managing your business finances effectively today with Giddh. Explore Giddh’s Features.

How to Choose the Right Accounting Software for Your Business

The right solution can help streamline operations, improve accuracy, and ensure compliance with financial regulations. However, with numerous options available, selecting the best accounting software for business can be a challenging task. Here are the key factors to consider when choosing the right platform that aligns with your business needs and growth plans.

Factors to Consider When Choosing Accounting Software

1. Size of Your Business

The size of your business affects the type of software you need. Small businesses need simple tools, while larger companies need more advanced features.

- Small businesses: Simple, cost-effective tools.

- Larger businesses: Scalable, advanced features.

2. Budget and Pricing Plans

Your budget determines the software you can afford. Look for plans that fit your business size and growth.

- Choose affordable plans for small businesses.

- Look for scalable pricing as your business grows.

3. Required Features (GST, Reporting, etc.)

Ensure that the best accounting software for businesses includes essential features such as tax compliance and reporting.

- GST compliance for Indian businesses.

- Automated reports like P&L and Balance Sheets.

- Inventory or payroll management, if needed.

4. Customer Support and Training

Good support ensures you can resolve issues quickly. Check for helpful training resources.

- Look for 24/7 support.

- Check for training resources like tutorials.

5. Integration with Other Tools

Your software should integrate seamlessly with other business tools, such as banking systems and CRM software.

- Ensure bank and payment integration.

- Look for app integrations.

Final Thought

So, selecting the right cloud-based accounting software can actually shape how smoothly your business operates, now and in the future. The tools we've explored—Giddh, Tally Solutions, Zoho Books, QuickBooks India, Suvit, Hive Payroll, and Volopay—each offer unique features tailored to different business needs.

By investing in the proper accounting tool, businesses can reduce errors, improve decision-making, and free up valuable time to focus on growth.

Looking for a powerful and user-friendly accounting solution? Giddh offers everything your business needs to manage finances effectively. Explore its features and see how it can simplify your accounting processes. Start exploring Giddh today.

FAQs

1. How does Giddh stand out among other accounting software?

Giddh excels in real-time GST compliance, multi-company support, and inventory management, making it an ideal solution for small and medium-sized businesses in India. It provides seamless access to financial data in one place.

2. Can I integrate accounting software with my business bank account?

Yes, Giddh and most modern accounting software integrate seamlessly with bank accounts and payment systems, providing real-time updates and streamlined transactions.

3. Is accounting software necessary for a startup in India?

Yes, the best accounting software for businesses is crucial for startups in India, as it helps automate tax filing, expense tracking, and reporting. It ensures GST compliance and reduces manual errors.

4. How much does accounting software cost in India?

Accounting software pricing varies based on features and business size. Giddh starts at INR 400 per month, with flexible plans for growing businesses.

5. Do I need technical knowledge to use accounting software?

No, Giddh and other modern software are user-friendly, with intuitive interfaces and tutorials. A basic understanding of accounting is helpful, but no advanced technical knowledge is required.

6. Can I upgrade my accounting software as my business grows?

Yes, Giddh and most accounting software for startups in India offer scalable plans, allowing businesses to upgrade features like multi-branch support and advanced reporting as they expand.