How Advanced Financial Reporting Software Maximizes Business Bottom Line

A recent study revealed that 60% of Indian SMBs face audit delays or penalties due to inaccurate or outdated financial data. Imagine how many business decisions are impacted by such inaccuracies.

Every finance team, from CFOs to controllers, is familiar with the stress of compiling reports manually, dealing with endless spreadsheets, and the constant back-and-forth with auditors, as well as the fear of missed deadlines or regulatory non-compliance. But what if there was a way to cut that time in half while improving data accuracy and ensuring compliance?

Is your finance team still living in spreadsheets? If the answer is yes, it's time to rethink your approach. Advanced financial data reporting software offers a more innovative and efficient approach to managing financial data and reporting processes.

In this blog, we'll explore exactly how such tools can transform your bottom line.

What Is Financial Data Reporting Software?

A Simple, Powerful Upgrade for Finance Teams

At its core, financial data reporting software is a tool designed to automate and streamline the process of generating financial reports, enabling financial teams to spend less time on manual tasks and more time on strategic decision-making.

This software is designed to handle key areas, including data collection, reconciliation, and compliance reporting, ensuring your reports are not only accurate but also timely and fully compliant with local regulations, such as GST and TDS in India.

Think of it like upgrading from a basic calculator to an intelligent CFO assistant. Instead of manually entering numbers and waiting hours to generate reports, the software automates this entire process, allowing your finance team to focus on more critical tasks, such as financial planning and strategy.

Key Features of Financial Data Reporting Software

-

Automation: Automates data entry, reconciliation, and financial report generation.

-

Reporting Dashboards: Offers intuitive dashboards to visualize key financial metrics.

-

Audit Logs: Detailed logs that ensure transparency and help with audit readiness.

-

Compliance Templates: Built-in templates for GST, TDS, and other local tax regulations to simplify compliance.

This software can integrate seamlessly with your existing accounting stack, whether you're using Tally or Excel, ensuring a smooth transition with minimal disruption.

How Can Advanced Financial Reporting Tools Optimize Your Bottom Line?

Advanced financial reporting tools enable businesses to optimize their profits by saving time, reducing errors, and gaining actionable insights that directly impact profitability and growth.

Automated Financial Reporting: Saving Time and Reducing Errors

Manual reporting is prone to human errors, miscalculations, and outdated data. These mistakes can cost businesses valuable time and resources, especially when it comes to compliance or making strategic decisions.

By automating the financial reporting process, these errors are virtually eliminated, and the time spent on generating reports is drastically reduced.

Key benefits:

-

Accuracy: Reduces the risk of errors in calculations, data entry, and report generation.

-

Time Efficiency: Saves hours, if not days, that would otherwise be spent on manual report preparation.

-

Consistency: Ensures consistent, accurate financial records for easy audits and evaluations.

Real-Time Business Insights: Enabling Smarter, Faster Decisions

Traditional reporting systems often rely on data that is outdated by the time it is reviewed. Advanced financial reporting tools provide real-time business insights, making financial data instantly accessible to your team. This allows decision-makers to act quickly with up-to-date information, ensuring that you never miss a business opportunity.

Key benefits:

-

Continuous Access: Stay informed about key metrics, including cash flow, profitability, and departmental expenses.

-

Quick Decision-Making: Make informed decisions faster with the most current financial data.

-

Increased Profitability: Faster insights lead to quicker actions, ultimately driving growth.

Enterprise Performance Management (EPM): Aligning Reporting with Growth Goals

Advanced financial reporting tools often come with Enterprise Performance Management (EPM) capabilities, which help businesses align their financial data with long-term strategic objectives. These tools support performance tracking, forecasting, and ensuring that every financial report ties directly to the company’s KPIs (Key Performance Indicators).

Key benefits:

-

Goal Alignment: Ensure that all financial data aligns with growth goals and performance targets.

-

Forecasting: Anticipate financial trends and make proactive adjustments.

-

Strategic Decisions: Support your leadership team in making informed decisions that drive long-term success.

Customized Financial Dashboards: Tailored KPIs for Each Department

Every department within a company has its own unique set of metrics that matter most to it. With financial reporting software, businesses can create customized financial dashboards to highlight the key performance indicators (KPIs) that are most relevant to each department.

Key benefits:

-

Department-Specific Insights: View financial data that is most relevant to each team’s objectives.

-

Quick Visual Representation: Dashboards enable straightforward interpretation of financial data at a glance.

-

Improved Communication: Align teams with a unified, clear financial overview.

Error Reduction & Data Accuracy: Stronger Compliance and Audit Readiness

Automated financial reporting significantly reduces the potential for human errors. Continuous reconciliation of financial data ensures that your reports are accurate, compliant with the latest regulations (like GST and TDS), and ready for audit at any time.

Key benefits:

-

Fewer Mistakes: Automates reconciliation and error-checking, ensuring greater data integrity.

-

Audit-Ready: With accurate and up-to-date reports, you’re always prepared for an audit.

-

Compliance: Ensures financial records are consistently compliant with local regulations.

Faster Closing Cycles: Quick Month-End and Year-End Reporting

Month-end and year-end reporting cycles are traditionally lengthy and labor-intensive. With advanced financial reporting tools, closing cycles are shortened, making it easier to close the books on time and with greater accuracy. This is particularly beneficial during audit season, when having timely and accurate data can prevent delays and issues.

Key benefits:

-

Quick Closures: Close books more efficiently at month-end and year-end.

-

Less Stress: Minimize last-minute scrambling to finalize reports.

-

Timely Reports: Always have accurate reports ready for audit or board meetings.

Scalable Reporting Solutions: Adapting to Multi-Entity and Global Needs

As businesses grow, their financial reporting needs evolve. Advanced financial reporting tools are built to scale, accommodating multi-entity businesses or those with international operations. These tools simplify multi-currency transactions and consolidate financial data from different regions or business units into one unified report.

Key benefits:

-

Scalable: Manage the financial data of a growing business without increasing complexity.

-

Global Transactions: Handle multiple currencies and regions with ease.

-

Simplified Consolidation: Consolidate data from different branches or business units into a single, coherent report.

Integrated Financial Data Analytics: Deeper Insights for Strategy

Beyond traditional reporting, many financial reporting tools now integrate data analytics. This enables businesses to analyze historical data, trends, and forecast future performance, providing CFOs and finance management teams with a deeper understanding of their financial health. These insights enable more strategic, long-term decision-making.

Key benefits:

-

Predictive Analytics: Forecast future trends to stay ahead of potential challenges.

-

Strategic Planning: Make data-driven decisions that support business growth.

-

Trend Analysis: Identify patterns that influence financial strategy and inform decision-making.

Cross-Department Collaboration: Unified, Transparent Reporting

Finance teams are often siloed from other departments, which can lead to discrepancies and misaligned financial goals. Advanced financial reporting software brings together departments by providing transparent, unified reporting. Everyone from HR to procurement can work with the same, up-to-date financial data.

Key benefits:

-

Collaboration: Foster cross-department collaboration with shared financial insights.

-

Transparency: Ensure all departments are aligned on financial data and objectives.

-

Accurate Decision-Making: Facilitate company-wide decisions based on the same financial data.

Cost Optimization: Lowering Operational Costs and Boosting ROI

By automating tasks that were previously manual, businesses save valuable time and resources. The efficiency gains from advanced financial reporting software can lead to a significant reduction in operational costs, while boosting ROI. For example, an Indian logistics company saved ₹3.5 lakh annually by automating GST compliance alone.

Key benefits:

-

Reduced Labor Costs: Automating reporting reduces the need for manual labor.

-

Higher ROI: Faster, more accurate reporting leads to better-informed decisions and improved financial performance.

-

Cost Savings: Save money by eliminating the time and resources spent on manual processes.

How to Choose the Right Financial Reporting Software

When selecting financial reporting software for your SMB in India, focus on tools that meet your current needs and scale with your business. Here’s a quick checklist of key features to look for:

Checklist for Indian SMBs

India-Specific Compliance

Ensure the software handles GST, TDS, and MCA regulations automatically, ensuring compliance at all times.

-

Why it matters:

-

GST Filing: Automates GST filing and reduces errors.

-

TDS Reports: Compliant with Indian tax laws.

-

MCA Compliance: Aligns with regulatory standards.

-

-

Audit-Ready Exports

Choose software that lets you easily export reports in formats like XML, Excel, or PDF for auditors.

-

Why it matters:

-

Streamlined Audits: Quick export for auditors.

-

Reduced Delays: Speed up the audit process.

-

Error-Free: Minimize discrepancies.

-

-

Real-Time Dashboards

Opt for software with real-time dashboards to monitor key metrics like cash flow and expenses.

-

Why it matters:

-

Instant Access: View data anytime, anywhere.

-

Better Decisions: Make informed choices faster.

-

Customizable KPIs: Focus on what matters most.

-

-

Cloud Access

Choose cloud-based solutions for flexibility, security, and scalability.

-

Why it matters:

-

Secure and Reliable: Robust data protection.

-

Anywhere Access: Access reports from any location.

-

Scalable: Grows with your business.

-

-

Easy Excel/Tally Migration

Ensure the software supports smooth migration from Tally or Excel, minimizing disruption.

-

Why it matters:

-

Seamless Transition: Simple data migration.

-

Minimal Disruption: Continue daily operations without interruption.

-

Data Integrity: Ensure no data loss during migration.

-

-

Why Giddh Is the Smart Choice for Finance Leaders

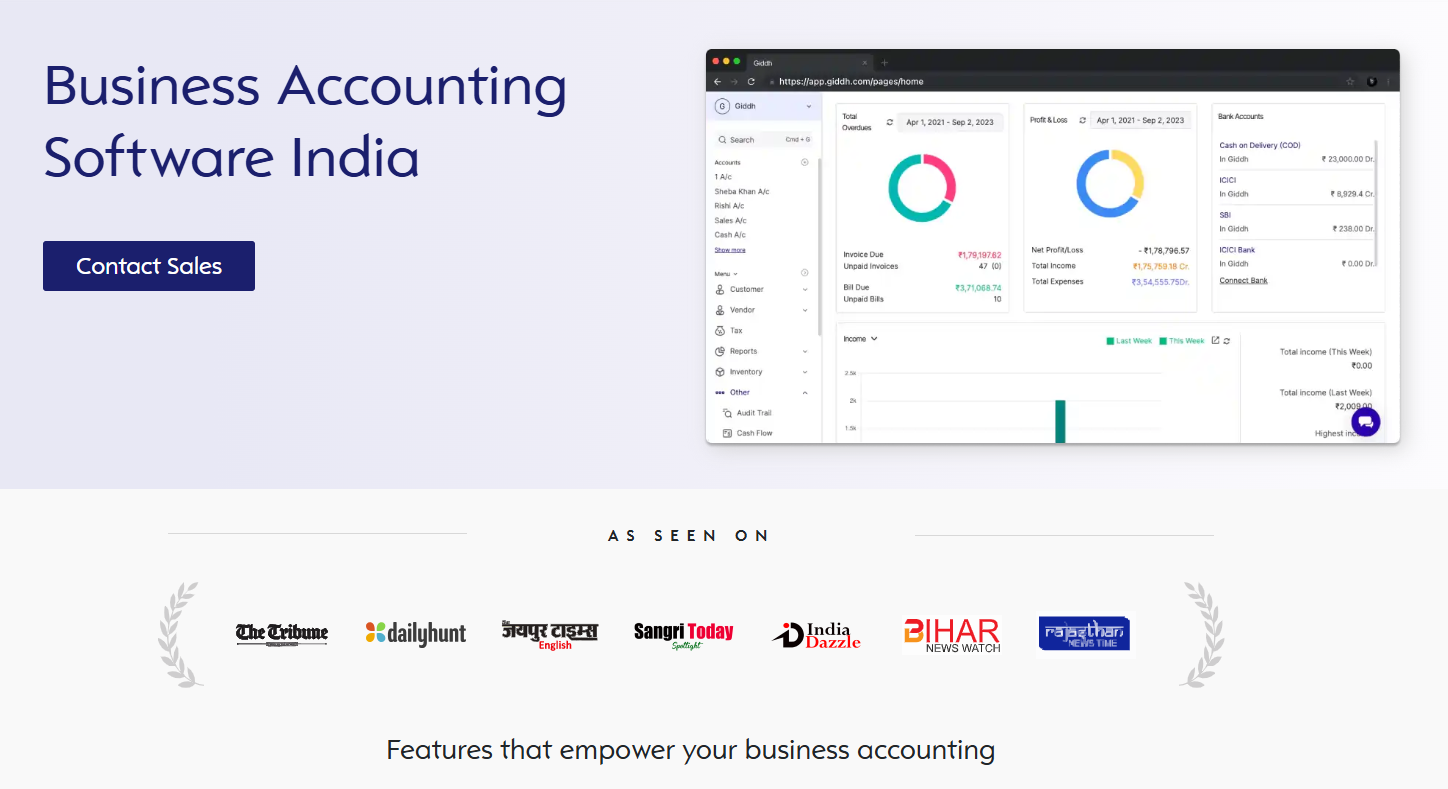

Giddh is an advanced, cloud-based financial data reporting software tailored for businesses in India. Its focus on automation, scalability, and real-time insights makes it the ideal choice for CFOs, finance directors, and controllers who need to manage growing businesses while ensuring compliance and accuracy.

Key Features of Giddh for Finance Teams

-

Automated, Real-Time Dashboards: Instant access to accurate financial insights.

-

Ledger-Based Accounting: Simplified tracking with precision.

-

Multi-Currency Support: Easy handling of global transactions.

-

White-Label Option: Custom branding for enterprises and partners.

-

Unlimited User Access: No restrictions on team collaboration.

-

Manage Over 100 Companies: Centralized control for group businesses.

-

Bank Reconciliation: Smooth and error-free reconciliation processes.

How Giddh Helps Optimize Financial Performance and Profitability

-

Faster decision-making with real-time financial data.

-

Reduced manual errors and operational costs.

-

Improved compliance, transparency, and audit readiness.

-

Stronger financial visibility across multiple business units.

Conclusion:

The risks of relying on outdated financial reporting systems are clear: missed deadlines, inaccuracies, and the potential for costly compliance penalties. By adopting advanced financial data reporting software, businesses can not only optimize their bottom line but also ensure smoother, faster, and more accurate reporting processes.

Switching to automated tools might feel like a big leap, but in reality, it’s easier and more cost-effective than most businesses assume. Imagine walking into your next audit with complete confidence and zero anxiety.

Call to Action: Ready to streamline your audits and secure your bottom line? Start your Giddh trial today.

FAQs:

Q1: What is financial data reporting software?

Financial data reporting software automates the process of creating accurate and timely financial reports, ensuring compliance with regulations and offering real-time insights.

Q2: Is this software only for large companies?

No, financial reporting software is beneficial for businesses of all sizes, including small and medium-sized enterprises (SMBs) that need to scale their financial operations efficiently.

Q3: How long does it take to implement?

Most financial reporting software, including Giddh, can be set up within a few days. It’s easy to integrate with your existing tools like Excel or Tally.

Q4: Will it replace my accountant?

No, it complements your finance team by automating manual tasks. Your accountants will be able to focus on more strategic tasks instead of data entry and reconciliation.

Q5: How much does it cost?

Costs vary depending on the size and needs of your business. However, most businesses recover their investment within the first few months thanks to increased efficiency and reduced errors