10 Best Accounting Software For Business In 2026

The Indian accounting software market was valued at USD 3.38 billion, and this figure is expected to grow by a CAGR of 9.1% until 2030. As businesses continue to expand and embrace digital transformation, the importance of a reliable accounting software system has never been more evident.

But with so many options available, how do you know which software is truly the best accounting software for business?

Are you finding it increasingly challenging to manage invoicing, compliance, and reporting manually? Or is your existing system failing to scale with your business growth, and leading to errors? These are the questions many business owners and finance managers across India are asking themselves as they look ahead to 2026.

The goal of this guide is to help you navigate through the 10 best accounting software solutions for businesses of all sizes. Whether you’re managing a startup, small enterprise, or a larger corporation, the software you choose will directly impact your bottom line.

So, let’s take a closer look at how to pick the right tool for the job and how it can make a significant difference in your financial operations.

What Are the Key Features to Look for in the Best Accounting Software for Businesses?

When choosing the best accounting software for business, it’s essential to look beyond just the price tag. While cost is a critical factor for small businesses, features such as automation, scalability, and integration capabilities are what will truly determine the right fit for your company. Here’s a breakdown of the key features to consider:

-

GST Compliance: As businesses in India must adhere to Goods and Services Tax (GST) regulations, the software must support GST invoicing and filing capabilities.

-

Automation: The best accounting software automates repetitive tasks, reducing human errors, saving time, and enhancing accuracy.

-

Cloud Access: Cloud-based software ensures that data is always accessible, secure, and updated in real-time.

-

Integration: Seamless integration with other tools you already use, such as CRM systems, payment gateways, and bank accounts, is crucial for streamlining workflows.

-

User-Friendly Interface: The software should be easy for non-accountants to use, with intuitive navigation and simple reporting features.

These features help ensure smooth, error-free financial management for businesses, especially those growing rapidly or operating across multiple locations.

Comparison Matrix:

| Software | Pricing | Best For | Key Features | USP |

|---|---|---|---|---|

| Giddh | ₹1,999/month | SMBs, startups | GST invoicing, Cloud-based, Real-time sync | Easy integration, Affordable for SMBs |

| TallyPrime | ₹18,000/year | Complex accounting needs | Multi-currency, GST-ready, Custom reports | Trusted in India, Strong community support |

| Zoho Books | ₹2,499/month | Startups, small businesses | Automated invoicing, Mobile app, GST filing | Integrates with Zoho apps, Cost-effective |

QuickBooks Online | ₹5,500/month | SMBs, medium businesses | Automated invoicing, GST filing, Real-time data | Global support, Strong integrations |

| Vyapar | Free/₹2,500/year | Small traders, shopkeepers | GST invoicing, Inventory tracking, Mobile-first | Mobile-first, Affordable |

| Busy Accounting | ₹7,500/year | Wholesalers, retailers | GST invoicing, Multi-location inventory | Ideal for traders, Strong reporting tools |

| Marg ERP | ₹18,000/year | Retail and pharmaceutical industries | Inventory, GST filing, Tax management | Tailored for retail/pharma, Robust inventory |

| SlickAccount | ₹1,999/month | Small businesses, startups | Automated invoicing, Cash flow, Budgeting | User-friendly, Affordable |

| Xero | ₹3,500/month | Growing businesses, multi-location | Cloud-based, Multi-currency, GST integration | Global operations, Strong app integrations |

SAP Business One | ₹1,50,000/year | Fast-growing enterprises, SMEs | Full ERP, Financial forecasting, Reporting | Highly scalable, Full ERP integration |

Top 10 Accounting Software for Business in 2026

As businesses continue to grow and evolve, choosing the best accounting software becomes a crucial decision for ensuring streamlined operations, accurate financial reporting, and effective compliance. In 2026, a robust accounting system can save businesses time, reduce errors, and facilitate financial decision-making.

This list covers the top accounting software for businesses in India, tailored for both small and large companies, and offers unique features to help simplify accounting, invoicing, and financial reporting.

Here’s a comprehensive guide to the best accounting software for business in 2026, helping you make an informed choice for your business needs.

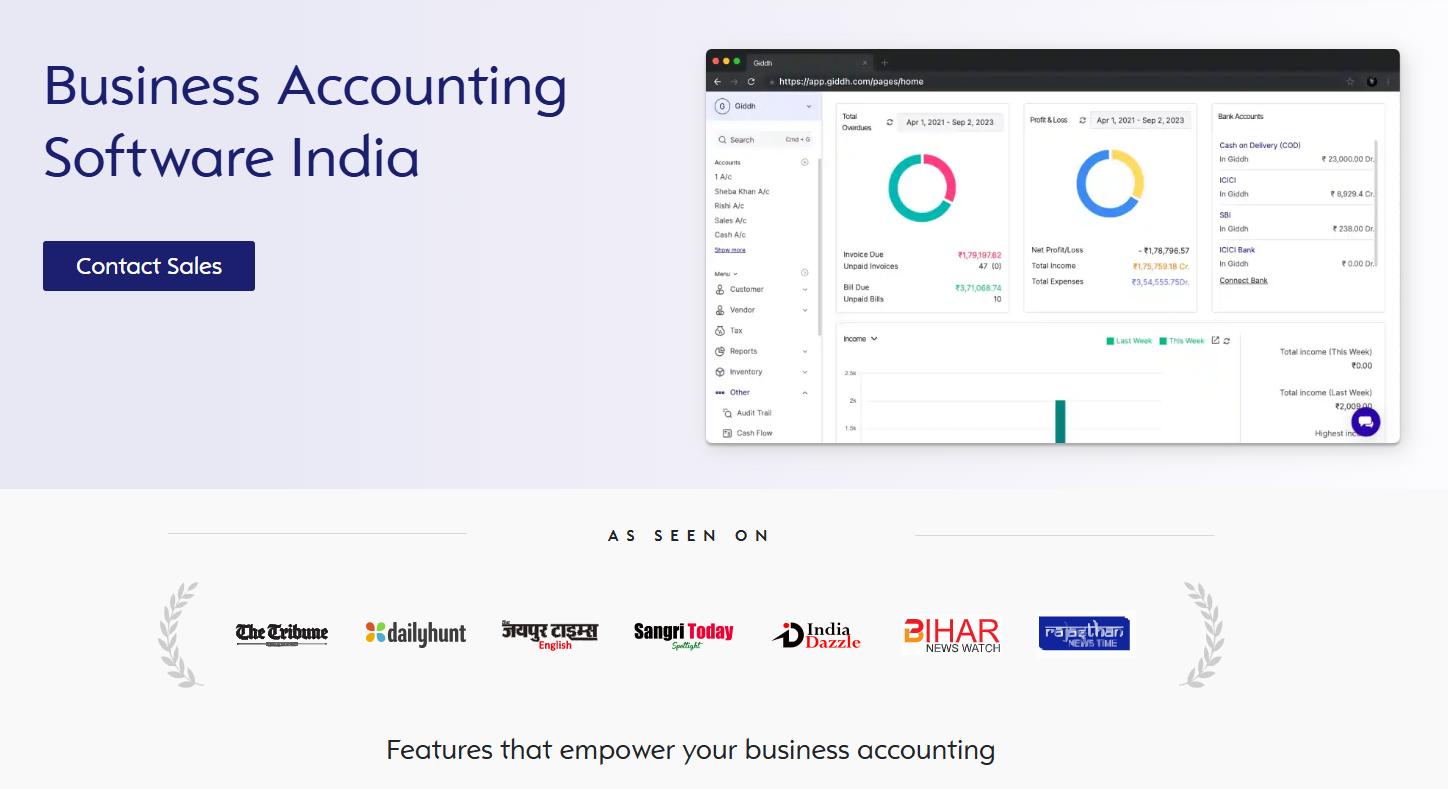

1 Giddh

Giddh is a comprehensive online accounting solution that seamlessly integrates with accounting systems, designed specifically for small to medium-sized businesses (SMBs) in India. It simplifies invoicing and financial reporting, offering businesses a user-friendly, cloud-based solution that automates and streamlines accounting tasks to save time and reduce human errors.

Key Features:

-

Cloud-Based Accessibility:

-

Access your accounting data from any device, anytime, anywhere.

-

Ensure real-time updates and data synchronization across your team, regardless of location.

-

-

GST-Compliant Invoicing & Filing:

-

Automatically generate GST-compliant invoices.

-

Simplify GST filing with accurate tax calculations and submissions.

-

Stay compliant with the latest tax regulations for Indian businesses.

-

-

Real-Time Data Sync:

-

Automatic reconciliation of transactions.

-

Real-time updates that reflect in the system, ensuring your reports are always up-to-date.

-

-

Invoice Automation:

-

Create and send invoices in minutes, automatically tracking payments and due dates.

-

Reduce administrative burden with automated reminders for overdue invoices.

-

-

User-Friendly Interface:

-

Intuitive design and easy navigation make it simple for non-accountants to use.

-

Quick onboarding ensures your team can get started without hassle.

-

-

Scalable for Business Growth:

-

Giddh adapts as your business grows, offering multi-user access and advanced reporting as needed.

-

Supports multiple accounts and complex business structures without compromising on performance.

-

-

Integrated Financial Reports:

-

Generate detailed reports like Profit & Loss, Balance Sheets, and Cash Flow.

-

Analyze your business’s financial health with a click, making it easier to make informed decisions.

-

-

Customizable Features:

-

Tailor the software to your business's unique needs.

-

Customize invoicing templates, payment gateways, and tax settings to fit your workflow.

-

Pros:

-

Highly scalable to accommodate business growth.

-

Easy integration with existing accounting systems.

-

User-friendly interface with quick onboarding for teams.

Cons:

- Limited advanced features for large enterprises with complex needs.

2 TallyPrime

TallyPrime is one of India’s most trusted and widely used accounting software solutions for SMBs. Known for its rich history in the Indian market, it remains a powerful tool for businesses dealing with complex accounting needs and high volumes of transactions.

Features:

-

Multi-currency and multi-user accounting support for global and multi-location businesses.

-

GST-ready with customizable reports for detailed financial management.

Pros:

-

Ideal for businesses with complex accounting needs, such as inventory management and taxation.

-

There is strong community support and resources in India.

Cons:

-

Steep learning curve for new users unfamiliar with accounting software.

-

Expensive customization is often required for small businesses or those with unique needs.

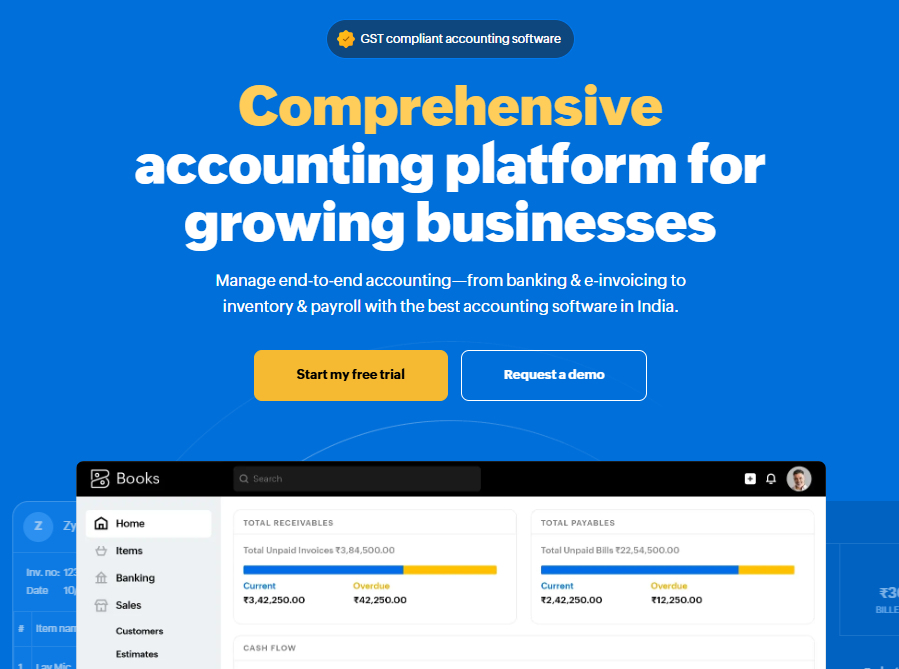

3 Zoho Books

Zoho Books is a cloud-based accounting software that’s a part of the Zoho ecosystem. Designed with startups and small businesses in mind, Zoho Books helps companies automate routine accounting tasks and ensure compliance with Indian tax regulations.

Features:

-

Cloud-based and GST-compliant for easy tax filing.

-

Automated workflows for invoicing, payments, and reporting.

Pros:

-

Affordable for small businesses and startups.

-

Strong mobile app for managing finances on the go.

Cons:

-

Limited offline functionality.

-

Additional costs apply for more advanced features, such as inventory management.

4 QuickBooks Online

QuickBooks Online is a globally recognized accounting software, known for its intuitive user interface and easy-to-use features. It’s an excellent choice for businesses of all sizes, with localized features for Indian companies such as GST filing integration and automated invoicing.

Features:

-

Cloud-based with real-time financial data updates.

-

GST filing integration for easy tax management.

Pros:

-

Excellent customer support and strong third-party integrations.

-

Intuitive UI, making it easy for even non-accountants to use.

Cons:

-

This option is expensive for small businesses or those on a tight budget.

-

Lacks full-fledged payroll features specific to India.

5 Vyapar

Vyapar is a mobile-first accounting software built for small traders and shopkeepers. Its simple yet effective tools make it ideal for businesses with limited accounting expertise, enabling them to manage their finances seamlessly.

Features:

-

GST-compliant invoicing and reporting.

-

Inventory tracking and financial reporting features.

Pros:

-

Affordable and easy to use for small businesses.

-

Mobile-first for on-the-go access, perfect for retail businesses.

Cons:

-

Not scalable for medium-sized businesses.

-

Limited customization options are available for businesses with unique needs.

6 Busy Accounting Software

Busy Accounting Software is ideal for wholesalers and retailers, offering a comprehensive solution for managing finances, taxes, and inventories. It is a GST-compliant accounting tool that can handle complex financial reporting requirements.

Features:

-

GST-compliant invoicing and filing.

-

Multi-location inventory tracking and financial reporting.

Pros:

-

Strong reporting tools that help businesses make informed decisions.

-

Ideal for trading businesses with complex inventory needs.

Cons:

-

The absence of a mobile app can limit accessibility.

-

Complex interface for first-time users.

7 Marg ERP

Marg ERP is an ERP-level accounting software tailored to the needs of the retail and pharmaceutical industries. It provides robust tools for inventory and financial management, making it suitable for businesses in these sectors.

Features:

-

Inventory management integrated with accounting.

-

GST filing and tax management.

Pros:

-

Tailored for retail and pharmaceutical businesses, with specialized features.

-

Robust inventory management to track stock and orders.

Cons:

-

The interface is complex for users unfamiliar with ERP systems.

-

Expensive for small businesses looking for a basic solution.

8 SlickAccount

SlickAccount is designed for small businesses seeking a straightforward accounting tool that focuses on automated invoicing, payment tracking, and budgeting. It’s an ideal solution for startups that need a straightforward solution for managing their finances.

Features:

-

Automated invoicing and payment tracking.

-

Cash flow management and budgeting tools.

Pros:

-

User-friendly and affordable for small businesses.

-

Ideal for startups with basic accounting needs.

Cons:

-

Lacks advanced features for larger companies or enterprises.

-

Limited integrations with other tools.

9 Xero

Xero is an international accounting software platform that has grown in popularity among growing businesses. It's a cloud-based accounting tool for businesses to manage finances from anywhere, while its multi-currency and GST features make it suitable for global operations.

Features:

-

Cloud-based with real-time data updates.

-

Multi-currency and GST features for businesses with international dealings.

Pros:

-

Excellent for multi-location/global operations.

-

Strong integrations with third-party apps and tools.

Cons:

-

Expensive for small and medium-sized businesses in India.

-

Limited support for India-specific tax filing and compliance.

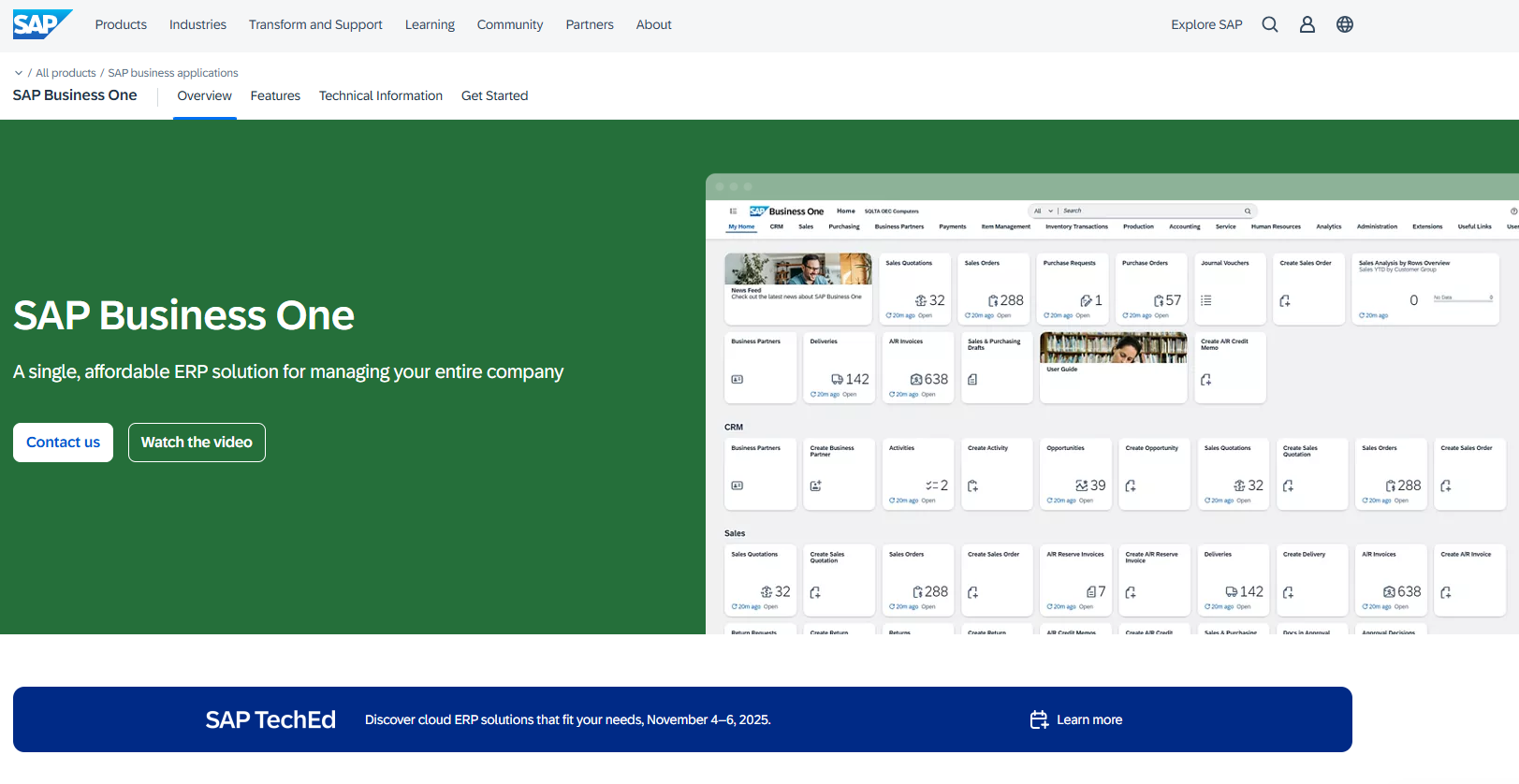

10 SAP Business One

SAP Business One is an enterprise-level ERP solution scaled down for small and medium-sized enterprises (SMEs). It offers full ERP integration along with advanced accounting features, making it suitable for fast-growing businesses.

Features:

-

Full ERP integration with accounting and financial forecasting.

-

Advanced financial reporting and analysis.

Pros:

-

Highly scalable to support growing businesses.

-

Excellent for fast-growing companies that need a comprehensive solution.

Cons:

-

Expensive, particularly for small businesses.

-

Complex implementation requiring professional setup.

Expert Tips for Choosing the Best Accounting Software for Your Business

Selecting the best accounting software for businesses is a critical decision that can directly impact your financial operations and business growth. Here are some expert tips to guide you in making the right choice:

-

Identify Your Needs:

Before choosing any software, evaluate your business size, complexity, and future growth. For example:-

Small businesses need basic invoicing and expense tracking.

-

Larger businesses may require more advanced features like multi-currency support or inventory management.

-

-

Consider Integration:

Ensure the software you choose can seamlessly integrate with your existing systems, such as CRM, payment gateways, and bank accounts. This reduces manual data entry and streamlines operations. -

Take Advantage of Trials:

Most accounting software offers free trials or demo versions. Testing out the software before committing will help you assess whether it meets your business needs.- Look for a user-friendly interface and ease of setting up.

-

Focus on GST Compliance:

In India, GST compliance is mandatory. Make sure the software you choose is GST-ready, allowing for seamless GST invoicing and filing. This feature will save time and reduce the risk of errors during tax season.

By following these tips, you can choose the best accounting software that not only suits your current business requirements but also scales with your future growth.

Conclusion:

Choosing the best accounting software for your business in 2026 requires careful consideration of your business’s size, goals, and growth plans. Small businesses need solutions that are affordable, easy to use, and scalable, while larger enterprises require software that can handle complex needs and high volumes of transactions.

With so many options available, it’s essential to evaluate each software based on features, integration capabilities, and pricing to find the perfect fit for your business. As you move into 2026, choosing the right accounting software can help your business save time, reduce errors, and improve financial transparency.

Are you ready to take the next step toward streamlining your finances? Giddh offers a free trial that can help you experience seamless invoicing and accounting integration tailored to Indian businesses.

Sign up for a FREE trial today and simplify your accounting workflow with Giddh!