How to Choose the Best Financial Reporting Software for Your Industry

Recent studies indicate that over 80% of businesses face inefficiencies due to outdated or manual financial reporting systems. The need for automated, scalable, and accurate financial reporting software has never been more critical. But with a vast range of options available, how can you determine what’s the best financial reporting software for your business?

For mid-sized businesses and enterprises, selecting the right financial reporting software is not just about numbers—it’s about driving strategic decisions and ensuring compliance. Financial managers, CFOs, and accountants are tasked with finding solutions that simplify operations, reduce human errors, and provide real-time insights. Yet, choosing the right solution remains an elusive goal for many organizations.

In this blog, we’ll explore the factors that make the best financial reporting software tailored to your industry. By the end, you'll be equipped with the tools to streamline your financial reporting, improve efficiency, and optimize your financial processes.

Why Financial Reporting Software is Critical for Your Business

Financial reporting has long been a challenge for organizations that rely on manual processes. Whether using spreadsheets or outdated systems, these methods lead to inefficiencies, costly errors, and increased compliance risks.

The Common Pain Points:

-

Manual Processes: Errors in spreadsheets or manual entries can lead to data inaccuracies.

-

Data Silos: Financial data stored across different systems makes it challenging to generate a unified report.

-

Lack of Real-Time Insights: In industries where quick decision-making is vital, outdated reports can delay critical business strategies.

Financial Reporting Benefits:

The best financial reporting software alleviates these pain points by offering:

-

Enhanced Accuracy: Automated data capture reduces human error.

-

Time Savings: Streamlined processes significantly reduce reporting time.

-

Compliance: Built-in compliance features ensure reports meet industry standards and regulations.

If you're still wondering, what’s the best financial reporting software for your business? The right solution can streamline your reporting, reduce errors, and allow you to focus on what matters—making informed decisions that drive growth.

Key Features to Look for in Financial Reporting Software

Automation and Time Savings

Automation is the cornerstone of modern financial reporting. It eliminates the need for manual data entry, reduces the chances of human error, and speeds up the reporting process. Automated online accounting helps create accurate reports without spending hours compiling data from various sources.

-

Financial Reporting Automation reduces manual intervention, enabling faster and more accurate financial analysis.

-

Real-Time Updates: With real-time data feeds, the software ensures that you’re always working with the most up-to-date financial data.

Integration with Existing Systems

When choosing the best financial reporting software, it’s essential to consider integration capabilities. The software should be able to pull data from various systems such as accounting software, ERP, and CRM platforms to provide a unified financial picture.

-

Seamless Integration: Whether it’s QuickBooks, SAP, or Oracle, ensure your reporting software integrates smoothly with existing systems.

-

Centralized Data Hub: Look for software that centralizes financial data for easy access and reporting.

Real-Time Analytics and Dashboards

The ability to analyze financial data in real time is a game-changer for businesses. Real-time financial reporting lets managers spot trends, track performance, and make informed decisions without delay.

-

Customizable Dashboards: Tailor dashboards to visualize financial data according to your industry’s needs, whether it’s cash flow, revenue, or expenses.

-

Software Financial Reporting: The best reporting software should offer comprehensive analytics to track financial health and support data-driven decisions.

Scalability and Flexibility

As your business grows, your financial reporting needs will evolve. The right software should scale with your firm and handle more complex reporting as you expand. Look for solutions that allow for customization based on your specific industry or business size.

Choosing the Best Financial Reporting Software for Your Industry

Each industry has unique financial reporting needs, and no one-size-fits-all solution exists. Understanding how different firms use online financial reporting solutions will help you make a more informed decision.

Retail Industry:

Retail businesses need financial software that can track inventory levels, monitor sales performance, and handle multiple locations. Look for software that integrates with point-of-sale (POS) systems and provides real-time sales data.

Manufacturing Industry:

Manufacturers need financial reporting software that can track production costs, manage budgets, and handle project-based reporting. The software should allow for cost management and provide detailed reports on job profitability.

Services Industry:

Service-based companies need financial reporting software that can handle project billing, revenue recognition, and service delivery costs. Software should support multi-location or online billing solutions and provide insights into profitability.

The best reporting software for your industry should cater to these specific needs. For example, retail businesses may need software that integrates directly with inventory management systems, while manufacturers may prioritize detailed cost-tracking features.

Benefits of Automating Your Financial Reporting

Focus on Efficiency

Automation not only reduces the time spent on creating reports but also ensures they are generated accurately and consistently.

-

Faster Reporting: Financial reports that used to take days can now be generated in minutes.

-

Reduced Errors: Automation minimizes human intervention, reducing errors caused by manual data entry.

Real-Time Data Processing

Financial reporting automation allows for real-time data processing, meaning you don’t have to wait for a monthly or quarterly update to assess your financial health.

-

Instant Access to Reports: With automated systems, you can generate reports on demand and instantly access critical insights.

-

Improved Decision Making: Real-time data allows you to make quick decisions based on the latest available information.

A case study example of how automation improved financial reporting might include a retail company that adopted an automated financial reporting system, reducing manual reporting time by 50% and enhancing the accuracy of its monthly sales reports.

Key Challenges in Selecting Financial Reporting Software

While there are many benefits to adopting new financial reporting software, it’s essential to avoid common pitfalls during the selection process.

1. Choosing Software with Too Many Features

Many financial reporting tools come with a host of features, but not all of them may be necessary for your business. Look for a solution that aligns with your specific needs.

2. Overlooking Integration Capabilities

Software that doesn't integrate well with your existing systems can create data silos and hinder your workflow. Always ensure the software integrates easily with your accounting, ERP, and other business systems.

3. Not Considering Future Scalability

Your business will grow, and so will your reporting needs. Choosing a software solution that can scale as your company grows is essential to avoid outgrowing the tool quickly.

4. Understanding the Costs

When evaluating software, consider both the upfront and long-term costs. Weigh the benefits of automation, scalability, and integration against the cost of implementation and ongoing support.

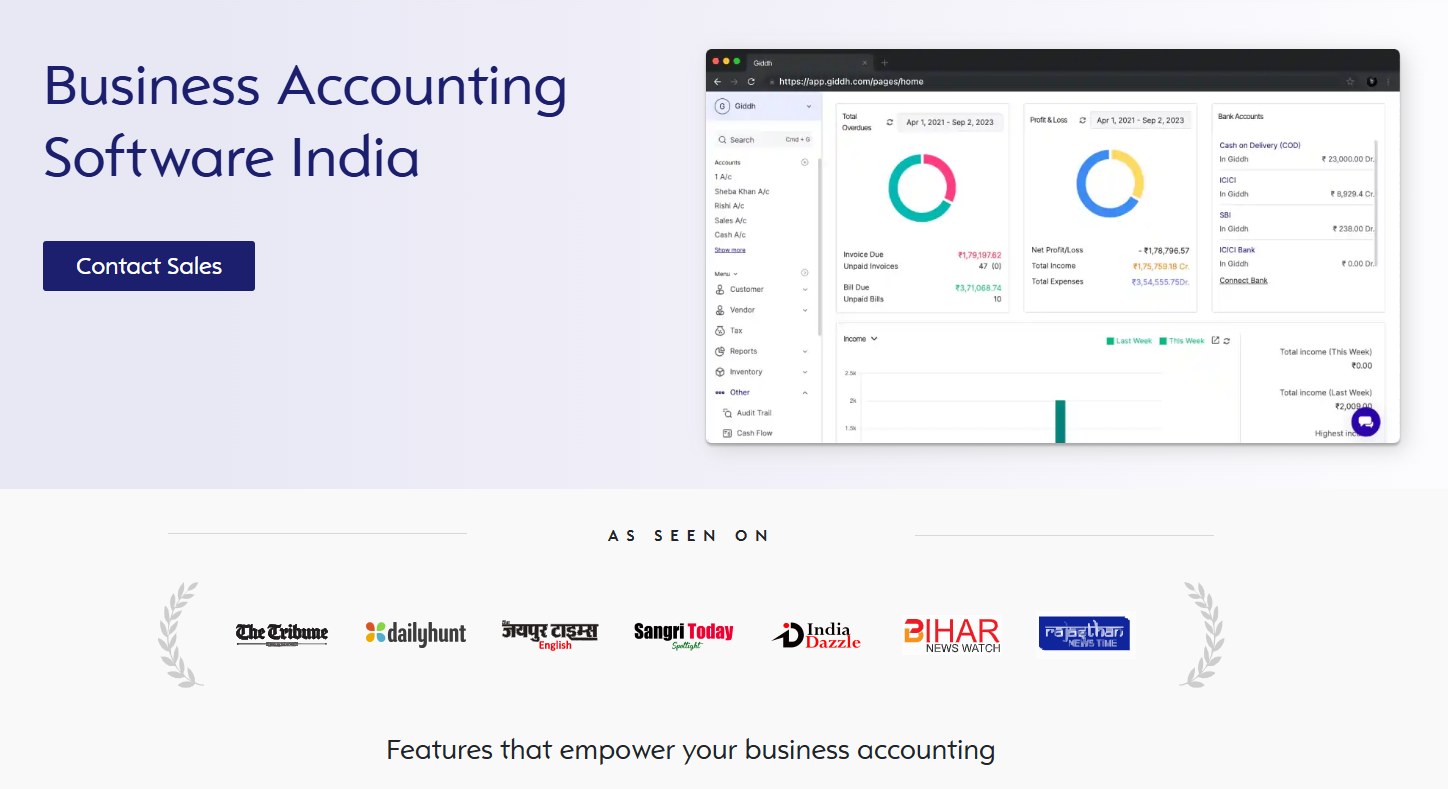

How Giddh Can Help You Choose the Right Financial Reporting Software

At Giddh, we understand that financial reporting software is not a one-size-fits-all solution. Our software is designed to streamline financial reporting for businesses of all sizes and industries. Whether you’re in retail, manufacturing, or services, Giddh integrates with your existing systems to provide accurate, real-time financial data.

Key features of Giddh:

-

Real-Time Reporting

Access up-to-the-minute financial data to make informed decisions quickly. -

Automated Reports

Reduce manual work and increase accuracy with automated financial reports, saving you time and effort. -

Scalable Solutions

Grow your business without outgrowing your financial software; Giddh adapts to your needs. -

Invoice Management

Streamline your invoicing process, track payments, and generate accurate invoices automatically. Simplify invoicing and ensure all records are up-to-date for faster billing and payment processing. -

Multi-Currency Support

Handle transactions in different currencies seamlessly, catering to global business needs. Automatically convert currencies based on current exchange rates to maintain accuracy in financial reporting. -

Inventory Management

Keep track of your stock levels, manage inventory movements, and sync it with financial data for comprehensive reporting. Track inventory levels, automate stock management, and align inventory data with your financial records. -

Bank Reconciliation

Automatically reconcile your bank statements with your accounting records, eliminating manual discrepancies. Match transactions automatically to ensure that your financial records align with your bank statements. -

Barcode Integration

Use barcode scanning for faster inventory tracking, reducing manual errors and improving accuracy. Scan barcodes to update inventory automatically, ensuring accuracy and reducing manual data entry. -

GST Compliance

Ensure your financial reports comply with GST regulations and automatically calculate GST for transactions. Keep your business compliant with automatic GST calculation and detailed reporting for audit purposes. -

Asset Management

Track your company’s assets, including depreciation, purchase history, and maintenance schedules. Manage your assets from acquisition to disposal with complete tracking for better decision-making and reporting.

With Giddh, you can rest assured that you have a powerful, integrated financial reporting solution that will streamline your processes, enhance accuracy, and support your business as it grows.

Making the Final Decision

As you approach the final stages of choosing your financial reporting software, consider these key evaluation criteria:

-

Integration: How easily will it integrate with your existing systems?

-

Automation: Does the software reduce manual work and improve accuracy?

-

Industry-Specific Features: Does it cater to your industry’s specific needs?

-

Scalability and Cost-Effectiveness: Can it grow with your business?

Take the time to understand your company’s unique needs before making a decision. The right software will simplify your processes, increase accuracy, and help drive your business forward.

Conclusion

Choosing the best financial reporting software is a critical decision for any mid-sized business or enterprise. With the right tool, you can automate processes, gain real-time insights, and streamline reporting to enhance operational efficiency. By understanding your specific industry needs and evaluating software based on features like automation, integration, and scalability, you can make an informed decision that will set your business up for long-term success.

Remember, the right financial reporting software is more than just a tool—it’s a strategic investment in the future of your business.

Ready to take the next step? Download our comprehensive guide on selecting the right financial reporting software for your industry.

FAQ

Q1: What’s the best financial reporting software for small businesses?

A1: The best financial reporting software for small businesses should be easy to use, affordable, and scalable. Look for solutions that integrate with existing systems and automate key financial reporting tasks.

Q2: How does financial reporting software help with compliance?

A2: Financial reporting software ensures compliance by automating the creation of reports that adhere to industry standards, making it easier to meet regulatory requirements.

Q3: Can financial reporting software integrate with existing accounting systems?

A3: Yes, most modern financial reporting software integrates seamlessly with accounting systems, ERPs, and CRMs, ensuring accurate, unified data for reporting.

Q4: How can automation improve financial reporting?

A4: Automation improves financial reporting by eliminating manual data entry, reducing errors, and speeding up the reporting process, allowing for more accurate and timely reports.