Why Every Small Business Needs Bookkeeping Software

TL;DR: Bookkeeping software is crucial for small businesses to manage their finances efficiently. It helps save time, reduce errors, ensure tax compliance, and provides real-time financial insights. Automating tasks with bookkeeping tools is a cost-effective solution for small business owners who struggle with manual accounting. Discover how using the best bookkeeping software for small businesses can streamline your financial management and help your business grow. |

Many business owners continue to rely on spreadsheets for financial management, a method that is prone to errors and inefficiencies. With over 30 million small businesses in India alone, it’s evident that many entrepreneurs face challenges in managing their accounting tasks.

If you’re among them, you’ve probably encountered the stress of tracking receipts, reconciling accounts manually, and worrying about tax season. It's no surprise that many business owners are looking for more efficient ways to manage their financials.

So, how can small business owners and entrepreneurs simplify their financial processes, save time, and reduce errors? The answer lies in bookkeeper accounting software, a powerful tool designed to automate financial management, improve accuracy, and free up your valuable time.

In this blog, we’ll dive into why every small business should embrace bookkeeping software and how it can transform the way you handle your finances.

What is Bookkeeping Software and Why Does it Matter?

Bookkeeping software is a type of accounting software designed to automate the management of financial transactions for businesses. It helps small business owners track their income, expenses, invoices, and taxes with minimal manual effort.

Why Is It Important for Small Businesses?

For small businesses, every dollar counts, and every minute spent on administrative tasks could be better spent on growth. Bookkeeping software allows business owners to automate key financial processes, including:

-

Expense tracking: Automatically categorize and track business expenses.

-

Invoicing: Generate invoices and send them directly to clients.

-

Financial reporting: Generate instant reports to understand cash flow, profitability, and financial health.

Example:

Let’s say you own a small eCommerce business. Without bookkeeping software, you might manually enter each transaction into spreadsheets, risking mistakes. With small business bookkeeping software, you can automatically sync sales from your website, categorize expenses, and instantly see your profits and losses. This streamlines operations and keeps everything organized.

Common Problems Small Business Owners Face Without Bookkeeping Software

1. Time-Consuming Manual Work

One of the biggest challenges for small business owners is managing financial data manually. Manual entry of invoices, receipts, and bank statements is not only time-consuming but also mentally draining. As a small business owner, you likely have a lot on your plate already. Bookkeeping should not be a time-sink.

2. Human Errors & Inaccuracies

Mistakes happen. But in the world of accounting, minor errors can lead to significant issues, including tax miscalculations and misreported profits. Inaccurate data can lead to missed opportunities, and, worse, penalties from tax authorities.

3. Tax Filing & Compliance Issues

As tax season approaches, small business owners often scramble to get their financial records in order. Without bookkeeping software, the risk of missing key tax deductions or filing incorrectly increases. Small mistakes can result in hefty fines or audits.

4. Missed Financial Insights

Without real-time tracking, business owners are left guessing their cash flow and profitability. This lack of insight can make it challenging to plan for the future, affecting decisions on growth and investment.

Why Businesses Need Bookkeeping Software For Finance Management

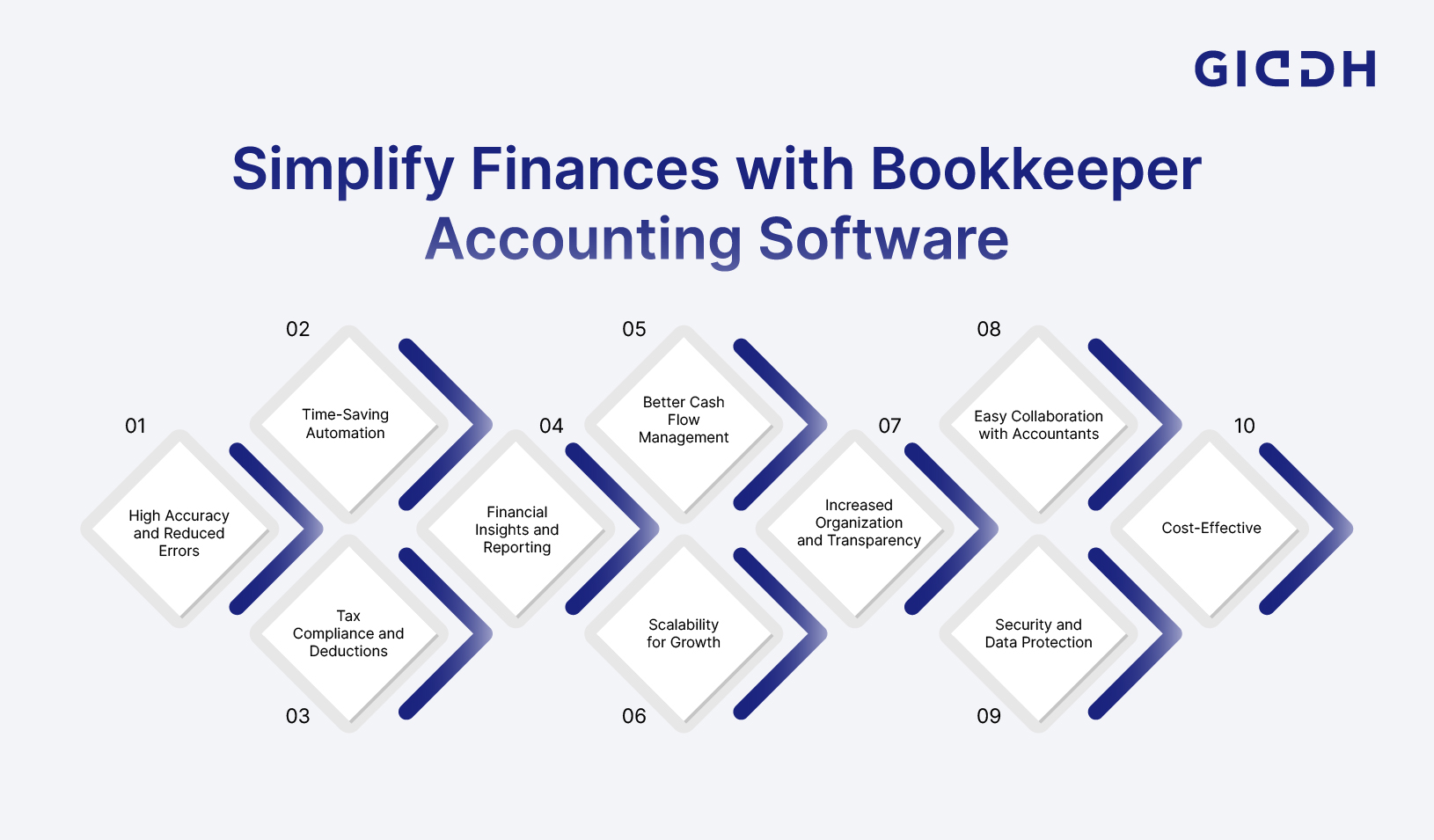

For small businesses, effective financial management is crucial for survival and growth. Bookkeeping software plays a pivotal role in ensuring that a company’s finances are organized, accurate, and compliant. Here’s why every small business should invest in bookkeeping software:

Improved Accuracy and Reduced Errors

-

Manual bookkeeping can lead to human errors such as incorrect data entry or missed transactions, which can cause financial misstatements.

-

Benefit: Bookkeeping software automates calculations, reducing the risk of mistakes and ensuring that financial records are accurate, which is vital for making informed decisions and complying with tax regulations.

Time-Saving Automation

-

Manual processes, such as entering transactions, reconciling accounts, or generating financial reports, can be time-consuming and often lead to inefficiencies.

-

Benefit: With bookkeeping software, much of the work is automated, allowing small business owners to focus on running their business rather than spending time on tedious administrative tasks.

Tax Compliance and Deductions

-

Tax season can be particularly stressful for small business owners with disorganized financial records.

-

Benefit: Bookkeeping software ensures that all necessary financial data is tracked accurately throughout the year, making tax filing much easier. It also helps identify deductions and credits, potentially saving money come tax time.

Financial Insights and Reporting

-

Tracking financial performance manually can be cumbersome, potentially missing the insights a business owner needs to grow their business.

-

Benefit: Bookkeeping software provides real-time reports on profits, expenses, cash flow, and other financial metrics, enabling businesses to make data-driven decisions quickly.

Better Cash Flow Management

-

Tracking cash flow manually can be challenging, and poor cash flow management is one of the leading causes of small business failure.

-

Benefit: Bookkeeping software enables businesses to monitor cash flow, track unpaid invoices, and manage expenses effectively. This ensures that the company has enough liquidity to cover operational costs and avoid cash shortfalls.

Scalability for Growth

-

Managing finances manually becomes increasingly complex as a business grows.

-

Benefit: As your business expands, bookkeeping software scales with it, supporting multiple accounts, transactions, and even tax rules in different regions, allowing the company to grow without financial management bottlenecks.

Increased Organization and Transparency

-

Disorganized financial records can lead to confusion, especially when tracking expenses or preparing for audits.

-

Benefit: Bookkeeping software provides a centralized, organized record of all financial transactions, making it easy to track income and expenses and ensuring transparency, which is vital for attracting investors or obtaining business loans.

Easy Collaboration with Accountants

-

Working with an accountant without proper software can be cumbersome, leading to inconsistencies in exchanged documents and data.

-

Benefit: Many bookkeeping software solutions allow small businesses to give accountants access to financial records in real-time, enabling better collaboration and more efficient financial management.

Security and Data Protection

-

Manual bookkeeping or using spreadsheets exposes a business to the risk of data loss, theft, or tampering.

-

Benefit: Bookkeeping software often includes secure cloud storage, encryption, and backup features, ensuring that sensitive financial data is safe and accessible when needed.

Cost-Effective

-

Hiring a full-time accountant can be expensive, particularly for small businesses with limited budgets.

-

Benefit: Bookkeeping software is a cost-effective solution for small businesses, offering features typically at a fraction of the cost of hiring a dedicated accounting team.

How to Choose the Right Bookkeeping Software for Your Business

Ease of Use

When selecting bookkeeping software, it’s essential to choose a user-friendly tool. Since small business owners are not necessarily accounting experts, they need a tool that doesn’t require technical knowledge.

- Look for software with simple navigation and clear interfaces.

Cost-Effectiveness

As a small business owner, cost is always a concern. Choose a cost-effective solution that provides essential features without breaking the bank. Many software solutions offer free trials, allowing you to test the product before committing.

- Find software that fits your budget while providing the features you need.

Customer Support

Responsive customer support is crucial when using new software. Whether you're troubleshooting an issue or needing help with tax filings, support should be readily available.

- Opt for software with robust customer service, including phone and chat support.

Customization

Not every business operates the same way. Look for software that offers customization options to suit your unique needs, such as adding custom fields for an invoicing and tracking solution to improve expense management.

Integration with Other Tools

Your bookkeeping software should integrate seamlessly with other business tools, such as inventory management or CRM systems.

Giddh: The Best Bookkeeping Software for Small Businesses

If you're looking for an intuitive and affordable solution for managing your finances, Giddh offers everything a small business owner needs to streamline accounting processes.

Features:

-

Automated invoicing: Create and send invoices quickly, automatically tracking payments.

-

Real-time financial reporting: View instant financial reporting software to understand your business’s performance.

-

Expense tracking: Track all business-related expenses and categorize them for tax purposes.

-

Tax compliance: Ensure accurate and timely tax filing with Giddh’s built-in tools.

User-Friendly:

Giddh’s simple interface allows non-accountants to manage their finances efficiently. Even if you're not an expert in accounting, Giddh’s tools are easy to navigate and use.

Affordable & Scalable:

Giddh offers affordable pricing plans with scalability, so as your business grows, you won’t need to change software. Giddh grows with you.

How Does Bookkeeping Software Help Small Business Owners Save Money?

1. Reduced Accounting Costs

With bookkeeping tools for SMEs, small businesses can save significant amounts of money by not needing to hire external accountants or bookkeepers.

2. Avoiding Tax Penalties

Bookkeeping software helps businesses stay on top of tax filings and avoid penalties due to missed deadlines or inaccurate filings.

3. Improved Financial Planning

With access to accurate, real-time financial data, businesses can make better-informed decisions, ultimately saving money in the long run.

Conclusion

In a competitive landscape, small businesses must operate efficiently and accurately, especially when managing their finances. By using bookkeeper accounting software, small business owners can save time, reduce errors, stay compliant with tax laws, and gain real-time insights into their financial health.

Whether you’re looking for small business bookkeeping software in India or the best bookkeeping software for small businesses worldwide, finding the right solution is essential for smooth operations and growth.

Ready to take control of your business finances? Start a free trial and discover the best bookkeeping software for small businesses today at Giddh!

FAQ:

1. Why is bookkeeping software essential for small businesses?

Bookkeeping software automates financial tasks like tracking income, managing expenses, and generating reports, helping small businesses save time, reduce errors, and ensure tax compliance. It streamlines accounting, allowing business owners to focus on growth.

2. How does bookkeeping software help reduce errors in accounting?

Bookkeeping software minimizes human error by automating data entry, performing real-time reconciliations, and offering built-in checks and balances. It ensures accurate financial records by validating transactions automatically.

3. Can small businesses manage invoices and expenses efficiently with bookkeeping software?

Yes, bookkeeping software allows small businesses to easily create and manage invoices, track expenses, and maintain organized records. This streamlines billing and ensures accurate tracking of cash flow.