3 Best Bookkeeping & Accounting Software Businesses Must Try in 2026

You didn’t launch your business to get stuck in endless spreadsheets or track down every receipt. You began your journey in pursuit of the freedom to innovate, the flexibility to set your own hours, and the opportunity to build something you're passionate about. But once money starts flowing, you need to have a clear picture of what's coming in, what's going out, and what's available to fuel your next big move.

That’s where online bookkeeping and accounting come in. It might not sound thrilling, but it doesn’t have to be a painful task. Free bookkeeping software is a valuable resource for small businesses, providing a streamlined approach to managing accounting tasks efficiently.

In this blog, we’ll explore!

- How can these tools help you manage your finances more effectively?

- Reduce the burden of manual tracking, and

- Provide free time to focus on growing your business.

Why Small Businesses Should Use Free Bookkeeping Software to Track Expenses

Bookkeeping software is a digital tool designed to help businesses efficiently track, manage, and organize their financial transactions. For small businesses, particularly startups, utilizing free bookkeeping software is essential for maintaining accurate records without incurring the costs of accounting services.

It simplifies key tasks such as invoicing, expense tracking, and generating financial reports, making the entire process faster and more accurate.

Key Benefits of Using Free Bookkeeping Software for Small Businesses:

-

Cost-effective: Saves money by eliminating the need for external accountants or expensive software subscriptions.

-

Ease of Use: No need to be an accounting expert—simple interfaces make it accessible for everyone.

-

Real-Time Financial Tracking: Helps keep track of expenses and income in real-time, providing accurate insights at any moment.

-

Automated Reports: Generates financial reports automatically, simplifying tax filing and economic assessments.

-

GST Compliance: Ensures that the business adheres to India’s GST regulations, reducing the risk of penalties.

Top 3 Bookkeeping Software Solutions for Small Businesses in India

Managing finances efficiently is crucial for small businesses, and having the proper bookkeeping and accounting tools can make all the difference. Whether you're a startup or a growing company, selecting a reliable platform is crucial for streamlining operations and ensuring compliance with tax regulations. Below, we’ll explore three of the top bookkeeping software solutions in India: Giddh, QuickBooks, and Zoho Books.

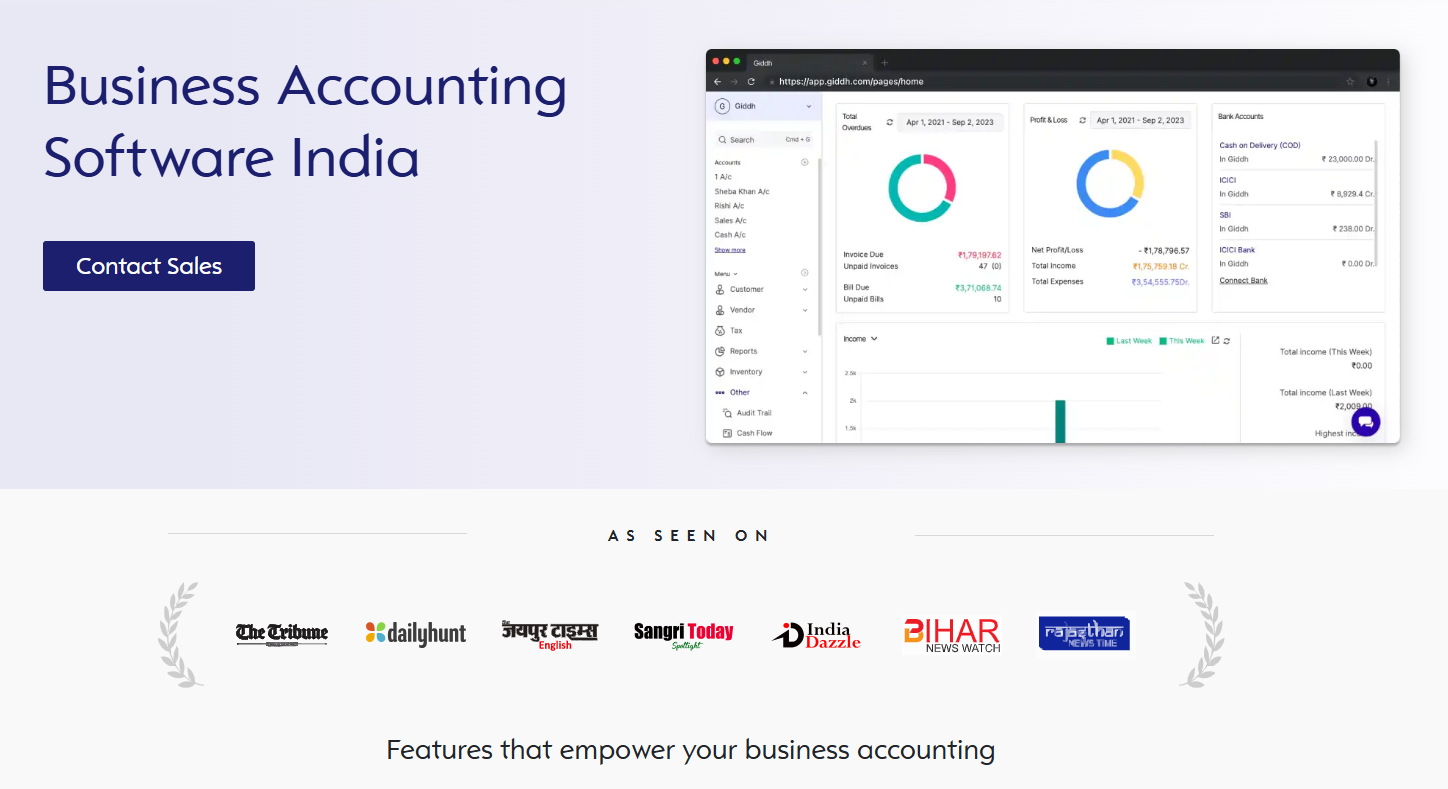

1. Giddh

As a free bookkeeping software solution, Giddh accounting software is used to simplify accounting for small businesses, startups, and service-based industries. With its easy-to-use interface and powerful features, Giddh makes bookkeeping seamless and accessible, without the need for expensive accountants or complex software.

Giddh stands out from other bookkeeping tools by offering a range of features designed to meet the specific needs of small businesses in India. Here’s what makes it unique:

Why You Should Try It

Giddh Online Bookkeeping Software is the ultimate solution for simplifying your business finances. It's the ideal choice for businesses that want a cost-effective solution to manage their accounting. The free version allows startups and small businesses to get started quickly and efficiently.

Features of Bookkeeping Software for Small Businesses

When choosing free bookkeeping software, small businesses should look for essential features that streamline operations. Giddh excels with the following:

GST Compliant: Managing GST compliance is crucial for small businesses in India, and Giddh makes it easy to stay compliant by automating tax calculations and streamlining GST-related tasks.

- Track GST reports

- Automated GST calculations

- Direct GST filing

- Easy tax management

Smart Mobile Accounting App: Whether you're at the office, traveling, or working remotely, you can access real-time data, track invoices, and monitor cash flow from anywhere.

- Access Anywhere

- Real-Time Updates

- Expense Management

- Cash Flow Tracking.

- Secure Cloud Storage

Smart Inventory Management: Giddh provides advanced inventory management features to help small businesses track stock levels, manage warehouses, and make accurate adjustments.

- Real-Time Inventory Tracking

- Warehouse Management

- Stock Adjustments

- Instant Reports

- Custom Tax & Pricing

Accurate Financial Reports Instantly: With Giddh, small businesses can generate key reports, such as balance sheets and profit & loss statements. Ensure that business owners have the necessary insights to make informed decisions and effectively track performance.

- Trial Balance Report

- Balance Sheet Report

- Profit & Loss Report

- Sales Register

- Purchase Register

Customer Portal: Giddh features a customer portal that streamlines interactions with clients, simplifying billing, invoicing, and payment tracking. It offers centralized location for managing financial data.

- Real-Time Statements

- Invoice Management

- Payment Tracking

- Multi-Member Access

- One-Click Dashboard

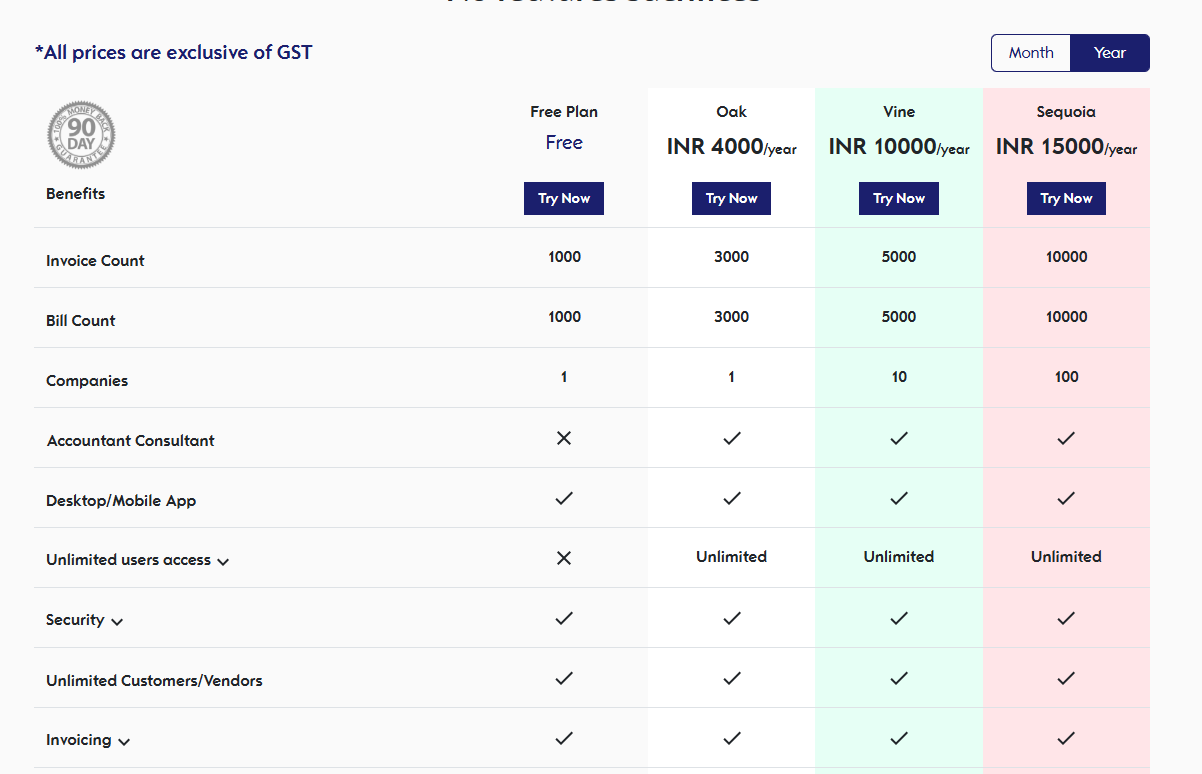

Pricing

-

Free Plan: Basic features suitable for startups and tiny businesses.

-

Paid Plans: Starting at INR 2,000/month for additional features, including multi-company support and advanced reporting.

2. QuickBooks

QuickBooks is one of the most popular accounting platforms for small businesses worldwide. It offers a comprehensive suite of features for bookkeeping and accounting, enabling companies to manage their finances, track expenses, and ensure tax compliance.

Key Features

-

Expense Tracking: Track and categorize all expenses to ensure clear financial reporting.

-

GST and Tax Reports: Auto-generates tax reports, making it easier to comply with Indian tax laws.

-

Invoice Creation: Easily create and send invoices, with customizable templates.

-

Bank Reconciliation: Automatically reconcile transactions with bank feeds for accurate financial data.

Pricing

-

Simple Start: INR 1,700/month (for self-employed and freelancers).

-

Essentials: INR 3,200/month (includes additional features like multiple users).

-

Plus: INR 4,800/month (includes advanced features such as project tracking and advanced reporting).

3. Zoho Books

Zoho Books is an online accounting software that offers a complete suite of accounting and bookkeeping tools for small businesses. Known for its seamless integration with other Zoho products, it is perfect for companies already using the Zoho ecosystem.

Key Features

- Automated Workflows: Automate repetitive tasks, such as invoicing and reminders, to save time.

- Inventory Management: Track stock levels and manage your products and sales seamlessly.

- Time Tracking: Track billable hours and add them to client invoices.

- Customizable Reports: Generate detailed financial reports with customizable templates.

Pricing

- Basic Plan: INR 1,500/month (for small businesses with basic needs).

- Standard Plan: INR 2,700/month (for growing businesses with additional features).

- Professional Plan: INR 4,000/month (includes advanced reporting and automation features).

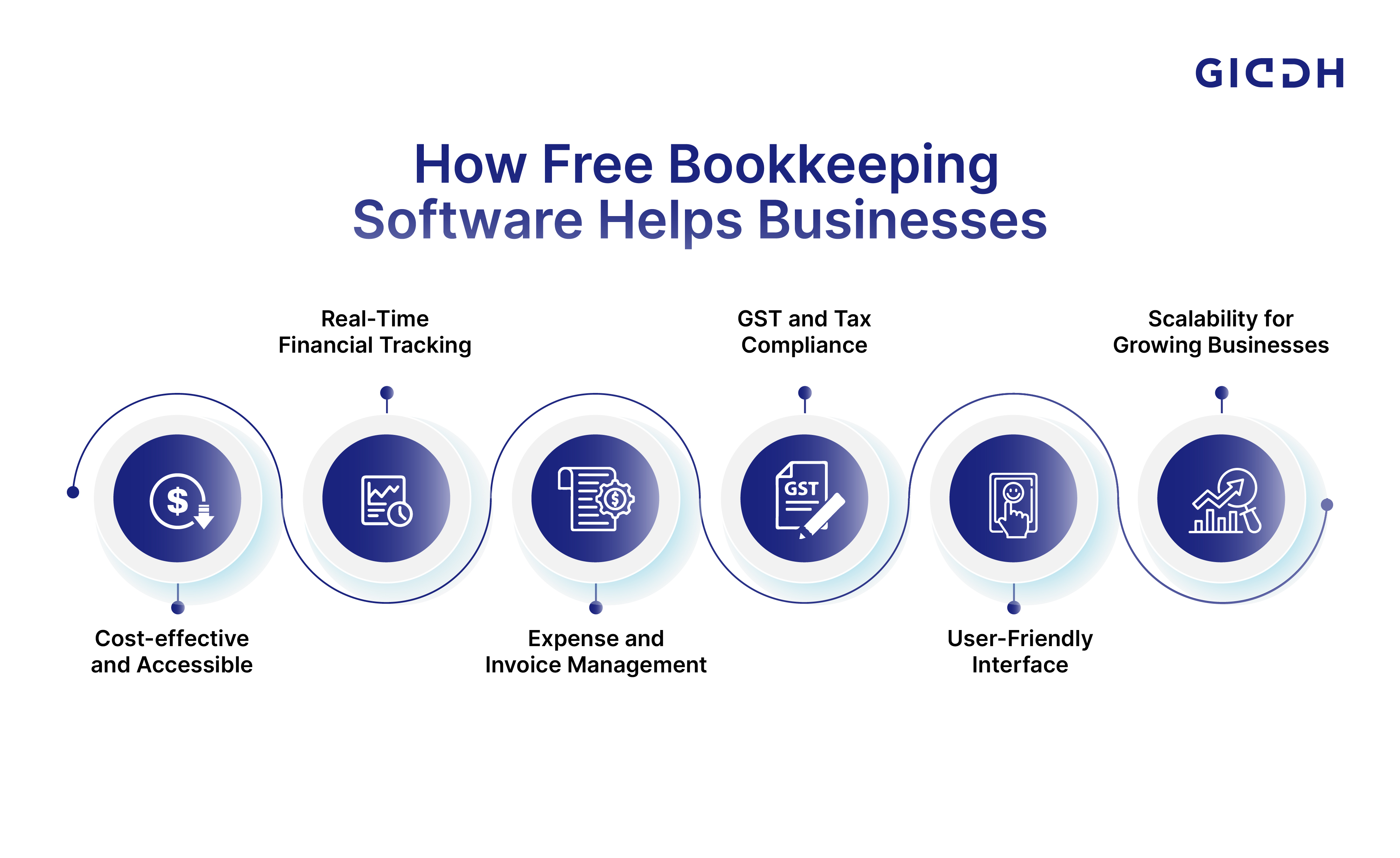

How Free Bookkeeping Software Helps Small Businesses Manage Finances

For small businesses, managing finances effectively can be a daunting task, especially with limited resources. Free bookkeeping software provides a practical solution to this challenge by offering an easy-to-use platform for tracking income and expenses, while also ensuring compliance with tax regulations.

These tools help small business owners keep their financial records organized and up-to-date without the need for expensive accounting services.

Here’s how free bookkeeping tools for small businesses can support financial management:

-

Cost-effective and Accessible

-

Zero upfront costs: Many free tools come with no initial fees, making them accessible to businesses on a tight budget.

-

Simple to start: Setting up an account and managing finances is quick and easy, requiring no technical expertise.

-

-

Real-Time Financial Tracking

-

Monitor cash flow: With up-to-date tracking, small business owners can see exactly where money is coming from and where it’s going.

-

Instant updates: As transactions are entered, the software automatically adjusts financial records, offering an accurate snapshot of business health.

-

-

Expense and Invoice Management

-

Effortless expense tracking: Free bookkeeping tools automatically categorize and track every expense, making it easier to stay on top of spending.

-

Streamlined invoicing: Easily generate and send invoices, reducing administrative time and ensuring timely payments.

-

-

GST and Tax Compliance

-

Tax-ready reporting: Many free tools offer features of GST compliance or other local tax liabilities, ensuring businesses stay compliant with government regulations.

-

Simplified filing: Automatically generate tax reports to make filing more efficient and reduce the chance of errors or missed deadlines.

-

-

User-Friendly Interface

-

No accounting experience required: These tools are designed to be intuitive, allowing business owners with little to no accounting knowledge to manage their finances efficiently.

-

Easy-to-read reports: Free bookkeeping software provides clear and concise reports that are easy to understand, enabling informed business decisions.

-

-

Scalability for Growing Businesses

-

Supports business expansion: As businesses grow, free bookkeeping software can often accommodate additional transactions, clients, and financial accounts.

-

Affordable Upgrades: For growing businesses, affordable bookkeeping software options offer enhanced features to meet more complex financial needs without a significant price increase.

-

Final Thought:

Traditional bookkeeping methods often result in wasted time, costly mistakes, and financial stress. Free bookkeeping software, such as Giddh, provides an innovative and cost-effective solution that helps businesses alleviate the economic burden of managing accounts.

With tools that simplify invoicing, expense tracking, and tax compliance, small businesses can focus on growth rather than financial management.

Giddh’s software ensures that your business stays organized, compliant with local regulations, and fully informed on finance matters, without any additional costs.

By streamlining your accounting processes, you gain greater control over your financial health, enabling you to make informed decisions that drive success.

Don’t wait! Start your free trial today and take control of your business finances.

FAQs

Why should small businesses use free bookkeeping software to track expenses?

Answer: Free bookkeeping software automates expense tracking, saving time and reducing errors. Giddh simplifies this with features like invoicing and tax calculations.

How can free bookkeeping software benefit small businesses?

Answer: It helps businesses stay organized, ensures tax compliance, and saves time by automating tasks. Giddh streamlines financial tracking and report generation.

What features should small businesses look for in free bookkeeping software?

Answer: Look for real-time tracking, automated invoicing, and tax reporting. Giddh offers all these and more, including GST compliance and multi-currency support.

Can free bookkeeping software help with GST compliance for small businesses in India?

Answer: Yes, Giddh automates GST calculations and generates GST-compliant invoices, making it easier for businesses to stay compliant.

Is it easy to transition from manual bookkeeping to free software like Giddh?

Answer: Yes, Giddh is user-friendly and designed for easy setup, making the transition from manual bookkeeping smooth and straightforward.