How E-Invoice Software Simplifies GST Compliance for Indian Businesses

TL;DR: E-invoice software is revolutionizing GST compliance for businesses in India. Automating invoicing and filing processes enables Indian SMBs to reduce errors, save time, and ensure GST compliance with ease. Learn how this tech-driven solution simplifies complex GST tasks, and discover why Giddh is the ideal choice for seamless integration and automation.

In 2024, over 12 million GST returns were filed in India, with businesses facing a constant challenge of maintaining compliance amid evolving tax regulations. The introduction of mandatory e-invoicing for businesses above a certain threshold has put even more pressure on small and medium-sized enterprises (SMBs) to adapt swiftly.

Manual invoicing and compliance processes consume significant time and are prone to errors, thereby increasing the risk of penalties. With tax laws constantly evolving, many business owners, accountants, and CFOs feel overwhelmed by the complexity of manually managing GST filings.

This is where e-Invoice software India can make all the difference. By automating the entire invoicing and filing process, businesses can stay ahead of compliance requirements, reducing human error and the time spent on repetitive tasks. As more SMBs move toward automation, adopting seamless GST e-invoicing software in India is becoming a necessity.

What Is E-Invoice Software and How Does It Work?

E-invoice software automates the invoicing and GST compliance automation processes, making them simpler and more efficient. For Indian businesses, this software connects with the Goods and Services Tax Network (GSTN) to ensure that invoices are valid and compliant with GST regulations.

Here’s how it works in a simplified manner:

-

Invoice Generation:

The software enables users to quickly and easily generate GST-compliant invoices with all required GST details. -

GST Validation:

The software automatically checks GST details, such as GSTIN and tax amounts, against the latest regulations to ensure accuracy. -

IRN Creation:

Once validated, the software generates the Invoice Reference Number (IRN) and QR Code, which are required for every invoice, and sends it to the GST portal. -

Data Synchronization:

The e-invoice tool syncs the generated data directly with your accounting systems, keeping your records up to date and error-free.

The process is designed to be seamless, even for non-technical users like accountants, CFOs, or business owners. You don’t need to be an IT expert to leverage this powerful tool.

Key Challenges Businesses Face in GST Compliance

GST compliance is crucial for all businesses in India, but it comes with its own set of challenges, particularly for small and medium-sized enterprises. Some of the most common difficulties include:

-

Manual Data Entry and Human Errors:

Manual entry of invoice details leads to human errors, increasing the risk of GST mismatches and penalties. -

Frequent Regulation Changes and Lack of Awareness:

Keeping up with constant updates to GST rules can be overwhelming for businesses, especially for those with limited resources or time. -

Time-Consuming Reconciliation:

Comparing purchase and sales data and matching GST returns can be time-consuming, leaving businesses scrambling to meet deadlines. -

Delays in Filing and Penalties:

Missing filing deadlines or submitting incorrect invoices can lead to penalties and interest charges. Businesses risk facing unnecessary financial burdens.

These challenges can be significantly reduced by leveraging e-invoice tools for Indian businesses, which automate invoicing and filing, reducing manual effort and eliminating the risk of errors.

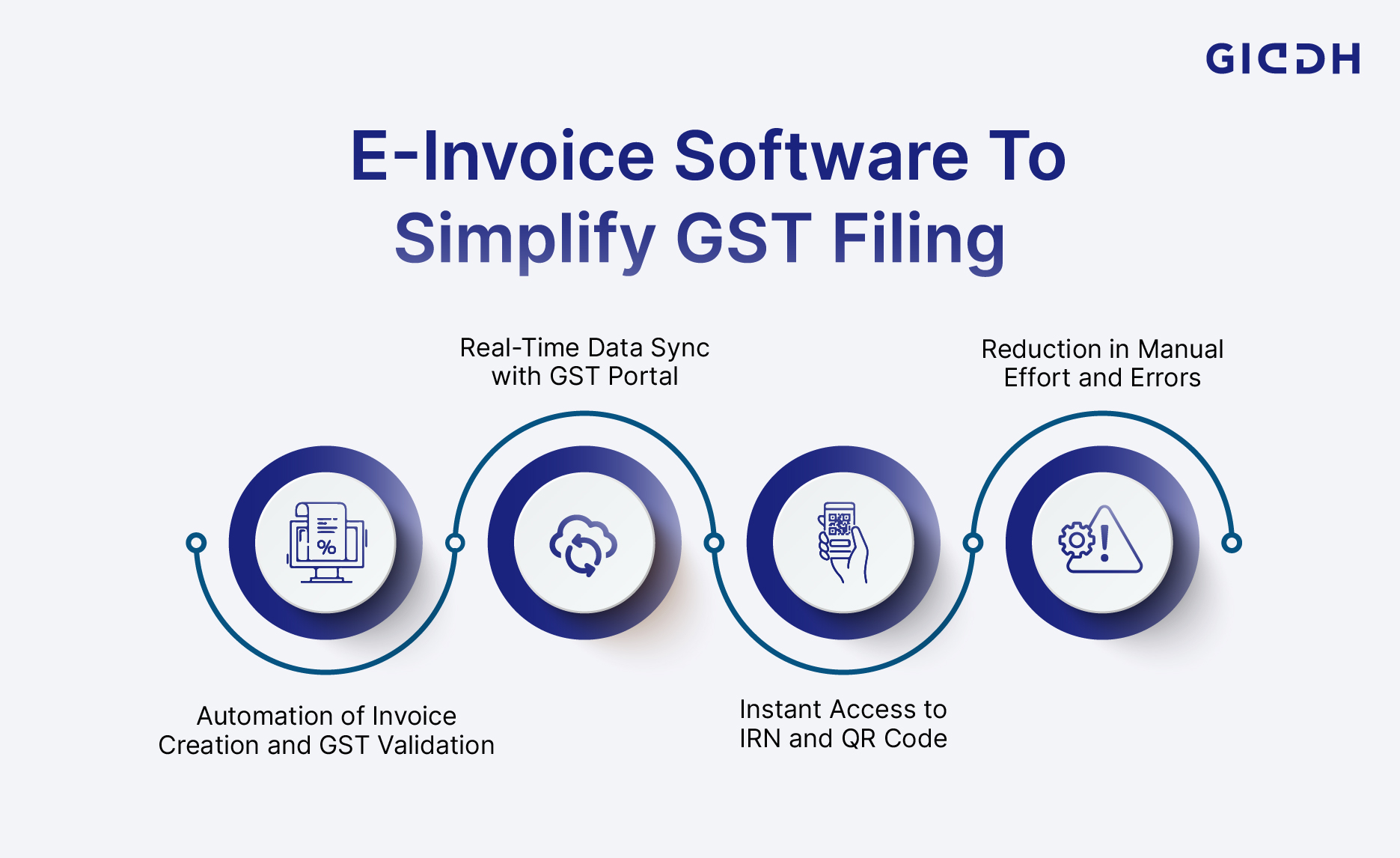

How E-Invoice Software Simplifies GST Filing

The process of GST filing can be tedious and error-prone, especially when done manually. However, with e-invoice software, businesses can enjoy the following benefits:

Automation of Invoice Creation and GST Validation:

With the GST e-invoicing software India, the generation of invoices and validation of GST details is automated. This eliminates human errors and speeds up the entire process.

Real-Time Data Sync with GST Portal and Accounting Systems:

Once an invoice is created and validated, it syncs with the GST portal and your accounting systems in real time, ensuring accuracy and reducing the need for manual data entry.

Instant Access to IRN and QR Code:

For every generated invoice, the e-invoice software provides instant access to the IRN and QR code required for compliance. This ensures your invoices are instantly recognizable and fully compliant with GST laws.

Reduction in Manual Effort and Errors:

With automation, the need for manual intervention is reduced significantly. This not only saves time but also improves the accuracy of your filings, decreasing the chances of errors.

By automating invoicing and filing, e-invoice software India simplifies the entire process, making it more manageable and less time-consuming for businesses of all sizes.

Benefits of Using E-Invoice Software for GST Compliance

There are several key benefits to using GST e-invoicing software India for compliance, including:

-

100% GST-Compliant Invoicing:

The software ensures that your invoices are 100% compliant with GST regulations, including automatic validation of GSTINs and tax amounts. -

Seamless Integration with ERP/Accounting Systems:

E-invoice tools for indian SMBs integrate seamlessly with your existing accounting software, eliminating the need for manual data transfers. -

Enhanced Accuracy and Audit Readiness:

With automated checks and validations, e-invoice software minimizes errors, helping you stay audit-ready at all times. -

Time and Cost Savings for Growing Businesses:

By reducing manual effort and errors, e-invoice software helps businesses save both time and money—resources that can be better spent on growth and strategy. -

Increased Transparency and Compliance Confidence:

Automation provides businesses with real-time access to their compliance status, offering confidence and clarity during audits or government scrutiny.

Why Giddh Is the Best E-Invoice Software for Indian Businesses

Giddh’s GST e-invoicing software India simplifies compliance. It offers automated GST filing for businesses, real-time validations, and seamless system integrations. Here’s why Giddh stands out:

-

Real-Time GSTN Integration:

Giddh’s software integrates directly with the GST portal, ensuring all invoices are validated against current GST regulations in real-time. -

Automated Invoice Generation and IRN Validation:

Every invoice generated is automatically validated, and IRNs (Invoice Reference Numbers) are instantly created, making your invoicing process faster and more reliable. -

Multi-User Access and Role-Based Control:

Giddh offers multi-user access, allowing your team to collaborate while maintaining control over who can view and modify specific data, ensuring security. -

Compatibility with Accounting Tools and ERPs:

Giddh seamlessly integrates with your existing accounting systems and ERP tools, simplifying data synchronization and minimizing errors.

By leveraging Giddh’s e-invoice software, businesses can reduce compliance risks, save time, and streamline their invoicing process—allowing them to focus on growth and innovation.

Real-World Impact: How Indian SMBs Are Simplifying GST Filing

To illustrate the power of e-invoice software, let’s take a look at a fictionalized case study of an Indian SMB, Sparsh Textiles:

Before adopting e-invoice software:

-

Sparsh Textiles struggled with manual data entry for GST filings, resulting in missed deadlines and penalties.

-

The company’s accountants spent over 20 hours per week reconciling invoices, resulting in slow growth and inefficiencies.

After adopting Giddh’s e-invoice software:

-

Automated invoice generation and real-time GST validation saved the company over 10 hours a week.

-

With accurate invoicing and timely filings, Sparsh Textiles avoided penalties and increased operational efficiency.

The transition to automated e-invoicing resulted in quantifiable benefits, including reduced errors, faster compliance, and significant time savings.

Getting Started with Giddh E-Invoice Software

How can you get started?

Getting started with Giddh is quick and straightforward. Here’s a step-by-step guide for SMBs and accountants:

-

Sign up for Giddh’s platform.

-

Integrate with your existing best accounting system or ERP.

-

Generate GST-compliant invoices effortlessly with automatic validation.

-

Get real-time access to your compliance status and file returns directly.

Conclusion

Automating GST compliance is no longer optional for Indian businesses; it’s a necessity. E-invoice software not only simplifies the invoicing process but also ensures businesses stay compliant, reduce errors, and save valuable time.

By embracing solutions like Giddh, SMBs can ensure their operations remain smooth, efficient, and compliant, ultimately paving the way for business growth.

Want to experience seamless GST compliance? Get started with Giddh’s e-invoice software India today and take the first step toward automated invoicing.

FAQ

1. What Is E-Invoice Software, And How Does It Help Indian Businesses Comply With GST?

E-invoice software automates the generation, validation, and filing of GST-compliant invoices. It ensures businesses are fully compliant with Indian tax regulations, reducing errors and the risk of penalties.

2. How Does E-Invoice Software Automate The GST Filing Process For Businesses In India?

E-invoice software automates the creation of GST-compliant invoices, validates GST details, generates IRNs, and synchronizes data with the GST portal in real-time. It integrates with accounting systems to ensure accurate filings and reduce manual effort.

3. Is E-Invoice Software Mandatory For All Businesses In India?

E-invoicing is mandatory for businesses with an annual turnover exceeding ₹10 crore. However, it is recommended that all companies adopt e-invoice software to streamline operations and ensure compliance.