How Bookkeeping Software Can Help Startups Manage Finances Efficiently

TL;DR: Startups often struggle with manual financial management, leading to errors and inefficiencies. Bookkeeping software can streamline operations by automating tasks, offering real-time financial insights, and ensuring compliance — helping startups save time, reduce errors, and improve financial decision-making. |

For startups, managing finances manually can be a daunting, time-consuming task. Without a dedicated accounting team, founders usually become bogged down by repetitive tasks, leaving little room for growth. This is where bookkeeping software for startups becomes invaluable.

Why should startups care about this?

Without the right tools, business owners risk inaccurate financial records, tax issues, and a lack of insight into their financial health. But what if a simple, automated solution could eliminate these obstacles?

The answer lies in bookkeeping software for startups, designed to streamline financial tasks, save time, and ensure compliance—ultimately helping businesses scale efficiently.

In this blog, we’ll explore how bookkeeping software is a must-have tool for growing businesses and how it can transform financial management for startups.

Why Do Startups Need Bookkeeping Software?

Managing finances manually can be overwhelming for startups, as it consumes valuable time and introduces errors that can hinder business growth. Bookkeeping software for startups offers a solution by automating time-consuming tasks and ensuring accurate financial records. Here’s why startups need it:

-

Time-consuming Tasks:

Founders often spend hours tracking invoices and receipts and reconciling accounts, which prevents them from focusing on core business activities. -

High Risk of Errors:

Manual data entry increases the risk of mistakes, leading to potential financial mismanagement, tax issues, and inaccurate reports. -

Limited Financial Insights:

Without real-time tracking, gaining a clear view of cash flow, profitability, and growth potential is challenging, which in turn makes it difficult to make informed decisions.

How Does Poor Financial Management Impact Startups?

When financial management isn’t streamlined, the consequences are far-reaching:

-

Cash Flow Problems:

Poor tracking can lead to missed payments, overdue invoices, and eventual cash flow crises, which may stall business growth. -

Missed Tax Deductions:

Manually tracking expenses can lead to missed tax-saving opportunities, resulting in higher-than-necessary tax burdens. -

Ineffective Decision-Making:

Lack of accurate financial data makes it nearly impossible to make sound, data-driven business decisions that fuel growth.

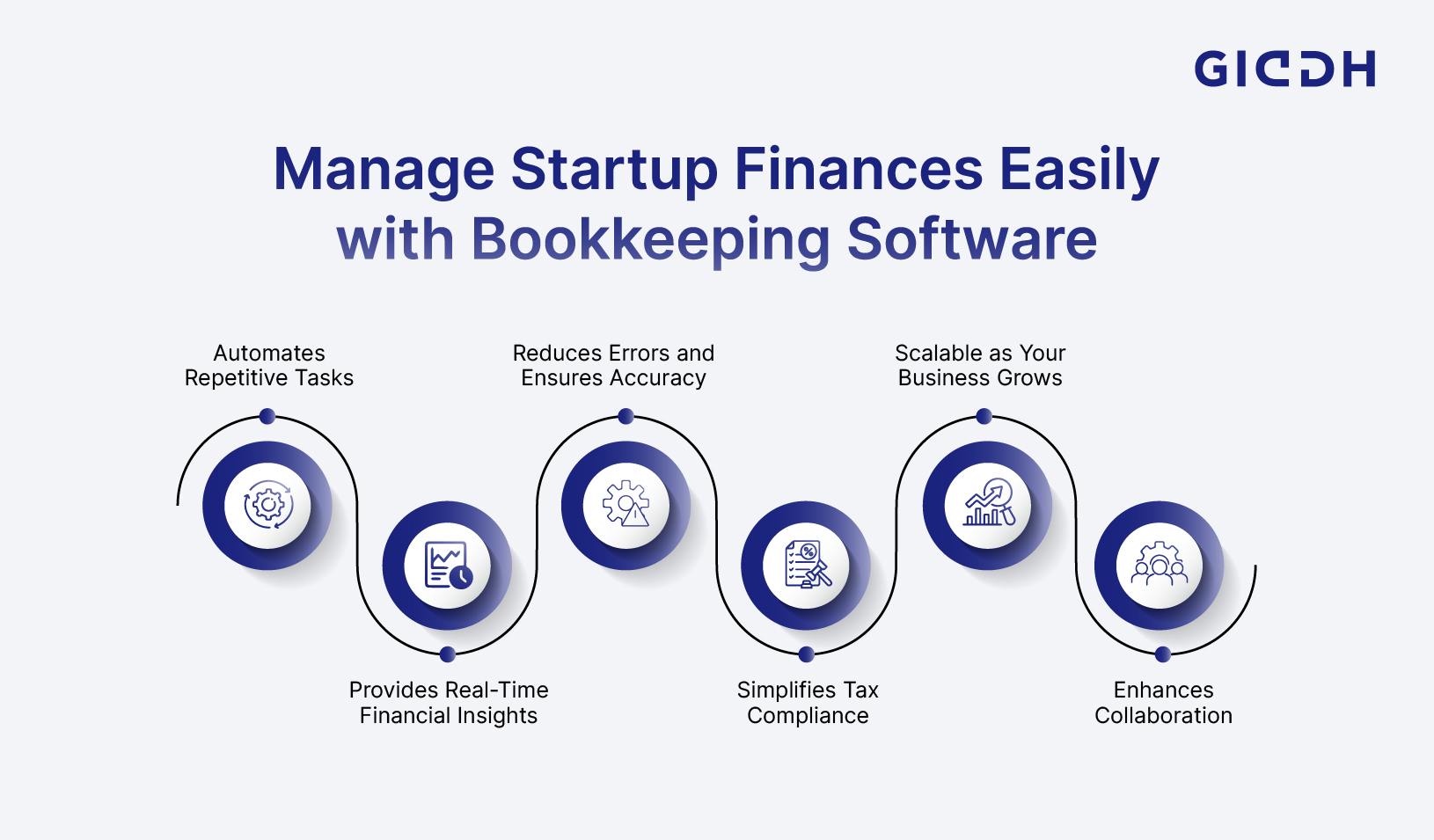

How Can Bookkeeping Software Help Startups?

-

Time-Saving Automation

Bookkeeping software automates tedious tasks like invoicing, expense tracking, and bank reconciliation. This not only saves time but also ensures accuracy. For a startup, time is precious, and the ability to automate key financial tasks means more hours to focus on growing the business. -

Real-Time Financial Insights

With real-time financial reporting and dashboards, bookkeeping software provides immediate access to data like cash flow, profits, and liabilities. This allows founders to monitor the health of their finances at a glance, making decision-making quicker and more efficient. -

Reduced Risk of Human Error

Manual bookkeeping is prone to errors, particularly with complex data entry. Bookkeeping software tracks transactions automatically, categorizing them correctly and ensuring accurate records for tax filing and audits. -

Scalability as Your Business Grows

As your startup grows, so do your financial needs. Bookkeeping software can handle increasing volumes of transactions, multiple employees, and complex tax rules without the need to hire additional staff, making it a scalable solution for small businesses. -

Efficient Tax Filing and Compliance

Manually tracking receipts, invoices, and other financial documents can lead to a backlog during tax season. Bookkeeping software organizes everything in one place, making tax filing a breeze. Many tools offer automatic tax calculations, ensuring compliance with the latest tax laws.

How Does Bookkeeping Software Streamline Financial Management for Startups?

Managing finances is one of the most critical yet challenging tasks for any startup. Manual processes are time-consuming, prone to errors, and often result in missed opportunities or compliance issues. This is where bookkeeping software for startups comes in—offering a streamlined approach to managing finances efficiently.

Here’s how bookkeeping software helps:

1. Automates Repetitive Tasks

Bookkeeping software can automate time-consuming tasks such as invoicing, tracking expenses, and reconciling bank statements. This enables startup owners to focus on core business functions, rather than spending hours on manual financial data entry.

-

Automates invoicing: Automatically generates invoices, reducing the time spent on billing clients.

-

Expense tracking: Automatically records and categorizes expenses as they occur.

-

Bank reconciliation: Automatically matches bank transactions with recorded ones, reducing manual reconciliation work.

2. Provides Real-Time Financial Insights

Real-time reports and dashboards provide startup owners with an up-to-date view of their financial situation. This helps you make informed decisions quickly, from tracking cash flow to monitoring profitability and planning for future growth.

-

Cash flow monitoring: Instantly view the inflow and outflow of funds.

-

Profitability tracking: Keep track of revenue and expenses to ensure your business remains profitable.

-

Financial forecasting: Project future revenue and costs based on current financial data.

3. Reduces Errors and Ensures Accuracy

Manual data entry increases the risk of human errors, which can lead to costly mistakes. Bookkeeping software automatically categorizes transactions, reducing the chances of errors and ensuring accuracy in financial records.

-

Automatic transaction categorization: Ensures that each transaction is recorded under the correct category.

-

Error detection: The software identifies discrepancies, ensuring no errors slip through.

-

Accurate reports: Generates precise financial reports with minimal manual input.

4. Simplifies Tax Compliance

Bookkeeping software helps ensure your startup is tax-compliant by tracking expenses, providing GST-compliant reports, and generating accurate financial statements. This makes tax filing much simpler and ensures you don’t miss out on deductions.

-

GST compliance: Automatically calculates and tracks GST on applicable transactions.

-

Tax reporting: Prepares reports for easy filing during tax season.

-

Deductions management: Helps identify potential tax-saving opportunities.

5. Scalable as Your Business Grows

As your startup expands, so do your financial management needs. Bookkeeping software grows with your business, allowing you to manage more transactions, handle multiple entities, and track complex financial data without needing additional staff.

-

Handles multiple entities: Manage finances for several business units or subsidiaries.

-

Increased transaction volume: Seamlessly handles a growing number of transactions.

-

Customizable features: Tailor the software to meet the evolving needs of your business.

6. Enhances Collaboration

Most modern bookkeeping software is cloud-based, meaning multiple team members or accountants can access financial data in real time. This improves collaboration, reduces the risk of outdated information, and keeps everyone on the same page.

-

Cloud-based access: Enables real-time access for multiple users.

-

Collaborative features: Allows accountants and team members to work together seamlessly.

-

Reduced errors from outdated data: Real-time updates ensure everyone is using the latest information.

How Can Giddh Help Your Startup?

Managing finances efficiently is crucial for startups, especially when resources are limited and growth is the goal. Giddh, a powerful bookkeeping software for startups, offers a comprehensive solution that simplifies accounting, reduces errors, and helps startups maintain control over their finances. From real-time financial insights to scalable features, Giddh adapts to your business needs and supports growth at every stage.

Whether you're tracking transactions, managing inventory, or ensuring GST compliance, Giddh provides the tools you need to stay organized and make smarter financial decisions. Here's a look at the key features of Giddh that can help streamline your financial management:

Key Features of Giddh

-

Ledger-Based Accounting:

Giddh allows you to track financial transactions in a clear, structured manner with a ledger-based system that simplifies reporting and analysis. -

Multi-Currency Support:

Whether you're doing business globally or locally, Giddh’s multi-currency feature helps you manage transactions in various currencies without hassle. -

White-Label Option:

Customize Giddh with your brand identity using the white-label option, making it ideal for accounting professionals or businesses seeking a personalized tool. -

Unlimited User Access:

Giddh lets you invite an unlimited number of users, making it easy for teams to collaborate and access data in real time. -

Manage Over 100 Companies:

For startups with multiple ventures or subsidiaries, Giddh enables the management of over 100 companies from a single account, simplifying financial oversight. -

Asset Management:

Keep track of your assets with Giddh’s asset management features, helping you monitor depreciation, track purchases, and ensure accurate reporting. -

Inventory Management:

Manage stock levels, track product sales, and optimize inventory with Giddh’s integrated inventory management system. -

Bank Reconciliation:

Giddh integrates with your bank accounts, automating bank reconciliation to save time and ensure accuracy in your financial records. -

Invoice Management:

Generate professional invoices automatically, track payments, and streamline the entire invoicing process, ensuring timely payments and improving cash flow. -

Barcode:

Streamline inventory management by integrating barcode scanning, making it easier to track products and stock levels. -

GST Compliance:

Stay compliant with India’s GST regulations by using Giddh’s built-in GST features, which help automate tax calculations and generate accurate GST returns.

Why Is Giddh Ideal for Startup Founders?

For startups in India or globally, Giddh offers a cost-effective solution with features that grow with your business. As a startup accounting software, it helps reduce financial errors, saves time, and ensures compliance without requiring a dedicated accountant.

How Do You Get Started with Bookkeeping Software?

Step 1: Choose the Right Tool

Before diving into any software, identify your business needs. Look for tools that automate routine tasks, integrate with your bank, and offer clear financial reports.

Step 2: Set Up Your Software

Once you've selected the software, import your existing financial data and adjust settings to fit your business model. Many tools, like Giddh, offer user-friendly interfaces to make the setup easy.

Step 3: Regular Monitoring and Adjustments

Don’t just set and forget. Use the software consistently to monitor your financial health. The insights you gain from regular reports will help you adjust your business strategy and keep growth on track.

Conclusion

Managing startup finances doesn’t have to be overwhelming. With the right bookkeeping software, you can streamline your financial management, save time, and focus on growing your business. Bookkeeping software for startups provides automation, accuracy, and scalability features, enabling you to manage your finances effectively as your business grows.

With tools like Giddh, you gain more than just an accounting system; you get a comprehensive tool that adapts to your needs. Don’t wait for tax season or financial issues to catch up with you—take control of your startup’s financial future today.

FAQs

How does bookkeeping software simplify financial management for startups?

Bookkeeping software automates time-consuming tasks like invoicing and expense tracking, provides real-time financial insights, and reduces human error. It saves time, ensures accuracy, and helps startups make data-driven decisions.

Can startups track expenses and revenue effectively using bookkeeping software?

Yes, bookkeeping software provides detailed tracking of expenses and revenue, offering real-time reports and insights. This ensures that startups have a clear picture of their financial health at any given moment.

What are the best bookkeeping tools for startups in India?

In India, Giddh stands out as one of the best startup accounting software tools, offering scalable features and ease of use. It provides solutions tailored to the unique financial needs of startups in India, including automated tax calculations and real-time reporting.