Cloud-Based Accounting Exposed: Separating Myth From Reality For Your Business

Cloud-based accounting has revolutionized how businesses manage their financial data. With cloud accounting software, organizations large and small can now access financial information anytime, anywhere. This solution promises enhanced efficiency, security, and ease of use.

However, despite its growing popularity, misconceptions about cloud accounting remain. Many businesses, especially small and mid-sized ones, hesitate to switch to cloud-based accounting due to these myths.

Understanding the truth behind these misconceptions can help you make an informed decision. In this blog, we will clear up these myths and explain the real benefits of cloud accounting. So, let’s get started!

The Top 03 Myths of Cloud-Based Accounting

Myth #1: Cloud-Based Accounting is Too Expensive

A common myth is that cloud-based accounting software comes with a hefty price tag, making it unaffordable for small businesses. In reality, cloud accounting solutions are often more affordable than traditional software because they operate on subscription models with no upfront costs or hardware requirements.

Reality: Cloud-based accounting programs often save businesses money in the long run. With no need for expensive servers or IT infrastructure, companies can pay a monthly or annual subscription fee that suits their needs.

This affordability, combined with the convenience of online access, makes cloud accounting an attractive option for businesses of all sizes.

Myth #2: Cloud Accounting is Not Secure

Security concerns are one of the most common barriers to adopting cloud accounting. Some business owners worry that storing financial data online exposes them to cyber threats and data breaches.

Reality: Cloud-based accounting providers invest heavily in security, including encryption, multi-factor authentication, and regular backups. In fact, cloud-based systems often offer better security than traditional methods, which may not give businesses the resources to implement the same level of protection.

Cloud accounting providers are required to comply with industry standards to ensure your financial data is safe. This is often more robust than what you can achieve with on-premise software and hardware.

Myth #3: Cloud-Based Accounting Programs Are Only for Large Businesses

Some believe that cloud-based accounting software is only suitable for large enterprises with complex accounting needs. This misconception stems from the assumption that such systems are too intricate or expensive for small businesses.

Reality: Cloud accounting for small businesses is designed to be scalable, with features that grow as your company does. In fact, many solutions are specifically tailored to meet companies' needs. These systems offer simple interfaces, affordable pricing, and the ability to scale features as your company grows.

With cloud accounting, even small businesses can access advanced features such as real-time financial reporting, invoicing, and tax management all on an affordable, easy-to-use platform.

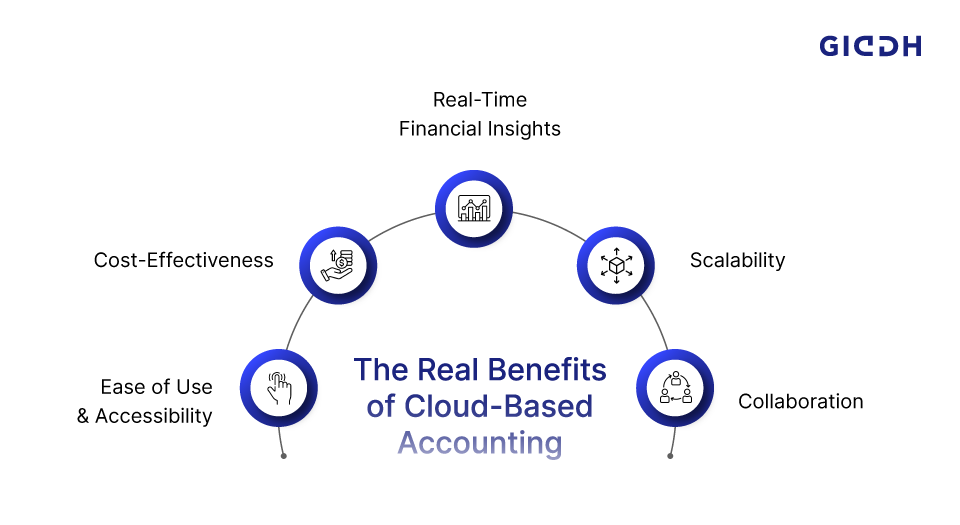

The Real Benefits of Cloud-Based Accounting

Now that we’ve debunked some of the most common myths, let’s take a look at the real benefits of cloud-based accounting.

1) Ease of Use & Accessibility

Cloud-based accounting software allows businesses to access financial data from anywhere, at any time, as long as they have an internet connection. This level of accessibility is particularly valuable for companies with remote teams or multiple locations.

2) Cost-Effectiveness

Cloud accounting software typically comes with a subscription-based pricing model, making it more affordable for businesses. There are no hefty upfront costs, no need to maintain expensive servers, and no hidden fees.

3) Real-Time Financial Insights

Cloud-based accounting software provides real-time access to financial data, enabling business owners to make informed decisions quickly. With cloud systems, you can track income, expenses, profits, and other key metrics as they occur.

4) Scalability

Cloud accounting systems are designed to scale with your business. As your company grows and your accounting needs become more complex, you can easily upgrade your plan or add additional features. This scalability ensures that your accounting software will continue to meet your needs as your business expands.

5) Collaboration

With cloud-based accounting, multiple users can access and work on the same data simultaneously, streamlining communication and collaboration. Whether you have an in-house accounting team or outsource your accounting needs, cloud systems make it easy for everyone involved to stay on the same page.

Why Giddh is the Best Cloud Accounting Software For Your Businesses?

Giddh is a powerful cloud accounting software that streamlines your financial management, giving you more time to focus on growing your business. Here’s how Giddh can make a difference:

Key Features Of Giddh

- Effortless Ledger-Based Accounting: Simplify your accounting with one-step ledger entries that make bookkeeping a breeze. Giddh’s cloud accounting system allows you to record and manage your finances quickly, reducing manual work and saving valuable time.

- Manage Multiple Companies & Branches with Ease: Whether you're managing a single business or multiple companies and branches, Giddh lets you handle everything under one roof—without the need for multiple subscriptions. Keep everything organized and accessible in one platform.

- Real-Time, Comprehensive Business Reports: Stay on top of your finances with instant access to detailed reports, including Profit & Loss (P&L), Balance Sheets, Aging Reports, and Tax Reports. With real-time data, you can make informed decisions that drive your business forward.

- Automated Multi-Currency Support: Expand globally with ease. Giddh lets you manage transactions across multiple currencies, making it ideal for international businesses or companies expanding into new markets. You can effortlessly handle cross-border accounting with automatic currency conversion.

- Seamless Tally Synchronization: Integrate effortlessly with Tally and sync your accounting data to eliminate the risk of manual entry errors. Giddh ensures smooth data transfer, saving you time and reducing the risk of errors, so your records are always accurate.

- Manage Over 100 Companies Under One Subscription: Whether you’re a growing enterprise or managing multiple subsidiaries, Giddh supports managing over 100 companies on a single subscription. Consolidate your financial data for better visibility and control.

Cloud-Based Accounting: A Game Changer For Small Businesses

Cloud-based accounting offers numerous advantages over traditional accounting methods. It’s cost-effective, secure, scalable, and provides real-time access to financial data benefits that can help businesses streamline operations and make better decisions.

For small businesses, transitioning to cloud-based accounting is more than just an upgrade; it’s a game-changer. With cloud accounting, businesses can manage their finances with ease, freeing up time to focus on growth and innovation.

Final Words!

Cloud-based accounting is not just a passing trend; it’s the future of business finance. By debunking common myths and understanding its tangible benefits, businesses can make informed decisions that set them up for long-term success.

For small businesses, Giddh offers an intuitive, affordable, and feature-rich cloud accounting solution.

Whether you're a small business owner just getting started or an established company looking for a better accounting solution, Giddh can help you streamline your accounting processes and ensure compliance with ease. Sign up today for a free trial.