Why Accounting Software Is Better Than Spreadsheets for Your Business.

Many small businesses begin their accounting journey with Excel. One of the major reasons to do so is that Excel is widely popular and easily accessible. Unfortunately, maintaining books on Excel or Google spreadsheets can be risky, inaccurate, and time-consuming.

Business owners and accountants are so used to working on spreadsheets that they never question why they even continue working on them!

Accurate financial reports are one of the most important things for running your business efficiently. Recording transactions and financial activities on spreadsheets makes your business reports prone to errors.

Therefore, it is essential to replace spreadsheets with reliable accounting software to ensure data integrity and save valuable time.

3 Significant Reasons Spreadsheet Can Limit Your Business Growth.

Here are seven major reasons that spreadsheets fall short when used for accounting (even for small businesses!)

1. Spreadsheets Are Prone To Error

Spreadsheets make it easy to keep making errors. A simple mistake like misplacing a decimal point or an extra zero at the end of a figure can surely result in a huge accounting error. A spreadsheet is simply a medium that contains your data and doesn’t offer the functionality of analysing the information in depth.

The Alternative

Using cloud-based accounting software for business means that your financial records are updated instantly. This also means that you completely override the danger of copy-and-paste errors.

And since everyone in your business has the access to the same data, you don’t have to spend time wondering if there’s a newer version of your accounts stored on someone else’s computer.

2. Spreadsheets Don’t Give You the Big Picture View

Sure you can create some comparative bar graphs from your Excel data, but it is extremely time-consuming and frankly, who has the time to go through all the menus and options?

If you want to see the big picture, analyse your sales trend or want to keep an eye on your net-worth, you end up spending hours sifting through and analysing data manually.

The Alternative

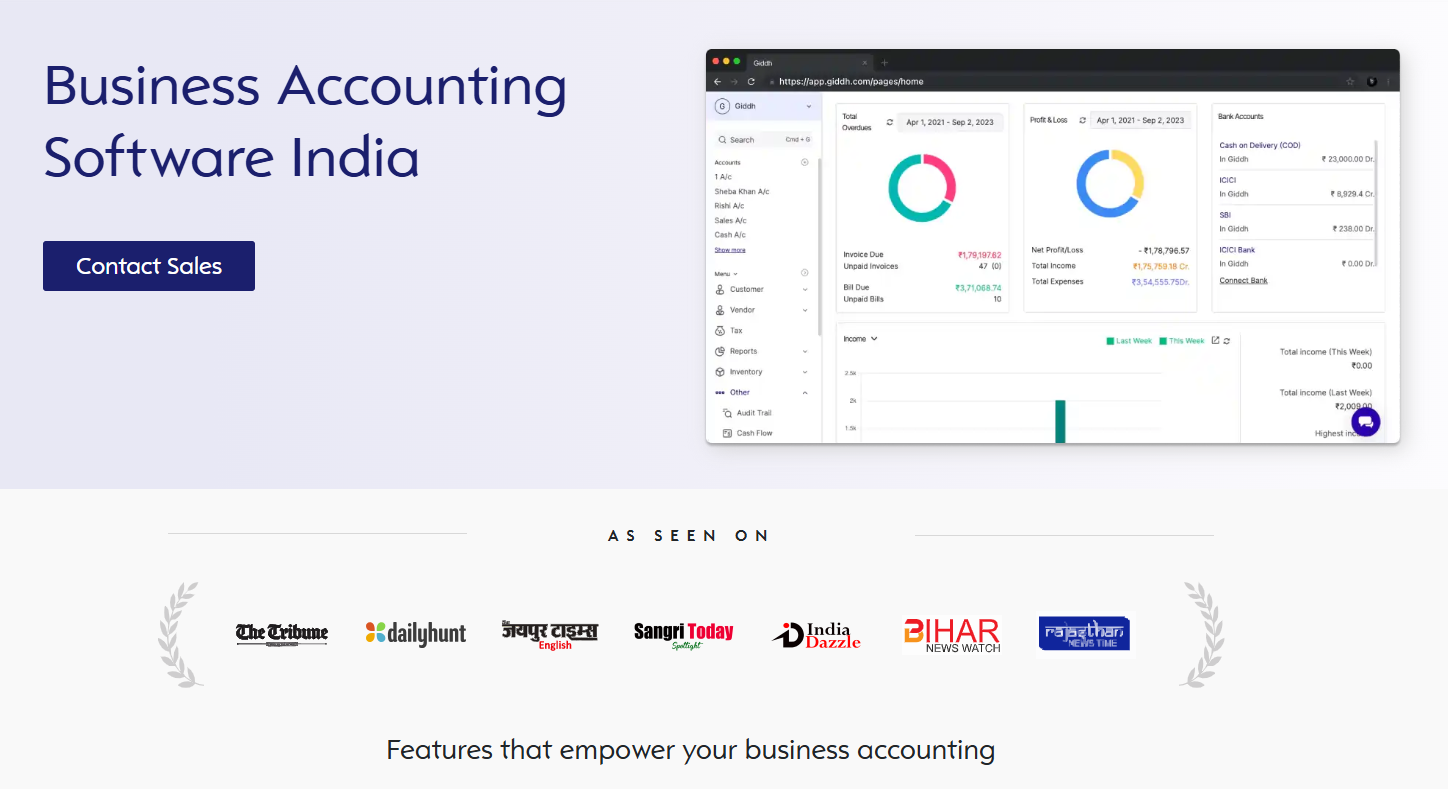

A robust online accounting software like Giddh, can help you keep an eye on the financial health of your business. Online accounting software best comes with a real-time dashboard that provides you with a big-picture view of your business. Using them you can-

- See your net worth, compare revenues, analyse profit/loss.

- See who owes you on overdue and who you owe money

- See the amount you’ve spent in your expenses and create strategies on how to curb those expenses.

3. Spreadsheets Can’t Keep You Tax Compliant

As we mentioned above, spreadsheets are just a medium on which you can store your financial data and do basic math calculations to generate basic reports. But what about tax compliance?

With the introduction of Goods and Services Tax(GST), now every small business will have to register and submit their GST returns.

If you keep using spreadsheets, you will have to manually download a GST return sheet and upload your data manually to file your return. Or worse, seek assistance of an accounting professional for the simple task of return filing and pay them an additional fee for the same. This is a process filled with hassles and you as a business owner can’t waste your time or resources on this.

The Alternative

Using cloud accounting software, you don’t need to worry about seeking assistance from any accounting professional for filing your GST return. Most accounting software types today come GST ready, so the invoices you create will be GST compliant, and your returns can be filed more easily as the return file is automatically created.

7 Important Processes Where Giddh Accounting Software Beats Spreadsheets

Managing Invoices

-

Time-saving: With Giddh, creating invoices is simple and quick, saving you significant time and effort compared to manually entering data in spreadsheets.

-

Reduced errors: Giddh guides you to enter information in the correct format, reducing the chances of mistakes.

-

Automated features: Unlike spreadsheets, Giddh automatically integrates data from your bank, reconciles transactions, and generates invoices, quotes, and estimates.

-

Professional invoices: Giddh allows you to create and send branded, professional-looking invoices, providing a polished image to your clients.

Capturing Receipt Details

-

Easy access: Giddh allows you to easily retrieve and report on expenses and suppliers in one place, eliminating the confusion of searching through multiple spreadsheets.

-

Receipt scanning integration: Giddh integrates with receipt-snapping apps, enabling you to quickly take photos of receipts and record transactions right from your phone.

-

Simplified record-keeping: No more dealing with piles of physical receipts or multiple spreadsheet files scattered across your device or office.

Managing Budgets

-

Collaborative budgeting: Giddh enables real-time collaboration on budget plans within a single, secure platform, eliminating version conflicts and the need to share spreadsheets via email.

-

Speed and efficiency: Budgeting in Giddh is faster and more efficient, enabling you to make changes quickly and run scenarios without multiple revisions.

-

Dynamic planning: Giddh offers real-time views of your performance and cash flow forecasts, making it easier to adapt to market changes and make informed decisions.

-

Minimized errors: Giddh is designed to reduce errors and duplication, streamlining processes and enabling faster financial adjustments.

Tracking Payments

-

Automated payment tracking: Unlike spreadsheets, Giddh automatically tracks payments and sends alerts for late payments, ensuring you stay on top of outstanding invoices.

-

Bank feeds integration: Giddh offers automated bank feeds, allowing you to reconcile income data directly from your bank, saving hours of manual effort.

-

Mobile-friendly: Track payments remotely via your mobile phone with Giddh, making it easier to stay updated even when you're on the go.

Submitting Returns and Keeping Business Records

-

Tax return submissions: Giddh simplifies tax return filing by automatically maintaining accurate records and submitting them to authorities such as HMRC, reducing audit risk.

-

Regulation updates: Giddh is regularly updated to reflect changes in rules and regulations, ensuring your business stays compliant.

-

Data security: Your financial accounting records are securely stored in the cloud with Giddh, making it easier to recover data in the event of theft, misuse, or disaster.

-

Error reduction: Giddh is built to minimize errors, helping you maintain clean, accurate business records with less effort.

Scheduling Shifts

-

Streamlined scheduling: Giddh’s cloud-based HR tools allow you to easily manage staff shifts and schedules from any device, reducing the hassle of using multiple spreadsheets and endless emails.

-

Real-time updates: Employees can access schedules, payslips, and request time off via the Giddh platform, all in real-time.

-

Automated payroll integration: Giddh’s HR features work seamlessly with payroll, helping you manage shifts, track hours, and generate payroll reports effortlessly.

-

Remote workforce management: With Giddh, you can manage schedules, track holidays, and approve time-off requests from anywhere, even if your team works remotely.

Expense Tracking for Payroll

-

Flexible tracking: Easily manage sick pay, parental leave, and student loan recovery.

-

Compliance assurance: Giddh ensures your business remains compliant with payroll regulations, reducing the risk of costly errors.

Conclusion

Transitions can be complicated. Adapting to the latest trends and automated accounting software requires the business owner to learn to use the software. However, this change is necessary if the business wants to grow its profits, curb unnecessary hassles, and operate more productively.

We’re sure you must be excited by now to know more about cloud accounting. If so, here’s a list of the 5 top signs your business is ready to make the transition from offline to online, cloud-based accounting.

As always, we are happy to answer any questions you have about cloud-based accounting.

Just comment below, or simply get in touch with us.

FAQs

1. Is Giddh secure for storing business financial data?

Absolutely! Giddh stores your data in a highly secure, cloud-based system with robust encryption and backup protocols. This ensures that your business financial data is safe from theft, loss, or damage, providing peace of mind for business owners.

2. How can Giddh help with budgeting and financial planning?

Giddh enables businesses to easily create, track, and modify budgets in real-time. It allows for collaboration on budget plans in a secure, single platform, reducing the errors and inefficiencies associated with using multiple spreadsheets. Giddh also provides dynamic forecasting and scenario planning, helping you make data-driven decisions.

3. Can I track my business’s cash flow with Giddh?

Yes! Giddh’s dashboards provide a real-time overview of your business’s financial health, including tracking your cash flow, income, expenses, and outstanding payments. This helps you make informed decisions and manage your liquidity more effectively.

4. How does accounting software help with taxes compared to spreadsheets?

Accounting software like Giddh is specifically designed to help with tax compliance. It automates tax calculations, generates GST-compliant invoices, and can even file returns directly. In contrast, spreadsheets require manual tax calculations, and keeping up with changing tax laws can be error-prone and time-consuming.

5. Can I use accounting software to collaborate with my team?

Absolutely! Accounting software like Giddh enables multiple users to access and collaborate on the same financial data in real time, with secure permissions. This is a major advantage over spreadsheets, which often involve sending multiple versions of the document and can lead to confusion or outdated information.