How Cloud-Based Collaborative Accounting Software Boosts Transparency

According to a 2024 survey by Deloitte, 76% of small and mid-sized businesses reported difficulties in maintaining accurate, real-time financial data due to outdated accounting processes. With so many companies still depending on spreadsheets and single-user desktop software, the result is inefficiencies, data delays, and reduced team collaboration.

But here’s a question every business owner should ask: if your finance team spends more time fixing errors than analyzing results, how much is it costing your growth?

This is where Cloud-based Collaborative Accounting Software steps in. Unlike traditional tools, it offers multi-user access, workflow automation, and real-time financial collaboration, enabling businesses to achieve greater transparency and operational efficiency.

In this blog, we’ll explore the common accounting challenges, the advantages of switching to cloud-based systems, and how solutions like Giddh make this transition seamless.

The Problem with Traditional Accounting Systems

For decades, businesses have relied on traditional accounting methods that work in silos. While they may handle basic bookkeeping, they fall short in areas where collaboration, speed, and accuracy are vital.

Here are the most common issues business owners face today:

-

Inefficiency: Manual data entry and isolated systems slow down reporting. Finance teams often spend hours reconciling books instead of focusing on strategy.

-

Lack of Transparency: Data silos hinder managers' ability to access clear financial insights, increasing the risk of errors and missed opportunities.

-

Collaboration Barriers: Single-user restrictions and version control issues result in duplicate work, miscommunication, and costly mistakes.

A survey by the Small Business Accounting Trends Report highlighted that 42% of businesses experience delayed decision-making due to scattered financial data. For growth-oriented SMEs, this is a significant bottleneck.

What is Cloud-based Collaborative Accounting Software?

At its core, cloud-based collaborative accounting software is a platform that allows multiple users to access, manage, and update financial data simultaneously from anywhere.

Unlike traditional desktop-based tools, which restrict access to one system, cloud solutions ensure that all stakeholders—from accountants to finance managers—work on the same set of real-time data.

Key features include:

-

Multi-user access for seamless team collaboration.

-

Cloud finance management tools that centralize reporting and dashboards.

-

Real-time data synchronization to eliminate version conflicts.

-

Accounting workflow automation to streamline repetitive tasks.

This makes it the best collaborative accounting software choice for businesses that value transparency and operational agility.

Benefits Of Collaborative Accounting Software For Transparency and Efficiency

4.1 Real-time Financial Collaboration

When multiple team members can log in and work on the identical financial records simultaneously, productivity increases, errors are minimized, and accountability is promoted.

Benefits:

-

Instant updates across all users.

-

No version mismatches.

-

Clear audit trails for transparency.

This is why real-time financial collaboration is becoming a cornerstone for modern finance teams.

Multi-user Accounting for Teams

Traditional tools often restrict access to a single user at a time. In contrast, cloud platforms provide a multi-user accounting system with role-based permissions.

-

Finance managers can approve entries.

-

Accountants can update ledgers.

-

Business owners can monitor reports instantly.

This layered access ensures financial data remains both secure and transparent across departments.

Accounting Workflow Automation

Automation is no longer optional—it’s essential. With accounting workflow automation, businesses can eliminate repetitive manual tasks, such as invoice generation, reconciliations, and expense tracking.

Advantages include:

-

Faster processing times.

-

Fewer manual errors.

-

Standardized workflows across the team.

Automation frees up finance professionals to focus on higher-value tasks, such as forecasting and strategy development.

Cloud Finance Management

One of the most significant advantages of cloud technology is accessibility. With cloud finance management tools, business leaders can track KPIs and generate reports from any device at any time.

-

Centralized dashboards for instant insights.

-

On-demand reporting for decision-making.

-

Remote access for teams across locations.

This flexibility ensures that financial data is always accessible and actionable, regardless of the team's location.

Why Businesses Are Switching to Cloud Accounting Solutions

The shift to cloud-based finance is no longer just a trend—it’s a necessity.

-

SMEs are leading adoption: A Statista report notes that nearly 58% of SMEs in 2023 adopted some form of cloud accounting solution.

-

Cost savings: Eliminating server infrastructure and reducing IT support expenses.

-

Scalability: Cloud platforms grow with your business, handling increased users and transactions seamlessly.

-

Regulatory compliance: Built-in audit trails and secure access align with modern compliance requirements.

For many companies, switching to Cloud Accounting Solutions for Businesses is about staying competitive in an environment where efficiency and accuracy define success.

Choosing the Best Collaborative Accounting Software

With numerous options available, how can decision-makers select the right platform? Here are the key factors to evaluate:

-

Security & Compliance: Ensure data encryption and adherence to financial regulations.

-

Scalability: The software should adapt as your team and transactions grow.

-

Integration: Must connect with existing CRMs, ERPs, and banking systems.

-

User Experience: Simple dashboards and intuitive workflows matter, especially for non-technical managers.

This is where Online Accounting Tools for Teams stand out—they combine usability with powerful functionality.

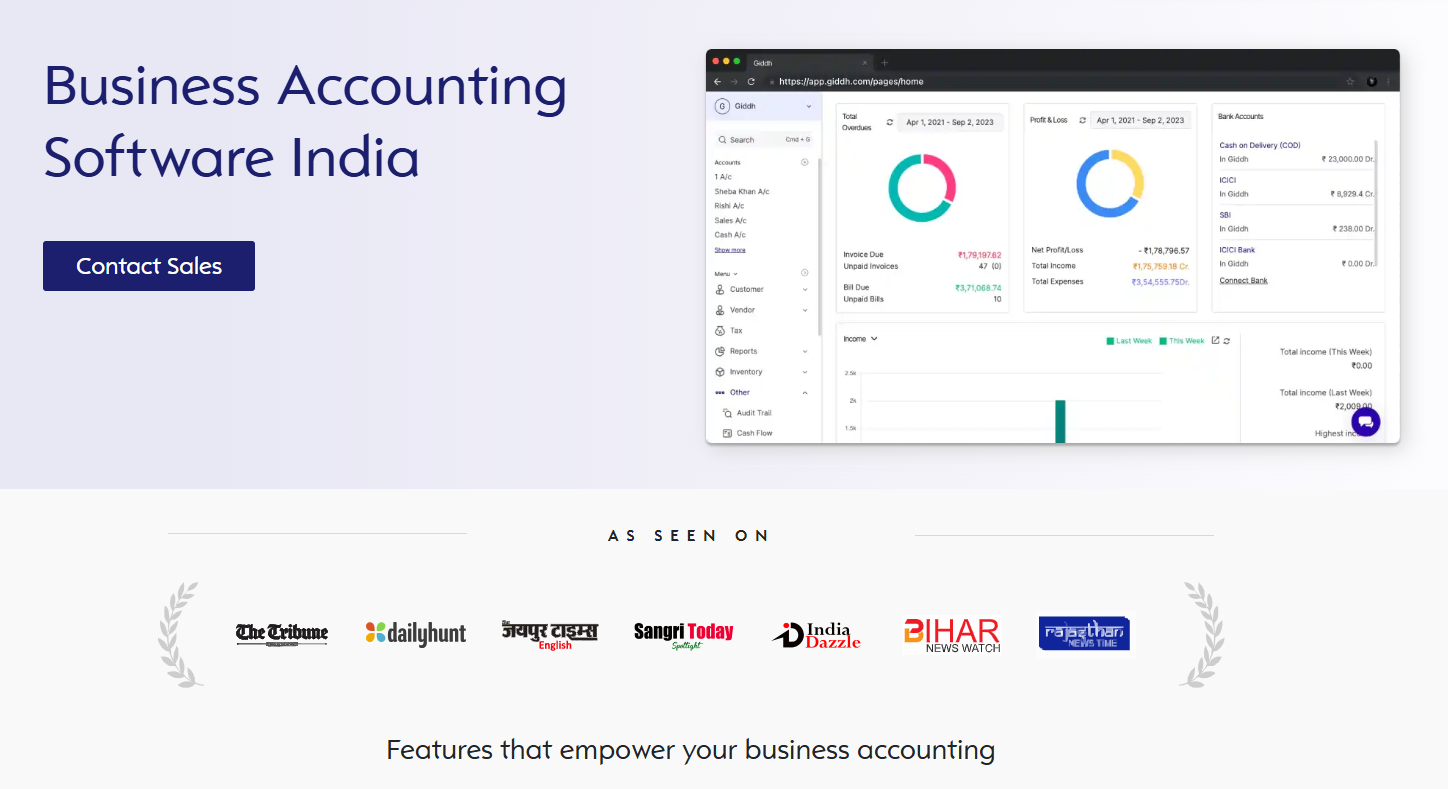

Giddh – Simplifying Collaborative Accounting

For small and mid-sized businesses, the biggest challenge is finding a tool that not only simplifies accounting but also scales with growth. Giddh is designed to meet this exact need. It combines collaboration, automation, and compliance into a single, easy-to-use platform that addresses the pain points of business owners and finance managers.

Here’s how Giddh helps solve common accounting challenges:

-

Ledger-Based Accounting – Organize finances with a simplified ledger-first approach, making entries easy to manage and track.

-

Multi-Currency Support – Seamlessly handle transactions across global markets without conversion errors.

-

White-Label Option – Customize the platform to reflect your brand identity and maintain professional consistency.

-

Unlimited User Access – Collaborate freely with your entire team, avoiding extra license fees.

-

Manage Over 100 Companies – Oversee multiple businesses from a single account with smooth switching.

Operational efficiency becomes effortless with these advanced tools:

-

Asset Management – Track, manage, and report on company assets with accuracy.

-

Inventory Management – Monitor stock levels, purchases, and sales in real time.

-

Bank Reconciliation – Connect with bank accounts for faster, error-free reconciliation.

-

Invoice Management – Create, send, and track invoices for improved cash flow control.

-

Barcode Integration – Simplify inventory operations with barcode-enabled processes.

Compliance and accessibility are built in:

-

GST Compliance – Automate tax calculations and reports to stay compliant with Indian regulations.

-

Multiple Device Access – Work seamlessly across desktops, tablets, or mobile devices, ensuring teams stay connected anywhere.

With this feature-rich suite, Giddh empowers businesses to achieve transparency, efficiency, and collaboration in their accounting workflows.

Explore how Giddh can help you transition smoothly into a cloud-based collaborative system.

Conclusion:

The era of isolated, error-prone accounting is fading. Cloud-based Collaborative Accounting Software is redefining how businesses manage finances by enabling real-time collaboration, workflow automation, and transparent reporting.

For small and mid-sized companies, this shift is more than a technology upgrade; it’s a competitive advantage. By adopting solutions like Giddh, businesses not only improve efficiency but also empower decision-makers with reliable, up-to-date insights.

If your organization is ready to eliminate inefficiencies and embrace financial clarity, the answer lies in cloud-powered collaboration.

Subscribe to a free trial today to transition to cloud-based accounting for improved efficiency.

FAQs

Q1. What is cloud-based collaborative accounting software?

It’s an online accounting platform that enables multiple users to access, update, and manage financial data in real-time, enhancing transparency and collaboration.

Q2. How does collaborative accounting software improve transparency?

By enabling role-based access and real-time updates, all stakeholders can view accurate, up-to-date financial records without relying on data silos.

Q3. What are the benefits of a multi-user accounting system?

It allows different roles—such as accountants, managers, and business owners—to work simultaneously, ensuring secure collaboration and faster reporting.

Q4. Is cloud-based accounting secure for small businesses?

Yes. Most platforms utilize encrypted data storage, secure login protocols, and compliance with financial regulations to safeguard sensitive information.

Q5. Which is the best collaborative accounting software for SMEs?

The ideal software should strike a balance between usability, scalability, and automation. Tools like Giddh provide these features while being cost-effective for growing businesses.