How GST Compliance Software Prepares You for Scrutiny Notices

Recent data indicate that the tax authorities in India issued approximately 33,000 GST notices to businesses for return discrepancies and short payments of taxes during fiscal years 2017-18 and 2018-19.

The Economic Times. With the rollout of the automated scrutiny module by the Central Board of Indirect Taxes and Customs (CBIC) and enhanced analytics / cross-data checks, the frequency and scope of notices are only increasing.

Manual GST processes riddled with spreadsheet mismatches, delayed reconciliations, and siloed vendor data leave finance teams vulnerable when a notice arrives. Enter GST compliance software: instead of scrambling when a notice lands, you stay audit-ready with visibility, automation, and faster response.

Why Businesses Struggle During GST Scrutiny

Manual Reconciliation Woes

-

Suppliers file returns; recipients claim input tax credit (ITC); records often misalign.

-

Example: a mismatch between GSTR-2A/2B and the internal purchase ledger causes scope for tax authority queries.

-

Manual tracing of thousands of vendor lines is time-intensive and error-prone.

Frequent GST Regulation Updates

-

Changes in filing formats, due dates, penalty thresholds, and ITC eligibility keep compliance teams busy.

-

Staying updated, implementing changes, training staff, and adapting systems consume resources.

-

Delays in adaptation lead to filing errors and potential scrutiny triggers.

Lack of Centralised Visibility

-

Large organisations with multiple GSTINs, locations, and business units often work in silos.

-

ERP data, vendor portals, spreadsheets, and reconciliation tools often fail to integrate seamlessly.

-

Without a single dashboard, compliance health becomes hard to monitor and control.

-

For CFOs and tax heads, this means a lack of control, unexpected liabilities, and stress when a scrutiny notice arrives.

Understanding GST Scrutiny Notices: What the Tax Department Looks For

Scrutiny notices under the GST regime arise when tax authorities identify potential issues or concerns.

Common triggers include:

-

Mismatch between GSTR-1 and GSTR-3B or between GSTR-2B and claimed ITC.

-

Turnover discrepancies across GST, income tax returns, and financial statements.

-

High or frequent refund claims, wrongly claimed ITC, late filings, and missing invoices.

GST compliance requirements during scrutiny

When a notice lands, you must be able to produce:

-

Documentation and audit trail supporting claimed ITC and outward supplies.

-

Reconciliations showing alignment of vendor data, invoices, e-way bills, and return data.

-

A robust reply to the notice (often Form ASMT-11) within the stipulated timeframe (usually 30 days) according to the scrutiny process.

Mini gst compliance checklist

-

Return consistency (GSTR-1, 3B, annual return)

-

Input tax credit matches with supplier filings and GSTR-2A/2B

-

Vendor compliance validation (they have filed their returns)

-

Proper e-way bill & supplier invoice document storage

-

Timely GST filing and payment of tax liability

-

Archiving of documents and audit trail for all significant transactions

Having such a checklist baked into your process significantly lowers risk.

How GST Compliance Software Simplifies Scrutiny Readiness

A. Automated Data Reconciliation

A good solution automatically aligns GSTR-2B data with your purchase ledger and vendor filings in real time.

That means: fewer manual mismatches, faster reconciliation cycles, and fewer hidden risk zones.

B. Audit-Ready Documentation

All required documents—vendor invoices, e-way bills, reconciliation logs—are stored centrally and securely.

When a notice arrives, you don’t hunt through folders; you generate reports at the click of a button.

C. Intelligent Alerts & Regulatory Updates

The software can:

-

Flag mismatches, such as high ITC claims, where the vendor has not filed returns.

-

Alert for upcoming due dates or delayed filings.

-

Push updates when GST rules change (e.g., due dates or documentation requirements).

When you implement the best GST compliance software in India, these steps happen without manual overhead.

D. Improved Accuracy & Response Speed

With reconciled data, you can respond quickly to a notice—pulling pre-built reports and relevant documents instead of scrambling.

Real-time visibility reduces guesswork, ups accuracy, and gives your compliance team confidence.

Key Features to Look for in the Best GST Compliance Software (with Checklist)

Here’s a GST compliance checklist of key software features you should evaluate:

-

Automated return-filing (GSTR-1, 3B, 9, etc.)

-

Real-time reconciliation of GSTR-2B/2A with internal purchase data

-

Multi-GSTIN + multi-user support (essential for larger businesses)

-

Cloud-based accounting dashboard for monitoring compliance health across business units

-

Vendor compliance tracking (which vendors have filed returns, which haven’t)

-

Secure data storage, audit-trail, document archival (for notice-response readiness)

👉 Ready to see how Giddh simplifies this entire checklist? Book a Free Demo.

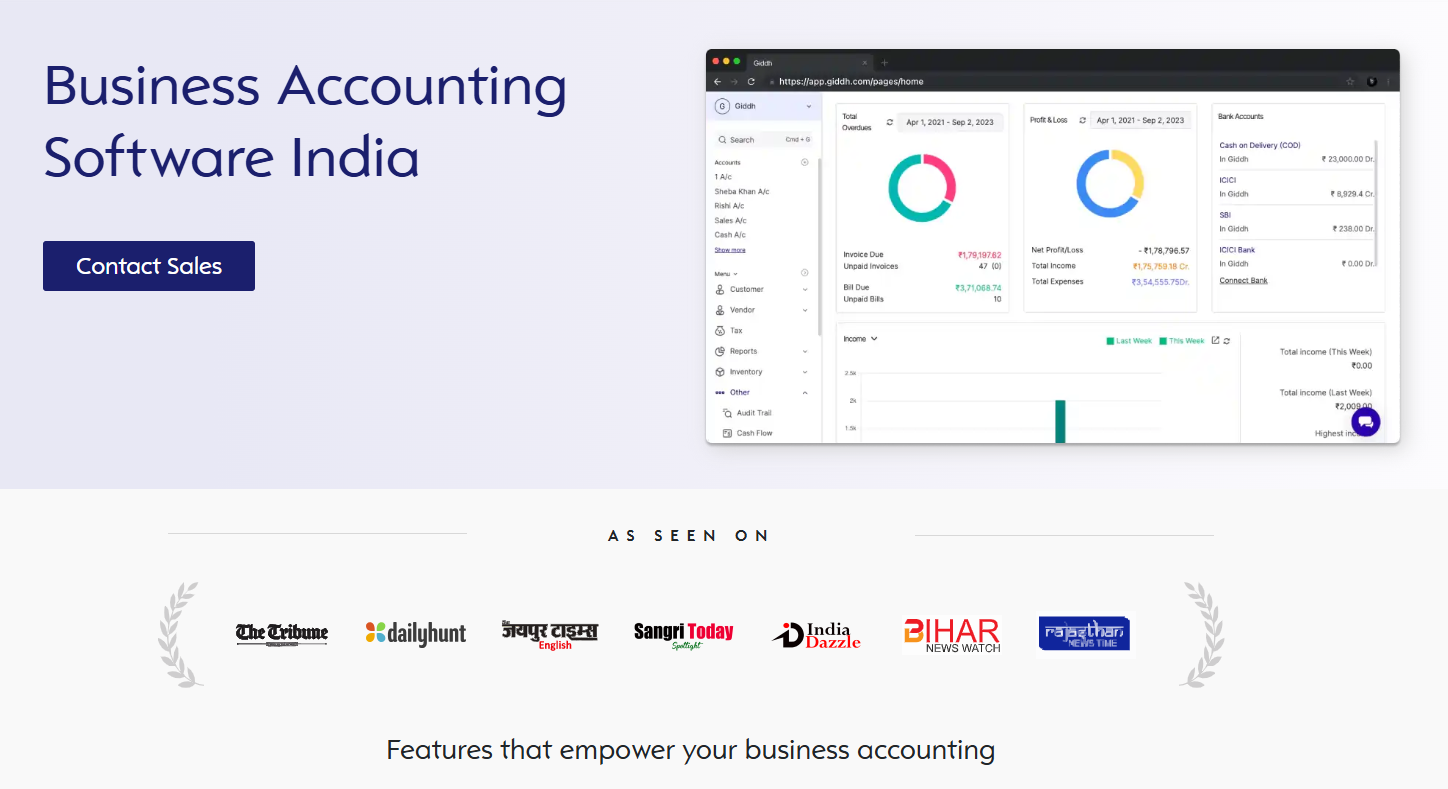

Why Giddh is the Best GST Compliance Software in India for Audit Readiness

When it comes to GST compliance software India trusts, Giddh stands out for several reasons:

-

Seamless GSTR-2B auto-reconciliation: you import supplier filings and reconcile instantly with purchase records.

-

A real-time dashboard provides CFOs and compliance leads with visibility into filing status, ITC claims, and vendor compliance.

-

Automated reports built for notice-response: pre-formatted and export-ready.

-

Integration with your accounting or ERP system—no isolated compliance silos.

Giddh has empowered hundreds of finance teams to stay audit-ready with minimal manual effort.

Final Thoughts:

GST scrutiny is not just a possibility; it’s an expectation for businesses that handle significant filings and multiple registrations. The good news is that with the proper process and platform, you don’t have to treat every notice like a fire drill.

Automating your reconciliations, centralising your data, and staying ahead of regulatory shifts gives you peace of mind, stronger compliance accuracy, and faster responses.

For finance leaders and compliance professionals, the goal is clear: build a system today so you’re ready tomorrow.

✅ Book a Free Demo | ✅ Get a Free Compliance Audit with Giddh

FAQ

Q1. What is GST compliance software, and how does it help during scrutiny?

Answer: GST compliance software is a specialised tool that automates the reconciliation of filings (such as GSTR-2B/2A vs. purchase data), tracks vendor compliance, manages document archival, and generates reports for notice responses. By standardising and streamlining these tasks, you reduce manual errors and improve readiness when a scrutiny notice arrives.

Q2. What are the GST compliance requirements for large businesses in India?

Answer: They must maintain accurate return filings (GSTR-1, 3B, 9, etc.), reconcile ITC claims with supplier data, maintain audit-trail documentation (invoices, e-way bills, ledger details), respond to scrutiny notices within stipulated timelines, and stay updated with any regulatory changes.

Q3. Which is the best GST compliance software in India?

Answer: While several solutions exist, the best GST compliance software in India will include automated reconciliation, multi-GSTIN support, vendor tracking, cloud-based dashboards, and seamless integration with your accounting system. Giddh is cited as a strong fit in this category.

Q4. How to create a GST compliance checklist for your business?

Answer: Start by listing your key processes—return filings, ITC claims, vendor data intake, documentation storage, reconciliation workflows. Then map software features or manual controls to each process, define responsible persons and timelines, and review the list periodically to keep it updated.

Q5. Can GST software automatically reconcile GSTR-2B data?

Answer: Yes. The right GST compliance software will import your supplier’s GSTR-2B/2A data, match it to your purchase ledger in real-time, flag mismatches, and generate reports. That directly reduces the risk of receipt-supplier non-filing showing up in a scrutiny notice.