7 Non-Finance Tips For Perfecting Your Startup’s Finance

Startup financial planning is often mistaken for a numbers-only activity—budgets, forecasts, and balance sheets. In reality, strong financial health begins much earlier, shaped by the everyday habits founders build from day one.

The way you price your time, control costs, make leadership decisions, and manage limited resources plays a far bigger role in your financial success than most spreadsheets ever will.

At an early stage, these small non-financial decisions quietly shape your cash flow, profitability, and funding readiness. This is why startup financial planning must start with the right mindset and discipline, not just the best accounting tools.

In this blog, we share three powerful non-finance tips that may not look like finance strategies at first—but have a direct and lasting impact on your startup’s financial growth.

What Is The First Step In Financial Planning

The first step in financial planning is:

✅ Setting Clear Financial Goals

Before budgets, investments, or tools, you must define what you want your money to achieve. This gives direction to every financial decision that follows.

Why this step matters

-

Creates a clear roadmap

-

Helps prioritise spending

-

Defines savings and investment needs

-

Improves short-term and long-term decision-making

-

Aligns business actions with financial outcomes

Examples of financial goals

-

Build 12-month cash runway.

-

Achieve break-even in 18 months

-

Reduce operational costs by 20%.

-

Increase monthly revenue by 2x.

-

Prepare for Series A funding.

Once goals are clear, the following steps become logical: assessing current position, budgeting, forecasting, and tracking.

#1. Good At Something? Don’t Do It For Free

Startup founders often find it fulfilling to have conversations with other entrepreneurs about various issues. As long as it’s an exchange of knowledge, information and resources, it’s a win-win. But if you are giving away your time for nothing in exchange, you are practically losing money.

How many times have you got yourself involved with a client issue which is not yours? If some of your clients have taken so much of your time that it qualifies in ‘consulting’, you should have charged for it. Giving away your time for free is almost like doing a free distribution of your service or product. If you are not getting any real value for this consultation, discussion, or talk, you must stop immediately.

How this improves startup finance (non-finance impact):

-

Protects revenue from unseen time leakage

-

Builds strong value-based pricing habits

-

Improves client quality and boundaries

-

Converts knowledge into monetisable assets

-

Strengthens cash flow without increasing costs

# 2. It’s Okay To Start Small

Don’t get too bogged down by limited capital at the start of your company. Flipkart founders started with selling books and at the time, they used to wrap those books themselves before sending it to courier services. Eventually such factors impressed the investors along with their valuation that got them their first round of funding.

Set examples of doing smart business, save costs when you can and charge for extra services where it’s due. These little factors play a big role in giving the investors the confidence that you know how to put their money to good use.

How this strengthens startup finances:

-

Encourages capital efficiency from day one

-

Builds strong cost-control habits

-

Reduces early-stage burn rate

-

Improves unit economics naturally

-

Signals financial maturity to investors

# 3. Investors Invest In The Pilot, Not The Plane

It’s your leadership and management skills with the available resources that would eventually get your investor’s money. Investors need to know that you have the ability to manage finances well, keep things within budget and increase or decrease marketing costs as the situation demands.

As a founder, you should know how to tell your story well. Be very clear about the exact pain point you are addressing. Articulate well about your solution or the service and how you stand out. Investors are people and if they cannot connect with you as a person, they are not likely to put their faith in your startup.

As you learn to practise these tips, you will soon realize you are able to cut your costs and earn reasonable profits for your business. For more finance tips, stay tuned to Giddh. If you need help with automated finance management.

Why this directly impacts your startup’s finance:

-

Builds investor trust and funding readiness

-

Shows budget control and financial discipline

-

Improves valuation through leadership credibility

-

Strengthens financial decision-making confidence

-

Encourages responsible growth planning

#4. Build Processes Before You Feel Ready

Many startups delay documenting processes because things feel “too early” or “too small.” In reality, the absence of basic workflows silently drains money. Repeating the same explanations, fixing avoidable errors, and relying on founder memory all translate into wasted time and hidden costs.

Simple processes—how sales follow up, how invoices are raised, how expenses are approved—create consistency. Consistency reduces mistakes. Fewer mistakes mean fewer financial leaks.

You don’t need complex SOPs or tools. Even a shared document outlining how things are done can protect your finances more than you expect.

How this improves startup finance (non-finance impact):

-

Reduces rework and operational inefficiencies

-

Prevents costly errors and miscommunication

-

Saves founder time that can be redirected to revenue

-

Improves predictability in cash flow activities

-

Prepares the business for scale without financial chaos

#5. Say No More Often Than Yes

Early-stage founders often say yes to everything—new feature requests, custom pricing, special discounts, last-minute changes. While this feels customer-friendly, it slowly weakens financial discipline.

Every unnecessary yes adds hidden costs: extra development time, delayed invoices, stretched teams, and diluted margins. Learning when to say no is not arrogance—it’s financial responsibility.

Clear boundaries protect your pricing, your time, and your team’s energy. They also attract better customers—ones who respect your value and pay on time.

Why this directly strengthens startup finances:

-

Protects margins from scope creep

-

Improves pricing consistency

-

Reduces unpaid or delayed work

-

Filters high-quality, financially healthy clients

-

Strengthens long-term profitability

#6. Hire Slowly, Not Emotionally

Hiring too early or too fast is one of the most common financial mistakes startups make—yet it rarely looks like a finance issue at first. Founders often hire out of pressure, fatigue, or optimism rather than clear workload and revenue signals.

Every hire increases fixed costs, reduces runway, and adds long-term financial commitment. A slightly delayed hire is almost always cheaper than an early wrong hire.

Before adding headcount, ask: Is this role directly improving revenue, efficiency, or retention right now? If the answer isn’t clear, wait.

How this improves startup finance (non-finance impact):

-

Preserves cash runway

-

Prevents long-term fixed cost pressure

-

Improves revenue-per-employee ratio

-

Reduces future restructuring or layoff costs

-

Encourages sustainable, revenue-led growth

#7. Track Decisions, Not Just Transactions

Most founders track money only after it’s spent or earned. Strong financial planning starts earlier—by tracking why decisions were made.

Why did you discount a deal? Why did you pause marketing? Why did you choose one vendor over another? These decision patterns reveal financial blind spots faster than reports alone.

When founders review decisions alongside outcomes, financial maturity improves quickly. Over time, this habit sharpens forecasting, pricing, and investment judgment.

Why this strengthens startup finances:

-

Improves quality of future financial decisions

-

Reduces repeat mistakes that drain cash

-

Builds stronger forecasting intuition

-

Aligns leadership thinking with financial outcomes

-

Creates investor-ready decision discipline

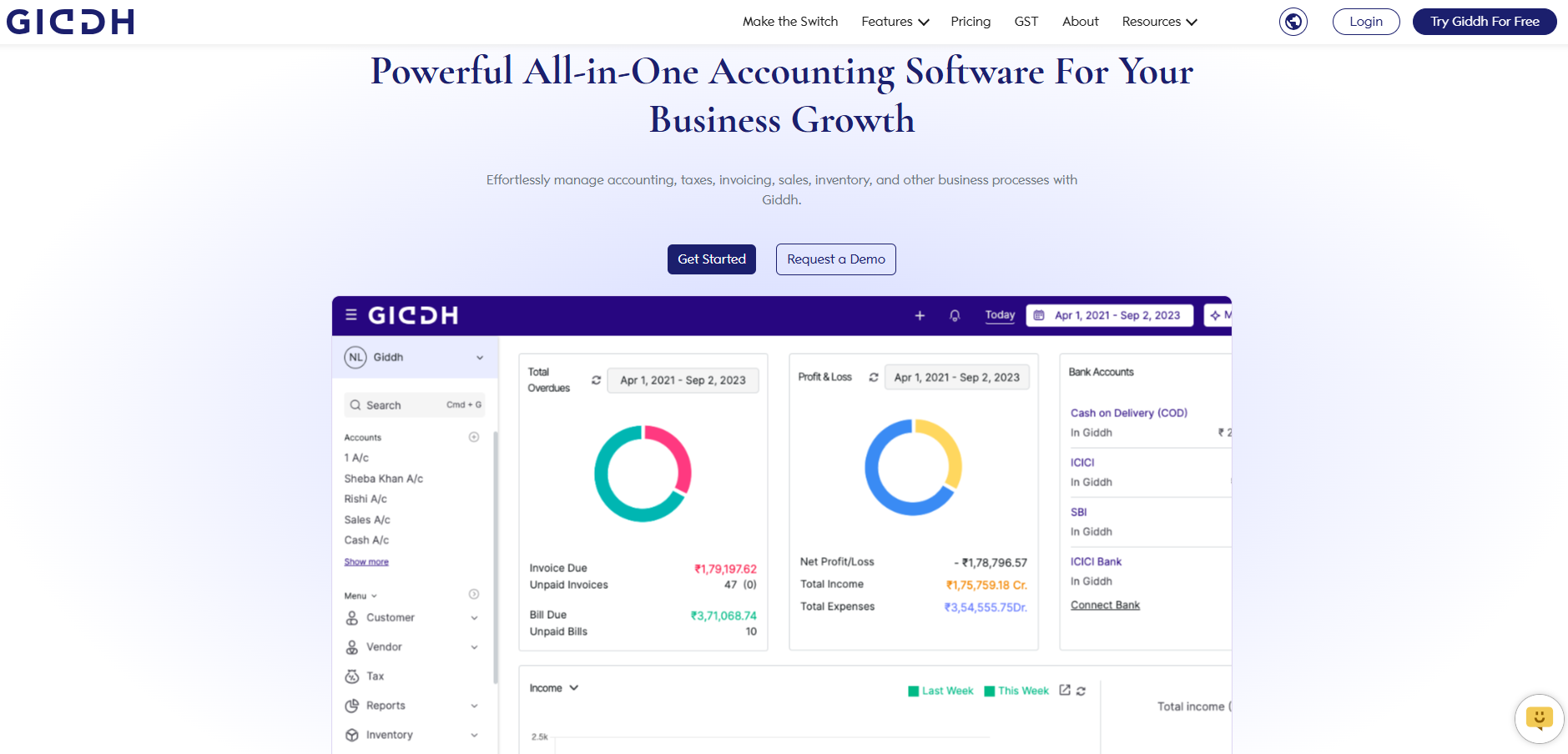

How Giddh Supports These Non-Finance Financial Disciplines

While non-finance habits drive financial outcomes, real-time financial reporting transforms those habits into measurable results. This is where Giddh plays a vital role for startups and growing businesses.

Giddh helps founders maintain financial discipline without adding operational complexity.

How Giddh strengthens your startup’s finance:

-

Real-time expense and income tracking

-

Automated invoicing and payment follow-ups

-

Clear profit & loss visibility

-

GST-compliant reporting for Indian businesses

-

Multi-company and multi-location management

-

Secure cloud-based access from anywhere

-

Free plan for early-stage startups

Giddh acts as the central financial nerve system, allowing founders to stay focused on growth while maintaining full financial control.

Conclusion

Perfecting startup finance doesn’t begin with spreadsheets—it begins with non-finance discipline. Charging for your expertise, starting lean, and building investor-ready leadership directly shape your cash flow, profitability, and funding potential. These habits determine whether a startup merely survives or truly scales with stability.

When supported by a smart accounting platform like Giddh, these non-finance decisions turn into measurable financial progress. With better visibility, accurate tracking, and automated reporting, founders gain the clarity needed to grow confidently and sustainably.