How Giddh’s Digital Invoicing Software Helps Businesses

As businesses face increasing pressure to streamline operations and improve efficiency, many turn to digital invoicing software to eliminate outdated practices. According to a recent Statista report, the global digital invoicing market is projected to grow by over 20% annually, underscoring a clear shift away from traditional methods.

Manual invoicing has long been a pain point for small to medium-sized businesses (SMBs), leading to delayed payments, human errors, and poor tracking. This inefficiency wastes time and can result in financial losses, affecting cash flow. For SMBs and entrepreneurs, manually managing invoicing, whether through Excel sheets or outdated billing software, is no longer viable.

This is where Giddh’s digital invoicing software comes in. It offers businesses an all-in-one solution to automate invoicing, ensuring timely, accurate billing. With powerful features that streamline invoicing and integrate seamlessly with existing business tools, Giddh is leading the digital billing software revolution.

Why Businesses Struggle with Traditional Invoicing

Despite its widespread use, traditional invoicing is fraught with inefficiencies that hinder business operations. Here are some of the key reasons businesses still struggle with manual invoicing:

-

Manual Entry and Data Duplication:

Entering invoice data manually increases the risk of errors. Businesses often have to input the exact details multiple times, leading to discrepancies and mistakes. -

Lack of Real-Time Visibility:

Without digital invoicing, businesses can’t track outstanding payments in real-time. This results in delayed follow-ups and poor cash flow management. -

Difficulty Tracking Payments:

Manually tracking who paid and who didn’t can be cumbersome. SMBs often lose track of unpaid invoices, which delays cash inflow and affects business operations. -

No Integration with Accounting or Banking Systems:

Many businesses still rely on standalone online invoicing tools. This lack of integration creates inefficiencies, making it harder to reconcile financial records and track expenses. -

Time Lost Managing Recurring Invoices:

Manually managing recurring invoices is time-consuming and leaves room for oversight and errors.

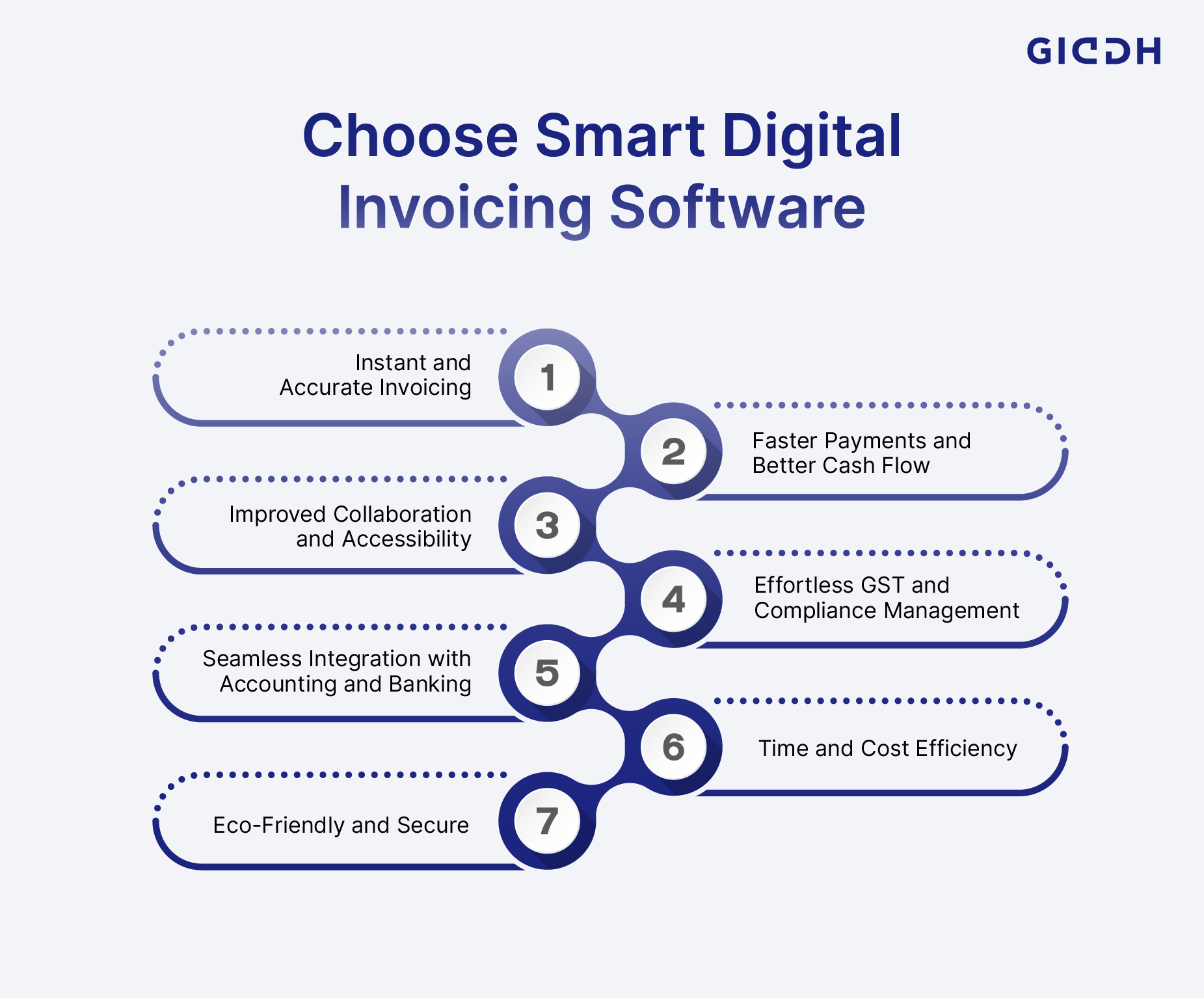

What Makes Digital Invoicing the Smarter Choice?

For growing businesses, traditional invoicing methods—manual entries, spreadsheets, and paper bills—slow down operations, increase errors, and limit financial visibility. Digital invoicing transforms that process by automating billing, improving accuracy, and helping businesses maintain complete control over payments and cash flow.

Here’s why switching to a digital invoicing software like Giddh is the more intelligent choice:

-

Instant and Accurate Invoicing

Generate invoices within seconds, with automatic tax calculations, pre-filled data, and error-free totals—no manual corrections or duplicate entries.

-

Faster Payments and Better Cash Flow

Share invoices instantly across multiple channels, including WhatsApp, email, and SMS. Real-time tracking lets you know when invoices are viewed and paid, keeping cash flow smooth and predictable.

-

Improved Collaboration and Accessibility

Cloud-based platforms allow teams to access, edit, and track invoices from anywhere—whether in the office or on the go—without version conflicts.

-

Effortless GST and Compliance Management

Digital invoicing ensures every invoice is GST filing solution and audit-friendly, helping businesses avoid compliance hassles during filing and audits.

-

Seamless Integration with Accounting and Banking

Unlike standalone tools, online accounting platforms like Giddh connect directly with accounting, inventory, and financial dashboards, offering complete business visibility in one place.

-

Time and Cost Efficiency

Automating recurring invoices, reminders, and follow-ups reduces manual work and administrative costs—freeing time for strategic financial planning.

-

Eco-Friendly and Secure

Paperless invoicing not only supports sustainability but also protects sensitive data through encrypted storage and secure backups.

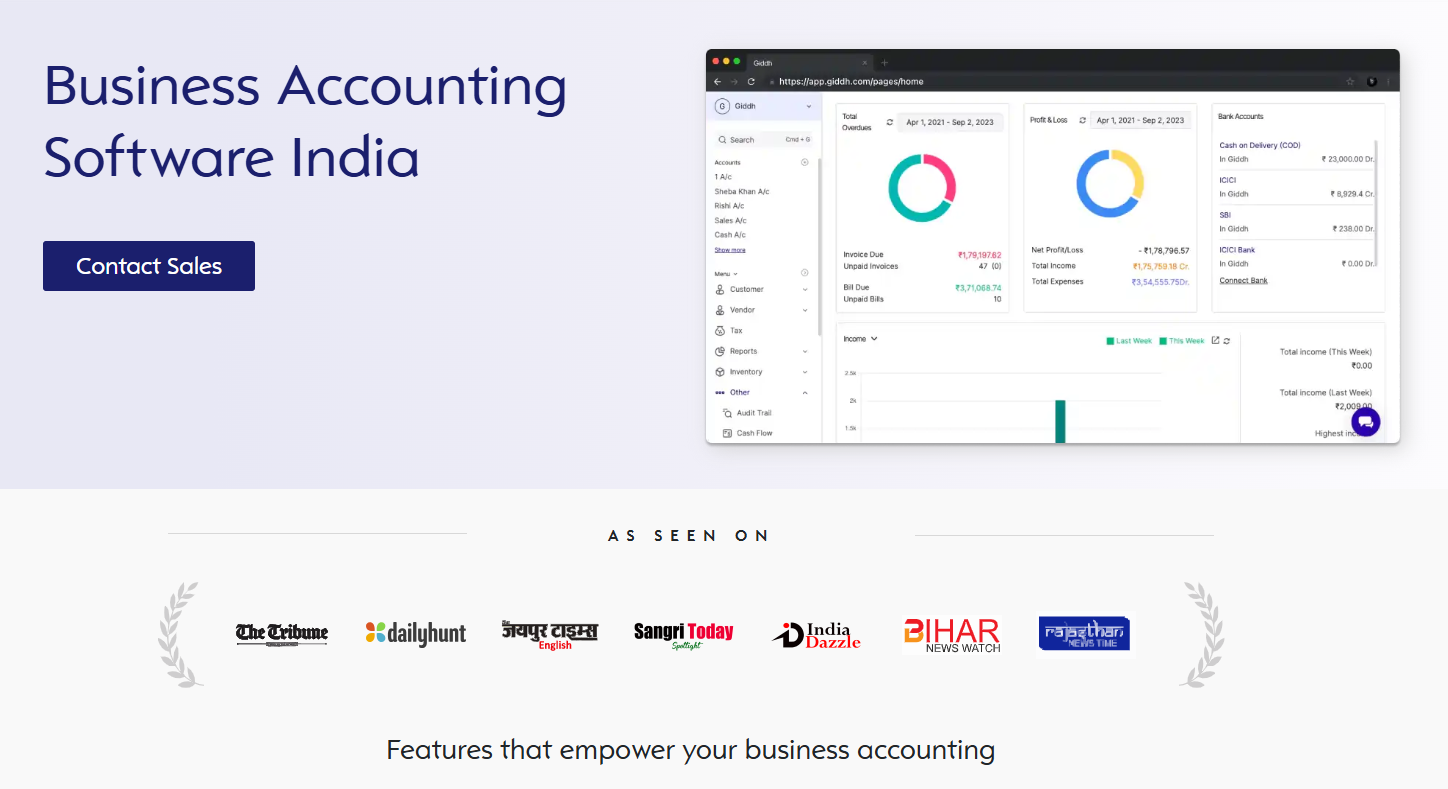

Introducing Giddh: A Smarter Way to Manage Invoices

For SMBs looking to move past the inefficiencies of traditional invoicing, Giddh is the solution. It’s a cloud-based accounting platform designed to simplify the end-to-end invoicing process, from creation to payment tracking.

Built with ease of use in mind, Giddh is perfect for small businesses, accountants, and entrepreneurs who want to automate their financial workflows without dealing with complex software. With an intuitive interface and robust functionality, Giddh is a solution that can grow with your business.

How Giddh Simplifies Digital Invoicing for Businesses

Giddh is a cloud-based invoicing and accounting platform designed for small and medium-sized businesses (SMBs) and entrepreneurs who need a more innovative way to manage their billing and finances. On the “Invoice Software” page, Giddh presents itself as “India’s smartest online invoicing software to simplify billing”.

With this platform, businesses can generate professional GST-compliant invoices in seconds, manage billing from multiple devices, and gain real-time visibility into their financial health.

Instead of relying on manual spreadsheets, disconnected tools, or legacy software, SMBs can adopt Giddh as their all-in-one digital invoicing software and online invoicing platform that integrates billing, tracking, and reporting.

Key high-level platform benefits include:

-

Cloud storage and auto-sync of all financial data across devices and users.

-

Anytime, anywhere access via web, Windows, macOS, Android, and iOS.

-

Secure data with enterprise-grade encryption and an uptime commitment.

-

A simple onboarding experience: start free trial → create invoices → track payments.

In short, if your business is looking for digital billing software that reduces manual tasks, speeds up cash flow, and offers an integrated view of invoicing and accounting, Giddh is a strong contender.

2. Key Features of Giddh’s Digital Invoicing Solution

Here are the standout features of Giddh that make it a robust digital invoicing software and digital billing software for SMBs:

• Create & Send Professional Invoices Instantly

Generate invoices in seconds with complete control over formatting.

Customizable templates mean your invoices look branded and client-ready.

• Barcode-Enabled Billing

Reduce human errors and speed up product/service billing by scanning items directly via barcodes.

• Effortless GST & Tax Compliance

Automatically apply GST (and other tax formats) tailored for Indian businesses, ensuring accuracy and compliance.

• Multi-Currency & International Billing

Handle global transactions seamlessly—real-time currency conversion allows you to invoice across borders.

• Send Invoices via WhatsApp, Email, SMS

Improve client communication and accelerate payments by delivering invoices across multiple channels.

• Recurring & Automated Invoicing

Set up recurring invoices and automate follow-ups so you don’t have to chase each billing cycle manually.

• Import, Export & Bulk Edit Invoices

For businesses dealing with high volumes, you can import via Excel, export data, and make batch edits across multiple invoices.

• Generate Multiple & Compound Invoices

Tailor invoice formats to specific transaction types—pro-formas, sales invoices, compound invoices—giving you flexibility.

Benefits: How Giddh Simplifies Digital Invoicing for Businesses

Here’s how the features translate into real-world benefits for SMBs and entrepreneurs, aligning with the pain points you described.

✅ Time-Savings & Reduced Manual Work

-

Instead of creating invoices from scratch and chasing payments manually, Giddh automates invoice generation, delivery, and follow-up.

-

Recurring and template-based billing means less repetitive effort.

-

Cloud-based access across devices means you’re not tied to one workstation or spreadsheet.

✅ Fewer Errors & Better Compliance

-

Automatic tax calculations (GST, etc) reduce the chances of mistakes.

-

Barcode-enabled billing and pre-built templates ensure consistency.

-

Role-based access and encrypted cloud storage ensure data integrity and security.

-

Audit-ready reports in one place.

✅ Improved Cash Flow & Visibility

-

Real-time tracking of payment status: paid vs pending invoices, sales trends, revenue breakdowns.

-

Multi-channel invoice delivery (WhatsApp, email, SMS) accelerates client response and payment.

-

Dashboards and reports let you monitor business health and make decisions faster.

✅ Scalability & Integration

-

Suitable for SMBs growing into multi-company, multi-branch, multi-currency operations (see user testimonials).

-

The cloud model allows you to onboard additional users, devices, and branches without heavy infrastructure investment.

-

Integration with other business tools becomes easier when your invoicing is in a modern online platform.

✅ Cost-Effectiveness & User Friendliness

-

Starting with a free trial gives risk-free access to the platform.

-

The intuitive interface and onboarding support (24×7 chat, email, phone) mean faster adoption and less training overhead.

-

One unified system (invoicing + accounting) reduces the need for multiple separate tools, cutting costs.

Why SMBs Choose Giddh Over Other Digital Billing Software

Many businesses are opting for Giddh over other digital billing software solutions. Here's why:

| Feature | Giddh | Traditional Invoicing Tools |

|---|---|---|

| Automation | Fully automated invoicing | Manual or semi-automated processes |

Integration | Integrates with accounting and banking tools | Limited or no integrations |

Cost-Effectiveness | Affordable for SMBs | Often costly for small businesses |

User Experience | Simple, intuitive interface | Complicated and outdated design |

Scalability | Grows with your business | Limited scalability |

Trust-Building Metrics

-

Uptime: Giddh ensures 99.9% uptime, so your invoicing process is always running smoothly.

-

Customer Reviews: SMBs rave about the ease of use and the time saved through automation.

-

User-Friendly Interface: Users without accounting backgrounds can quickly adapt to Giddh’s simple, intuitive platform.

Real-World Impact: How Businesses Benefit from Using Giddh

Case Example: A small consulting firm using Giddh saw a 50% reduction in time spent on invoicing tasks. They were able to track payments more effectively, leading to faster cash flow and fewer overdue invoices. The business also reported significantly reduced errors, as Giddh’s automated tax and GST calculations eliminated the need for manual adjustments.

-

Quantifiable Benefits:

-

Time Saved: 5+ hours per week

-

Faster Payments: 30% reduction in overdue invoices

-

Fewer Errors: Almost 100% accuracy in invoicing and tax calculations

-

Conclusion:

By switching to Giddh’s digital invoicing software, businesses can eliminate the pain points associated with manual invoicing. From faster invoice creation to real-time payment tracking, Giddh makes invoicing simpler, faster, and more accurate.

Stop letting invoicing errors, delayed payments, and wasted time hold your business back. Automate your invoicing with Giddh and make your financial operations more efficient, reducing errors and improving cash flow.

Start using Giddh today, and experience the future of invoicing!

FAQ

How Does Digital Invoicing Simplify The Billing Process For Businesses?

Digital invoicing automates the creation, sending, and tracking of invoices. This eliminates manual errors, saves time, and ensures timely payments by providing businesses real-time insights and automated reminders.

What Are The Benefits Of Using Giddh For Digital Invoicing In Businesses?

Giddh simplifies invoicing by automating processes, integrating seamlessly with accounting systems, enabling real-time payment tracking, and ensuring compliance with tax regulations. This helps businesses save time, reduce errors, and improve cash flow.

Can Digital Invoicing Reduce Invoicing Errors?

Yes, digital invoicing eliminates manual data entry, automates calculations, and ensures that invoices are consistent, reducing the likelihood of human errors and improving accuracy.