Top 7 Online Invoicing Software For Billing In 2026

According to a recent survey by Statista, nearly 60% of small businesses in India struggle with late payments and billing errors due to their reliance on manual invoicing practices. For business owners, even a minor billing mistake can delay payments, impact cash flow, and create compliance risks. These challenges become even more pressing as businesses expand and manage multiple clients across different regions and currencies.

Manual methods, such as spreadsheets or handwritten invoices, may seem manageable at first, but they often result in missed due dates, calculation errors, and wasted time on repetitive tasks. This directly affects revenue and long-term growth.

The solution lies in adopting online invoicing software for billing, designed to simplify invoicing, ensure tax compliance, and accelerate payment cycles.

In this guide, we’ll explore the top invoicing tools for 2026, helping you choose the right platform to streamline your billing process and boost financial efficiency.

Why Online Invoicing Software is a Game Changer for Small Businesses in India

Managing finances is one of the biggest challenges for small businesses and freelancers in India. Manual billing often leads to delayed payments, calculation errors, and lost invoices.

For example, a freelancer may spend hours preparing bills on spreadsheets, while small businesses risk late fees when due dates are missed. These issues not only waste time but also affect cash flow and client relationships.

Benefits of Online Invoicing Software for Billing

Automation of Recurring Invoices

-

Saves time by auto-scheduling regular invoices.

-

Reduces repetitive tasks and ensures timely delivery.

Real-Time Tracking of Payments and Due Dates

-

Provides instant updates on cleared and pending payments.

-

Helps avoid missed follow-ups with clients.

Seamless Integration with Accounting Tools

-

Syncs with business apps for smooth financial management.

-

Reduces duplicate data entry and manual work.

Reduced Human Errors

-

Eliminates calculation mistakes common in manual billing.

-

Generates accurate invoices every time.

Legal Compliance with GST

-

Prepares GST-compliant invoices required by Indian tax rules.

-

Minimizes risk of penalties from non-compliance.

Increased Cash Flow

Online invoicing software for billing speeds up the entire payment cycle. By sending timely reminders and easy digital payment options, businesses receive money faster. It ensures steady cash flow, supporting day-to-day operations and long-term growth.

Top 7 Online Invoicing Software for Billing in 2026

Managing invoices efficiently is no longer a choice but a necessity for small business invoicing tools. Manual billing can lead to late payments, human errors, and compliance issues.

With the right online invoicing software for billing, businesses can streamline operations, save time, and improve cash flow. Below are seven of the most reliable invoicing solutions for 2026, reviewed with features, pricing, and benefits.

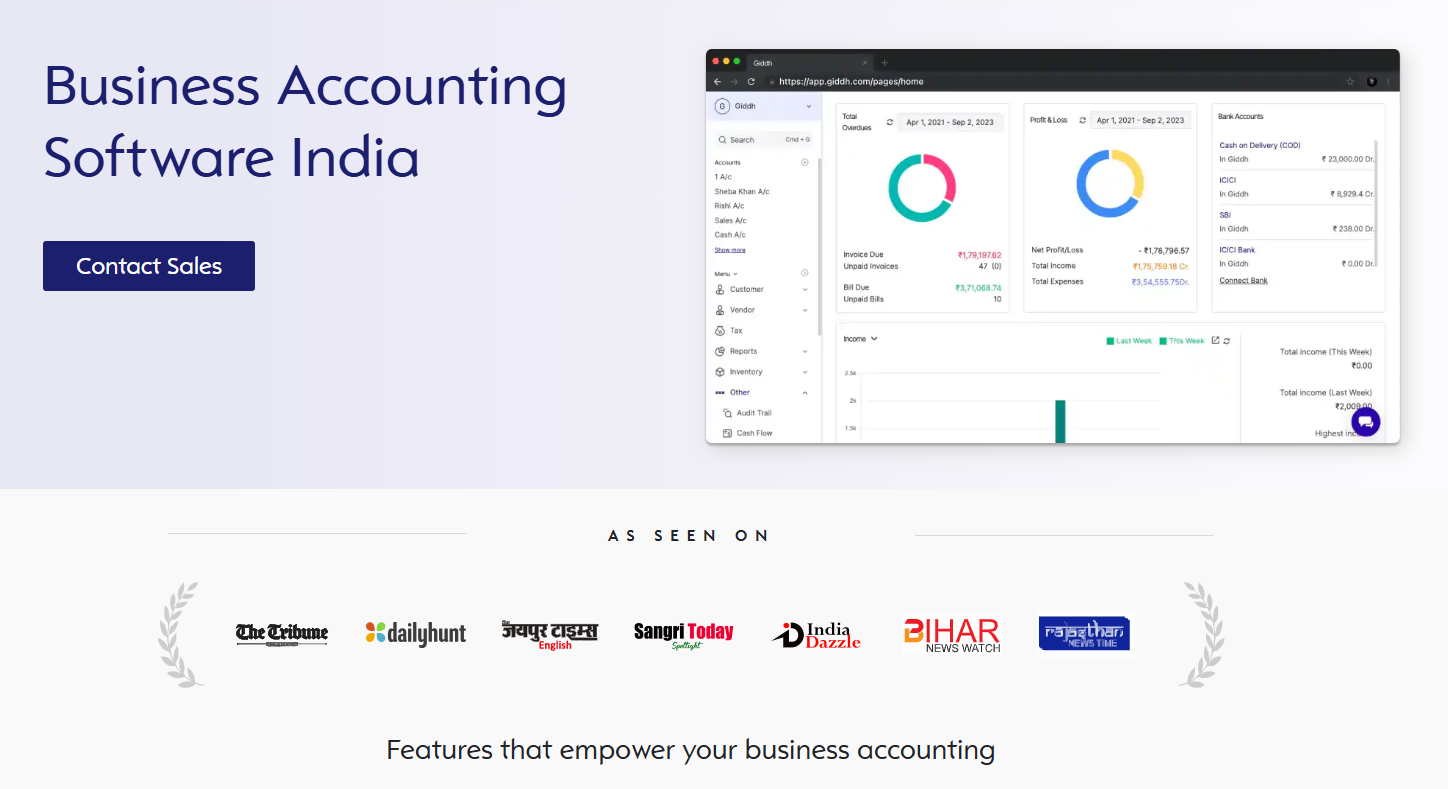

1. Giddh

Giddh is one of the best online invoicing software built for Indian small businesses and freelancers. It simplifies billing with GST-ready invoices, a clean interface, and direct integration with payment gateways. Perfect for Indian companies seeking straightforward, GST-compliant invoicing and streamlined accounting management.

Some Must-Have Features of Giddh:

Create and Send Professional Invoices

Generate professional invoices quickly with cloud access across devices.

- Easy creation

- Instant sending

- Branded templates

Barcode Invoicing

Speed up top billing and invoicing software by scanning product barcodes instead of manual searches.

- Faster entries

- Fewer errors

- Easy tracking

GST Invoicing

Apply GST automatically based on the client's state for accurate compliance.

- Auto GST type

- Error-free billing

- Tax-ready invoices

Other Taxes

Add TCS, TDS, or custom taxes for complete transparency.

- Multiple tax options

- Manual tax setup

- Easy compliance

5. Multi-Currency Invoices

Bill international clients with automatic exchange rate conversion.

- Real-time rates

- Smooth global billing

- Multiple currencies

Multi-Channel Sending

Share invoices via WhatsApp, email, or SMS for faster delivery.

- Multiple channels

- Quick reach

- Faster payments

Import & Export

Import invoices from Excel or export in bulk as needed.

- Easy migration

- Bulk exports

- Saves effort

Multiple & Compound Invoices

Create multiple or composite invoices in a single operation.

- Bulk generation

- Flexible billing

- Time-saving

Automation

Automate reminders, recurring invoices, and client follow-ups.

- Auto reminders

- Recurring billing

- Smarter workflow

Pricing: Affordable plans with flexible options for growing businesses.

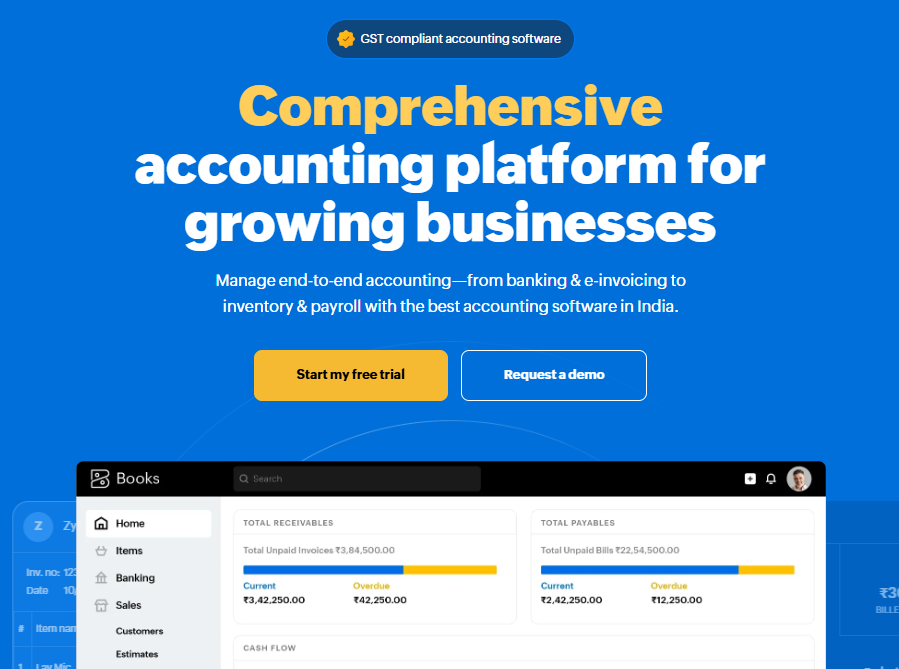

2. Zoho Invoice

Zoho Invoice delivers a smooth, cloud-based invoicing software experience. Its user-friendly design suits both freelancers and small businesses managing multiple projects.

Features:

-

Multi-currency invoicing for international clients.

-

Time tracking for projects and billable hours.

-

Professionally designed custom templates.

-

Recurring billing for regular clients.

Pricing: A free plan is available, with premium features available at an additional cost.

3. QuickBooks Online

QuickBooks Online combines invoicing with full-scale accounting tools. It helps track income, expenses, and invoices while syncing directly with banks and apps.

Features:

-

Automated invoicing with reminders.

-

Tax-ready calculations and reports.

-

Invoice tracking to monitor overdue payments.

-

Integration with banking and third-party apps.

Pricing: Subscription-based pricing with multiple plans for different business sizes.

4. FreshBooks

FreshBooks is designed for freelancers and small businesses that need invoicing, payments, and time tracking under one dashboard. Its easy navigation reduces learning curves.

Features:

-

Customizable invoices that reflect branding.

-

Built-in time tracking and expense recording.

-

Project management tools for client collaboration.

-

Mobile app access for on-the-go billing.

Pricing: Monthly subscription with a free trial option.

5. Wave

Wave stands out as a cost-effective choice for startups and solo entrepreneurs. It combines invoicing and accounting without upfront costs.

Features:

-

Unlimited invoices and estimates.

-

Expense tracking with financial reporting.

-

Digital payment processing options.

-

Cloud access with secure backups.

Pricing: Free software, with paid add-ons for payroll and advanced payment features.

6. Invoicely

Invoicely is a straightforward invoicing platform suitable for small businesses that need fast billing and multi-language support.

Features:

-

Supports multiple languages and currencies.

-

Recurring invoice scheduling for repeat clients.

-

Online payment gateways for quick settlements.

-

User-friendly dashboard for easy tracking.

Pricing: Free basic version, with premium upgrades for advanced needs.

7. Bill.com

Bill.com is a comprehensive platform for businesses handling large volumes of payments and global invoicing needs. It streamlines accounts payable and receivable in one place.

Features:

-

Automated billing cycles and approvals.

-

Payment reminders and scheduling.

-

Integration with major accounting platforms.

-

Secure processing for global transactions.

Pricing: Tiered pricing plans suited for medium to large businesses.

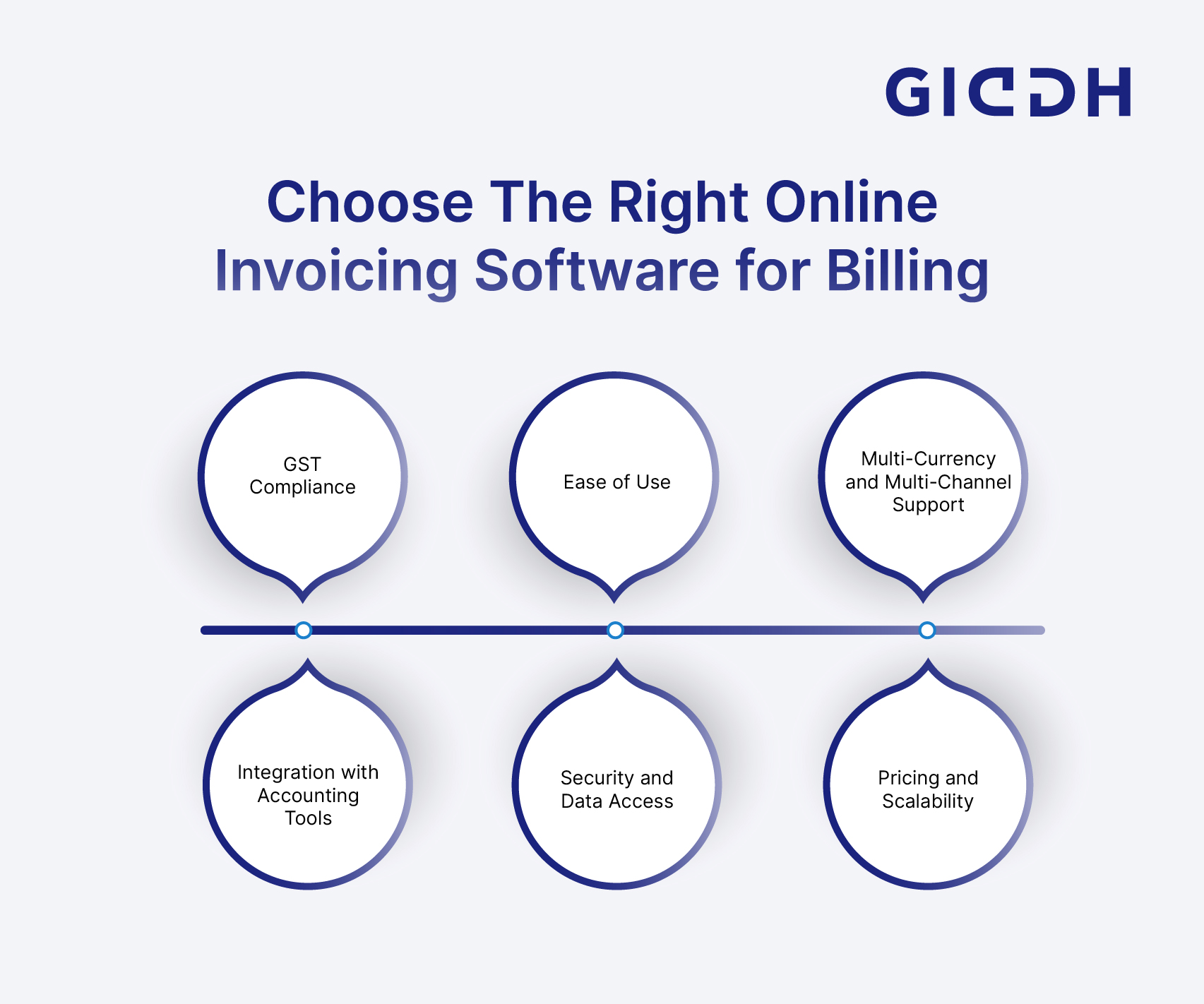

How To Choose The Right Online Invoicing Software For Your Business In India

Running a business in India presents unique challenges, particularly in Invoice tracking and management, payments, and tax compliance. With multiple options available, selecting the right online invoicing software for billing can feel overwhelming. The key is to focus on features that simplify your workflow while ensuring legal compliance and financial clarity.

1. GST Compliance

For Indian businesses, GST-ready billing software India is non-negotiable. Choose software that automatically applies the correct GST type based on client details, reducing manual errors and saving time during tax filing.

2. Ease of Use

A user-friendly interface ensures your team can adapt quickly without long training sessions. Simple navigation and automation features like recurring invoices make day-to-day billing effortless.

3. Multi-Currency and Multi-Channel Support

If you deal with international clients, real-time currency conversion is essential. Additionally, software that enables sending invoices via email, WhatsApp, or SMS enhances communication and accelerates payments.

4. Integration with Accounting Tools

Look for platforms that integrate seamlessly with your accounting system, banking apps, or business management tools. It reduces duplicate data entry and keeps your financial records consistent.

5. Security and Data Access

Cloud-based invoicing provides access across devices while ensuring your data is secure. Features like invoice locking prevent unauthorized edits and maintain accuracy in financial records.

6. Pricing and Scalability

Every business has a budget. Compare pricing plans and choose software that offers flexibility to grow with your business. A free trial or demo can help you evaluate its value before committing to it.

Final Thought:

Managing invoices manually often leads to errors, delays, and compliance issues that hurt both cash flow and client relationships. The right online invoicing software for billing eliminates these challenges by automating recurring tasks, ensuring GST compliance, and providing real-time payment tracking.

By evaluating features such as ease of use, multi-currency support, and seamless integration with accounting tools, businesses can find a solution that aligns with their unique needs. Small businesses and freelancers in India, in particular, benefit from faster payments, reduced errors, and improved financial transparency.

Ready to take control of your billing process? Explore innovative invoicing solutions today. Try Giddh for free and experience how automated invoicing can simplify your workflow while keeping your business compliant and growth-focused.

FAQs Section

1. Can Giddh help with GST compliance in India?

Yes. Giddh automates GST calculations, supports reverse charge, e-invoicing, and integrates with the GSTN portal for accurate filings.

2. How secure is my financial data with Giddh?

Giddh uses encryption, secure backups, and role-based access controls to protect your data. Invoice locking prevents unauthorized edits.

3. How do I integrate Giddh with my accounting system?

Giddh offers built-in accounting features and API support, allowing seamless syncing of ledgers, inventory, and tax reports.

4. Are there free invoicing options available in Giddh for Indian small businesses?

Yes. Giddh provides a free trial with access to core invoicing and GST features, ideal for startups and SMBs.