How to Use Accounting Software for Business The Importance of Accounting Software

Like many business owners, you may have started out managing your finances with a basic spreadsheet. While that works in the early stages, it quickly becomes overwhelming as your operations expand. Manually tracking every transaction isn’t just time-consuming, it also leaves room for costly errors.

That’s where accounting software steps in. Understanding how to use accounting software for business can help you shift from reactive bookkeeping to proactive financial management.

Today’s platforms go far beyond simple data entry. Many solutions are built to handle billing, customer invoicing, payroll processing, and even generate tailored financial reports, all within the same system.

This guide walks you through the practical aspects, helping you understand which features matter, how to utilize them effectively, and what benefits you can expect in return. Let’s simplify the numbers, one entry at a time.

What is Accounting Software?

Accounting software is a digital tool designed to record, process, and manage a business’s financial transactions. It replaces traditional paper-based methods, such as ledgers and journals, with automated systems that increase speed, accuracy, and organization.

There are different types of accounting software, ranging from simple programs for basic recordkeeping to advanced platforms that handle:

- Accounts payable and receivable

- Invoicing and payment tracking

- Payroll management

- Ledger maintenance

- Tax reporting

- Asset tracking

Modern accounting software enables businesses to streamline their financial operations, minimize manual errors, and access real-time data for informed decision-making. Knowing how to use accounting software for business gives you control over your finances and supports long-term growth.

How To Use Accounting Software?

So, all your business processes are now streamlined with accounting software. What’s next? How do you make complete use of the software to receive all the immense benefits that it has to offer?

The first step in how to use accounting software for business is selecting the right software for your organization. Not all accounting software offers the same benefits, so it’s essential to understand what features you need. Knowing exactly why to use accounting software and how it can meet your business needs will help you make an informed choice. Some of the basic functions that your accounting software must possess are:

- invoice processing

- Expense and income tracking

- Vendor payment

- Organise financial statements

- Tax forms preparation

Accounting software helps businesses stay organised and keep track of their financial records. Here’s how you can use the above-mentioned functions of an accounting software for online businesses to take control of your financial processes within your organisation.

Invoice Processing

Accounting software for online businesses makes it easy to store invoice information for your vendors and customers. To create an invoice, you will need to enter information regarding the transaction, including the product or service offered, quantity, price, invoice number, due date, and account details.

Save and Share PDFs: Save invoices as PDFs and email them to customers for a record.

Track Customer Debt: Both you and your customer will have a record of payments owed.

Enter Vendor Invoices: Log received invoices to track payments due and ensure timely payment.

Track expenses and income

Your accounting software provides you with a clear view of your organisation's income and expenses. Whenever you make or receive a payment, you can check the software to view the new balance, which shows the amount you owe and the amount owed to you. If you use accrual accounting, your software should offer features like accounts receivable and accounts payable tracking.

Track Expenses: Refer to vendor invoices for accurate expense tracking.

Filter Unpaid Invoices: Easily identify unpaid invoices to manage costs.

Monitor Income: Track paid and unpaid customer invoices to gauge earnings.

Vendor payment

When you understand how to use accounting software for business, making vendor payments is straightforward. With accounting software, you can store all your invoices and easily see the exact amount owed to each vendor. To make payments, simply select the vendor, date, amount, and account, then print a cheque. You can even automate the process to eliminate the need for handwritten cheques.

Organise financial statements

With accounting software, you can access your financial reports anytime and anywhere you want. Select the period or date and check all your profit and loss statements or the balance sheets within that period. Additionally, you don’t have to invest your time in preparing the statements as the software will track the income and expenses of your organisation and generate the report.

Prevent Loss: Keep financial records safe and secure.

Better Organization: Easily organize and access files.

Quick Access: Retrieve records anytime.

Enhanced Security: Protect data from theft or damage.

Tax forms preparation

In addition to all the features that you can use accounting software for, there are some legal reasons to use it as well. When handling numerous financial transactions and reports, mistakes can occur, leading to penalties for inaccurate tax filings. Luckily, you can use the accounting software to help you with your tax preparation by analysing the proper receipts and deposit statements.

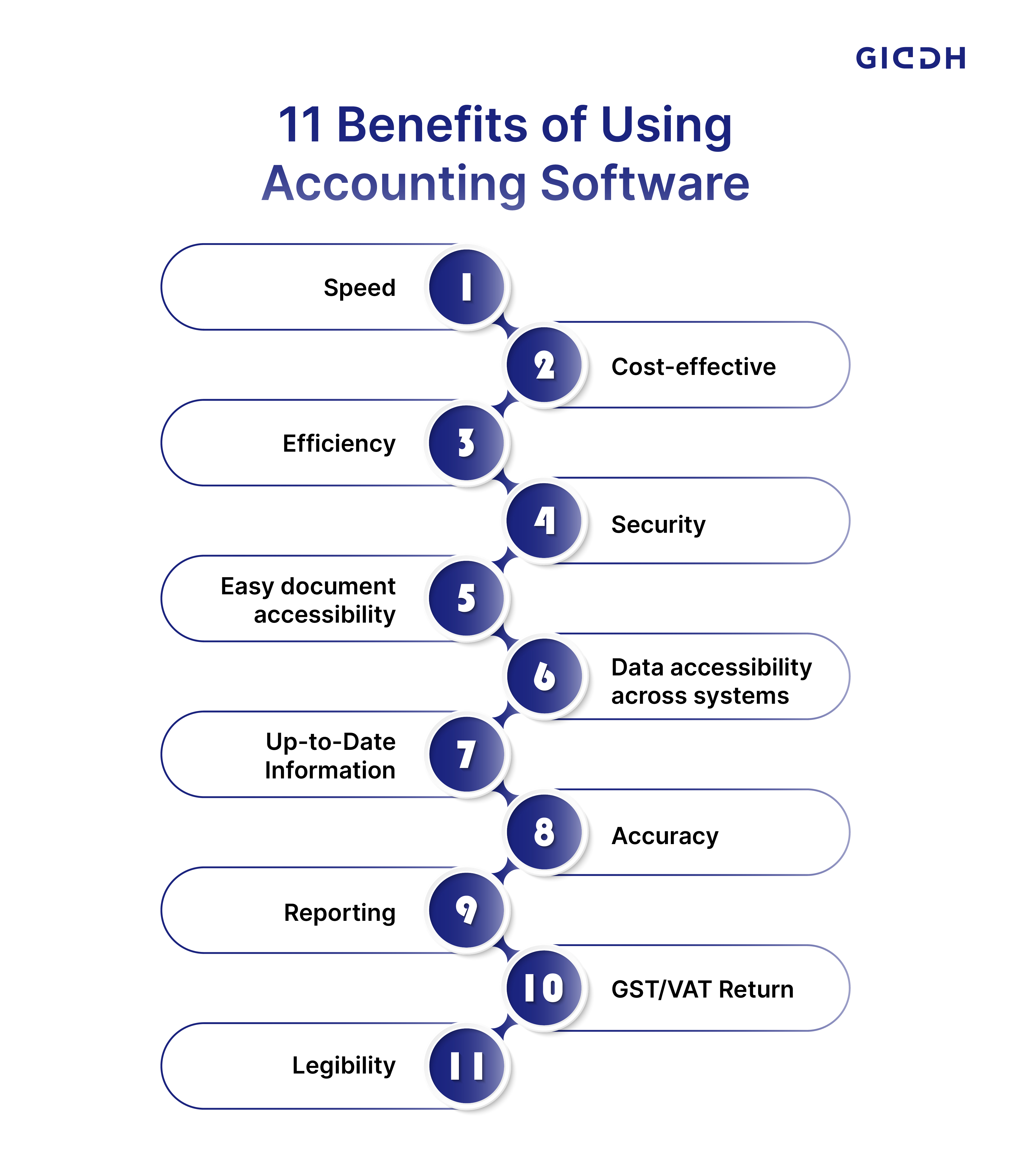

What Are The Benefits Of Using Accounting Software?

Businesses using accounting software can benefit in several ways. Here are some solid reasons why getting accounting software is the best thing you can do to boost your business.

Speed: Accounting software enables faster entry and processing of data related to back-end transactions, customer invoices, cheques, bank deposits, and other financial transactions.

Cost-effective: By using accounting software, you can save on the expenses and time that would have been otherwise spent by your staff while manually handling your accounts. As the software ensures the accuracy of the accounting data, you will also reduce the audit expenses.

Efficiency: As debt collections and stock control become more efficient with better use of time and resources, your overall cash flow is improved.

Security: You get an extra layer of protection for your records by controlling who gets access to specific areas of the accounts. It helps prevent unauthorised access to your data.

Easy document accessibility: Whenever you need documents and reports for invoicing, they can be quickly accessed from the software. You can automatically generate all your documents, such as purchase orders, credit notes, and statements.

Data accessibility across systems: Accounting data can be accessed simultaneously on different systems in various locations.

Up-to-Date Information: As the accounting software is automatically updated, you can be assured that the customer or client account or transaction you are viewing at any time is up-to-date.

Accuracy: Accounting software effectively reduces the likelihood of human error compared to manually recording transactions and making entries.

Reporting: Usually, an accounting software will offer customisable reporting options so that you can produce data sets for a specific area to be evaluated. The reports generated can be used to make crucial business decisions.

GST/VAT Return: One of the most significant benefits of accounting software is that it enables you to estimate the figures for GST or VAT returns automatically.

Legibility: The data provided in the accounting software is easier to read compared to data filled in manually. This can prevent errors resulting from poorly written figures.

Read on to find out why accounting software is necessary for businesses and what accounting software’s role is in helping you run a successful venture.

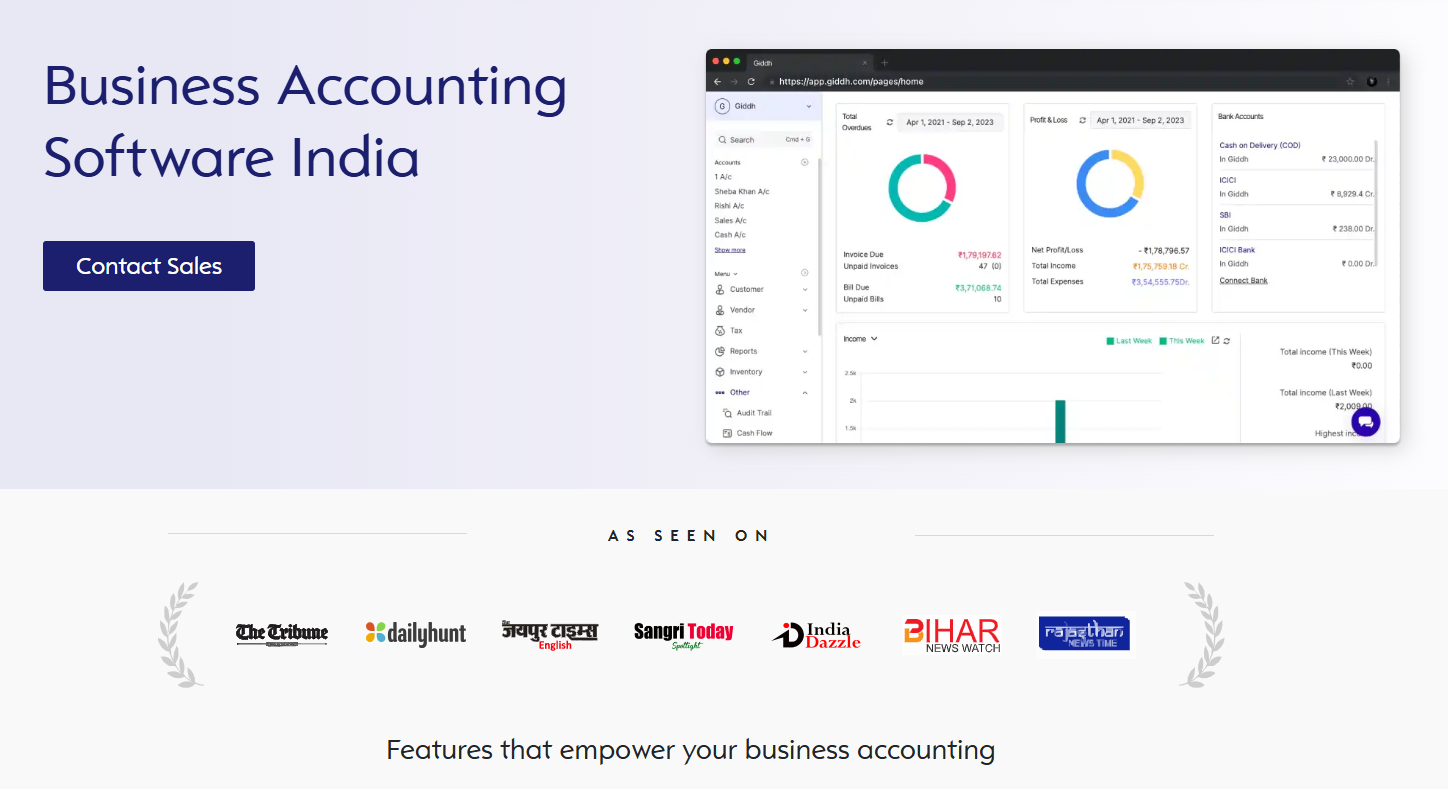

Giddh: The Best Accounting Software for Business

Giddh is designed to simplify financial management for businesses of all sizes. Whether you're a small startup or a large organization, Giddh provides the tools needed to manage your finances more effectively.

By understanding how to use accounting software for business, you can take control of your financial processes with Giddh’s easy-to-use features, making everyday tasks such as tracking expenses, generating reports, and staying compliant effortless.

Features

Giddh stands out by offering a comprehensive set of features that help businesses stay organized and efficient:

-

Ledger-Based Accounting: Keep accurate, up-to-date financial records with minimal effort.

-

Multi-Currency Support: Manage transactions across multiple currencies, making global business easier.

-

GST & VAT Compliance: Stay compliant with tax regulations and simplify filing.

-

White-Label Option: Customize the software to reflect your brand.

-

Unlimited User Access: Share access across your team without restrictions.

-

Manage Over 100 Companies: Scale seamlessly as your business grows.

-

Asset Management: Track assets and investments with precision.

-

Inventory Management: Keep track of stock and orders to ensure you never run out.

-

Bank Reconciliation: Easily match your bank statements with accounting records.

-

Any Time, Any Device: Access your financial data from anywhere, at any time.

-

Seamless Integration: Connect with other tools and systems for smooth data transfer.

Giddh offers flexible pricing plans designed to fit businesses of all sizes. Whether you're a small business or a large enterprise, you’ll find a plan that meets your needs while staying within your budget. Pricing is based on the features you need, ensuring you only pay for what you use.

How To Choose The Best Accounting Software?

If you run a business, you need to understand the Importance of Accounting Software to track and record your income and expenses accurately. Ideally, this is the first software you should consider purchasing for your business; however, many business owners postpone getting the software unless they need to apply for a loan or pay their taxes.

When you are planning to get accounting software for your business requirements, you will be flooded with several options to choose from, and that could be confusing. However, you can easily filter out what you want if you are clear about the criteria that must be taken into consideration before investing in an accounting system.

Here are some essential criteria to help you decide which software will be the best fit for your business.

Online or Offline

The first thing that you need to decide is whether you need an online software or an offline one for your desktop systems. Today, almost all businesses prefer cloud-based software because of the advantages it offers over traditional offline software.

Desktop-based offline software may be used in some companies, such as retail stores, where internet connectivity isn’t always necessary. They can get their work done just fine with offline POS systems.

Some of the advantages that cloud accounting software has over offline systems are:

- You can just sign up for the cloud services and start recording your transactions right away.

- All upgrades and changes are implemented automatically without affecting your data.

- You get the flexibility of accessing your records from anywhere and at any time.

- You don’t have to worry about backup or maintenance as your service providers will take care of that.

- Collaboration between different departments within an organization becomes easier.

Data Security

If you plan to use online accounting software for small businesses, the data security feature is the most critical factor to consider.

Inquire About Data Storage: Ask how your service provider stores application data.

Check Hosting Providers: Many use Amazon, Rackspace, or their servers.

Ensure Security Measures: Confirm the provider’s security protocols to protect your data.

User Interface & Complexity

Most business owners don’t come from an accounting background. Even if a dedicated accountant uses the accounting software, it must offer an easy-to-use interface so that business owners can log in to the system and gain an overview of their financial statements and records.

Avoid Complexity: Opt for software with an intuitive and easy-to-use interface.

Minimize Training: Simplify employee training to save time and cost.

Focus on Essentials: Choose software that doesn't include unnecessary features.

Scalability

Business owners typically select an accounting system based on their current needs. As their business starts to grow, the software fails to match the requirements, and they are forced to migrate to new software. The process of completely switching to a new software from your existing system can be highly challenging.

Choose Scalable Software: Ensure the software grows with your business.

Start Small, Scale Up: Begin with an entry-level version, then upgrade as needed.

Giddh for Growth: Giddh adapts to your business’s evolving needs.

Hidden Costs

Sometimes, an accounting software provider may offer a basic version of the software at a low cost and then charge extra for additional features and maintenance costs. It is always better to know about these costs before buying the software.

Check for Hidden Costs: Verify if there are additional charges for features.

Review Pricing Pages: Visit the provider’s site for details on basic and premium costs.

Understand Additional Fees: Look for pricing on extra services or features.

After-sales Support

After-sales support is a crucial feature of your accounting software, yet many businesses tend to overlook it. It doesn’t matter how easy-to-use or good your software is; you will need support at some point. If you encounter an issue with a part of the software and support is not readily available, your investment will be futile.

Avoid Low-Cost, Low-Support Software: Some inexpensive options often compromise support services.

Verify Support Quality: Ensure the software offers reliable customer support.

Don't Skip Support Costs: Consider Support Quality When Making a Purchase.

Conclusion

Adopting accounting software for your business enables you to manage financial tasks with greater efficiency and accuracy. One thing to note here is that it doesn’t substitute the job of accounting professionals in your organisation, but rather enhances their productivity.

How to use accounting software for business becomes effortless with Giddh’s accounting software, recognized as the best in India. It features a minimal learning curve, allowing you to master it in a day. With functionalities tailored to your unique business needs, Giddh makes financial management simple and effective.

It can help you and your audit/accounting team gain total visibility into the organisation’s financial health and prepare reports that assist in making informed decisions for the future of the business.

Want to simplify your business finances? Get started with free accounting software. Choose a solution that’s easy to use, cost-effective, and designed to save you time.

FAQs

What can accounting software do for your business?

Accounting software streamlines financial tasks, including tracking income and expenses, generating invoices, managing payroll, and producing financial reports. It helps businesses stay organized, compliant, and efficient in managing finances.

Which accounting software is best for a small business?

The best accounting software for small businesses includes Giddh, QuickBooks, and Xero. They offer user-friendly features, cost-effective pricing, and scalable solutions to meet the needs of small businesses.

How to Use Accounting Software?

To use accounting software, start by setting up your account and entering your business details. Add customers, vendors, and financial transactions. Track income and expenses, generate invoices, and produce reports for decision-making.

Benefits of using accounting software

Accounting software saves time, reduces human errors, enhances financial visibility, ensures tax compliance, and facilitates informed decision-making. It streamlines processes and improves overall financial management.

What type of accounting is best for a small business?

Small businesses most commonly use cash-based and accrual-based accounting. Cash accounting is simpler and works well for smaller companies with straightforward finances. Accrual accounting offers more accuracy for growing businesses.