HSN Codes Decoded: The Quickest Way to Find the Right Code for Your Product

Recent compliance data suggests that a significant number of GST returns are delayed or amended due to incorrect product classification and HSN codes. One tax technology survey revealed that classification errors account for a large portion of GST mismatches in return filings. How can a finance team reduce this risk while keeping operations efficient?

For many, the challenge begins with a fundamental question: what HSN code applies to your product? Despite clear frameworks, confusion around codes, multiple variants, overlapping categories, and evolving GST complaint slabs makes the HSN code search a time-consuming task.

Finance managers need a reliable, fast approach that goes beyond guessing or manual lookup lists. This blog demystifies HSN code use, shows practical methods to find the right code, and highlights smarter ways to simplify GST compliance.

What Is an HSN Code and Why Does It Exist

HSN (Harmonised System of Nomenclature) is an internationally recognized system of names and numbers for classifying traded products. It organizes products into chapters and headings so that taxes, tariffs, and statistics can be applied consistently.

Global vs India:

The HS code is the base international classification. India uses the same system but extends it to HSN codes for GST compliance. This alignment supports clarity in global trade and in domestic taxation frameworks.

Why India Uses It:

With GST unifying indirect taxes, India adopted HSN to impose consistent tax rates across products and services. The structured hierarchy helps in accurate tax application and reduces disputes over classification.

HS vs HSN:

- HS Code: Global standard up to 6 digits.

- HSN Code (India): Indian GST classification based on HS, often up to 8 digits for precision.

HSN Code: A numerical classification system for goods used in India under GST to assign tax rates and track product categories.

Is HSN Code Mandatory Under GST?

Yes, HSN codes are generally required on invoices where GST applies. The requirement varies by turnover thresholds:

- Businesses with turnover above specified limits must include HSN codes on their tax invoices.

- For smaller businesses below the threshold, simpler invoice formats may apply, but HSN inclusion can still be beneficial.

B2B vs B2C:

- In B2B transactions, HSN codes are essential for tax filings and input tax credits.

- In B2C invoices, HSN may not always be mandatory, but it is advised to avoid disputes and ensure transparency.

Consequences of Missing or Incorrect Entry:

- Reduced trust from vendors and customers during audits.

- Incorrect tax rates leading to filing errors.

- Potential scrutiny or penalties during compliance checks.

Finance managers should always validate codes before finalization to minimize errors.

What Is an HSN Code List and How It’s Structured

Understanding the HSN code structure helps in accurate classification.

Structure Overview:

- Chapters (2-digit): Broad categories (e.g., Metals, Chemicals).

- Headings (4-digit): Subgroups within chapters.

- Sub-headings (6-digit): Further detail on specific product types.

- Extended Digits (8-digit India-specific): Precise classification for taxation.

Example:

- 84 – Machinery

- 8407 – Engines

- 8407 21 – Diesel engines, >800 cc

Why Lists Cause Misclassification:

Manual lists can be outdated, lack context, or miss GST rate associations. Without search tools, finding the correct code quickly becomes error-prone.

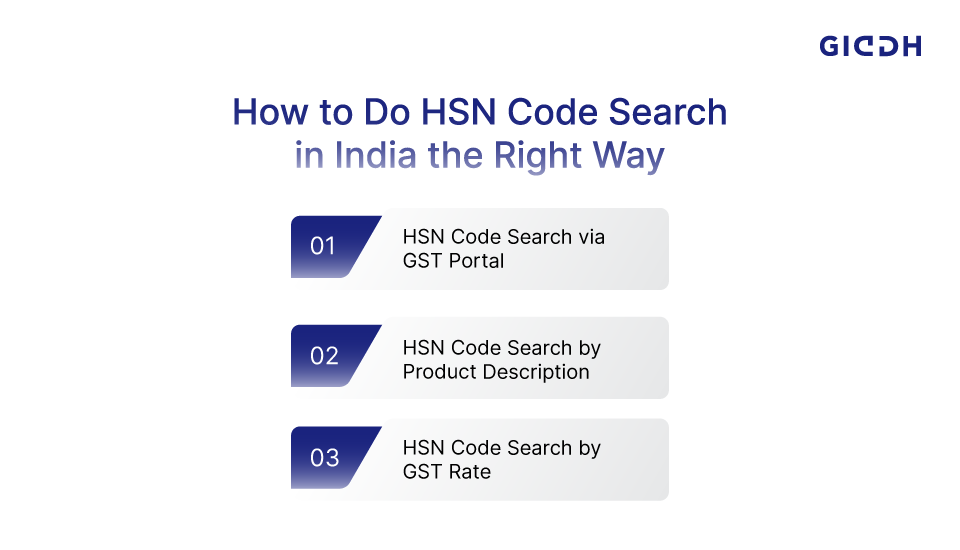

How to Do HSN Code Search in India (All Practical Methods)

Accurate HSN code search is critical for correct GST application, avoiding penalties, and ensuring smooth ITC (Input Tax Credit) claims. Here’s a breakdown of the most practical and commonly used methods finance professionals rely on—along with their strengths, limitations, and insider tips.

1. HSN Code Search via GST Portal

This is the default method most businesses start with—using the official government site. It's authoritative but not always the fastest.

Step-by-Step:

-

Visit the GST Portal HSN Search page.

-

Click on “Search HSN Code” under the “Search Taxpayer” tab.

-

Enter a product description or relevant keyword.

-

Select your industry or product segment if applicable.

-

Browse results and note the corresponding HSN and GST rates.

Pro Tips:

-

Use clear, non-brand-specific terms.

-

Add qualifiers like material type or use case (e.g., “plastic kitchen containers” vs. just “containers”).

-

Try both singular and plural forms.

Common Pitfalls:

-

Too generic queries return irrelevant codes.

-

Product synonyms might not be indexed uniformly.

-

GST rates may not appear next to every result—requiring cross-verification.

Limitations:

-

It’s not intuitive for new users.

-

Doesn’t provide product context or examples.

-

No AI-driven suggestions or fuzzy matching—exactness matters.

2. HSN Code Search by Product Description

For businesses with unique SKUs or complex product mixes, description-based search offers more flexibility and specificity.

How It Works:

-

Start by listing key product traits: size, use, material, and industry.

-

Construct search strings (e.g., “ceramic wall tiles for bathrooms”).

-

Use unofficial but trusted databases or third-party apps integrated with updated HSN libraries.

Why It Helps:

-

Matches products more intuitively than numeric filters.

-

Improves relevance when you’re unsure of the code but know product specs.

-

Supports multi-attribute matching, improving accuracy.

Use Case Example:

A business selling “stainless steel kitchen tongs” may find a better code via description search (e.g., HSN 732393) than using vague terms like “utensils”.

Risks:

-

Similar products may fall under multiple chapters—especially if use varies (e.g., household vs. industrial tools).

-

Needs domain knowledge or system rules to avoid overlaps.

3. HSN Code Search by GST Rate

A lesser-known but effective strategy is searching backward from the applicable GST rate to narrow down HSN possibilities.

When It Works Best:

-

You’re aware of the correct GST rate slab for a product (e.g., 5%, 12%, 18%, 28%).

-

You’re classifying frequently sold items and just need the code to match the rate.

How to Use It:

-

Use portals that allow reverse HSN lookup by GST percentage.

-

Cross-match with product categories under that slab.

-

Filter codes by usage (e.g., raw materials, end products).

Pro Tip:

Giddh and similar accounting software tools support auto-recommendation of HSN codes based on the GST rate linked to your product list.

Limitations:

- Same rate ≠ , same product class. Multiple codes can carry identical GST rates but differ in classification.

- May lead to false assumptions if rate changes aren't tracked in real time.

Common HSN Code Mistakes Finance Teams Make

These mistakes slow down month-end processes and cause compliance risks:

- Using outdated codes from old GST charts.

- Copy-pasting from competitors without checking product attributes.

- Assigning broad chapter codes instead of precise 6–8 digit matches.

- Ignoring GST rate mismatches during searches.

Impact:

- Filing errors.

- Wrong tax liability.

- Audit challenges.

Efficiency comes from verified classification processes and reliable lookup systems.

How Accounting Software Simplifies HSN Code Search

Modern accounting tools reduce manual effort and errors:

Automated HSN Suggestions:

- Product name triggers HSN suggestions based on datasets.

GST Rate Mapping:

- The system automatically associates the correct GST rate with the HSN code.

Built-in Validation:

- Alerts if HSN codes don’t match expected tax slabs.

Document Consistency:

- Invoices embed correct codes, reducing rework.

Software dramatically speeds up classification and invoice preparation.

How Giddh Helps with Accurate HSN Code Search & GST Compliance

Manually navigating portals or outdated lists for HSN classification wastes hours each month—and even then, errors slip through. That’s where Giddh accounting software steps in as a smarter solution.

Giddh embeds an intelligent HSN code engine directly into your invoicing and product management workflow, helping you eliminate guesswork and save valuable time.

Key Features That Set Giddh Apart:

✅ Automatic HSN Code Suggestions

Type a product name or description, and Giddh intelligently suggests the most relevant HSN code based on historical GST data and category mapping.

✅ Built-In GST Rate Integration

Every HSN code is pre-linked with its correct GST rate, ensuring consistency between product classification and tax application.

✅ Real-Time Error Validation

During invoice creation, Giddh flags any inconsistencies between product type, assigned HSN code, and GST rate—helping you correct mistakes before submission.

✅ Bulk Product Classification

Manage extensive product catalogs with ease using Giddh’s batch classification tools. Apply or update HSN codes across multiple SKUs at once.

✅ Updated Government Database Sync

Giddh stays aligned with the latest CBIC notifications and GST rule changes, so your HSN codes and rates remain fully compliant.

✅ Unified Product + Tax Mapping

HSN classification integrates seamlessly with your entire accounting workflow—journal entries, ledgers, reports, and returns.

✅ Multi-Location and Multi-User Support

Perfect for businesses with distributed teams or branches. Finance managers can standardize GST compliance across all departments and locations.

By automating HSN code search and syncing GST compliance directly into day-to-day processes, Giddh removes the manual burden from finance teams. The result? Fewer filing errors, faster month-ends, and better peace of mind during audits.

Conclusion:

Getting HSN codes right is more than box-ticking; it’s central to accurate taxation and smooth operations. Many businesses still rely on slow manual lookup methods or imperfect search portals. This not only wastes time but also exposes them to compliance risks.

Structured methods, such as keyword searches, GST rate filtering, and the use of up-to-date lists, improve accuracy. Yet, finance teams scale best when they adopt automation and smarter tools. Software that streamlines HSN code search with built-in suggestions, GST rate mapping, and error checks frees up valuable time and reduces risk.

If your team spends hours trying to match products with codes or rework invoices due to classification errors, it’s time to rethink your approach.

👉 Request a free demo today and experience how Giddh simplifies GST-ready accounting and HSN code lookup.

FAQs:

1. What HSN code should I use for new products?

Start with the most precise description of the product, use authoritative lists, and validate against GST rates. Trusted software can suggest codes based on names and attributes.

2. Can one product have multiple HSN codes?

Yes. Different variants or uses of the same product may fall under other headings if their nature changes materially.

3. How often do HSN codes change?

HSN lists are updated periodically by authorities. Finance teams should check official notifications and maintain updated classification databases.

4. Is HSN required for service invoices?

Services use SAC codes rather than HSN codes. But if you invoice goods and services together, include the appropriate codes to stay complian